Polypropylene Nonwoven Fabrics Market Share, Size, Trends, Industry Analysis Report

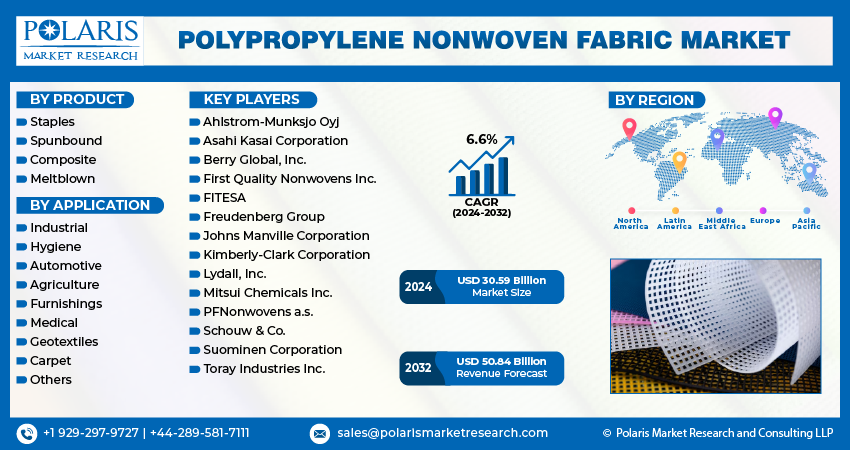

By Product (Staples, Spunbound, Composite, Meltblown); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4520

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

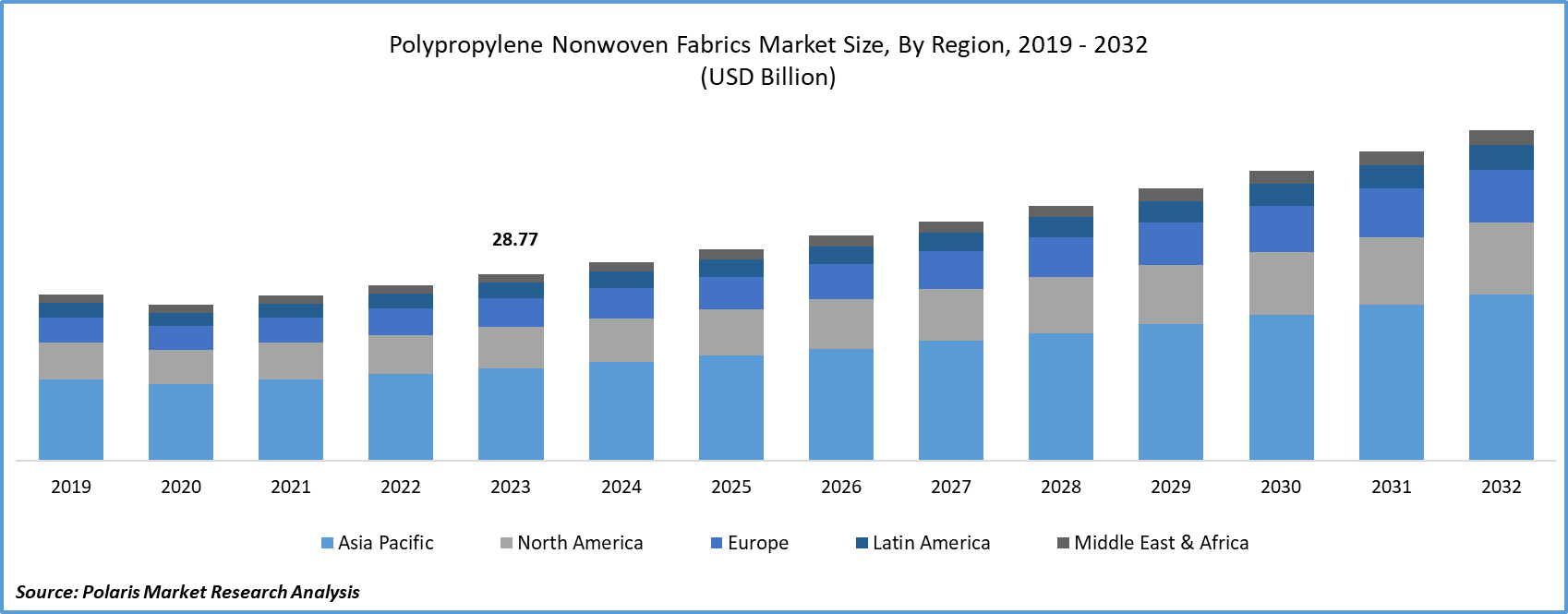

Polypropylene nonwoven fabrics market size was valued at USD 28.77 billion in 2023. The market is anticipated to grow from USD 30.59 billion in 2024 to USD 50.84 billion by 2032, exhibiting the CAGR of 6.6% during the forecast period

Polypropylene Nonwoven Fabrics Market Overview

The rising demand for polypropylene nonwoven fabric in the hygiene industry for the manufacturing of sanitary products for women, babies, and adults will drive the polypropylene nonwoven fabrics market growth.

- For instance, in March 2020, Berry launched a new product in its Synergex range specifically intended for facemask use. The newly released mask presents a novel substitute for the traditional facemask layer structure by providing a single-sheet multilayer of nonwoven materials.

Polypropylene (PP), a nonwoven material produced through melt-blown technology, constitutes the primary component in the fabrication of most disposable masks. Its density falls within the range of 20 to 25 grams per square meter. The melt-blown manufacturing process involves filling a die with numerous small cavities and subsequently introducing hot air after the plastic is extruded into the die. This results in the transformation of the material into minute filaments, each with a diameter of less than one micron.

Polypropylene nonwoven fabrics are widely recognized as highly versatile materials in the market. Unlike fabrics made by weaving, knitting, or other similar methods, these materials are knowingly designed to fulfill a wide range of customer demands. Some strong nonwoven variations are made primarily of polypropylene (PP), but others include cotton and polyester. When exposed to the elements, polypropylene nonwoven fabrics naturally decompose, with a maximum lifespan of 90 days. However, if kept indoors, these fabrics can last up to five years. Nonwoven polypropylene is environmentally friendly because it does not contribute to pollution, burns non-toxic, is odorless, and leaves only a small amount of dust residue.

To Understand More About this Research: Request a Free Sample Report

Spunbonded technology is the most frequently utilized manufacturing method for polypropylene nonwoven fabrics. The substantial advantages of this technique, such as its low cost and simple manufacturing process, have played a crucial role in securing a significant market share for these products. Meltblown and composite product demand is anticipated to increase, particularly in geotextiles and industrial applications, owing to their exceptional moisture barrier and robust strength properties.

Nonwoven polypropylene emerges as a low-cost material for masks. The microstructure and pattern give it a competitive advantage in bacterial filtration and air permeability. These masks have a filtration efficiency of at least 95 percent against bacteria and are lightweight, waterproof, flexible, and adaptable. Furthermore, because they are intended for single use, they are known for their cleanliness and hygiene.

The market is strongly fragmented, with numerous small players operating globally. Intense price competition illustrates the importance of innovative product development and production efficiency, increasing competitive pressures. Further, leading polypropylene nonwoven fabric manufacturers collaborate with customers, raw material suppliers, and machinery manufacturers to research, develop, and launch new products. This collaborative effort seeks to compete through product differentiation and the implementation of cost-effective technologies.

The COVID-19 pandemic has had a significant impact on the polypropylene nonwoven Fabrics market. Lockdowns, business shutdowns, and travel restrictions imposed by the governments have hampered the polypropylene nonwoven fabrics market growth. Furthermore, the rising demand for polypropylene nonwoven fabrics in the agricultural sector is significantly driving the polypropylene nonwoven market growth.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Polypropylene Nonwoven Fabric Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Polypropylene Nonwoven Fabrics Market Dynamics

Market Drivers

The increasing use of polypropylene nonwoven fabrics in the hygiene products drive the polypropylene nonwoven fabrics market growth

Polypropylene nonwoven fabrics are widely utilized in hygiene products like feminine hygiene products, adult incontinence products, baby diapers, and medical supplies like surgical gowns, drapes, and masks. The demand for these products remains persistent owing to rising healthcare awareness, the growth of the population, and evolving medical practices. As the level of consumers' disposable income rises, there is more spending by consumers on personal hygiene products including sanitary products, diapers, and wipes.

The growing demand for polypropylene nonwoven fabrics in consumer goods is driven by factors such as global population growth, particularly in emerging economies, which expands the consumer base for products made with these fabrics. This includes not only hygiene products but also various applications such as packaging, agriculture, and construction. The surge in urbanization and infrastructure development increases the demand for geotextiles and construction materials made from polypropylene nonwoven fabrics. These fabrics are utilized in a variety of applications, including erosion control, road construction, and drainage systems. Furthermore, advances in technology in the medical and healthcare sectors have fueled the expansion of innovative products based on nonwoven fabrics.

The rising demand for polypropylene nonwoven fabric in the medical sector facilitates the growth of the market

The increasing demand for polypropylene nonwoven fabric in the medical sector fosters market growth. This increase in demand is owing to the distinctive features and versatile applications of polypropylene nonwoven fabric in the healthcare industry. Polypropylene nonwoven fabric is extensively used in the manufacture of medical textiles such as surgical gowns, masks, and drapes due to its low cost and lightweight nature. Its non-allergenic nature, combined with excellent barrier properties against fluids and microorganisms, makes it an effective option in medicine.

Furthermore, the ongoing emphasis on infection prevention measures, combined with the expansion of global healthcare infrastructure, has boosted the use of polypropylene nonwoven fabric. The fabric's ability to fulfill the stringent quality standards required in medical applications has contributed to the polypropylene nonwoven market growth, establishing its position as an indispensable material in the evolving landscape of healthcare textiles.

Market Restraints

Fluctuations in the price of polypropylene hampering on the growth of the market

As crude oil is an important component in polypropylene production, the cost of polypropylene is affected by fluctuations in crude oil prices. The worldwide sociopolitical landscape, marked by conflicts and natural disasters, contributes to significant fluctuations in crude oil prices. These fluctuations have a negative impact on the PP nonwoven fabric manufacturing process. The increased costs of acquiring raw materials raise the overall cost of polypropylene nonwoven fabrics, potentially decreasing demand for these fabrics in the production of masks, sanitary pads, sanitary napkins, and baby diapers. For instance, the Russia-Ukraine conflict in 2022 caused a spike in crude oil prices, affecting polypropylene production and, as a result, decreased polypropylene nonwoven fabric production.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Polypropylene Nonwoven Fabrics Market Segmental Analysis

By Product Analysis

- The spunbound segment held the largest market share in 2023, it is the most cost-effective technology which utilized for manufacturing polypropylene nonwoven fabrics. The superior properties of spunbonded nonwoven fabrics, combined with the efficient manufacturing process associated with this technology, are expected to drive demand for the product in a wide range of applications. These applications include packaging materials, medical supplies, hygiene products, geotextiles, and shoe manufacturing, among others. Spunbonded technology is the most widely used method for producing nonwoven fabrics.

- Staples polypropylene nonwoven fabrics witnessed the fastest growth in the market. Staples polypropylene nonwoven fabrics are becoming increasingly important in medical settings owing to their superior filtration and low-pressure drop properties. The increasing use of staple polypropylene nonwoven in a variety of medical applications, including medical packaging, gloves, masks, surgical gowns, covers, and drapes, is anticipated to contribute significantly to market growth. Surgical drapes, gowns, and masks are anticipated to be the primary applications driving the polypropylene nonwoven market growth.

By Application Analysis

- Based on application analysis, the market has been segmented on the basis of industrial, hygiene, automotive, agriculture furnishings, medical, geotextiles, carpets, and others. The hygiene segment held the largest Polypropylene Nonwoven Fabrics market share in 2023, owing to the rising demand for hygiene products such as baby diapers, adult incontinence products, and feminine hygiene products. Polypropylene nonwoven fabrics have a smooth, soft, and stretchable texture, as well as water resistance and recyclable properties, which make them ideal for use in hygienic products. Furthermore, government initiatives encouraging the use of sanitary pads seek to reduce health risks for women, such as sexually transmitted infections (STIs) and urinary tract infections (UTIs). The rising living standard in developing nations has raised the demand for baby diapers, which makes it easier to care for infants.

- The industrial application segment witnessed the fastest growth in the polypropylene nonwoven fabrics market. In industrial applications, polypropylene nonwoven fabrics are utilized more for the manufacturing of noise absorber felt, semiconductor polishing pads, air conditioner filters, cable insulation, conveyor belts, tapes, display felts, and coated fabrics.

Polypropylene Nonwoven Fabrics Market Regional Insights

Asia Pacific dominated the largest market in 2023

- Asia Pacific dominated the polypropylene nonwoven fabrics market. China is the largest producer of polypropylene nonwoven fabric. In urban cities in China, disposable diaper usage is increasing. Furthermore, the Indian government has launched several programs to promote the use of sanitary pads and napkins as a preventive measure against urinary infections in women. The polypropylene market growth in the region is being propelled by a rising population and increased demand for polypropylene nonwoven fabric in a variety of industries, including healthcare, agriculture, construction, and geotextiles. Leading market participants are prioritizing the development of products that possess features such as comfort, sustainability, and water and dust resistance.

- Europe has witnessed the fastest growth in the polypropylene nonwoven market. European nations such as the United Kingdom, Germany, France, and Italy contribute significantly to regional market growth. This is owing to the increased use of feminine hygiene products and greater awareness of the benefits of sanitary pads and napkins during menstruation. Particularly, Scotland has set an example by becoming the first country to provide free sanitary pads and napkins to those in need. This initiative aims to address the stigma and lack of education surrounding menstruation while increasing the availability of feminine hygiene products.

Competitive Landscape

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Ahlstrom-Munksjo Oyj

- Asahi Kasai Corporation

- Berry Global, Inc.

- First Quality Nonwovens Inc.

- FITESA

- Freudenberg Group

- Johns Manville Corporation

- Kimberly-Clark Corporation

- Lydall, Inc.

- Mitsui Chemicals Inc.

- PFNonwovens a.s.

- Schouw & Co.

- Suominen Corporation

- Toray Industries Inc.

Recent Developments

- In July 2023, Berry Global partnered with Deaconess Midtown Hospital and Nexus Circular to responsibly recycle sterile, non-hazardous plastic packaging and nonwoven fabric from the hospital's surgical center. This initiative aims to divert approximately 500 pounds of gently used plastic from landfills each week, primarily from the outer packaging of surgical instruments and surplus nonwoven surgical gowns and clothes.

- In September 2022, Suominen launched 'FIBRELLA Strata,' a tri-layer nonwoven intended for a variety of industries and applications, with a particular emphasis on the baby market. The product's three-layer structure is known for its exceptional softness and cleaning performance.

- In April 2022, Pegas Nonwovens announced a partnership with Smart Plastic Technologies to pioneer the development of nonwoven fabrics incorporating SPtek ECLIPSE technology.

Report Coverage

The polypropylene nonwoven fabrics Market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, and their futuristic growth opportunities.

Polypropylene Nonwoven Fabrics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 30.59 billion |

|

Revenue forecast in 2032 |

USD 50.84 billion |

|

CAGR |

6.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

Custom Market Research Services

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Browse Our Top Selling Reports

Unmanned Surface Vehicle Market Size, Share 2024 Research Report

Car Camera Cleaning Systems Market Size, Share 2024 Research Report

3D Printing High Performance Plastic Market Size, Share 2024 Research Report

FAQ's

key companies in Polypropylene Nonwoven Fabrics Market are Ahlstrom-Munksjo Oyj, Asahi Kasai Corporation, Berry Global, Inc., First Quality Nonwovens Inc., FITESA

Polypropylene nonwoven fabrics market exhibiting the CAGR of 6.6% during the forecast period

The Polypropylene Nonwoven Fabrics Market report covering key segments are product, application, and region.

key driving factors in Polypropylene Nonwoven Fabrics Market are rising demand for polypropylene nonwoven fabric in the medical sector facilitates the growth of the market

The polypropylene nonwoven fabrics market size is expected to reach USD 50.84 Billion by 2032