Europe Digestive Health Supplements Market Share, Size, Trends, & Industry Analysis Report

By Type (Enzymes, Prebiotics, Probiotics, Symbiotic, Others); By Form; By Distribution Channel; By Country; Segment Forecast, 2025- 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4339

- Base Year: 2024

- Historical Data: 2020 - 2023

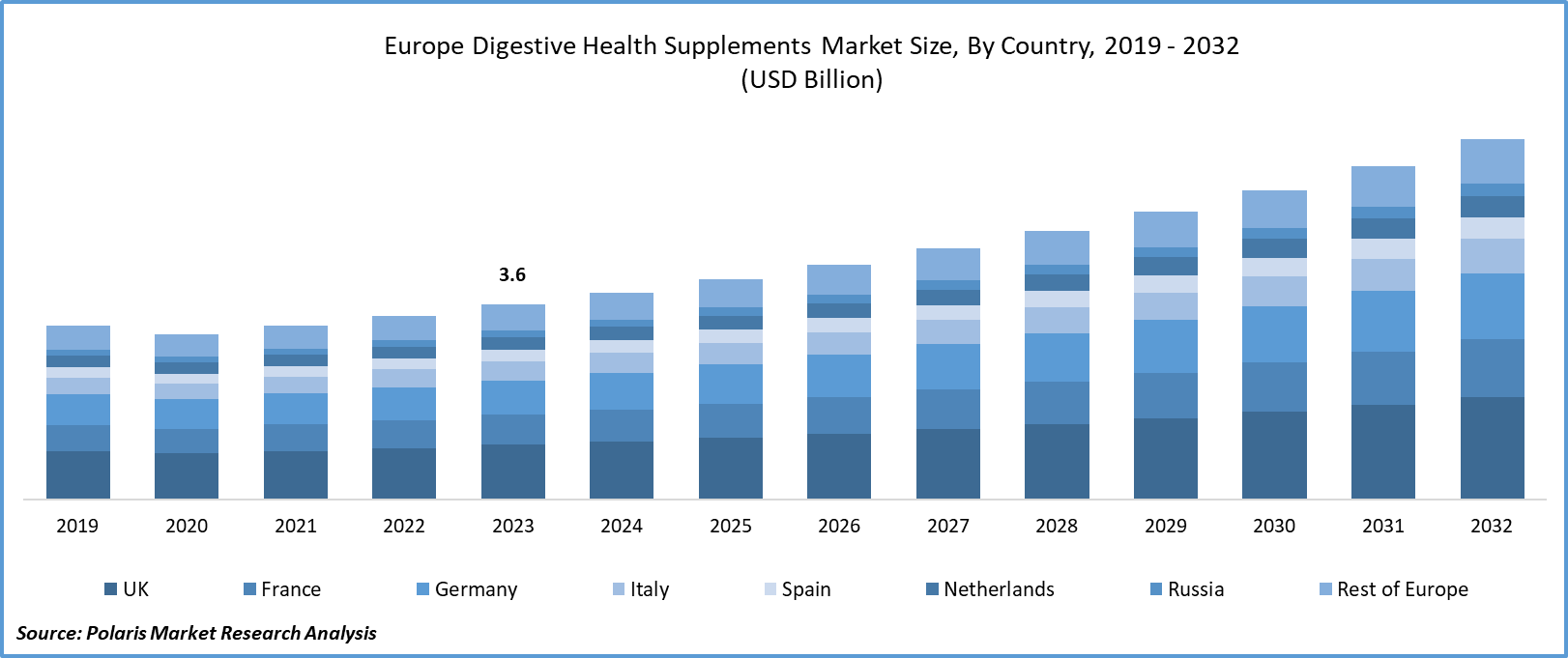

The Europe Digestive Health Supplements Market will reach USD 4.5 billion in 2024 and expand at a CAGR of 6.0% through 2034. Growth is driven by aging demographics, strong regulatory support for nutraceuticals, and heightened consumer focus on digestive wellness.

Market Introduction

Countries across Europe are exhibiting unique trends within the digestive health supplements market. For instance, in Western European nations such as the U.K., there is a notable inclination towards functional foods with digestive health benefits, leading to innovative product formulations. In contrast, Eastern European countries are experiencing a rising demand for traditional remedies, blending modern supplement trends with established herbal practices.

Opportunities abound for industry players to capitalize on these trends. Collaborations between supplement manufacturers and healthcare professionals are becoming pivotal, fostering credibility and awareness. Moreover, the integration of advanced technologies, such as personalized nutrition and microbiome analysis, presents a frontier for innovation.

For instance, in May 2023, Lallemand Health Solutions unveiled the inaugural and exclusive organic iteration of the probiotic yeast Saccharomyces boulardii. This milestone release, commemorating the 100th anniversary of the yeast's discovery, was initially launched in January.

Thus, the digestive health supplements market share in Europe is poised for robust expansion, fueled by a confluence of factors like shifting consumer preferences, regional variations, and the embrace of cutting-edge technologies. Industry stakeholders have the chance to not only meet current demands but also to shape the future of digestive health in the region.

To Understand More About this Research: Request a Free Sample Report

Industry Growth Drivers

The Rise in the Popularity of Health and Wellness is Projected to Spur Product Demand

The surge in popularity of sports and fitness nutrition is impacting the dietary supplements market. A growing number of fitness enthusiasts and athletes are creating a heightened demand for supplements that improve performance, facilitate muscle recovery, and contribute to overall physical well-being.

Increased Awareness is Expected to Drive Europe’s Digestive Health Supplements Market Growth

The global awareness and the COVID-19 outbreak have sparked health-conscious behavior among people, leading to an increased interest in supplements that bolster immune health. This heightened demand encompasses vitamins, minerals, and other formulations designed to boost the immune system. The COVID-19 outbreak has accentuated the significance of proactive health measures, positioning dietary supplements as an essential part of people's strategies for immune support.

Industry Challenges

Regulatory Challenges are Likely to Impede the Market European Digestive Health Supplements Growth Opportunities

The growth of digestive health supplements in Europe faces hindrances primarily due to regulatory challenges and varying standards across European countries. The European Union lacks a harmonized approach to health claims and labeling for such supplements, leading to confusion among consumers and hindering market expansion. Additionally, skepticism surrounding the efficacy of some digestive health products, coupled with a preference for natural dietary sources over supplements, poses a challenge. Economic uncertainties and budget constraints in certain regions also contribute to restrained consumer spending on non-essential health products. Overcoming these barriers will require concerted efforts from industry stakeholders to establish clearer regulations, build consumer trust, and address economic factors influencing purchasing decisions.

Report Segmentation

The market is primarily segmented based on type, form, distribution channel, and country.

|

By Type |

By Form |

By Distribution Channel |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Probiotics Segment is Expected to Dominate the European Digestive Health Supplements Market During the Forecast Period

The probiotic segment is dominating the Europe digestive health supplements market. The increasing occurrence of gastrointestinal disorders, such as irritable bowel syndrome (IBS) and inflammatory bowel diseases, has driven a surge in the demand for probiotics. The effectiveness of probiotics in improving symptoms and enhancing gut health resonates with the rising consumer preference for healthcare solutions that are efficient and preventive. This trend is notably pronounced among the elderly demographic, where heightened awareness regarding digestive health issues amplifies the inclination towards incorporating probiotics into their wellness routines.

By Form Analysis

The Tablets Segment is Expected to Dominate the European Digestive Health Supplements Market During the Forecast Period

In 2023, the Europe digestive health supplements market share was predominantly influenced by tablets, commanding a significant market share. In the digestive health supplements market of the U.K. and Russia, tablets are experiencing significant market growth. The convenience and precise dosage offered by tablets has fueled consumer preference in both regions. In the U.K., an increasing number of health-conscious individuals are using tablets as a convenient and quick fix for digestive health issues. Similar to this, as individuals become more aware of the importance of gut health, there is an increased demand for tablet-based digestive health supplements in Russia. This spike in tablet usage highlights a larger trend in these markets where customers are looking for affordable, effective treatments for digestive health.

By Distribution Channel Analysis

The Online Stores Segment is Expected to Witness the Highest Growth During the Forecast Period

The online retail sector is projected to witness the highest CAGR in the sales of digestive health supplements during the forecast period in Europe. The surge in digitization within the healthcare and wellness domains is propelling the online digestive health supplement market in the region. Digital platforms are pivotal in providing convenience and accessibility, meeting the growing demand for these supplements in Europe. E-commerce is transforming consumer behavior concerning digestive health supplements, emphasizing the significant role of online channels in reshaping the market landscape.

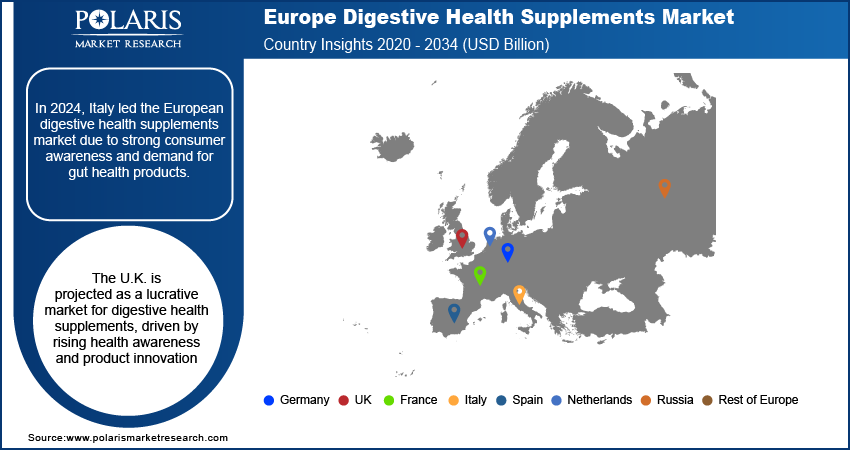

Country Insights

Italy Region Dominated the Europe Digestive Health Supplements Market in 2024

Italy dominated the European digestive health supplements market in 2024 and is expected to continue to do so. Italy's diverse regions exhibit unique cooking traditions and dietetic preferences, leading to distinct supplement choices. Robust online platforms and e-commerce channels play a pivotal role in driving the European digestive health supplements market growth, particularly in regions with a strong digital presence. The ease of accessing information and making online purchases contributes significantly to the overall expansion of the market. An illustrative example is the October 2020 launch of Centro Sperimentale del Latte's Flogranic Probiotics, a certified organic product range in Italy featuring Lactobacillus strains aimed at enhancing respiratory and oral health. This highlights the ongoing innovation and market response to regional preferences in Italy's dynamic supplement landscape.

In the meanwhile, the U.K. is projected as the lucrative country in the digestive health supplements market. The U.K. market for digestive health supplements is expanding because of a number of important factors. Demand is driven by a growing understanding of the significance of gut health and an increase in the frequency of digestive problems. The market is growing as a result of the health-conscious population in the U.K. actively seeking out preventative healthcare options. Furthermore, a greater emphasis on intestinal well-being is a result of changes in lifestyle, such as stress and dietary adjustments. The market gains from ongoing product improvements that satisfy consumer demands for convenient and efficient supplements. The United Kingdom is positioned as a strong market for digestive health supplements with the potential for sustainable growth due to the dynamic interaction of these elements.

Key Market Players & Competitive Insights

The Europe digestive health supplements market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the Europe digestive health supplements market include:

- ADM Protexin Ltd

- Bayer AG

- BioGaia AB

- Chr. Hansen Holding A/S

- Deerland Probiotics & Enzymes

- Dupont de Nemours, Inc.

- Herbalife Nutrition Ltd

- Nestlé S.A.

- Nutraceutix, Inc.

- Pfizer Inc.

- Probi AB

- Royal DSM N.V.

- Schiff Nutrition International

- The Clorox Company (Renew Life)

- Yakult Honsha Co., Ltd.

Recent Developments

- In October 2024 – Sirio launches “GummiBiotic” gummy supplements for digestive health across Europe

- In December 2023, Clasado Biosciences, based in Berkshire, UK, unveiled a novel addition to its direct-to-consumer (D2C) product lineup aimed at supporting children's immune health. The latest offering, the Bimuno Kids Immunity supplement, incorporates the company's key Bimuno galacto-oligosaccharides (GOS) prebiotic ingredient.

- In June 2023, Nestlé International Travel Retail (ITR) and Dufry collaborated to introduce the wellness brand Solgar to the channel, utilizing the Mind. Body. Soul. The shop-in-shop retail concept at airports in Athens and Zurich.

Report Coverage

The Europe digestive health supplements market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, forms, distribution channels, and their futuristic growth opportunities.

Europe Digestive Health Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 4.8 billion |

|

Revenue forecast in 2034 |

USD 8.1 billion |

|

CAGR |

6.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Country scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

Uncover the dynamics of the Europe Digestive Health Supplements sector in 2025 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2034, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Personal Cloud Market Size, Share 2024 Research Report

High-speed Data Converter Market Size, Share 2024 Research Report

Temperature Sensors Market Size, Share 2024 Research Report

Field Programmable Gate Array (FPGA) Market Size, Share 2024 Research Report

Drylab Photo Printing Market Size, Share 2024 Research Report

FAQ's

The Europe digestive health supplements market size is expected to reach USD 8.1 billion by 2034

Key players in the market are ADM Protexin Ltd, Nestlé S.A., Now Foods, NutraMarks, Inc., Procter & Gamble Co

key driving factors in Europe Digestive Health Supplements Market are rise in the popularity of health and wellness is projected to spur product demand

Europe Digestive Health Supplements Market exhibiting the CAGR of 6.00% during the forecast period.

The Europe Digestive Health Supplements Market report covering key segments are type, form, distribution channel, and country.