Lysosomal Storage Disease Treatment Market Size, Share, Trends, & Industry Analysis Report

By Disease Type (Gaucher's Diseases, Fabry Diseases, Pompe’s Syndrome, Mucopolysaccharidosis, and Others), By Type of Therapy, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6066

- Base Year: 2024

- Historical Data: 2020-2023

Overview

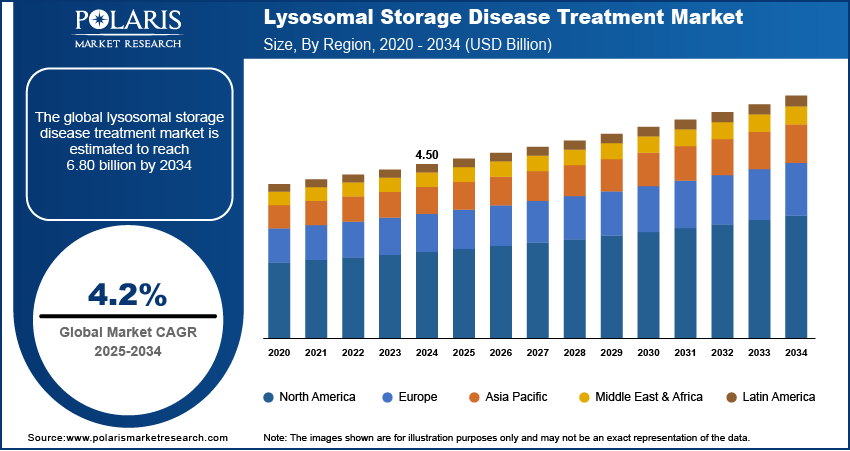

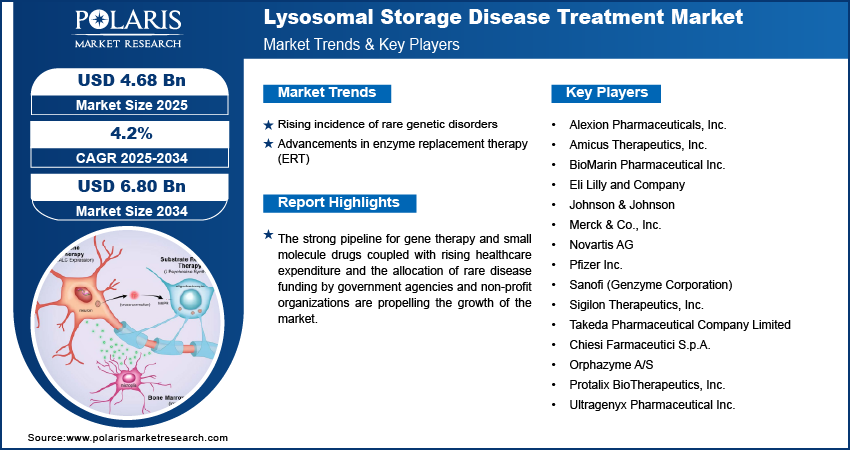

The global lysosomal storage disease treatment market size was valued at USD 4.50 billion in 2024, growing at a CAGR of 4.2% from 2025–2034. Rising incidence of rare genetic disorders coupled with advancements in enzyme replacement therapy (ERT) are driving the growth of the market.

Key Insights

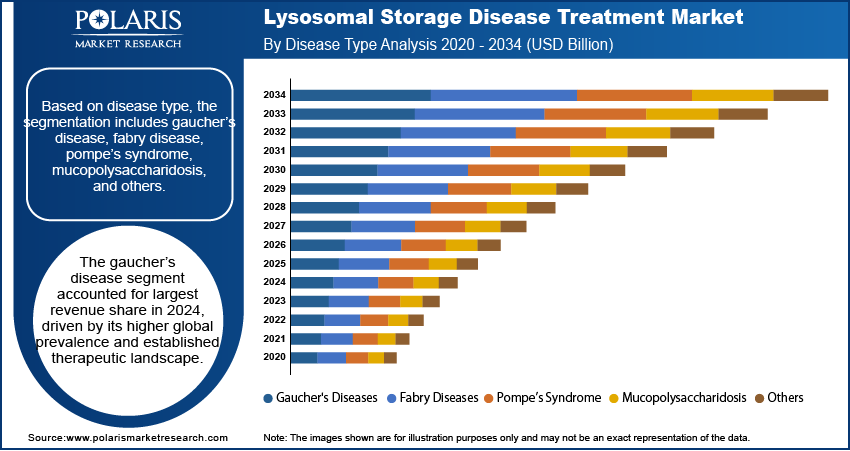

- The gaucher’s disease segment accounted for largest market share in 2024.

- The stem cell therapy segment is projected to grow at the fastest rate over the forecast period, due to the growing exploration of hematopoietic stem cell transplantation and ex vivo gene editing for lysosomal storage disorders.

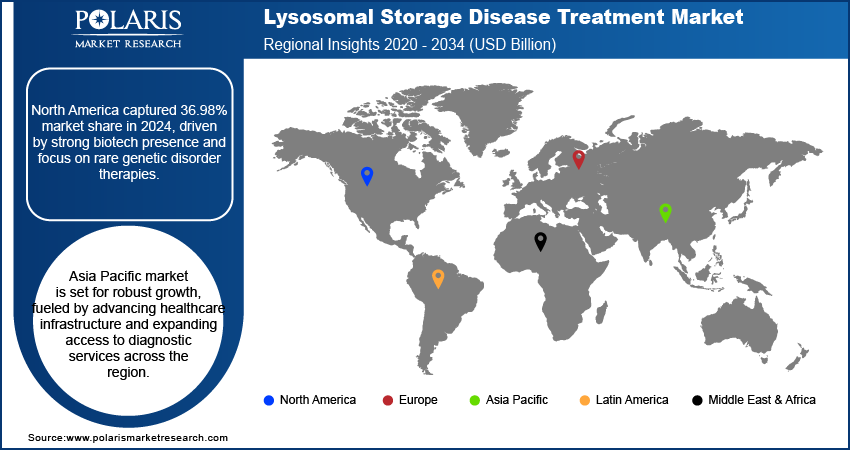

- The North America lysosomal storage disease treatment market accounted for 36.98% of the global market share in 2024.

- The US lysosomal storage disease treatment market held largest regional share of the North America market in 2024, driven by robust regulatory environment that incentivizes the development of rare disease treatments.

- The market in Asia Pacific is projected to grow at a CAGR of 6.13% from 2025-2034. This growth is due to rising improvements in healthcare infrastructure and diagnostic services across the region.

- The market in China is expanding due the establishment of regional centers of excellence dedicated to genetic disorders.

Industry Dynamics

- Rising incidence of rare genetic disorders is expanding the patient population requiring long-term management of lysosomal storage diseases.

- Advancements in enzyme replacement therapy (ERT) are contributing to improved clinical outcomes and broader therapeutic adoption across healthcare systems.

- High treatment costs and limited reimbursement in certain emerging markets continue to hinder equitable access to novel therapies.

- Adoption of precision gene editing tools such as CRISPR-Cas9 and base editors is creating new opportunities for curative treatment of inherited lysosomal storage disorders.

Market Statistics

- 2024 Market Size: 4.50 billion

- 2034 Projected Market Size: 6.80 billion

- CAGR (2025-2034): 4.2%

- North America: Largest market in 2024

Lysosomal storage disease (LSD) treatment focuses on correcting enzyme deficiencies that lead to the accumulation of harmful substances within cells, through enzyme replacement therapy, substrate reduction therapy, or gene-based interventions. These therapies help manage symptoms, slow disease progression, and improve patient quality of life, in conditions such as Gaucher, Fabry, and Pompe disease. The growing shift from symptomatic care to disease-modifying and potentially curative approaches is gaining momentum, driven by advancements in genetic research, early diagnosis through newborn screening, and the emergence of precision therapies.

The market is growing rapidly due to the strong pipeline for gene therapy and small molecule drugs, in gene therapies and small molecule drugs, which are developed with the aim of achieving disease modification or curative outcomes. Companies are actively investing in R&D targeting specific conditions such as Gaucher disease, Fabry disease, and mucopolysaccharidosis (MPS) types, with clinical-stage products gaining regulatory attention. For instance, in May 2025, WuXi Biologics and CANbridge Pharmaceuticals launched China’s first locally developed enzyme replacement therapy (ERT), velaglucerase‑beta (Gaurunning), following its approval by the NMPA for treating type I and III Gaucher disease in patients aged 12 and older. The focus on precision therapies is expanding the scope of treatment, for neuronopathic forms of LSDs.

In addition, rising healthcare expenditure and the allocation of rare disease funding by government agencies and non-profit organizations are expanding access to lysosomal storage disorder treatments. According to the US Health Affairs report, healthcare spending in the US rose by 7.5% in 2023, reaching USD 4.9 trillion, up from a growth rate of 4.6% in 2022. Countries with high disease burdens are increasingly integrating LSD treatments into national reimbursement schemes, improving affordability and availability of therapy. Initiatives led by international health alliances and philanthropic funding are supporting screening programs, physician education, and therapeutic rollout strategies across the globe.

Drivers & Opportunities/Trends

Rising Incidence of Rare Genetic Disorders: The rising prevalence of rare inherited metabolic conditions, including Gaucher disease, Fabry disease, and Pompe disease, is increasing the demand for lysosomal storage disease treatment. According to the latest report by Rare Diseases International, more than 300 million people globally are affected by rare diseases. Over 6,000 distinct rare conditions are identified, impacting approximately 3.5% to 5.9% of the world’s population. This rise in diagnosed cases is attributed to the expanding reach of newborn screening programs, improved genetic testing capabilities, and greater physician awareness of lysosomal storage disorders.

Advancements in Enzyme Replacement Therapy (ERT): Surge in developments in enzyme replacement therapies are improving safety, efficacy, and convenience for patients undergoing regular infusions, thus propelling the market growth. New formulations are developed to enhance enzyme targeting, reduce immunogenic responses, and optimize dosing schedules. For instance, in October 2023, the US Food and Drug Administration (FDA) approved the first enzyme replacement therapy for alpha-mannosidosis, a rare and progressive lysosomal storage disorder. This highlights a significant boost in the treatment landscape for ultra-rare diseases, offering a new therapeutic option for patients previously lacking targeted interventions. These innovations are accelerating the role of ERT as a standard care pathway for several well-characterized LSDs.

Segmental Insights

Disease Type Analysis

Based on disease type, the segmentation includes gaucher’s disease, fabry disease, pompe’s syndrome, mucopolysaccharidosis, and others. The gaucher’s disease segment accounted for largest revenue share in 2024, driven by its higher global prevalence and established therapeutic landscape. Treatment options such as enzyme replacement therapy and substrate reduction therapy are widely available for this condition, in regions with structured rare disease programs. Government reimbursement schemes and international awareness campaigns enhanced diagnosis rates and access to therapies for Gaucher’s disease, contributing to its market leadership.

Pompe’s syndrome is projected to grow at the fastest CAGR during the forecast period, supported by improvements in early diagnosis and growing clinical attention to infantile and late-onset forms of the disease. Expansion of newborn screening initiatives, coupled with increased R&D activity targeting CNS-related indicators, is driving development of new treatment options. Enhanced disease awareness among healthcare professionals and inclusion of Pompe’s syndrome in global treatment guidelines are further accelerating patient access to therapies.

Type of Therapy Analysis

Based on therapy, the segmentation includes enzyme replacement therapy, stem cell therapy, substrate reduction therapy, and others. The enzyme replacement therapy (ERT) accounted for largest revenue share in 2024, due to growing adoption in care for several lysosomal storage disorders. ERT received regulatory approvals for Gaucher, Fabry, and Pompe diseases, and is well-integrated into national treatment protocols. Hospitals and specialty centers continue to rely on ERT for managing disease progression, reducing symptom severity, and improving quality of life in eligible patients.

Stem cell therapy is projected to witness the fastest growth through 2034, driven by its emerging potential in treating the neurological and systemic complications of LSDs. Advancements in gene-modified stem cell platforms and ongoing clinical trials targeting mucopolysaccharidosis and related disorders are supporting segment expansion. Growing exploration of hematopoietic stem cell transplantation and ex vivo gene editing for lysosomal storage disorders is driving increased interest in stem cell therapy from investors and regulatory bodies.

End User Analysis

Based on end user, the segmentation includes hospitals, clinics, and others. The hospitals accounted for largest revenue share in 2024, attributed to the administration of specialized treatments including enzyme replacement therapy infusions and stem cell transplantation. These institutions are equipped with advanced diagnostic tools, multidisciplinary teams, and supportive care infrastructure needed for complex LSD management. Hospital-based treatment also ensures ongoing monitoring, which is crucial for managing side effects and evaluating therapeutic efficacy.

Clinics are anticipated to grow at the fastest CAGR during the forecast period, due to the shift toward outpatient and home-infusion services that enhance patient convenience. Specialty clinics focusing on rare genetic disorders are becoming more prevalent, in urban areas, improving access to LSD therapies. The trend of decentralizing care to reduce treatment burden is contributing to the rising preference for clinic-based services, for stable patients undergoing long-term management.

Regional Analysis

North America lysosomal storage disease treatment market accounted for 36.98% of global market share in 2024. This dominance is due to the presence of major biotechnology and pharmaceutical companies focused on advancing therapies for rare genetic disorders. Strategic investments in drug discovery, gene therapy platforms, and precision medicine are contributing to the expansion of the LSD treatment pipeline. Government and private funding initiatives in the US and Canada are accelerating rare disease research, enabling early-stage innovation and clinical trial execution. Access to advanced healthcare infrastructure and diagnostic capabilities further supports the timely identification and management of LSDs in the region.

The US Lysosomal Storage Disease Treatment Market Insight

The US held largest market share in North America lysosomal storage disease treatment landscape in 2024, driven by robust regulatory environment that incentivizes the development of rare disease treatments. For instance, the US Food and Drug Administration’s, Orphan Drug Designation program is accelerating rare disease treatment by offering incentives such as tax credits and market exclusivity for therapies targeting conditions affecting fewer than 200,000 people in the US. These initiatives are pushing biopharmaceutical companies to invest in new treatment modalities, including gene therapies and enzyme enhancements. The growing number of product approvals and active clinical trials in the US highlights the country's strong focus on advancing LSD care through innovation and regulatory support.

Asia Pacific Lysosomal Storage Disease Treatment Market

The market in Asia Pacific is projected to grow at a CAGR of 6.13% from 2025-2034. This growth is due to rising improvements in healthcare infrastructure and diagnostic services across the region. Countries such as China, India, and South Korea are expanding capabilities in rare disease detection through nationwide screening programs, laboratory upgrades, and professional training. Government-led rare disease policies and financial assistance programs are introduced to improve patient access to life-saving treatments. Furthermore, the region is witnessing a rise in public-private partnerships aimed at accelerating the availability of specialized care for LSD patients.

China Lysosomal Storage Disease Treatment Market Overview

The market in China is expanding due the establishment of regional centers of excellence dedicated to genetic disorders. These centers, primarily located in major urban healthcare hubs, are improving the diagnosis and management of LSDs through multidisciplinary care and centralized data systems. For instance, in February 2025, China launched its first AI model for rare disease diagnosis, developed jointly by Peking Union Medical College Hospital (PUMCH) and the Institute of Automation under the Chinese Academy of Sciences. This AI model aims to improve early detection and diagnostic accuracy for rare diseases, including lysosomal storage disorders. National initiatives focused on genomic research and medical innovation are attracting investment in the development of advanced therapeutics for rare diseases, propelling China's position as a growing market for LSD treatment.

Europe Lysosomal Storage Disease Treatment Market

Europe is projected to hold a substantial market share by 2034, driven by established rare disease monitoring systems and research-oriented healthcare policies. Countries in the region maintain detailed rare disease registries and clinical databases that facilitate long-term surveillance, patient identification, and treatment optimization. The presence of collaborative funding mechanisms such as the European Union’s Horizon research programs is advancing drug development for LSDs. These initiatives support cross-border clinical studies and translational research, enhancing therapeutic access across multiple member states. Favorable reimbursement frameworks and centralized evaluation processes are further contributing to the adoption of novel treatments in the region.

The lysosomal storage disease (LSD) treatment market is moderately competitive, with pharmaceutical and biotech companies intensifying efforts to address the needs in rare genetic disorders. Industry leaders are focusing on expanding treatment portfolios through enzyme replacement therapies (ERT), substrate reduction therapies (SRT), and gene therapies aimed at offering more targeted and potentially curative outcomes. A growing emphasis on orphan drug development and regulatory incentives is pushing key players to accelerate clinical trials, pursue global approvals, and strengthen early access programs. Companies are also engaging in strategic collaborations with academic institutions, research organizations, and contract development and manufacturing organizations (CDMOs) to enhance innovation pipelines and manufacturing scalability. Emerging biotech firms are contributing to competitive differentiation through novel platforms focused on autophagy modulation, enzyme stabilization, and next-generation gene editing.

Prominent companies operating in the lysosomal storage disease treatment market include Alexion Pharmaceuticals, Inc., Amicus Therapeutics, Inc., BioMarin Pharmaceutical Inc., Eli Lilly and Company, Johnson & Johnson (Actelion Pharmaceuticals Ltd.), Merck & Co., Inc., Novartis AG, Pfizer Inc., Sanofi (Genzyme Corporation), Sigilon Therapeutics, Inc., Takeda Pharmaceutical Company Limited (Shire Plc), Chiesi Farmaceutici S.p.A., Orphazyme A/S, Protalix BioTherapeutics, Inc., and Ultragenyx Pharmaceutical Inc.

Key Players

- Alexion Pharmaceuticals, Inc.

- Amicus Therapeutics, Inc.

- BioMarin Pharmaceutical Inc.

- Eli Lilly and Company

- Johnson & Johnson (Actelion Pharmaceuticals Ltd.)

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi (Genzyme Corporation)

- Sigilon Therapeutics, Inc.

- Takeda Pharmaceutical Company Limited (Shire Plc)

- Chiesi Farmaceutici S.p.A.

- Orphazyme A/S

- Protalix BioTherapeutics, Inc.

- Ultragenyx Pharmaceutical Inc.

Industry Developments

- July 2025: The FDA granted Priority Review for Denali’s BLA submission of tividenofusp alfa (DNL310), setting a PDUFA action date of January 5, 2026, as a novel enzyme replacement therapy (ERT) designed to deliver IDS across the blood–brain barrier for Hunter syndrome (MPS II). The FDA designation followed positive Phase 1/2 data showing normalization of CNS and systemic biomarkers paving the way for accelerated approval under the COMPASS Phase 2/3 study.

- December 2024: ISU Abxis launched its Gaucher disease treatment, Abcertin (imiglucerase), in MENA markets, expanding beyond South Korea. The product remains outside WHO/EMA biosimilar approvals but reflects growing regional outreach.

Lysosomal Storage Disease Treatment Market Segmentation

By Disease Type Outlook (Revenue, USD Billion, 2020–2034)

- Gaucher's Diseases

- Fabry Diseases

- Pompe’s Syndrome

- Mucopolysaccharidosis

- Others

By Type of Therapy Outlook (Revenue, USD Billion, 2020–2034)

- Enzyme Replacement Therapy

- Stem Cell Therapy

- Substrate Reduction Therapy

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lysosomal Storage Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.50 Billion |

|

Market Size in 2025 |

USD 4.68 Billion |

|

Revenue Forecast by 2034 |

USD 6.80 Billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.50 billion in 2024 and is projected to grow to USD 6.80 billion by 2034.

The global market is projected to register a CAGR of 4.2% during the forecast period.

North America dominated the market in 2024, holding 36.98% share.

A few of the key players in the market are Alexion Pharmaceuticals, Inc., Amicus Therapeutics, Inc., BioMarin Pharmaceutical Inc., Eli Lilly and Company, Johnson & Johnson (Actelion Pharmaceuticals Ltd.), Merck & Co., Inc., Novartis AG, Pfizer Inc., Sanofi (Genzyme Corporation), Sigilon Therapeutics, Inc., Takeda Pharmaceutical Company Limited (Shire Plc), Chiesi Farmaceutici S.p.A., Orphazyme A/S, Protalix BioTherapeutics, Inc., and Ultragenyx Pharmaceutical Inc.

The gaucher’s disease segment dominated the market in 2024. This dominance is driven by its higher global prevalence and established therapeutic landscape.

The stem cell therapy segment is expected to witness the fastest growth during the forecast period, due to the growing exploration of hematopoietic stem cell transplantation and ex vivo gene editing for lysosomal storage disorders.