Digestive Health Supplements Market Share, Size, Trends, Industry Analysis Report

By Type (Enzymes, Prebiotics, Probiotics, Symbiotic, Others); By Form; By Distribution Channel; By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 130

- Format: PDF

- Report ID: PM4338

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

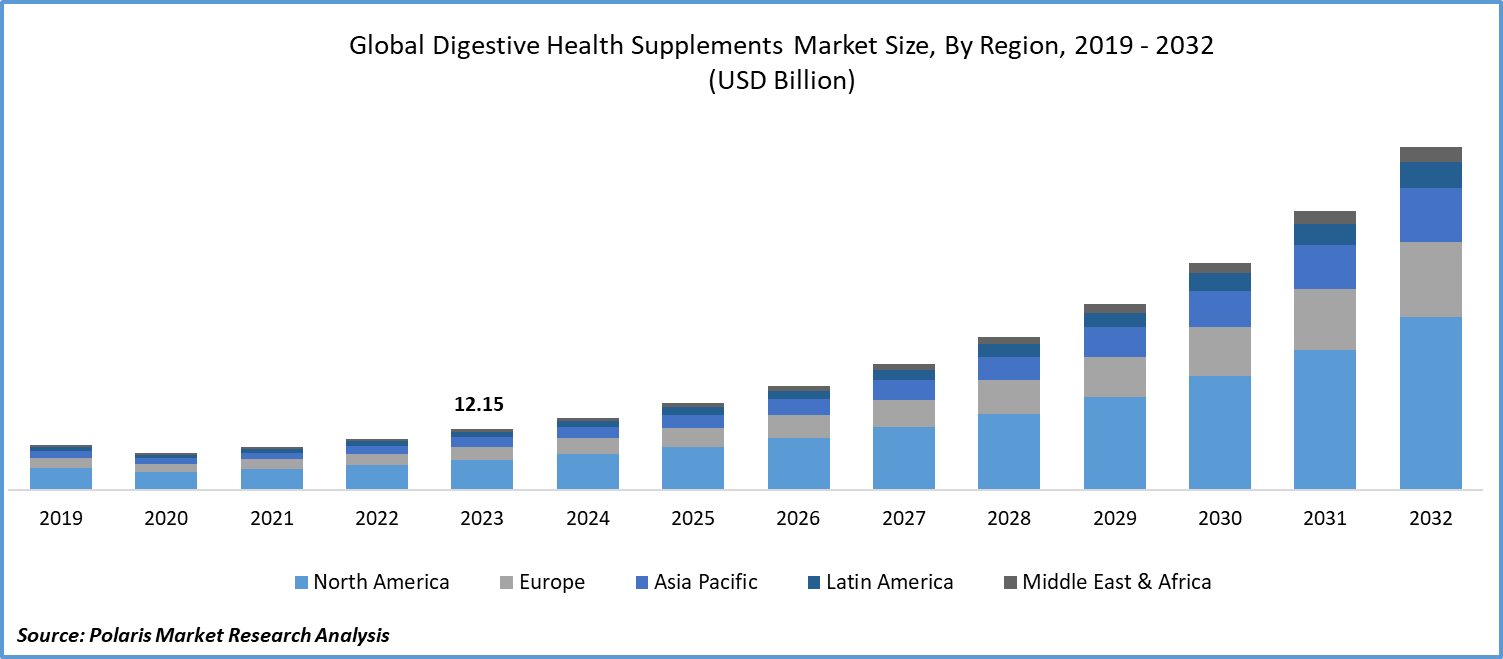

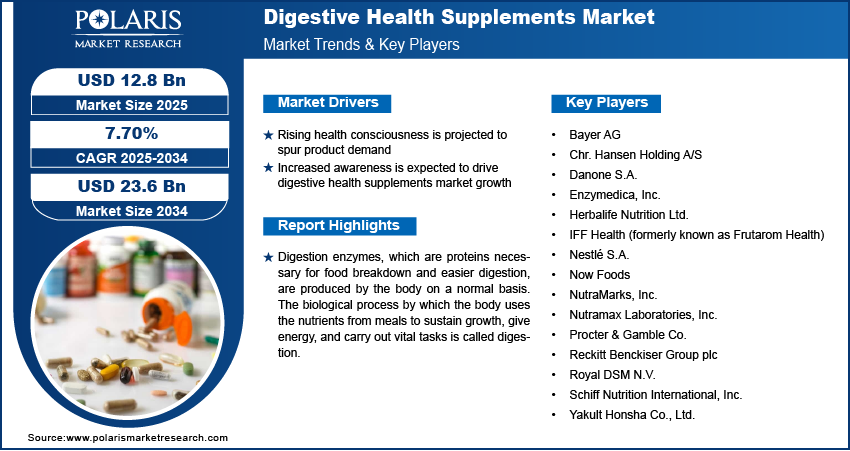

The digestive health supplements market was worth USD 12.01 billion in 2024 and is projected to register at a CAGR of 7.7% between 2025 and 2034. Increasing awareness of gut health, demand for probiotic formulations, and upcoming trends in preventive healthcare are fueling the market growth.

Market Insights

- The enzymes segment is projected to grow at an impressive CAGR during the projected period. Enzymes are predominantly utilized in the production and processing of dairy products due to their ability to enhance the quality, texture, and flavor of diverse products.

- In 2024, digestive health supplements in a capsule form dominated the overall business. Innovations such as targeted delivery with delayed-release capsules drive the growth of this segment.

- Pharmacies and drugstores together emerged as a dominant distribution channel in the market in 2024. These stores provide customers easy access to an array of digestive supplements, leading to a higher preference for in-store purchases.

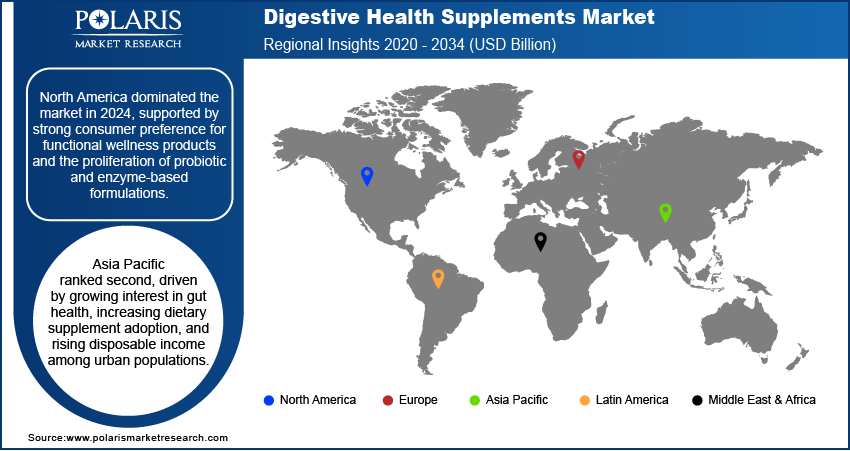

- North America dominated the global digestive health supplements market in 2024. Its dominance is attributed to the robust presence of prominent industry participants, governmental backing for novel product innovation, and advancements in the probiotic and prebiotic domains.

- The market in Asia Pacific is expected to growt at the fastest rate during the forecast period, primarily due to a rise in the prevalence of digestive problems, increased access to improved treatment procedures, and government campaigns encouraging a healthy lifestyle.

Market Dynamics

- Rising health consciousness and improving standard of living, particularly in developing countries, bolster the digestive health supplements market.

- Cutting-edge innovations in terms of precision medicine and tailored nutrition are expected to bring new opportunities into the market. These developments have the potential to power research efforts to customize supplements based on individual needs defined by their microbiome and genetic makeup.

- Strategic alliances and R&D expenditures will have a significant impact on the market's future.

- Regulations and the need for thorough clinical evidence to support supplement efficacy slow down product development and manufacturing, thereby extending the time-to-market.

Market Statistics

Market Size in 2024: USD 12.01 billion

Projected Market Size in 2034: USD 23.6 billion

CAGR, 2025–2034: 7.7%

Largest Market in 2024: North America

AI Impact on Digestive Dietary Supplements Market

- Supplement brands are eyeing the use of AI-driven data analysis of health (gut microbial flora, genetic profiles, lifestyle habits) to offer personalized digestive health solutions tailored to individual needs.

- Machine learning automates the analysis of bioactive compounds, clinical studies, and consumer feedback, which helps create more effective probiotic, prebiotic, and enzyme-based supplements.

- AI tools are used by brands and marketing teams to track consumer behavior, including purchasing patterns, online searches, and health app data, to identify trends in digestive wellness. This information can help them with targeted product launches.

- AI tools power demand forecasting for digestive supplements, reducing the risk of stockouts or overproduction and ensuring timely delivery.

- AI platforms assist in monitoring labeling accuracy, ingredient safety, and compliance with relevant health regulations.

- Virtual nutrition coaches on health apps encourage supplement uptake by explaining digestive health issues and providing personalized product suggestions.

To Understand More About this Research: Request a Free Sample Report

With its alleged benefits in treating common kinds of stomach irritation, heartburn, and other disorders garnering attention, digestive enzyme supplements are growing in popularity.

Digestion enzymes, which are proteins necessary for food breakdown and easier digestion, are produced by the body on a normal basis. The biological process by which the body uses the nutrients from meals to sustain growth, give energy, and carry out vital tasks is called digestion. A sustained rise in the global market for supplements promoting digestive health is being driven by rising preventative healthcare expenditures. This tendency is influenced by growing disposable income and increased health consciousness.

The market for digestive health supplements is about to undergo a revolution because of cutting-edge innovations like precision medicine and tailored nutrition. The next step is the customization of supplements based on personal needs using microbiome analysis and genetic profiling. This strategy indicates a substantial change in the way digestive health supplements are created and applied in the changing healthcare environment, as it promises more accurate and efficient results.

- For instance, in October 2023, Clasado Biosciences, based in Berkshire, UK, and ingredient distributor Stratum Nutrition from Carthage, MO, collaborated to unveil a prototype of a prebiotic-postbiotic gummy supplement at the SupplySide West trade show in Las Vegas.

The market for digestive health supplements is expanding due to rising digestive problems, a focus on preventative healthcare, and the use of cutting-edge technology in product creation. Strategic alliances and R&D expenditures will have a significant impact on the market's future direction as it is positioned for continued evolution. However, the market for supplements for digestive health faces obstacles from regulations and the need for thorough clinical evidence to support supplement efficacy. In the industry, openness and strict quality control are crucial, as shown by strict legislation and increased scrutiny.

Industry Growth Drivers

-

Rising health consciousness is projected to spur product demand

The digestive health supplements market growth is greatly aided by an increasing focus on preventative healthcare, which is being driven by rising health consciousness and disposable income. Age-related digestive problems among the aging population are another significant factor driving the market for digestive health supplements. Further propelling the market's rising trajectory are technological innovations like precision medicine and personalized nutrition, which create new opportunities for customized and targeted digestive health products.

-

Increased awareness is expected to drive digestive health supplements market growth

Growing awareness of the complex relationship between digestive health and general well-being has led to a demand for such supplements. The increasing prevalence of digestive disorders, which include irritable bowel syndrome (IBS) and gastroesophageal reflux disease, will continue to drive the market and expansion as people search for effective solutions.

Industry Challenges

-

Regulatory challenges are likely to impede the market for digestive health supplements growth opportunities

Regulatory challenges stand as a prominent factor hindering the growth of the digestive health supplements market. Stricter regulations and the need for comprehensive clinical evidence to support product efficacy pose obstacles for market players. The scrutiny surrounding health claims and labeling requirements adds complexity, impacting the timely introduction of new products. Navigating these regulatory hurdles demands substantial investments in research and development, potentially slowing down the market's growth. Addressing these challenges with transparency and adhering to regulatory standards becomes imperative for sustained progress in the competitive digestive health supplements landscape.

Report Segmentation

The market is primarily segmented based on type, form, distribution channel, and region.

|

By Type |

By Form |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

-

The enzymes segment is expected to witness the highest growth during the forecast period

The enzymes segment is projected to grow at a CAGR during the projected period in the digestive health supplements market. Anticipated growth in the segment is driven by the versatile nature of food enzymes and the increasing demand for enzyme cultures within the food & beverage industry. Predominantly utilized in the production and processing of dairy products, food enzymes find extensive application across the food sector, enhancing the quality, texture, and flavor of diverse products. Traditional applications like baking, brewing, and cheese-making, alongside emerging areas such as fat modification and the creation of novel sweeteners, underscore the widespread utility of food enzymes. This diverse range of applications is poised to propel the segment's expansion during the forecast period. The increased knowledge of the advantages of supplementing with enzymes spurs innovation, increasing product offers and making a substantial contribution to the market for digestive health supplements' steady rise.

By Form Analysis

-

The capsules segment is expected to dominate the digestive health supplements market during the forecast period

In 2023, the digestive health supplements market share was predominantly influenced by capsules, commanding a significant market share. Consumer preferences and technical improvements are driving the robust expansion of the capsules market within the digestive health supplements sector. Furthermore, the popularity of vegetarian and plant-based capsules is in line with the growing trend of health consciousness. Innovations like targeted delivery with delayed-release capsules are driving the market's rise. The market for supplements has grown substantially overall, with a notable contribution from capsules, which are essential in providing advantages related to digestive health in the context of increasingly tailored nutrition.

By Distribution Channel Analysis

-

The pharmacies & Drug Stores segment is expected to witness the highest growth during the forecast period

Pharmacies & Drug Stores emerged as the dominant players in the distribution channels segment. In the market for digestive health supplements, pharmacies, and medicine stores are seeing significant development. These stores give customers easy access to a large selection of digestive supplements as they place a higher priority on their health and wellness. Pharmacy and drugstore offerings of digestive health products are growing as a result of increased consumer awareness and professional recommendations.

Regional Insights

North America region dominated the global digestive health supplements market in 2024

North America dominated the global digestive health supplements market in 2023 and is expected to continue to do so. The substantial market share of the area is ascribed to the robust existence of prominent industry participants, governmental backing for novel product innovation, and technical progressions in the probiotic and prebiotic domains. Growing healthcare expenditures, changing food laws impacting product claims, fast scientific and processing technology improvements, an aging population, and an increased emphasis on diet-related well-being are some of the factors driving the region's rise.

In the meanwhile, the Asia-Pacific area is expected to develop at the quickest rate due to reasons such as an aging population, a rise in the frequency of digestive problems, improvements in treatment, and government campaigns encouraging a healthy lifestyle.

Key Market Players & Competitive Insights

The digestive health supplements market is fragmented and is expected to witness competition due to the presence of several players in the market. Major players in the market continually enhance their technologies to maintain a competitive edge, ensuring efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Bayer AG

- Chr. Hansen Holding A/S

- Danone S.A.

- Enzymedica, Inc.

- Herbalife Nutrition Ltd.

- IFF Health (formerly known as Frutarom Health)

- Nestlé S.A.

- Now Foods

- NutraMarks, Inc.

- Nutramax Laboratories, Inc.

- Procter & Gamble Co.

- Reckitt Benckiser Group plc

- Royal DSM N.V.

- Schiff Nutrition International, Inc.

- Yakult Honsha Co., Ltd.

Recent Developments

- In July 2025 – BP Nutriscience launches Enescene Probio 3+ synbiotic powder in Malaysia

- In January 2024, M&S collaborated with Zoe, the science nutrition and gut health company led by prominent epidemiologist and medical doctor Professor Tim Spector, to introduce a novel gut shot. This product to be accessible in M&S Foodhalls and online on Ocado starting from January 2024.

- In October 2023, Gutsi, a probiotic company based in New Zealand, introduced a 60-day Gut Reset Kit with the aim of providing consumers with easier access to practitioner-grade supplements.

Report Coverage

The digestive health supplements market research report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, market trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, forms, distribution channels, and their futuristic growth opportunities.

Digestive Health Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 12.8 billion |

|

Revenue forecast in 2034 |

USD 23.6 billion |

|

CAGR |

7.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Delve into the intricacies of digestive health supplements in 2025 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2034 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Canopy Market Size, Share 2024 Research Report

Luxury Cigar Market Size, Share 2024 Research Report

Metal Stamping Market Size, Share 2024 Research Report

3D Imaging Market Size, Share 2024 Research Report

Managed SIEM Services Market Size, Share 2024 Research Report

FAQ's

The global digestive health supplements market size is expected to reach USD 23.6 billion by 2034

Key players in the market are Bayer AG, Nestlé S.A., Now Foods, NutraMarks, Inc., and Procter & Gamble Co

North America contribute notably towards the global Digestive Health Supplements Market

Digestive Health Supplements Market exhibiting the CAGR of 7.70% during the forecast period.

The Digestive Health Supplements Market report covering key segments are type, form, distribution channel, and region.