Aviation Analytics Market Size, Share, Trends, Industry Analysis Report

By Component (Services, Solutions), By Deployment, By Business Function, By Application, By End Use, and By Region -Market Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM2710

- Base Year: 2024

- Historical Data: 2020-2023

Overview

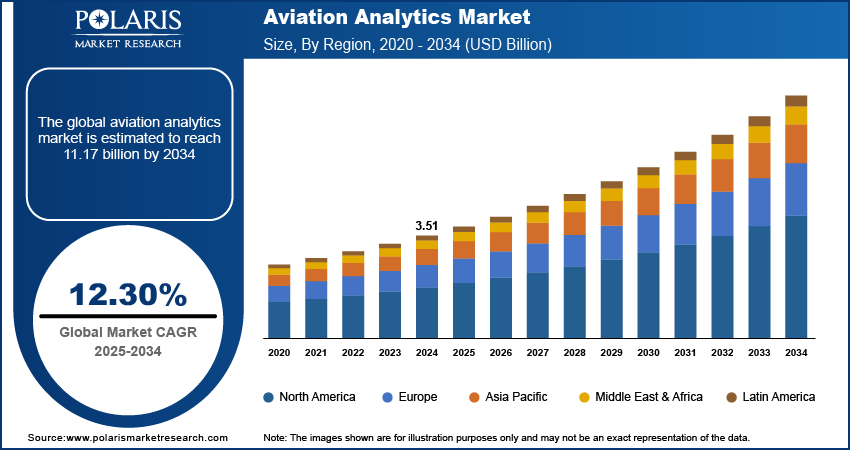

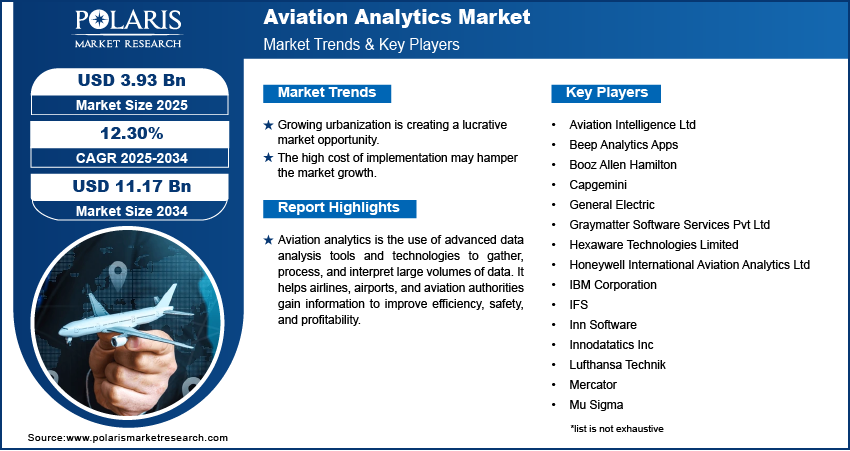

The global aviation analytics market size was valued at USD 3.51 billion in 2024. The market is projected to grow at a CAGR of 12.30% during 2025 to 2034. Key factors driving demand for aviation analytics include the growth of air traffic, rising urbanization, and the increasing complexity of operations.

Key Insights

- The solution segment held the largest revenue share in 2024 and is anticipated to lead the market over the forecast period, owing to the rising need for a customized aviation analytics solution that can address industry issues.

- The rising demand for customizable and sole ownership solutions in the industry drove the dominance of the on-premise segment in 2024.

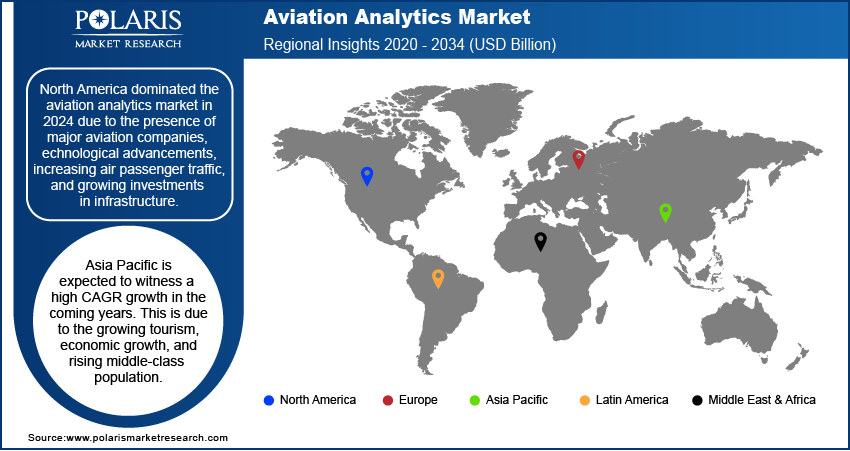

- North America dominated the aviation analytics market in 2024 due to the presence of major aviation companies, technological advancements, increasing air passenger traffic, and growing investments in infrastructure.

- Asia Pacific is expected to witness a high CAGR growth in the coming years. This is due to the growing tourism, economic growth, and rising middle-class population.

Industry Dynamics

- The global aviation analytics market is fueled by the growing disposable income of the middle-class population and the development of budget-friendly airlines.

- The increasing airport congestion with the emergence of new flight routes and aircraft providers is also anticipated to increase demand for aviation analytics.

- Growing urbanization is creating a lucrative market opportunity.

- The high cost of implementation may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 3.51 Billion

- 2034 Projected Market Size: USD 11.17 Billion

- CAGR (2025-2034): 12.30%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Aviation Analytics Market

- Optimizes fuel efficiency and flight routes, reducing operational costs and emissions.

- Improve passenger experience through demand forecasting and personalized services.

- strengthens safety by detecting faults in real time.

- Helps airlines to boost revenue management and optimize pricing strategies

Aviation analytics is the use of advanced data analysis tools and technologies to gather, process, and interpret large volumes of data. It helps airlines, airports, and aviation authorities gain information to improve efficiency, safety, and profitability. The applications of aviation analytics include optimizing flight schedules, improving fuel efficiency, enhancing predictive maintenance, and strengthening safety measures. The demand for aviation analytics is being driven by the increasing penetration of analytical solutions to update aircraft fleets and operations to ensure flight safety.

The COVID-19 pandemic had a negative impact on the growth of the market. The aviation industry was severely impacted as operations of many airlines were halted, and many national and international flights remained grounded. In addition, due to the rise in infection, demand for air travel was also reduced, halting the aviation analytics market. Moreover, aviation analytics use a large volume of data which requires a skilled workforce; lack of technical and analytical skills is a major factor in restraining the market growth.

Industry Dynamics

Growth Drivers

The growing disposable income of the middle-class population acorss the globe is propelling the market growth. Bureau of Economic Analysis stated that the disposable personal income in the US increased +0.6% in April 2025 from March 2025. This is fueling an increase in air travel, which is generating more complex data that airlines must manage. This is propelling airline companies to adopt advance aviation analytics. Moreover, the growing government intiative to promote airline travel, especially in emerging economies such as India is leading to market growth. The increasing number of international tourism destination coupled with growing urbanization is further driving the demand for aviation analytics.

Report Segmentation

The market is primarily segmented based on component, deployment, business function, application, end use, and region.

|

By Component |

By Deployment |

By Business Function |

By Application |

By End Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Component Insight

The solution segment held the largest revenue share in 2024 and is anticipated to lead the market over the forecast period, owing to the rising need for a customized aviation analytics solution that can address industry issues. Solutions also assisted in improving operational productivity, maintenance, and profitability in the businesses, which encouraged airline companies to adopt specilized aviation analytics solutions. Moreover, solutions helped airline companies understand customer preferences and gather meaningful data when customers book tickets and so that they could target a specific audience by offering personalized discounts. The growing aircraft accidents during landing and takeoff also propelled the solution segment dominance.

.webp)

Deployment Insight

The on-premise segment dominated the revenue share in 2024, owing to its enhanced control over data, security, performance, and cost predictability. Data security is also one of the major factor for the deployment of on-premise solutions by airline companies. Many airlines preferred in-house software infrastructure and services that guarantee data protection. The increasing development of aviation infrastructure in emerging countries such as India, Brazil, Thailand, and others further led the segment's dominance.

End Use Insight

The airline segment is growing at a high CAGR over the forecast period owing to the increase in disposable income of the middle-class population and emerging countries. The increase in the number of aviation passengers acorss the globe, availability of low-cost airlines, and demand for solutions to maintain flight data & customer analytics is further boosting the segment growth. Moreover, the increasing number of airline companies in developed and developing countries is leading to an increase in segment revenue.

Regional Analysis

North America dominated the aviation analytics market in 2024 due to the presence of major aviation companies, technological advancements, increasing air passenger traffic, and growing investments in infrastructure. The Bipartisan Infrastructure Law provided $20 billion for airport infrastructure. The presence of major tourist destination such as New York, Los Angeles, Las Vegas, and Washington D.C also increased the air travel, which led to the the dominance of North America. Moreover, the high disposable income and existence of advanced technological companies in the region also led the industry dominance in 2024.

Asia Pacific is expected to witness a high CAGR growth in the coming years. This is due to the growing tourism, economic growth, and rising middle-class population. The rising investments and developments in cloud technologies are expected to drive demand over the forecast period. Moreover, growing government initiatives to promote air travel in countries such as India is further contributing to the regional growth. India launched UDAN Scheme to boost regional connectivity and promote air travel.

Competitive Insight

Some of the major players operating in the global market include Atheer, Inc., Aviation Intelligence Ltd, Beep Analytics Aps, Booz Allen Hamilton, Capgemini, Genral Electric, Graymatter Software Services Pvt Ltd, Hexaware Technologies Limited, Honeywell International Aviation Analytics Ltd, IBM Corporation, Ins Software, Ifs, Innodatatics Inc, Lufthansa Technik, Mercator, Mu Sigma, Oracle Corporation, Ramco Systems, Relx Group Plc, Rusada, Sap Se, Asas Institute Inc, Swiss Aviation Software Ltd, Windward Islands Airways International N.V, and Zestiot.

Recent Developments

In July 2022, General Electric signed a memorandum of understanding with Teradata and Microsoft to work on a designed solution to reduce carbon emissions. The companies will work on a product that will provide pilots with equipment to monitor emissions, report, and take immediate action to minimize them.

In July 2022, Malaysia Airlines extended its partnership with SITA to complete its upgrade that offers secure, speedy, and consistent network connectivity between its hub in Kuala Lumpur and its overseas operations. In addition, SITA will help travelers to reduce the cost of connectivity and enhance service quality to access new services.

Aviation Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.51 billion |

| Market size value in 2025 | USD 3.93 billion |

|

Revenue forecast in 2034 |

USD 11.17 billion |

|

CAGR |

12.30% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Key Companies |

Atheer, Inc., Aviation Intelligence Ltd, Beep Analytics Apps, Booz Allen Hamilton, Capgemini, General Electric, Graymatter Software Services Pvt Ltd, Hexaware Technologies Limited, Honeywell International Aviation Analytics Ltd, IBM Corporation, Ins Software, Ifs, Innodatatics Inc, Lufthansa Technik, Mercator, Mu Sigma, Oracle Corporation, Ramco Systems, Relx Group Plc, Rusada, Sap Se, Asas Institute Inc, Swiss Aviation Software Ltd, Windward Islands Airways International N.V, and Zestiot. |

FAQ's

• The global market size was valued at USD 3.51 billion in 2024 and is projected to grow to USD 11.17 billion by 2034.

• The global market is projected to register a CAGR of 12.30% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market include Atheer, Inc., Aviation Intelligence Ltd, Beep Analytics Apps, Booz Allen Hamilton, Capgemini, General Electric, Graymatter Software Services Pvt Ltd, Hexaware Technologies Limited, Honeywell International Aviation Analytics Ltd, IBM Corporation, Ins Software, Ifs, Innodatatics Inc, Lufthansa Technik, Mercator, Mu Sigma, Oracle Corporation, Ramco Systems, Relx Group Plc, Rusada, Sap Se, Asas Institute Inc, Swiss Aviation Software Ltd, Windward Islands Airways International N.V, and Zestiot.

• The solution segment dominated the market revenue share in 2024.