Medical Grade Polypropylene Market Size, Share, Trends, Industry Analysis Report

By Type (Homopolymer Polypropylene, Random Copolymer Polypropylene, Impact Copolymer Polypropylene, Other Types), By Applications, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6230

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

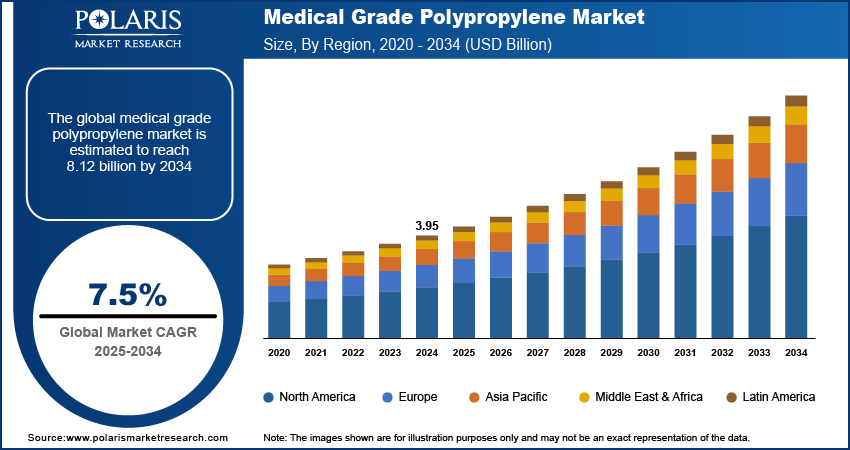

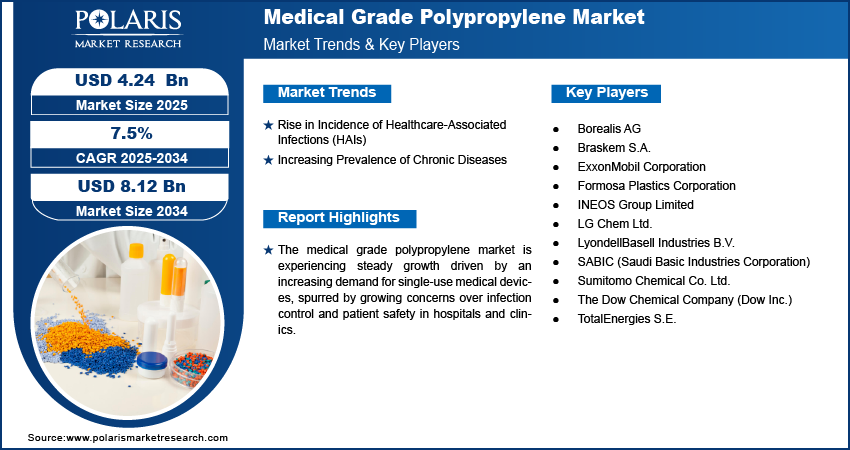

The global medical grade polypropylene market size was valued at USD 3.95 billion in 2024 and is anticipated to register a CAGR of 7.5% from 2025 to 2034. The landscape is mainly driven by the growing demand for lightweight, cost-effective, and safe materials in medical devices and packaging. Another key factor is the rising focus on infection control and patient safety, leading to increased use of single-use medical products.

Key Insights

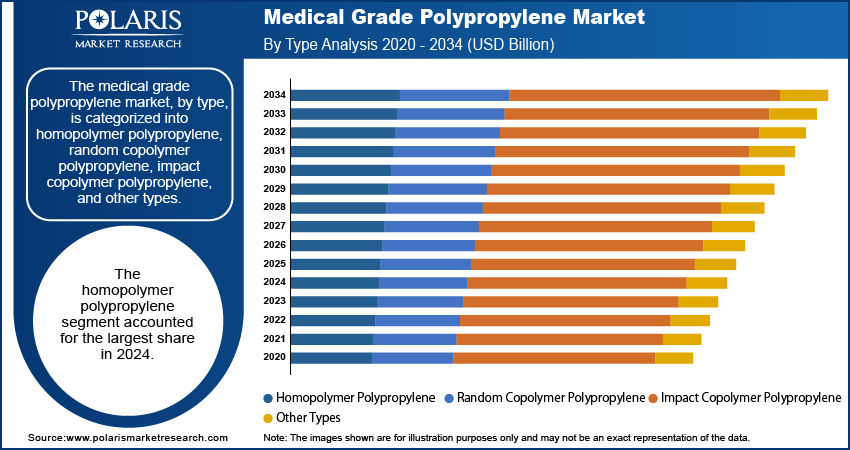

- By type, the homopolymer polypropylene segment held the largest share in 2024 due to its inherent properties, including high stiffness, excellent chemical resistance, and superior tensile strength, which are crucial for rigid medical components.

- By applications, the medical devices segment held the largest share in 2024 as medical grade polypropylene is extensively used in manufacturing a vast array of critical instruments and components.

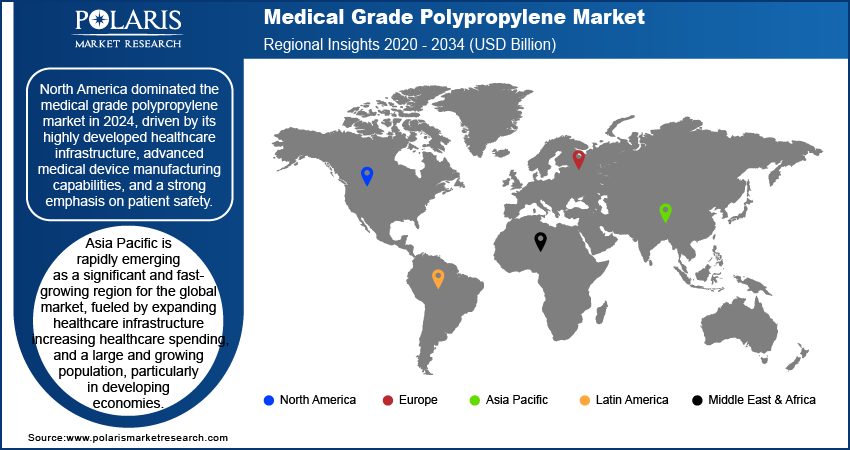

- By region, North America dominated the medical grade polypropylene industry in 2024, driven by its highly developed healthcare infrastructure, advanced medical device manufacturing capabilities, and a strong emphasis on patient safety.

Industry Dynamics

- The rising focus on infection control and patient safety in healthcare settings is leading to a greater adoption of disposable medical products such as syringes, IV components, and diagnostic tools. Polypropylene's chemical resistance, lightweight nature, and ability to be easily sterilized make it an ideal choice for these single-use items.

- There is a global expansion of hospitals, clinics, and medical facilities, especially in emerging economies. This development, coupled with increasing healthcare expenditures, drives the demand for a wide range of medical devices and packaging materials, where polypropylene is a preferred material due to its cost-effectiveness and versatility.

- Ongoing innovations in medical devices and surgical instruments require materials with specific properties such as high stiffness, chemical resistance, and compatibility with various sterilization methods. Polypropylene continuously evolves to meet these needs, including the development of advanced formulations that enhance its performance in complex medical applications.

Market Statistics

- 2024 Market Size: USD 3.95 billion

- 2034 Projected Market Size: USD 8.12 billion

- CAGR (2025–2034): 7.5%

- North America: Largest market in 2024

AI Impact on Medical Grade Polypropylene Market

- AI-based inspection systems are used to streamline quality control by detecting defects or contamination in real time.

- They enhance production efficiency through predictive analytics for process optimization and reduced material waste.

- AI tools are used for automated documentation and traceability of manufacturing processes, which help companies comply with various regulations.

- The technology enables demand forecasting by analyzing emerging healthcare market trends and consumption patterns.

- Market players adopt AI tools to reduce downtime through predictive maintenance of manufacturing equipment.

The medical grade polypropylene sector involves specialized polypropylene resins that meet strict standards for use in healthcare, including medical devices, packaging, and equipment. These materials are chosen for their safety, compatibility with the body, and ability to withstand sterilization.

Drivers shaping the market are the increasing adoption of minimally invasive surgeries and the strict regulatory landscape governing medical device materials. These factors play a significant role in dictating the types and grades of polypropylene, including bio-based polypropylene needed.

The rising trend of minimally invasive surgeries, such as laparoscopy and endoscopy, positively impacts the demand for specific polypropylene formulations. These procedures require smaller, more precise instruments and devices, often disposable, that can be easily inserted and manipulated within the body with minimal trauma. Polypropylene's properties such as lightweight nature, stiffness, and moldability make it suitable for these intricate components. The use of polypropylene meshes in hernia repair surgeries, which are often performed minimally invasively, highlights this trend. The National Institutes of Health (NIH) recognizes the benefits of minimally invasive surgery and techniques, including reduced patient recovery times and lower infection rates, further drives the adoption of compatible materials.

Drivers and Trends

Rise in Incidence of Healthcare-Associated Infections (HAIs): The increasing global concern over healthcare-associated infections is a major driver for the medical grade polypropylene market expansion. HAIs can lead to prolonged hospital stays, increased treatment costs, and even mortality, making their prevention a top priority for healthcare systems worldwide. This drives the demand for single-use, sterile medical devices and packaging, for which polypropylene is an ideal material due to its excellent barrier properties, ease of sterilization, and cost-effectiveness.

The Centers for Disease Control and Prevention (CDC) reported in their "2023 National and State HAI Progress Report" that despite overall decreases in some HAIs between 2022 and 2023, the issue remains a significant public health challenge, with hospital-onset Clostridioides difficile infections and MRSA bloodstream events still being monitored closely. This continued prevalence of HAIs underscores the critical need for disposable medical supplies. The ongoing efforts to reduce HAIs by shifting toward single-use instruments and sterile packaging are driving the growth.

Increasing Prevalence of Chronic Diseases: The rising global burden of chronic diseases is significantly boosting the demand for medical devices, which fuels the growth. Conditions such as diabetes, cardiovascular diseases, and respiratory illnesses require continuous monitoring, diagnosis, and long-term management, often involving a range of medical devices. Polypropylene's versatility, biocompatibility, and durability make it a preferred material for manufacturing these essential devices and their packaging.

The World Health Organization (WHO) highlighted in a 2024 publication that noncommunicable diseases (NCDs), including chronic conditions, are responsible for a significant majority of global deaths, emphasizing the urgent demand for effective management strategies. This growing prevalence necessitates a constant supply of devices such as syringes for insulin delivery, diagnostic kits, and various components for monitoring equipment. The increasing number of individuals affected by chronic conditions and the corresponding need for ongoing medical care are thus propelling the expansion.

Segmental Insights

Type Analysis

Based on type, the segmentation includes homopolymer polypropylene, random copolymer polypropylene, impact copolymer polypropylene, and other types. The homopolymer polypropylene segment held the largest share in 2024, due to its inherent properties, which make it highly suitable for a wide array of medical and pharmaceutical applications. Homopolymers offer high stiffness, excellent chemical resistance, and superior tensile strength, making them ideal for rigid medical components. They can also withstand common sterilization methods such as autoclaving and gamma irradiation without significant degradation, ensuring the safety and integrity of medical devices. Its cost-effectiveness and ease of processing, including injection molding and extrusion, further contribute to its widespread adoption in products such as syringes, medical vials, laboratory equipment, and various pharmaceutical packaging solutions. This dominance is a result of its long-standing proven performance and reliability in critical healthcare settings.

The random copolymer polypropylene segment is anticipated to register the highest growth rate during the forecast period. This growth is largely driven by its enhanced properties, particularly improved clarity, flexibility, and impact strength compared to homopolymers. These characteristics make random copolymers highly desirable for applications where transparency and a certain degree of pliability are crucial, such as IV solution bags, clear diagnostic components, and certain flexible packaging for pharmaceutical products. The increasing demand for advanced medical packaging that allows for visual inspection of contents and devices requiring enhanced flexibility, along with a growing emphasis on patient comfort in device design, are key factors fueling the expansion of this segment. As healthcare innovations continue to push for more sophisticated and user-friendly medical solutions, the demand for random copolymers is expected to surge during the forecast period.

Applications Analysis

Based on applications, the segmentation includes medical devices, medical packaging, nonwoven medical textiles, drug delivery systems, and other applications. The medical devices segment held the largest share in 2024. This dominance stems from the wide and essential use of polypropylene in manufacturing a vast range of medical instruments and components. Its properties, such as high strength-to-weight ratio, chemical resistance, biocompatibility, and ability to withstand various sterilization methods such as gamma radiation, ethylene oxide, and autoclaving make it an ideal material. Polypropylene is extensively used in disposable items such as syringes, IV components, catheters, and diagnostic kits, which are crucial for infection control and patient safety in healthcare settings. Its ease of processing, allowing for high-volume and intricate molding, further solidifies its position as a preferred material for these critical applications, serving both everyday medical needs and specialized surgical tools.

The nonwoven medical textiles segment is anticipated to register the highest growth rate during the forecast period. This growth is significantly driven by an increasing emphasis on hygiene, infection prevention, and the widespread adoption of single-use products in healthcare facilities. Nonwoven polypropylene fabrics are integral to products such as surgical gowns, masks, drapes, caps, and shoe covers, providing essential barrier protection against contaminants. The heightened global awareness of infectious diseases, as highlighted by public health organizations, has consistently fueled the demand for disposable protective apparel. Additionally, advancements in nonwoven technology that enhance comfort, breathability, and filtration efficiency are further contributing to the rapid expansion of this application segment.

Regional Analysis

The North America medical grade polypropylene market accounted for the largest share in 2024, driven by its well-established healthcare infrastructure, advanced medical device manufacturing capabilities, and a strong emphasis on patient safety and stringent regulatory standards. The demand for medical grade polypropylene is consistently high due to the widespread adoption of single-use medical devices and the continuous innovation in healthcare technologies. The presence of major pharmaceutical and medical device companies in the region also contributes to a steady demand for high-quality, specialized polymer materials.

U.S. Medical Grade Polypropylene Market Insights

In North America, the U.S. plays a leading role in the global medical grade polypropylene landscape. The country benefits from robust healthcare spending, ongoing improvements in medical facilities, and the continuous expansion of pharmaceutical and diagnostic services. This environment fosters a strong need for reliable and biocompatible materials such as medical grade polypropylene, used extensively in products ranging from basic syringes to complex surgical tools and advanced drug delivery systems. The focus on reducing healthcare-associated infections and the increasing elderly population further contribute to the steady demand for medical grade polypropylene in the U.S.

Europe Medical Grade Polypropylene Market Trends

Europe is a prominent region in the medical grade polypropylene industry, characterized by its mature healthcare systems, significant investments in medical technology, and a growing emphasis on innovation in medical device manufacturing. The rising prevalence of chronic diseases and an aging population across many European countries are key factors driving the demand for medical devices and, consequently, and medical grade polypropylene. Additionally, the region's strict regulatory framework for medical devices ensures a high standard for materials, favoring the use of certified medical grade polypropylene.

The Germany medical grade polypropylene market holds a dominant position in Europe, due to its advanced healthcare infrastructure, substantial investments in medical research and development, and a strong presence of leading medical device manufacturers. Germany's commitment to producing high-quality medical products drives a continuous demand for premium medical plastics, including various grades of polypropylene. The country's robust regulatory environment and focus on innovation further support the growth and adoption of sophisticated medical grade polypropylene solutions.

Asia Pacific Medical Grade Polypropylene Market Overview

Asia Pacific is rapidly emerging as a significant and fast-growing market for medical grade polypropylene. This growth is fueled by expanding healthcare infrastructure, increasing healthcare spending, and a large and growing population, particularly in developing economies. The rising awareness about hygiene and infection control, coupled with the increasing prevalence of chronic diseases, is boosting the demand for both disposable medical devices and advanced medical packaging solutions, all of which rely heavily on medical grade polypropylene. The region's increasing manufacturing capabilities for medical devices also contribute to its strong position.

China Medical Grade Polypropylene Market Assessment

China is a key country driving the growth of the medical grade polypropylene market in Asia Pacific. With its massive manufacturing base and extensive plastic processing industry, China is a major consumer of polypropylene for various applications, including medical. The country's rapid industrialization, large population, and significant investments in healthcare modernization are accelerating the demand for medical devices and pharmaceutical packaging. This, in turn, fuels the need for medical grade polypropylene, making China a dominant force in the region's market dynamics.

Key Players and Competitive Insights

The medical grade polypropylene industry features a competitive landscape dominated by several large chemical and polymer manufacturers. These key players continuously innovate and expand their product portfolios to meet the evolving demands of the healthcare sector. Competition centers around product quality, regulatory compliance, customization capabilities, and global supply chain reliability. Companies often invest heavily in research and development to create advanced polypropylene grades with enhanced properties such as improved clarity, flexibility, and sterilization resistance, while also focusing on sustainability initiatives to offer bio-based or recycled content options. Strategic partnerships with medical device manufacturers and pharmaceutical companies are also common, aiming to secure long-term supply agreements and tailor solutions for specific applications.

A few prominent companies include LyondellBasell Industries Holdings B.V., SABIC (Saudi Basic Industries Corporation), ExxonMobil Corporation, Braskem S.A., Borealis AG, INEOS Group Limited, TotalEnergies S.E., The Dow Chemical Company (Dow Inc.), Formosa Plastics Corporation, Sumitomo Chemical Co. Ltd., and LG Chem Ltd.

Key Players

- Borealis AG

- Braskem S.A.

- ExxonMobil Corporation

- Formosa Plastics Corporation

- INEOS Group Limited

- LG Chem Ltd.

- LyondellBasell Industries B.V.

- SABIC (Saudi Basic Industries Corporation)

- Sumitomo Chemical Co. Ltd.

- The Dow Chemical Company (Dow Inc.)

- TotalEnergies S.E.

Medical Grade Polypropylene Industry Developments

September 2024: Braskem introduced an innovative bio-circular polypropylene, branded WENEW, derived from used cooking oil. This product, mass-balanced and ISCC Plus certified, represents a significant step toward sustainability in the plastics industry, including potential applications in food packaging relevant to healthcare.

Medical Grade Polypropylene Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Homopolymer Polypropylene

- Random Copolymer Polypropylene

- Impact Copolymer Polypropylene

- Other types

By Applications Outlook (Revenue – USD Billion, 2020–2034)

- Medical Devices

- Medical Packaging

- Nonwoven Medical Textiles

- Drug Delivery Systems

- Other applications

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Grade Polypropylene Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.95 billion |

|

Market Size in 2025 |

USD 4.24 billion |

|

Revenue Forecast by 2034 |

USD 8.12 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.95 billion in 2024 and is projected to grow to USD 8.12 billion by 2034.

The global market is projected to register a CAGR of 7.5% during the forecast period.

North America dominated the share in 2024.

A few key players include LyondellBasell Industries Holdings B.V., SABIC (Saudi Basic Industries Corporation), ExxonMobil Corporation, Braskem S.A., Borealis AG, INEOS Group Limited, TotalEnergies S.E., The Dow Chemical Company (Dow Inc.), Formosa Plastics Corporation, Sumitomo Chemical Co. Ltd., and LG Chem Ltd.

The homopolymer polypropylene segment accounted for the largest share of the market in 2024.

The nonwoven medical textiles segment is expected to witness the fastest growth during the forecast period.