Airlines Market Size, Share, Trends, & Industry Analysis Report

By Transport Type (Domestic, International), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 116

- Format: PDF

- Report ID: PM3892

- Base Year: 2024

- Historical Data: 2020-2023

What is Airlines Market Size?

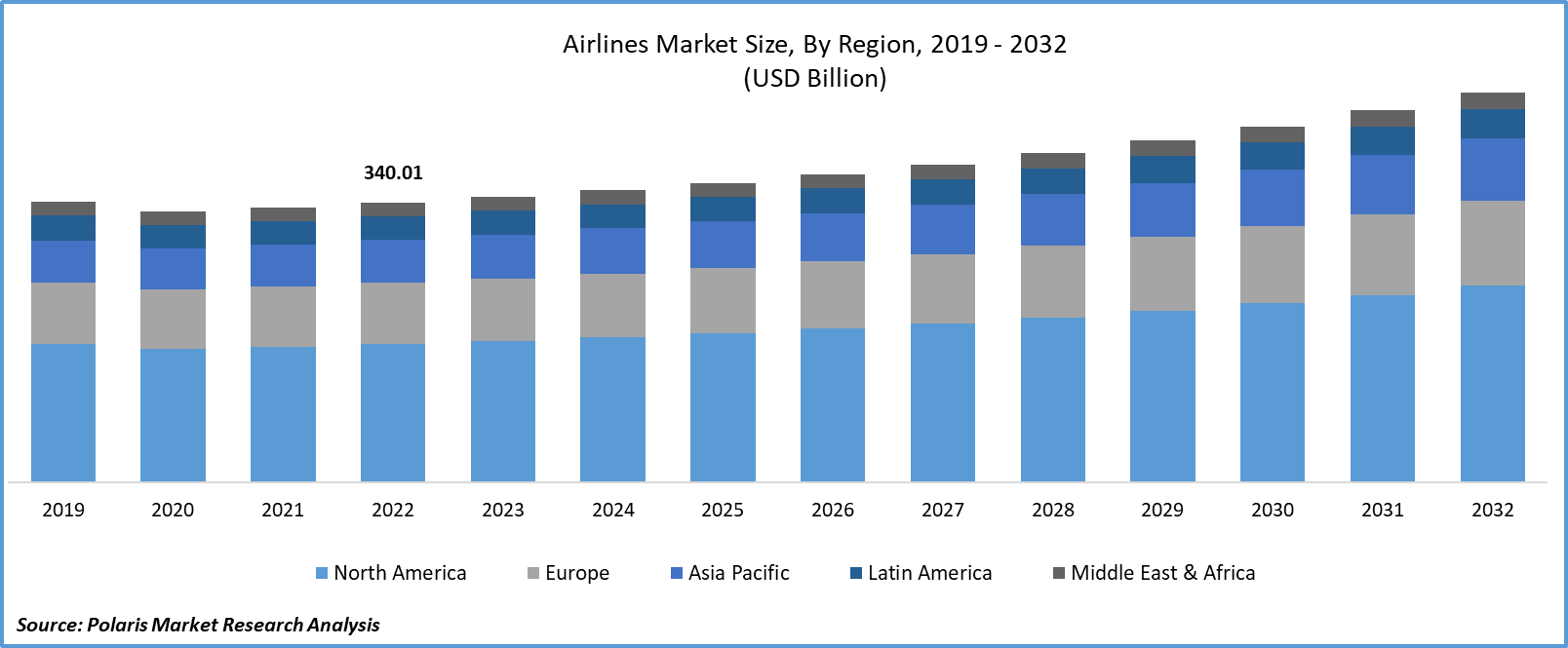

The global airlines market size and share was valued at USD 590.12 billion in 2024 and is expected to grow at a CAGR of 3.3% during the forecast period. The growth is driven by rising disposable income, growth in tourism, and expansion of low-cost carriers.

Key Insights

- The international segment is expected to witness significant growth during the forecast period due to the ease of air travel regulations and increasing tourism.

- The passenger dominated with largest share in 2024 due to rising use of modern tactical data connection technologies.

- Asia Pacific dominated with largest share in 2024 due to the rising demand for air travel in countries such as China and India.

- North America is projected to accounted for a significant share in the global market as the region boasts a stable and robust economy, providing a conducive environment for the airline industry to flourish.

Industry Dynamics

- The rising disposable income and economic expansion is fueling the industry growth.

- Increasing domestic and international tourism is fueling the growth.

- The expansion of low-cost carriers is driving the growth.

- High operational costs, including fuel prices, maintenance, and regulatory compliance, significantly restrain profitability in the airlines market.

Market Statistics

- 2024 Market Size: USD 590.12 Billion

- 2034 Projected Market Size: USD 818.35 Billion

- CAGR (2025-2034): 3.3%

- Largest Market: Asia Pacific

Impact of AI on Industry

- Improves operational efficiency by reducing downtime with the help of predictive analytics.

- Improves customer experience by providing chatbots and virtual assistants 24/7.

- Enhanced demand forecasting for cargo capacity planning.

To Understand More About this Research: Request a Free Sample Report

Airlines form the foundation of our contemporary global society. Their significance is diverse, contributing to economic expansion, fostering cultural connections, and ensuring prompt emergency responses. It enhances global accessibility but also accelerates progress and advancement across a broad spectrum of industries and pursuits. An airline is a company operator that offers air transport services to carry passengers and freights worldwide. It primarily consists of airplanes, pilots, cabin crew, loaders, passengers, and other staff. Airlines use aircraft to offer their services and may form partnerships or alliances where they both operate the same flight. Depending on their operating region, airlines can have a license issued by a governmental aviation body or may be recognized with an air operating certificate. Airlines play a crucial role in the travel industry across the globe.

Airlines are often grouped into three categories, which include international airlines, national airlines, and regional airlines. International airlines, which operate large passenger jets, are focused on providing global services and carrying passengers/cargo over large distances. National airlines typically employ medium-sized and large-sized jets and focus on offering services in areas within the nation. Regional airlines, which are the smallest of the three main airline types, are focused on providing services within specific regions. Growth in employment opportunities in the aviation industry is projected to spur the airline market demand in the upcoming years.

Growth Drivers

What are the Factors Driving Airlines Market?

The industry is driven by mixed of various factor. The major factor driving is rising disposable income of general population. This rise in disposable income is fueled by economic growth in developing countries such as India, Brazil, and Vietnam. According to the U.S. Energy Information Administration, the per capita disposable income in India was USD 5,497 in 2022 and expected to reach USD 17,609 by 2050. This increase is supporting general population to spend on tourism, international studies and work-related trips. Consequently, driving the demand for the air travel. Additionally, growth in the e-commerce sector and globalization of trade is driving the demand for efficient transportation mode, which in turn is driving the demand for the air cargo. To meet this demand, airlines are diversifying their revenue with integration of air cargo which is further driving the industry growth.

Report Segmentation

The market is primarily segmented based on transport type, application, and region.

|

By Transport Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Why International Transport Type Segment is Expected to Grow at Fastest Rate?

The international segment is expected to grow at the fastest growth rate over the next coming years on account of the ease of air travel regulations and increasing tourism. Numerous nations have loosened their regulations on international air travel, fostering heightened competition among airlines and subsequently driving down fares for consumers. This has, in turn, spurred an increase in demand. Moreover, the tourism industry plays a pivotal role in propelling international air travel. Highly sought-after destinations worldwide draw in millions of tourists annually, significantly fueling the expansion of the global international airlines market. Furthermore, increasing awareness and accessibility is another factor contributing to the growth. The availability of online booking platforms, travel agencies, and improved marketing strategies have made it easier for people to plan and book international trips, thereby boosting demand.

Which Segment by Application Register Largest Market Share in 2024?

The passenger segment accounted for the largest market share in 2024 as passengers constitute the primary source of revenue for airlines. Ticket sales, ancillary services, and loyalty programs contribute substantially to an airline's financial viability. As a result, understanding and catering to passenger needs and preferences is paramount for sustained success in the industry. Moreover, passengers play a crucial role in shaping airline strategies. Their demands for comfort, convenience, and value influence decisions regarding routes, aircraft configurations, and service offerings. Airlines that prioritize passenger satisfaction are more likely to build strong brand loyalty and garner positive reviews, which can lead to increased market share and profitability. Passengers also drive innovation in the airline industry. Their evolving expectations for in-flight entertainment, connectivity, and amenities have spurred technological advancements and improvements in customer experience. This competitive edge encourages airlines to invest in modernizing their fleets and adopting cutting-edge technologies.

Regional Insights

How Asia Pacific Captured Largest Market Share in 2024?

The Asia Pacific region dominated the global market with the largest market share in 2024 due to the substantial population and the surge in air travel within countries such as China and India. Additionally, the region's status as a manufacturing hub amplifies cargo profitability for local airlines, while the escalating demand for commercial air travel propels further growth. According to Boeing's forecast reports, the Asia-Pacific region is anticipated to represent roughly half of the world's air traffic and approximately 40% of all upcoming aircraft deliveries over the next two decades, thereby driving the growth

What are the Reasons for North America's Fastest Growth?

The North America region is expected to be the fastest-growing region, with a healthy CAGR during the projected period as North America boasts a stable and robust economy, providing a conducive environment for the airline industry to flourish. This stability encourages both leisure and business travel. Moreover, the region is at the forefront of aviation technology, with many airlines investing in modern and fuel-efficient fleets. This enhances operational efficiency and cost-effectiveness. Consequently, driving the growth of industry in the region.

Who are the Key Players Operating in Airlines Market?

The airlines market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Air France KLM

- American Airlines Group

- ANA Holdings

- British Airways

- Delta Air Lines

- Deutsche Lufthansa

- Hainan Airlines

- Japan Airlines

- LATAM Airlines Group

- Qantas Airways

- Ryanair Holdings

- Singapore Airlines

- Southwest Airlines

- Thai Airways International PCL

- United Continental Holdings

- WestJet Airlines

Recent Developments

- October 2025, Air Transat launched new international routes for Summer 2026, expanding its network from Québec City, Ottawa, Montréal, and Toronto. The airline enhanced year-round connectivity to Europe, Latin America, and the Caribbean, strengthening its global presence in leisure travel

- October 2025, United Airlines revealed six new international routes as part of its 2026 expansion plan, following a teaser campaign that engaged the public. The announcement, led by SVP Patrick Quayle, emphasized United’s strategy to strengthen its global connectivity.

- June 2023, British Airways planned to expand in the Indian aviation sector and has raised its weekly flight frequency beyond pre-pandemic levels.

- February 2023, Singapore Airlines acquired a 25% share in Air India, followed by an investment of $267 million in the Tata-owned airline. After merging with Vistara, Air India's CEO, Campbell Wilson, declared that the combined carrier would operate under the name "Air India". This strategic merger not only fortifies Singapore Airlines' presence in the Indian market but also positions it to vie competitively in the growing aviation sector.

Airlines Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 590.12 billion |

| Market size value in 2025 | USD 609.31 billion |

|

Revenue Forecast in 2034 |

USD 818.35 billion |

|

CAGR |

3.3% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Transport Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Browse Our Top Selling Reports

Prosthetics And Orthotics Market Size, Share 2024 Research Report

Dark Fiber Network Market Size, Share 2024 Research Report

Polypropylene Nonwoven Fabric Market Size, Share 2024 Research Report

Amniocentesis Needle Market Size, Share 2024 Research Report

Protein Hydrolysates Market Size, Share 2024 Research Report

FAQ's

• The market size was valued at USD 590.12 Billion in 2024 and is projected to grow to USD 818.35 Billion by 2034.

• The market is projected to register a CAGR of 3.3% during the forecast period.

• A few of the key players in the market are Air France KLM, American Airlines Group, ANA Holdings, British Airways, Delta Air Lines, Deutsche Lufthansa, Hainan Airlines, Japan Airlines, LATAM Airlines Group, Qantas Airways, Ryanair Holdings, Singapore Airlines, Southwest Airlines, Thai Airways International PCL, United Continental Holdings, WestJet Airlines.

• The passenger segment accounted for the largest market share in 2024.

• The international is expected to record significant growth.