Liquid Filling Machines Market Share, Size, Trends, Industry Analysis Report

By Liquid Type, By Equipment Type (Automatic, Semi-Automatic), By End-User (Food & Beverage, Healthcare & Pharmaceuticals, Cosmetics, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 115

- Format: PDF

- Report ID: PM2346

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

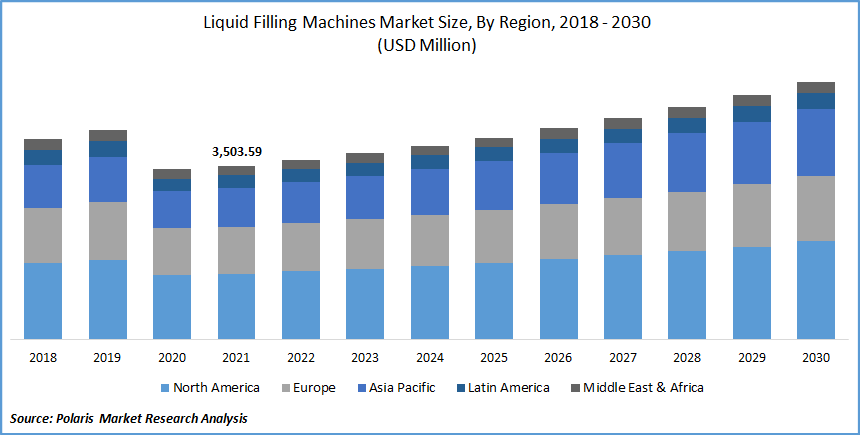

The global liquid filling machines market was valued at USD 3,503.59 Million in 2021 and is expected to grow at a CAGR of 4.6% during the forecast period. Liquid Filling Machines are utilized to fill eatery and other care products across the food & beverage, healthcare & pharmaceutical, and cosmetics industries. The increasing demand for liquid filling machines from various sectors is anticipated to drive the liquid filling machines market's growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The increasing consumption of soft drinks & milk, and cosmetic products across emerging nations is anticipated to boost the product liquid filling machines demand. Furthermore, the rapidly growing tourism & travel industry is fueling the liquid filling machines market's growth.

The onset of the COVID-19 reflects the downfall of the industry growth owing to the unprecedented restrictions on movement and the disruptions in personal and business activities. The interruption in the supply chain, lockdown measures, and limited consumer and corporate spending is anticipated to hamper the liquid filling machines industry growth. The impact of the COVID-19 outbreak is far-reaching, having adverse effects on communities, individuals, and societies globally.

The negative impact of the COVID-19 outbreak on the major end-user industries such as food & beverage, cosmetics, and others is anticipated to hinder the growth of the industry. The reduction in tourism activities globally due to lockdown restrictions is expected to hamper market growth further. On the positive hand, the threat of COVID-19 has prompted various pharmaceutical companies to invest more in developing vaccines that can prevent the further spread of the virus, boosting the demand for liquid filling machines market.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing demand for liquid filling machines from various end-user industries such as healthcare & pharmaceuticals, cosmetics, and food & beverages, is anticipated to drive the market's growth globally. These industries require their processes to be free from contamination, and the use of liquid filling machines eliminates the need for human touch. Furthermore, pharmaceutical companies are investing in R&D in order to broaden their product portfolio, presenting huge liquid filling machines market growth opportunities.

For instance, in March 2019, Cambrex Corporation, based in Canada, doubled its liquid packaging capacity at its Quebec and Mirabel sites in Canada. Additionally, the increasing adoption of automated machinery across industries is anticipated to boost the market's growth. For instance, in December 2019, AeroFlexx partnered with Fameccanica in order to diversify their industrial automated machinery. Fameccanica is an expert in liquid filling machines and converting, which is essential for AeroFlexx's manufacturing process.

Report Segmentation

The market is primarily segmented on the basis of liquid type, equipment type, end-user, and region.

|

By Liquid Type |

By Equipment Type |

By End-User |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by End-User

The food & beverage segment held the largest market share in 2021. The considerable share of the segment can be attributed to the population's changing lifestyle and work culture. As, people are required hygienic, healthy, and safe packaged beverages and ready to eat meals. Thus, the increasing consumption of packaged products is estimated to drive the global demand for liquid filling machines. Furthermore, the growing consumption of packaged distilled water, healthy juices, and others is anticipated to augment the segment's growth. The rising demand for pasteurized milk in developed & developing nations is expected to offer substantial growth opportunities for the segment.

The cosmetic segment is projected to witness the highest CAGR growth rate in the forecasting years. The increasing growth of the cosmetic industry globally is anticipated to drive the segment's growth. Further, the rising demand for innovative packaging from the cosmetics industry is expected to drive the demand for liquid filling machines.

Geographic Overview

Geographically, Asia Pacific accounted for the largest revenue share. The primary factors driving the growth of the market in the Asia Pacific include the rising population coupled with the increasing per capita income and changing lifestyle of the population. Furthermore, the increasing demand for packaged products across the food & beverage industry in the Asia Pacific is anticipated to drive the market's growth. Additionally, according to LOreal, the region is experiencing huge demand for cosmetic products, especially luxury products.

This is favored by the increasing trend of online shopping and the growing focus on physical appearance and personal hygiene. This growing cosmetic industry in the Asia Pacific is anticipated to present huge market growth opportunities. For instance, a London-based cosmetic brand, Pixi, entered the Indian cosmetic market in 2019. Other global brands are entering the Asia Pacific market, further driving the market's growth.

Moreover, during the COVID-19 outbreak, various pharmaceutical companies such as Serum Institute, India Immunologicals, Mynvax, Biological E, and Panacea Biotec, among others, started working on the development of a vaccine for the virus, driving the demand for liquid filling machines.

Moreover, the North American market is anticipated to exhibit progressive CAGR over the forecasting years. The fast growth of the segment can be attributed to the huge consumption of bottled water and convenience food products. The rising focus of the population towards health and hygiene is anticipated to drive the market's growth further. Furthermore, the increasing consumption of beverages such as wine, beer, and healthy drinks across the U.S. is expected to offer tremendous market growth opportunities, as liquid filling machines help in minimizing human error and further reduce the assembly line process.

Competitive Insight

Some of the major players operating in the global market include Accutek Packaging Equipment Companies, Inc., Barry-Wehmiller Companies, Bosch Packaging, Coesia Group, E-PAK Machinery., Filling Equipment Co., GEA Group, Inline Filling Systems, JBT Corp, KHS GmbH, Krones Group, Robert Bosch GmbH, Ronchi Mario S.p.A, Scholle Packaging, and Tetra Laval International.

Liquid Filling Machines Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3,503.59 Million |

|

Revenue forecast in 2030 |

USD 5,205.78 Million |

|

CAGR |

4.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Liquid Type, By Equipment Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Accutek Packaging Equipment Companies, Inc., Barry-Wehmiller Companies, Bosch Packaging, Coesia Group, E-PAK Machinery., Filling Equipment Co., GEA Group, Inline Filling Systems, JBT Corp, KHS GmbH, Krones Group, Robert Bosch GmbH, Ronchi Mario S.p.A, Scholle Packaging, and Tetra Laval International. |