Amniocentesis Needle Market Share, Size, Trends, Industry Analysis Report

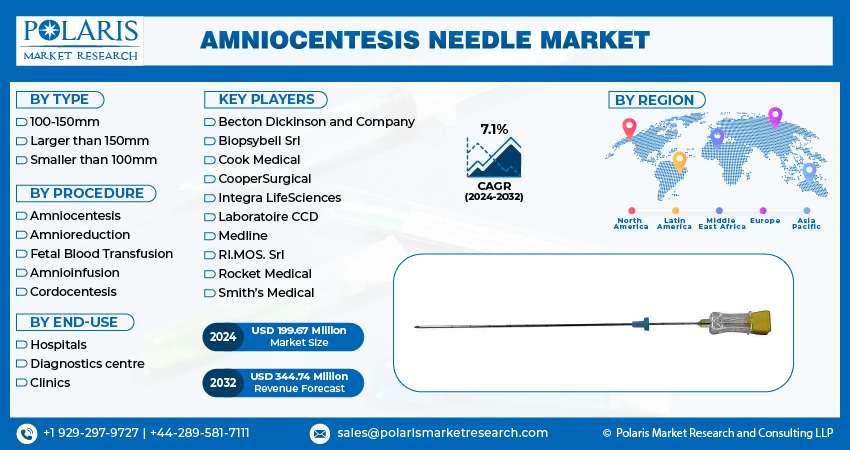

By Type (100-150mm, Larger than 150mm, Smaller than 100mm); By Procedure; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4526

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

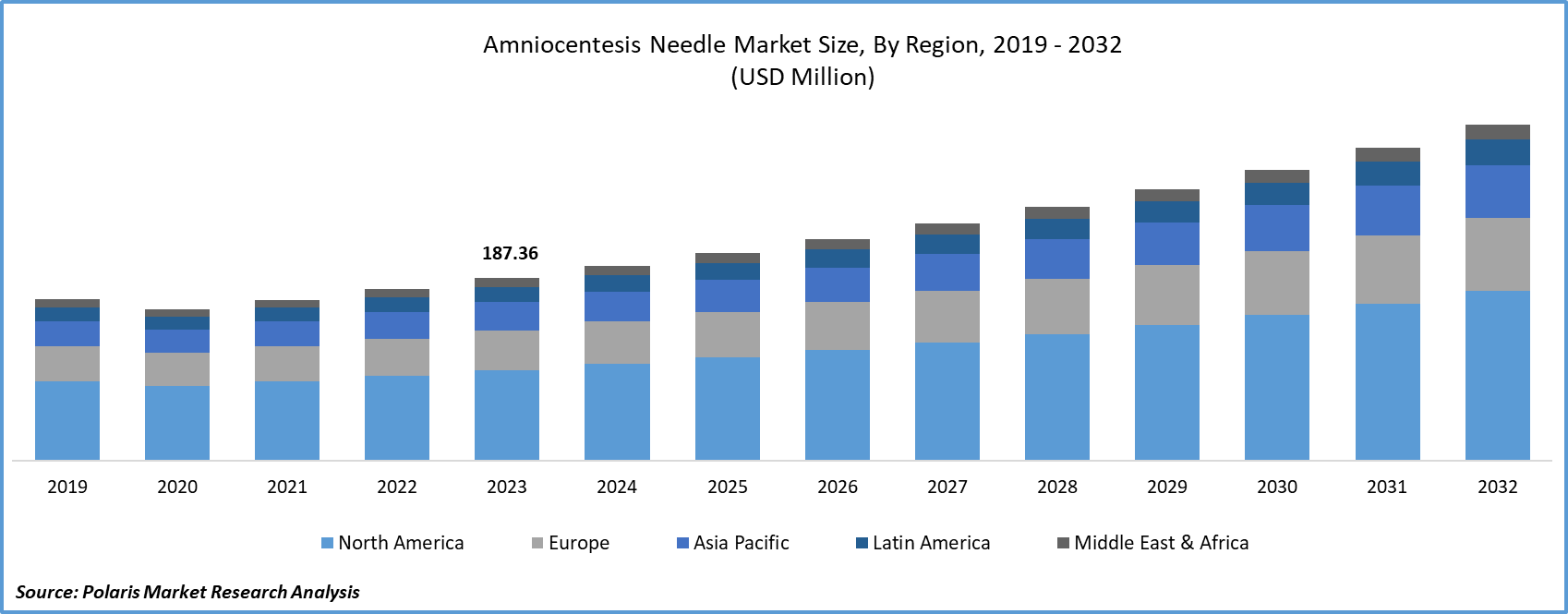

Amniocentesis Needle Market size was valued at USD 187.36 million in 2023. The market is anticipated to grow from USD 199.67 million in 2024 to USD 344.74 million by 2032, exhibiting the CAGR of 7.1% during the forecast period

Amniocentesis Needle Market Overview

A prenatal procedure called amniocentesis is performed to identify infections and chromosomal abnormalities in fetuses. A small amount of fluid, 30 cubic centimeters, is taken from the womb for this test. This is then utilized to identify any hereditary diseases that the infants may have. The primary cause of the market's expansion is the rise in genetic disease frequency on a global scale. Healthcare professionals are recommending amniocentesis procedures more frequently, with a higher success rate. This is likely due to increased awareness of congenital diseases, including Down's syndrome. Additionally, there is a growing population of pregnant individuals and increased investment in healthcare research and development. These factors are expected to drive sales of amniocentesis needles.

- In March 2021, The BD Chorionic Villus Sampling (CVS) System, a novel amniocentesis needle introduced by Becton Dickinson and Company, has a revolutionary ergonomic handle design that reduces hand fatigue and increases accuracy throughout operations.

With increasing pregnancy rates and the widespread use of diagnostic tests in developed countries, the amniocentesis market is expected to grow in the coming years. Furthermore, a high occurrence of congenital abnormalities and a rise in middle-aged mothers during the projected period will also be the factors to fuel the market.

To Understand More About this Research: Request a Free Sample Report

Furthermore, technological advancements in healthcare, specifically within prenatal diagnostics, play a pivotal role. Ongoing enhancements in the design of amniocentesis needles and diagnostic techniques have significantly improved accuracy, safety, and patient comfort. These improvements concentrate on optimizing needle structure, minimizing size, and refining procedural precision, ultimately ensuring a safer and more comfortable experience during amniocentesis procedures. Additionally, advancements in genetic testing and molecular diagnostics have bolstered the thorough examination of samples acquired through amniocentesis. This progress markedly enhances the precision in identifying various genetic abnormalities, thereby contributing to an overall improved experience.

The research report offers a quantitative and qualitative analysis of the Amniocentesis Needle Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Amniocentesis Needle Market Dynamics

Market Drivers

Rising Occurrence of Gestational Diabetes bolstering the growth of the Amniocentesis Needle market industry.

The global surge in diabetes cases has led to numerous health complications for many individuals. The elevated prevalence of gestational diabetes has consequently increased the demand for amniocentesis, particularly in pregnant women with diabetes who experience a heightened accumulation of amniotic fluid. This condition poses risks to both maternal and fetal health, driving the need for amniocentesis needles to alleviate complications by draining excess amniotic fluid and addressing the health concerns of pregnant women.

Market Restraints

Rising Preference for Non-Invasive Prenatal Tests (NIPTs) is likely to hamper the growth of the market.

The rising popularity of minimally invasive procedures is anticipated to continue growing in the foreseeable future, driven by research advancements and increased accessibility to non-invasive procedures. This trend, however, poses a potential challenge for the amniocentesis needle market revenue, as these procedures often do not necessitate the use of needles. Additionally, Non-Invasive Prenatal Tests (NIPTs) offer advantages such as reduced infection risk and cross-contamination, further impacting the demand for amniocentesis needles. Companies are responding to this shift by introducing new non-invasive prenatal tests to meet the demand generated by advancements in minimally invasive technologies, potentially posing a threat to the growth of the amniocentesis needle market forecast in the near future. For instance, In April 2021, ARCEDI Biotech ApS introduced EVITA TEST COMPLETE™, a prenatal genetic blood test capable of isolating and identifying fetal cells in maternal blood, providing comprehensive information on 22 chromosome pairs and sex chromosomes as early as the 12th week of pregnancy.

Report Segmentation

The market is primarily segmented based on type, procedure, end-use, and region.

|

By Type |

By Procedure |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Amniocentesis Needle Market Segmental Analysis

By Type Analysis

- The segment of needles ranging from 100 to 150 mm secured the largest market share in 2023, attributed to their versatility and applicability across various medical procedures, including drug administration, vaccinations, and blood sampling. These needles strike a balance between precision and patient comfort, making them a preferred choice in the medical field. Notably, they are frequently employed for females with a normal body mass index (BMI) and are commonly administered to pregnant women with a higher BMI. For example, in the UK, where a substantial obstetric challenge stems from a high obesity rate affecting 21.3% of pregnant women, with only 47.3% having a normal BMI, the usage of this needle is anticipated to rise in obstetric practice.

- The segment of needles smaller than 100 mm exhibits the fastest CAGR throughout the forecast period. In the context of early pregnancies, there is a growing preference for shorter needles, especially when dealing with a smaller amniotic sac where maneuverability is crucial. These shorter needles align with the increasing demand for minimally invasive procedures, minimizing patient discomfort and tissue trauma. Ongoing advancements in needle design, including atraumatic tips and compatibility with ultrasound guidance, contribute to enhancing the safety and accuracy of early-trimester procedures, further fostering the adoption of smaller needles. Moreover, the medical practitioners' inclination towards smaller needle sizes, driven by improved maneuverability and reduced risk of complications, is a significant factor contributing to the heightened adoption and anticipated rapid expansion of this specific segment in the market.

By Procedure Analysis

- The amniocentesis procedures segment, dominated the revenue share in 2023. This growth is primarily attributed to the significance of amniocentesis as a crucial prenatal diagnostic tool, providing valuable insights into fetal health, genetic conditions, and chromosomal abnormalities essential for expectant parents and healthcare providers. Recent years have witnessed advancements in amniocentesis techniques, including non-invasive prenatal testing (NIPT) and sophisticated genetic testing technologies, expanding its scope and enhancing accuracy. Notably, the increasing adoption of NIPT offers highly precise genetic information while avoiding the invasiveness associated with alternative procedures. The rise in maternal age and heightened awareness of genetic disorders have further propelled the demand for such prenatal assessments.

- The fetal blood transfusion segment is experiencing a significant CAGR over the forecast period. Progress in fetal medicine and perinatal care has led to a heightened recognition of the effectiveness of fetal blood transfusion procedures in addressing specific fetal conditions. Additionally, advancements in needle technology, characterized by smaller gauges and atraumatic tips, are enhancing the safety and feasibility of fetal blood transfusions, consequently fostering their increased adoption. Moreover, the escalating incidences of fetal blood disorders, such as hemolytic disease, necessitating specialized interventions like intrauterine transfusions, have played a pivotal role in the expanded utilization of fetal blood transfusion procedures within this particular medical application.

Amniocentesis Needle Market Regional Insights

The North American region dominated the global market with the largest market share in 2023

The prominence of this is credited to a robust healthcare infrastructure, sophisticated prenatal care facilities, and a heightened awareness regarding the significance of prenatal testing among expectant parents. A growing number of couples in the U.S. and Canada are choosing prenatal screening to assess the health of their unborn babies and detect genetic conditions and chromosomal abnormalities. The presence of advanced diagnostic technologies and innovative genetic testing methods within healthcare facilities in North America has significantly bolstered the region's leading position in this domain.

The U.S. held the largest market share in North America. This can be attributed to the robust healthcare infrastructure and extensive research and development endeavors in the medical sector, resulting in technological advancements in prenatal diagnostics. The heightened demand for prenatal testing procedures, including amniocentesis, in the U.S. is driven by factors such as a higher prevalence of genetic disorders, an aging population, favorable reimbursement policies, and increased awareness among healthcare professionals and patients about the benefits of prenatal testing. These factors collectively position the U.S. as an ideal market for products like amniocentesis needles and other prenatal testing solutions when compared to other countries in North America.

Asia Pacific region is propelled to be the fastest growing region in the amniocentesis market by a rising awareness of prenatal care and the significance of genetic screening. Countries with substantial populations, such as China and India, are experiencing an escalating demand for advanced prenatal diagnostics. The Asian nations have witnessed a surge in the number of pregnant women seeking comprehensive prenatal care. Additionally, ongoing technological advancements in the region, coupled with the emergence of telemedicine and digital healthcare solutions, are extending the accessibility of prenatal testing services.

India held the largest market share in the Asia Pacific region. This can be attributed to its substantial population and a growing awareness of prenatal health and genetic concerns. The increased recognition of these factors has generated a heightened demand for advanced prenatal diagnostic techniques such as amniocentesis. This increased awareness has particularly underscored the significance of early and accurate diagnosis, especially within a significant population, thereby contributing significantly to India's prominence in the Asia Pacific region.

Competitive Landscape

The Amniocentesis Needle market opportunities is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Becton Dickinson and Company

- Biopsybell Srl

- Cook Medical

- CooperSurgical

- Integra LifeSciences

- Laboratoire CCD

- Medline

- RI.MOS. Srl

- Rocket Medical

- Smith’s Medical

Recent Developments

- In April 2023, Rocket Pharmaceuticals declared the augmentation of its leadership team to reinforce its expanding and industry-leading portfolio of AAV and LV gene therapy assets.

- In June 2023, Becton, Dickinson, and Company concluded the transaction by selling its surgical instrumentation, laparoscopic instrumentation, and sterilization container assets to STERIS plc.

- In February 2022, CooperSurgical completed the acquisition of Cook Medical's reproductive health portfolio for a significant sum of USD 875 million. This portfolio includes a variety of medical equipment tailored for fertility, obstetrics, gynecology, and in vitro fertilization (IVF).

Report Coverage

The Amniocentesis Needle market growth report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, procedure, end-use, and futuristic growth opportunities.

Amniocentesis Needle Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 199.67 million |

|

Revenue forecast in 2032 |

USD 344.74 million |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Procedure, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Quality Assured

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Amniocentesis Needle Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports

Airlines Market Size, Share 2024 Research Report

Legal AI Market Size, Share 2024 Research Report

Pipeline Pigging Services Market Size, Share 2024 Research Report

FAQ's

The global Amniocentesis Needle market size is expected to reach USD 344.74 million by 2032

Key players in the market are Biopsybell Srl, Cook Medical, CooperSurgical, Integra LifeSciences, Laboratoire CCD

North American contribute notably towards the global Amniocentesis Needle Market

Amniocentesis Needle Market exhibiting the CAGR of 7.1% during the forecast period

The Amniocentesis Needle Market report covering key segments are type, procedure, end-use, and region.