Prosthetics and Orthotics Market Share, Size, Trends, Industry Analysis Report

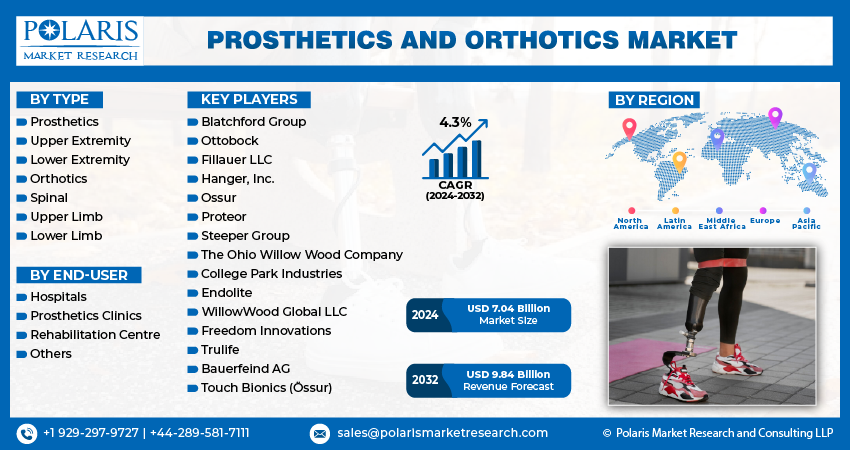

By Type (Prosthetics, Orthotics); By End-user; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4514

- Base Year: 2023

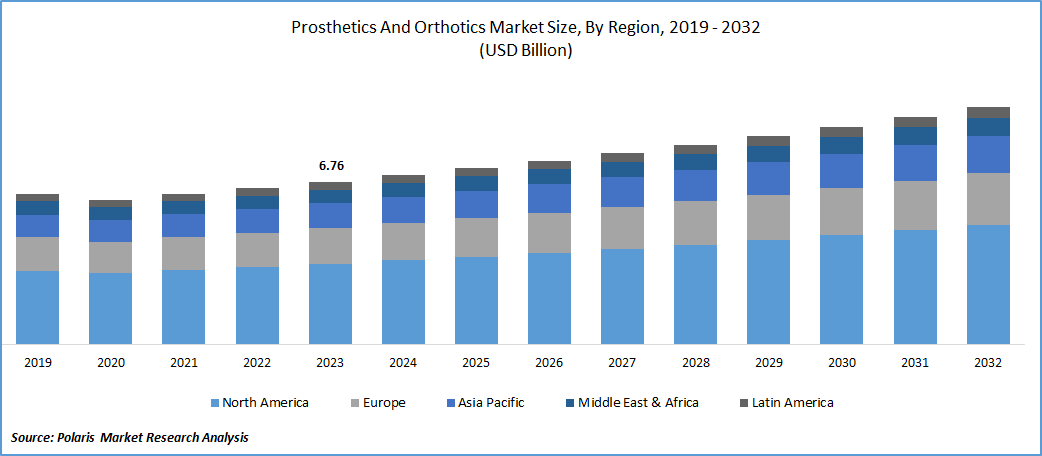

- Historical Data: 2019-2022

Report Outlook

- Prosthetics and Orthotics Market size was valued at USD 6.76 billion in 2023.

- The market is anticipated to grow from USD 7.04 billion in 2024 to USD 9.84 billion by 2032, exhibiting the CAGR of 4.3% during the forecast period.

Market Introduction

The prosthetics and orthotics is experiencing dynamic changes driven by evolving technologies, demographic shifts, and advancements in materials and manufacturing processes. This market, aimed at improving the lives of individuals with limb impairments, encompasses a range of devices, including prosthetics for amputated limbs and orthotics for supporting and aligning musculoskeletal structures.

The continued advancement of technology is a prominent trend in the prosthetics and orthotics business. The usefulness, comfort, and aesthetics of prosthetic and orthotic devices are being improved by innovations such as 3D printing, myoelectric prosthetics, and new materials.

To Understand More About this Research: Request a Free Sample Report

Moreover, in the prosthetics and orthotics industry, personalization and customization are receiving more attention. Customized solutions that consider the unique requirements and traits of individual patients are becoming more and more common. This trend is consistent with the more general move toward customized treatments in healthcare.

- For instance, in January 2024, OrthoPediatrics has revealed its acquisition of Boston Orthotics & Prosthetics, with the financial details remaining undisclosed.

Prosthetics and orthotics are becoming more widely known in developing economies, and the infrastructure supporting healthcare is getting better. There is an increasing chance for market penetration and expansion as these areas invest in healthcare.

The usage of prosthetic and orthotic devices is not just restricted to medicine. Their use in sports and rehabilitation is becoming more and more popular. Customized equipment for athletes and physical therapy patients opens up new business opportunities for industry participants.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Prosthetics And Orthotics Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Market Trends

Industry Growth Drivers

Increasing amputation cases is projected to spur the product demand.

The prosthetics and orthotics market growth is greatly aided by rising amputation cases. Factors such as traumatic injuries, accidents, and medical conditions like diabetes contribute to the rising number of amputations globally. This creates a substantial market for prosthetic limbs, with the potential for continuous growth.

Increased ageing population is expected to drive prosthetics and orthotics market growth.

The global aging population is a significant driver for the prosthetics and orthotics market. With age comes an increased prevalence of musculoskeletal disorders and limb-related conditions, creating a substantial demand for prosthetic and orthotic devices. As individuals age, the prevalence of musculoskeletal disorders and mobility-related challenges rises, necessitating the adoption of prosthetic and orthotic solutions. These advanced technologies offer enhanced mobility and support for elderly individuals, contributing to improved quality of life. With a growing aging demographic worldwide, the demand for prosthetics and orthotics is on the ascent, driving market growth as these devices become integral in addressing age-related musculoskeletal issues and ensuring continued mobility and independence for the elderly population.

Industry Challenges

High expense of advanced technologies is likely to impede the market prosthetics and orthotics growth opportunities.

High expense of advanced technologies stand as a prominent factor hindering the growth of the prosthetics and orthotics market. Although new technologies provide more functionality, the expense of these state-of-the-art orthotic and prosthetic devices might be a major obstacle. Financial limitations may restrict access to cutting-edge technologies, particularly in underdeveloped nations.

Moreover, in some areas, people are not aware of the advantages and accessibility of orthotics and prosthetics. Because potential users might not look for or be aware of the solutions available, this impedes prosthetics and orthotics market growth.

Report Segmentation

The market is primarily segmented based on type, end-user, and region.

|

By Type |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Prosthetics segment is expected to witness highest growth during forecast period

The prosthetics segment is projected to grow at a CAGR during the projected period in the prosthetics and orthotics market. This is propelled by various significant factors. Firstly, the increasing prevalence of traumatic injuries, accidents, and medical conditions leading to amputations contributes significantly to the demand for prosthetic devices. Secondly, technological advancements such as myoelectric prosthetics and innovative materials are enhancing the functionality and comfort of prosthetic limbs, attracting a wider user base.

Additionally, a growing aging population with age-related musculoskeletal issues further fuels the demand for prosthetics to restore mobility. The rise of personalized and customized prosthetic solutions, aligned with individual patient needs, is also a notable factor propelling the segment's growth. Overall, a combination of technological innovation, demographic shifts, and a heightened focus on individualized healthcare contributes to the flourishing prosthetics segment in the prosthetics and orthotics market.

By End-Users Analysis

Prosthetics clinics segment is expected to dominate the prosthetics and orthotics market during forecast period

The prosthetics clinics segment leads the prosthetics and orthotics market, demonstrating its dominance in the sector. For those in need of prosthetic devices, prosthetics clinics are essential in offering specialized treatments. These clinics are essential centers for prosthetic evaluation, fitting, customization, and maintenance, guaranteeing a thorough and individualized response to patient needs. The significance of prosthetics clinics is ascribed to their proficiency in handling a wide range of situations, including congenital limb deficits and accident-related amputations. Within the dynamic environment of the prosthetics and orthotics business, prosthetics clinics are essential drivers of innovation and individualized care due to their pivotal role in cooperating with manufacturers, patients, and healthcare professionals.

Regional Insights

North America region dominated the global prosthetics and orthotics market in 2023

North America dominated the global prosthetics and orthotics market in 2023 and is expected to continue to do so. The region witnesses a significant increase in osteosarcoma incidence, a surge in road accidents, a rising prevalence of sports injuries, and a growing burden of diabetes-related amputations, particularly in the United States. Notably, osteosarcoma, the most prevalent bone cancer, sees around 1,000 new cases diagnosed annually in the U.S., with half of them affecting children and teens, as per the American Cancer Society. Primarily affecting individuals aged 10 to 30, this underscores the region's heightened demand for prosthetics and orthotics, driving the market's growth in North America.

The Asia Pacific region is poised for substantial growth in the global prosthetics and orthotics market, driven by several factors. The increasing geriatric population, a rising incidence of sports injuries and road accidents, a growing number of diabetes-related amputations, and an upsurge in osteosarcoma prevalence contribute to the market's expansion in the region. Notably, in India, as per the Ministry of Road Transport and Highways, over 1.5 lakh people succumb to road accidents annually, translating to an average of 1130 accidents and 422 deaths daily or 47 accidents and 18 deaths every hour. This alarming scenario is anticipated to increase the demand for prosthetics and orthotics in the Asia Pacific region.

Key Market Players & Competitive Insights

The prosthetics and orthotics market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Blatchford Group

- Ottobock

- Fillauer LLC

- Hanger, Inc.

- Ossur

- Proteor

- Steeper Group

- The Ohio Willow Wood Company

- College Park Industries

- Endolite

- WillowWood Global LLC

- Freedom Innovations

- Trulife

- Bauerfeind AG

- Touch Bionics (Össur)

Recent Developments

- In November 2023, Blatchford, a manufacturer specializing in prosthetics, introduced Tectus, an innovative intelligent orthotic device. This groundbreaking technology aimed to empower individuals with partial lower limb paralysis, facilitating easier, more natural, and comfortable walking. Tectus was designed to enhance confidence and safety, offering a life-changing solution for those facing mobility challenges due to lower limb paralysis.

- In April 2022, Blackrock Neurotech and Phantom Neuro have collaborated to develop prosthetics and exoskeletons capable of real-time replication of human movement.

Market Analysis & Report Coverage

The prosthetics and orthotics market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, form, distribution channel, and their futuristic growth opportunities.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.04 billion |

|

Revenue forecast in 2032 |

USD 9.84 billion |

|

CAGR |

4.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Download Sample Report

Want to check out the Prosthetics And Orthotics Market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

Browse Our Top Selling Reports

Hydrogen Hubs Market Size, Share 2024 Research Report

Therapeutic Hypothermia Systems Market Size, Share 2024 Research Report

Digestive Health Supplements Market Size, Share 2024 Research Report

Europe Digestive Health Supplements Market Size, Share 2024 Research Report

Lidocaine Hydrochloride Market Size, Share 2024 Research Report

FAQ's

The Prosthetics And Orthotics Market report covering key segments are type, end-user, and region.

The global prosthetics and orthotics market size is expected to reach USD 9.84 billion by 2032

Prosthetics and Orthotics Market CAGR of 4.3% during the forecast period

North America regions is leading the global market

Increasing amputation cases is projected to spur the product demand are the key driving factors in Prosthetics And Orthotics Market