Meetings, Incentives, Conferences, and Exhibitions (MICE) Market Size, Share, Trends, Industry Analysis Report

: By Type (Meetings, Incentives, Conferences, and Exhibitions), Booking Mode, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5607

- Base Year: 2024

- Historical Data: 2020-2023

Meetings, Incentives, Conferences, and Exhibitions (MICE) Market Overview

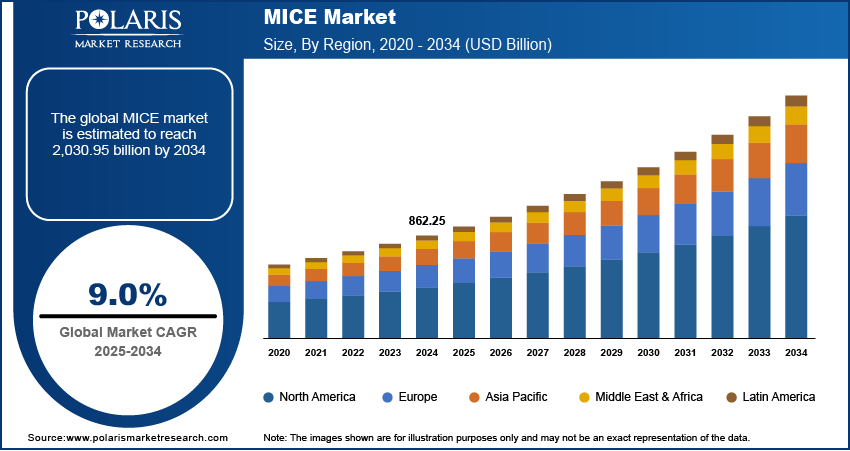

The MICE market size was valued at USD 862.25 billion in 2024. The market is projected to grow from USD 937.43 billion in 2025 to USD 2,030.95 billion by 2034, exhibiting a CAGR of 9.0% during 2025–2034.

Meetings, incentives, conferences, and exhibitions (MICE) focus on organizing corporate and business-related gatherings. The term encompasses four distinct types of events. Meetings are planned occasions where individuals or groups come together to discuss strategies, share ideas, or make decisions, often in corporate settings such as boardrooms or conference centers. Incentives involve travel or events designed to reward and motivate employees or partners for their achievements, fostering loyalty and morale. These programs often include leisure activities in prestigious destinations. Conferences are larger-scale gatherings aimed at knowledge sharing, enterprise networking, and professional development within specific industries or fields. They typically feature keynote speakers, workshops, and panel discussions. Exhibitions focus on showcasing products, services, or innovations to a targeted audience.

The growing employment in emerging nations is propelling the MICE market growth. As per the data published by the Reserve Bank of India, employment in India increased to USD 7.75 million in 2023–24 compared to USD 5.68 million in 2014–15. Increased employment fuels companies to organize more meetings to align teams, communicate strategies, and drive collaboration across departments and regions. An increased workforce also leads organizations to invest in incentive programs that reward high-performing staff and enhance employee retention. Rising employment further fuels professional development initiatives, prompting firms to send employees to industry conferences and training events. Therefore, as employment grows in emerging nations, businesses need to maintain motivation, share knowledge, and strengthen corporate visibility, which significantly drives market expansion.

To Understand More About this Research: Request a Free Sample Report

The meetings, incentives, conferences, and exhibitions market demand is driven by the growing international trade globally. The United Nations Conference on Trade and Development published data stating that global trade hit a record $33 trillion in 2024. International trade propels companies to organize meetings with international clients, suppliers, and stakeholders to negotiate deals, discuss strategies, and establish trust. Trade growth also pushes organizations to attend or host exhibitions where they can showcase products, explore market trends, and connect with potential buyers or distributors. Furthermore, companies use incentive travel to reward international teams and strengthen relationships with overseas partners. Therefore, the rise in global trade activity drives a greater need for face-to-face interaction, knowledge exchange, and promotional opportunities, all of which fuel market revenue.

Meetings, Incentives, Conferences, and Exhibitions Market Dynamics

Increasing Urbanization Globally

Urban centers offer advanced digital infrastructure, accessibility, and a variety of services that attract companies looking to organize professional gatherings efficiently. The growing number of businesses and professionals in urban areas further creates a greater demand for networking opportunities, knowledge exchange, and team-building activities, all of which rely on the MICE sector. According to data published by the World Economic Forum, 4.3 billion people live in urban areas, and it is expected to rise to 80% by 2050. Rising urbanization is fueling corporations to choose vibrant urban environments for incentive and conference programs due to their entertainment options, culinary scenes, shopping districts, and unique experiences that appeal to a diverse workforce. Therefore, as urbanization accelerates, it strengthens the MICE ecosystem necessary for hosting impactful events.

Rising Number of Corporate Offices Worldwide

Each new office represents a hub of employees, clients, and stakeholders who require engagement through meetings, training sessions, performance reviews, and corporate announcements. Businesses also use incentive programs to align teams and foster a unified culture across multiple locations. Furthermore, a growing corporate presence intensifies competition, prompting companies to participate in exhibitions to enhance visibility, launch new products, and connect with industry peers. As organizations continue to scale geographically, the demand for well-organized, purpose-driven events grows rapidly, making business gatherings and meetings an essential part of corporate expansion strategies. Hence, the rising number of corporate offices worldwide drives the MICE market demand.

MICE Market Assessment by Segment

Market Evaluation by Type

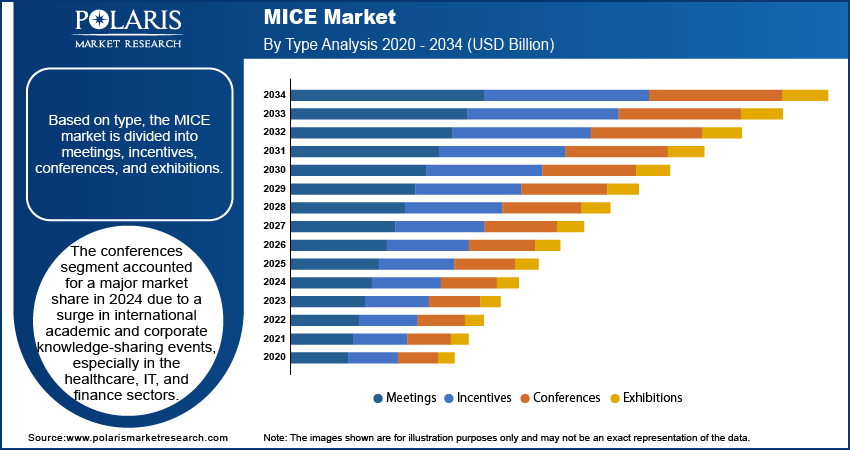

Based on type, the MICE market is divided into meetings, incentives, conferences, and exhibitions. The conferences segment accounted for a major market share in 2024 due to a surge in international academic and corporate knowledge-sharing events, especially in the healthcare, IT, and finance sectors. Businesses and professional associations prioritize these corporate events to facilitate networking, foster innovation, and strengthen brand positioning. The rise of hybrid formats, which combined in-person and virtual attendance, further broadened the reach of conferences, enabling organizers to attract a larger, more diverse audience without geographical constraints. Additionally, investments in advanced event technology and improved infrastructure in emerging economies contributed to the increased appeal and accessibility of conference tourism.

The incentives segment is expected to grow at a robust pace in the coming years. Organizations increasingly view incentive travel as a strategic tool to boost employee motivation, reward performance, and enhance talent retention. The shift toward personalized, experience-driven rewards is fueling segment growth, particularly among younger professionals who value unique travel experiences over traditional benefits. Moreover, the growing emphasis on employee well-being and workplace culture has prompted companies to allocate higher budgets for incentive programs. Regions such as Southeast Asia and the Middle East are witnessing the rapid development of luxury resorts and exclusive retreats, making them attractive destinations for incentive-based luxury travel.

Market Insight by Booking Mode

In terms of booking mode, the market is segregated into direct booking, online travel agents and agencies (OTAs), destination management companies (DMCs), travel management companies (TMCs), and others. The travel management companies (TMCs) segment dominated the meetings, incentives, conferences, and exhibitions market share in 2024 due to their ability to offer comprehensive and customized solutions for corporate clients. Businesses increasingly relied on TMCs to manage complex travel logistics, negotiate cost-effective packages, and ensure policy compliance across international operations. TMCs provided end-to-end services, including group bookings, risk management, travel & expense management, and real-time support, which helped organizations streamline travel operations and reduce costs. The ability of travel management companies (TMCs) to integrate technology platforms for seamless itinerary management and reporting further strengthens their value to businesses, contributing to their market dominance.

The online travel agents and agencies (OTAs) segment is projected to grow at the fastest pace during the forecast period, owing to the increasing digitalization and the growing preference for user-friendly, self-service platforms. Event planners and small to mid-sized businesses increasingly favor OTAs for their transparency, flexibility, and wide range of customizable options. The rise in adoption of mobile booking apps, AI-driven personalization, and secure digital payment systems has made online platforms more appealing, especially to younger, tech-savvy professionals organizing meetings or group travel. Furthermore, OTAs' continuous expansion in their inventory and partnerships with hotels, venues, and local service providers is driving their adoption.

Meetings, Incentives, Conferences, and Exhibitions Market Regional Analysis

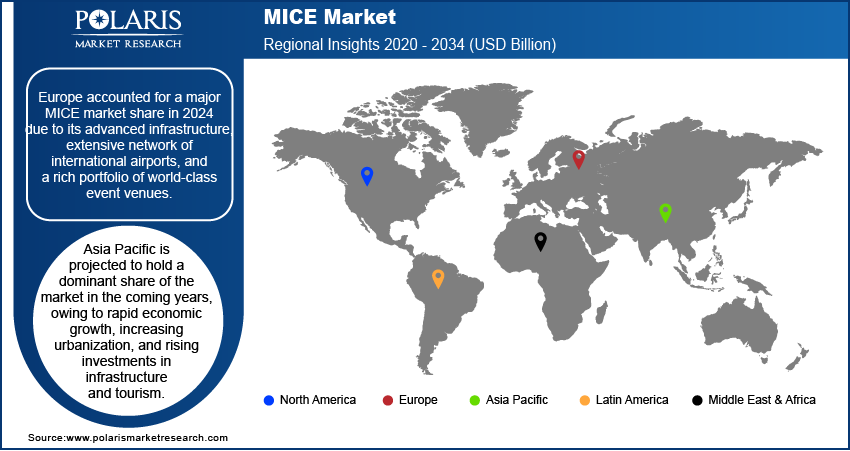

By region, the report provides MICE market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe accounted for a major market share in 2024 due to its advanced infrastructure, extensive network of international airports, and a rich portfolio of world-class event venues. Countries such as Germany, France, Spain, and the UK consistently host large-scale conferences, exhibitions, and corporate gatherings across various industries. Germany led the regional market share, with cities such as Berlin, Frankfurt, and Munich offering advanced and aesthetic convention centers and efficient public transportation. The country’s central location in Europe and strong presence of sectors such as automotive, pharmaceuticals, and technology contributed to the high frequency of business events. Additionally, Europe’s cultural appeal, historic landmarks, and strong government support for business tourism further elevate its attractiveness as a premier destination for global gatherings.

Asia Pacific is projected to hold a dominant share of the market in the coming years, owing to rapid economic growth, increasing urbanization, and rising investments in infrastructure and tourism. According to data published by the United Nations Human Settlements Programme, 54% of the global urban population lives in Asia, and it is expected to grow by 50% by 2050.

Countries such as China, India, Singapore, and Thailand have been expanding their capacity to host international events by constructing modern exhibition centers, improving transport connectivity, and streamlining visa policies. Among them, China is estimated to dominate the regional market, with major cities such as Shanghai, Beijing, and Guangzhou witnessing a sharp rise in the number of business events. The country’s booming corporate sector, government-backed initiatives to boost inbound tourism, and rising demand for knowledge-sharing platforms are fueling the MICE market expansion. Moreover, the demand for professional events and large-scale business gatherings is projected to rise in the region as multinational companies continue to expand operations across Asia.

Meetings, Incentives, Conferences, and Exhibitions Market – Key Players & Competitive Analysis Report

The global meetings, incentives, conferences, and exhibitions market is highly competitive, with key players leveraging strategic mergers and acquisitions, partnerships, and collaborations to expand their market presence and enhance service offerings. Major companies have pursued aggressive M&A strategies to consolidate their positions. Major players in the market are investing in customized experiences to diversify their product portfolios, sustainability initiatives, and AI-driven event management tools. The competitive intensity is further intensified by the entry of tech-savvy startups offering innovative solutions such as VR-based venue tours and blockchain-enabled ticketing.

The MICE market is fragmented, with the presence of numerous global and regional market players. Major players in the market are ATPI Ltd.; AVIAREPS AG; BCD Meetings & Events; Beyond Summits; Cambria DMC; Capita plc; Carlson Wagonlit Travel; Ci Events; Conference Care; Creative Group, Inc.; CWT Meetings & Events; FCM Meetings & Events; Global Business Travel Group, Inc.; Global Cynergies, LLC; Maritz; Meetings and Incentives Worldwide, Inc.; One10, LLC; and Questex.

BCD Travel is a global company in corporate travel management, offering innovative solutions for business travel and the meetings, incentives, conferences, and exhibitions (MICE) sector. Founded in 2006 and headquartered in Utrecht, Netherlands, the company operates in over 170 countries. BCD Travel specializes in simplifying business travel through digital tools that enhance program adoption, cost savings, and traveler satisfaction. Its services include strategic travel management, risk mitigation, sustainability consulting, and tailored solutions for MICE activities. The company’s MICE division, BCD Meetings & Events (BCD M&E), delivers comprehensive event services such as strategic meetings management, venue sourcing, attendee engagement, and event production.

Conference Care is a major provider in the meetings, incentives, conferences, and exhibitions (MICE) industry, specializing in venue sourcing and event management services. Established in 1995 and headquartered in Hinckley, Leicestershire, the company serves a broad range of clients, including multinational corporations, SMEs, government departments, NGOs, local authorities, and associations. Conference Care handles over 10,000 venue bookings and more than 100 event management projects annually. Its services span strategic meetings management, event production, virtual events, digital solutions, carbon consultancy, and sustainable event planning. The company’s approach is tailored to meet diverse client needs, offering personalized solutions that optimize return on investment while reducing risks and costs.

List of Key Companies in MICE Market

- ATPI Ltd.

- AVIAREPS AG

- BCD Travel

- Beyond Summits

- Cambria DMC

- Capita plc

- Carlson Wagonlit Travel

- Ci Events

- Conference Care

- Creative Group, Inc.

- CWT Meetings & Events

- FCM Meetings & Events

- Global Business Travel Group, Inc.

- Global Cynergies, LLC

- Maritz

- Meetings and Incentives Worldwide, Inc.

- One10, LLC

- Questex

Meetings, Incentives, Conferences, and Exhibitions (MICE) Industry Developments

January 2025: The Global Sustainable Tourism Council (GSTC) announced the launch of its new training program tailored specifically for the MICE sector.

November 2024: The Ministry of Tourism, Government of India, participated in IBTM, one of the leading global travel exhibitions on MICE held in Barcelona. The participation aim was to promote India as a potential destination for hosting conferences and conventions.

Meetings, Incentives, Conferences, and Exhibitions Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Meetings

- Incentives

- Conferences

- Exhibitions

By Booking Mode Outlook (Revenue, USD Billion, 2020–2034)

- Direct Booking

- Online Travel Agents and Agencies (OTAs)

- Destination Management Companies (DMCs)

- Travel Management Companies (TMCs)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Meetings, Incentives, Conferences, and Exhibitions Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 862.25 Billion |

|

Market Forecast in 2025 |

USD 937.43 Billion |

|

Revenue Forecast by 2034 |

USD 2,030.95 Billion |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 862.25 billion in 2024 and is projected to grow to USD 2,030.95 billion by 2034.

The global market is projected to register a CAGR of 9.0% during the forecast period.

Europe held the largest share of the global market in 2024.

A few of the key players in the market are ATPI Ltd.; AVIAREPS AG; BCD Meetings & Events; Beyond Summits; Cambria DMC; Capita plc; Carlson Wagonlit Travel; Ci Events; Conference Care; Creative Group, Inc.; CWT Meetings & Events; FCM Meetings & Events; Global Business Travel Group, Inc.; Global Cynergies, LLC; Maritz; Meetings and Incentives Worldwide, Inc.; One10, LLC; and Questex.

The conferences segment dominated the market revenue share in 2024.

The online travel agents and agencies (OTAs) segment is expected to grow at the fastest pace in the coming years.