Medical Tubing Market Share, Size, Trends, Industry Analysis Report

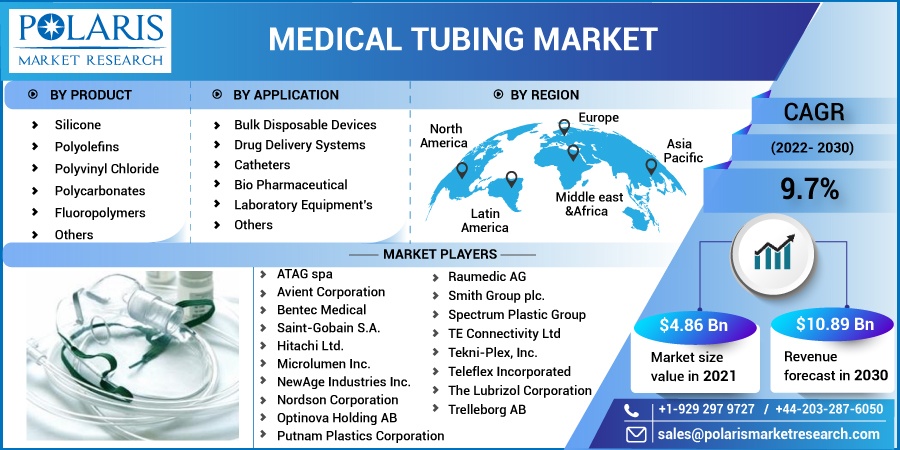

By Product (Silicone, Polyolefins, Polyvinyl Chloride, Polycarbonates, Fluoropolymers); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM2571

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

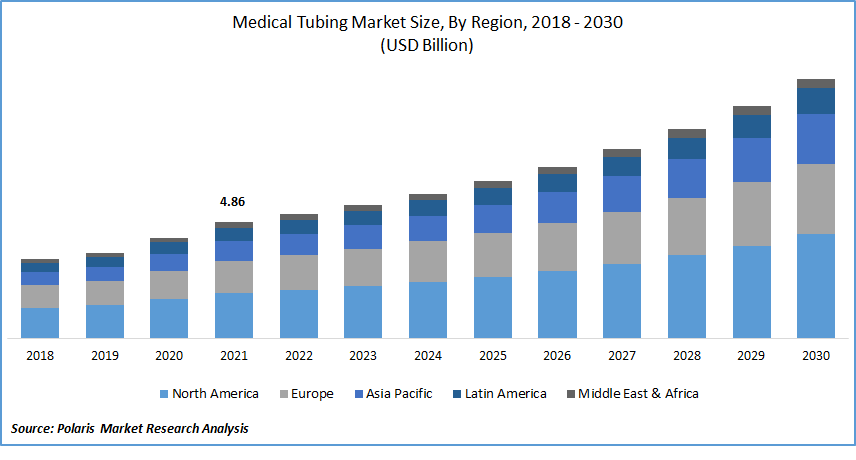

The medical tubing market was valued at USD 4.86 billion in 2021 and is expected to grow at a CAGR of 9.7% during the forecast period. Medical tubing is designed for various applications that allow clinicians to administer fluid and devices or allow for gas and liquid flow. It has become the most habitual and supportive gadget for the modern healthcare and medical industry. An increase in medical conditions and disorders such as cardiovascular, gastrointestinal, urological, and others have driven the growth of the medical tubing market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Tubing is used for IV and ventilators and also supports access devices and as a delivery method for other devices. For cardiovascular disorders, catheters are used for catheterization to test the disease condition and locate narrowing blood vessels, and count the pressure and oxygen level in numerous parts of the heart, including checking pump function, biopsy, diagnosing congenital heart deformity, and recognizing the heart valve issues.

A wide range of materials is used to execute medical tubing, including plastic, rubber, metal, and glass. Flexibility, durability, hardness, and abrasion resistance are the crucial performing properties of medical tubes, raising the growth of the medical tubing market.

The Covid-19 pandemic had positive growth in the medical tubing market. An increase in the number of Covid-19 patients increased the production and growth of medical devices, which drove the demand for medical tubes. There was an increase in the length of IV tubes for placing outside the hospital rooms owing to high inflow of the patients with coronavirus infection.

The Covid-19 pandemic has caused respiratory disorders leading to an extreme amount of death worldwide. Due to this, the production and sales of Infusion pumps and ventilators significantly increased. Additionally, the increase in blood testing increased the demand for medical tubes in the laboratory, which has driven the medical tubing market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Surgical techniques, including laparoscopic, endoscopic, thoracoscopic surgeries, and others, use thin tubed with attached camera and small surgical equipment for inserting into patients’ body during surgeries, which has led to the increase in the demand for thin tubes, driving the overall market growth. Additionally, the increased advanced robotic surgery system by healthcare and medical faculties has increased the demand for medical tubing.

The increased medical conditions and diseases, including asthma, bronchitis, and COPD among the different age groups, have increased the demand for respiratory equipment such as cannula to assist patients with breathing problems. In this, the tubes are inserted through vocal cords above the trachea, with the other end connected to the ventilator to help the patient breath. The geriatric population suffering from various urological disorders employs catheters for collecting drainage urine from the bladder, which is also expected to complement market growth.

Report Segmentation

The market is primarily segmented based on product, application and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Polyvinyl chloride accounted for the largest market share in 2021

Based on product, the medical tubing market is categorized into silicone, polyvinyl chloride, polyolefins, polycarbonates, and fluoropolymers, in which polyvinyl chloride accounted for the most significant market share in 2021. PVC medical tubes are widely used with several medical devices as they are versatile, non-toxic, inert, and easily manufactured.

The PVC medical tubes are more flexible than others which is a crucial application leading the PVC tubes market share. It is extensively used for medical extension of lines, tubing for blood tubing sets, medical suction, and air or oxygen high-pressure transfer medical hoses leading to the growth of PVC tubes.

Other than medical tubes, it’s also used in blood plasma transfusion sets, catheters and cannulas, blood bags, surgical gloves, blood vessels for artificial kidneys, intravenous solutions giving scene containers, endotracheal tubing, and many more. Additionally, flooring, wall covering and bedding covers, and mattresses of hospitals and OTs are done with PVC. In the pharmaceutical industry, blister and dosage packs for medicines are manufactured using PVC. As a result, the material finds numerous applications in the healthcare sector.

Bulk disposable devices segment is expected to grow at the highest rate during the forecast period

The market has been segmented based on application into bulk disposable devices, drug delivery system, catheters, bio pharmaceutical laboratory equipment, and others. The bulk disposable devices segment accounted for the largest market share in 2021. It is also estimated to be the fastest-growing segment during the forecast period.

It includes tubes for several purposes, such as blood transfusion, IV transfusion tubing, respiratory tubing, urological products, syringes, needles, surgical instruments, and others. During the Covid-19 pandemic, the number of patients increased the disposable products as risk prevention of the infection, due to which the demand for bulk disposable devices increased, complement the growth of the medical tubing market.

The growing cases of cardiovascular, nephrological, neurological, gastrointestinal, and others in the geriatric population have increased the demand for catheters in hospitals and OT. Therefore, the applications for the catheter market are supposed to grow over the coming period.

North America accounted for the largest share in 2021

North America accounted for the largest revenue share in 2021. The growing geriatric population in countries such as U.S. and Canada have driven the market for medical tubing. An increase in governmental expenditure for upgrading and developing healthcare infrastructure with the help of health insurance companies has led to the betterment of the healthcare industry in this region.

Asia Pacific is supposed to be the fastest growing region for the medical tubing market. Due to increase in the air borne disease such as asthma, bronchitis, and others have increased the demand for medical devices and equipment in this region which results in growing demand for the medical tubing market

Competitive Insight

Some of the major players operating in the global market include ATAG spa, Avient Corporation, Bentec Medical, Saint-Gobain S.A., Hitachi Ltd., Microlumen Inc., NewAge Industries Inc., Nordson Corporation, Optinova Holding AB, Putnam Plastics Corporation, Raumedic AG, Smith Group plc., Spectrum Plastic Group, TE Connectivity Ltd, Tekni-Plex, Inc., Teleflex Incorporated, The Lubrizol Corporation, Trelleborg AB, Vanguard Products Corporation, Zeus Industrial Products, Inc.

Recent Developments

On 2nd February 2022, Zeus announces the launching of its new product named PTFE Sub-Lite-Wall multi lumen tubing with new features including high structural integrity, improved planarity, high lubricity and excellent dielectric strength. It’s also biocompatible with the working temperature of 260 °C (500 °F).

On 8th April 2021, Optinova Holding AB launched a product Optinova’s Cardiac Rhythm Management (CRM) Lead Tube made with thin walls to meet demanding multi-lumen design. It’s made from implant grade TPU for safety and comfort of the patient.

Medical Tubing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.86 billion |

|

Revenue forecast in 2030 |

USD 10.89 billion |

|

CAGR |

9.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ATAG spa, Avient Corporation, Bentec Medical, Saint-Gobain S.A., Hitachi Ltd., Microlumen Inc., NewAge Industries Inc., Nordson Corporation, Optinova Holding AB, Putnam Plastics Corporation, Raumedic AG, Smith Group plc., Spectrum Plastic Group, TE Connectivity Ltd, Tekni-Plex, Inc., Teleflex Incorporated, The Lubrizol Corporation, Trelleborg AB, Vanguard Products Corporation, Zeus Industrial Products, Inc. |