Masterbatch Market Share, Size, Trends, Industry Analysis Report

By Type (Biodegradable, Filler, Additive, Color, Black, White); By Carrier Polymer; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4555

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

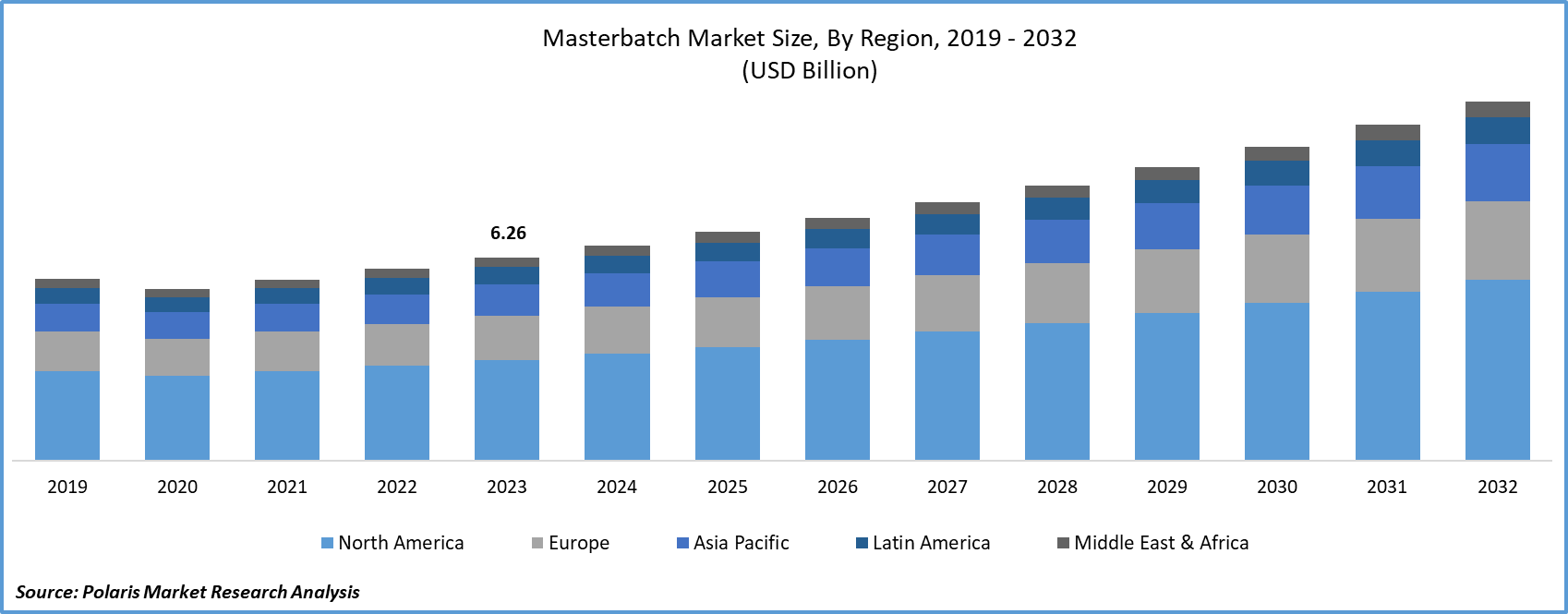

Masterbatch Market size was valued at USD 6.26 billion in 2023. The market is anticipated to grow from USD 6.63 billion in 2024 to USD 11.06 billion by 2032, exhibiting the CAGR of 6.6% during the forecast period.

Masterbatch Market Overview

Masterbatch serves as a solid or liquid additive applied to paint or confers specific properties to plastics. Colored Masterbatch, specifically, imparts color or shade to plastic items and can also convey various properties such as strength, impact resistance, UV stabilization, biodegradability, and antioxidants, among others. Typically, this product comprises a mixture of pigment and additives encapsulated in a carrier resin, which is then granulated after a heat cycle. It facilitates efficient coloring of raw polymer during the plastic manufacturing process, offering cost-effectiveness and enabling savings for plastics manufacturers. Moreover, these additives are user-friendly, ensuring a clean and stable process and reducing safety risks associated with the use of powder pigments.

The substitution of metal with plastics across end-use industries such as automotive and transportation, building and construction, consumer goods, and packaging is anticipated to be a crucial factor for the increasing global market size in the forecast period.

The product is accessible in both solid and liquid states, serving the purpose of adding color and augmenting beneficial attributes of polymers, including antistatic, UV stabilization, flame retardation, antilocking, and antifog. Different carrier polymers, such as polyethylene, polyvinyl chloride, polyethylene terephthalate, and polypropylene, are commonly chosen to be utilized alongside the product in injection molding and extrusion processes.

To Understand More About this Research: Request a Free Sample Report

The growing demand in the U.S. packaging industry is set to drive market growth. The U.S. packaging market has experienced significant expansion, particularly with the growth of e-commerce. Across 50 states, there are approximately 16,806 plastic manufacturing facilities in the U.S, which grow the market statistics. The increased utilization of plastic in various sectors like building & construction, consumer goods, and automotive is expected to propel the masterbatch market's growth in the country in 2023 to 2032. Manufacturers in the consumer goods sector are focusing on appealing product packaging to attract a larger customer base, ultimately boosting their product sales. Different types of masterbatch, when combined with polymers, contribute to creating attractive packaging, leading to an anticipated increase to the demand and growth in the forecast period.

Masterbatch is finding applications in emerging areas such as packaging. A notable instance is the collaboration between Gerdau Graphene and Packseven, a Brazilian flexible films manufacturer, which successfully developed the world's first stretch film enhanced with graphene using masterbatch technology. The graphene-enhanced masterbatch, introduced in July 2023, has shown the potential to decrease plastic consumption by 25%, as reported by the company.

Masterbatch Market Dynamics

Market Drivers

Commonly Favored Coloration Technique Bolstering the Growth of the Masterbatch Market Size

Masterbatch stands out as the most extensively utilized and favored coloring technique embraced by manufacturers over powders, pastes, and liquid additives. Traditional coloring methods involving the direct addition of color pigments come with several drawbacks, such as low-quality assurance, inconsistent color across batches, reduced hygiene due to spillage, and increased dust during dispersion. Masterbatch effectively addresses many of these challenges, providing convenience, ease of color incorporation, and improvements in the properties of natural or base polymers. Color masterbatch boasts advantages over alternative methods, including process stability, optimal dispersion, reliability, handling of large powder volumes, and decreased cleaning expenses. These merits have contributed to the widespread adoption of color masterbatch as the preferred coloring method.

Market Restraints

Additional Storage Capacity, Extended Lead Times, and Susceptibility to Heat are Likely to Hamper the Growth of the Market

Masterbatch has certain drawbacks, such as increased storage requirements for pellets compared to other dry and liquid colors, longer lead times for orders than dry colors, and additional exposure to heat for both carriers and additives compared to pure pigments. Additionally, the physical properties of masterbatch pellets can change compared to dry and liquid colors, as they are often manufactured using resins different from those used in the final product. The use of dissimilar resins may lead to alterations in the processing characteristics of these resins, which end users may use without sufficient technical knowledge.

Report Segmentation

The market is primarily segmented based on carrier polymer, type, end-use, and region.

|

By Carrier Polymer |

By Type |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Masterbatch Market Segmental Analysis

By Carrier Polymer Analysis

The polypropylene (PP) carrier polymer segment emerged as the market leader in 2023, driven by the increasing demand for polypropylene attributed to its excellent mechanical strength, flexibility, and ability to enhance surface quality. Its lightweight properties make it a preferred choice for replacing metal components in the automotive industry, contributing to segment growth. Germany's expanding production facilities, particularly in the manufacturing sector, are anticipated to boost the demand for polyethylene. At the same time, the presence of numerous plastic component manufacturers in Europe ensures easy and cost-effective access to plastics, driving regional market growth.

Polypropylene's widespread use in consumer goods, coupled with its antimicrobial and antibacterial properties, contributes to growing product demand, especially in building and construction applications. Additionally, environmental concerns are prompting polypropylene manufacturers to shift their focus from synthetic to biobased materials, further propelling market growth throughout the forecast period.

By End-Use Analysis

The packaging masterbatch end-use segment emerged as the market leader in the forecast period. This dominance is driven by the packaging industry, encompassing retail, industrial, and consumer packaging, including both flexible and rigid options. The growing urban population seeking packaged goods contributes to the rising demand for packaging solutions. Consumers prioritize convenient, sustainable, flexible, protective, and traceable packaging, and plastic packaging aligns with these requirements. The anticipated increase in demand for plastic packing is expected to drive the overall demand for masterbatch products. Emerging economies like India and China, and countries industry analysis present significant growth opportunities for the packaging industry.

The increase in infrastructural projects within these nations has led to heightened demand in the building and construction sector, potentially fostering an increase in product demand. Additionally, the implementation of government initiatives like Make in India and Smart City plans is expected to further elevate the demand for the product in the forecast period.

Masterbatch Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share in 2023

The region provides substantial growth prospects for market players across various countries. Factors such as a growing population in APAC, readily available raw materials, increased adoption of modern technologies, ongoing innovations, accessible and economical land, and low labor costs are anticipated to drive significant market expansion in the region. The rise in automobile production facilities and the relocation of European automobile manufacturers to the cost-effective markets of Asia are poised to bolster the growth of the masterbatches market in the automotive sector. APAC holds the top position in terms of vehicle production, contributing significantly to the heightened demand for masterbatches in the automotive industry.

Europe emerges as the rapidly growing region for masterbatch, driven by the increasing demand for polymers and the rising need for color and special effects to distinguish products. Despite this growth, stringent government regulations imposing bans on plastic usage have hampered market expansion. The widespread application of masterbatch across packaging, building & construction, automotive, consumer goods, and agriculture industries enhances product aesthetics and quality, appealing to customers. Presently, the heightened emphasis on producing superior products for food and non-food packaging applications in Europe is a key driver propelling the masterbatch market size in the region.

Competitive Landscape

The Masterbatch market player is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- A. Schulman, Inc.

- Ampacet Corporation

- Cabot Corporation

- Clariant AG

- Global Colors Group

- Hubron International Ltd.

- Penn Color, Inc.

- Plastiblends India Ltd.

- PolyOne Corporation

- Tosaf Group

Recent Developments

- In June 2023, Ampacet introduced PET UVA, a masterbatch designed to shield packaging contents from detrimental UV light, preserving food freshness, prolonging product shelf life, and reducing waste. Additionally, the company provides UVA in PP and PE formulations.

- In June 2023, Ampacet introduced a new additive, AA Scavenger 0846, specifically designed to control acetaldehyde levels in both PET and rPET bottles. This product launch aligns with the company's sustainability initiatives in the packaging industry, promoting the use of recycled materials and waste reduction.

- In April 2023, Penn Color, Inc. inaugurated a state-of-the-art facility in Rayong Province, Thailand, as part of its expansion strategy for manufacturing capabilities. The primary goal of this new plant is to facilitate the production of high-quality colorant and additive masterbatches to serve the Asia-Pacific market.

Report Coverage

The Masterbatch market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, carrier polymer, type, end-use, and their futuristic growth opportunities.

Masterbatch Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.63 billion |

|

Revenue Forecast in 2032 |

USD 11.06 billion |

|

CAGR |

6.6% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Carrier Polymer, By Type, By End-Use, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 Masterbatch Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

The Masterbatch Market report covering key segments are carrier polymer, type, end-use, and region.

Masterbatch Market Size Worth $11.06 Billion By 2032

Masterbatch Market exhibiting the CAGR of 6.6% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Masterbatch Market are • Growing automotive industry demand is expected to drive market expansion