Microbiome Sample Preparation Technology Market Share, Size, Trends, Industry Analysis Report

By Product (Instruments & Consumables); By Workflow; By Application; By Disease; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 126

- Format: PDF

- Report ID: PM2669

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

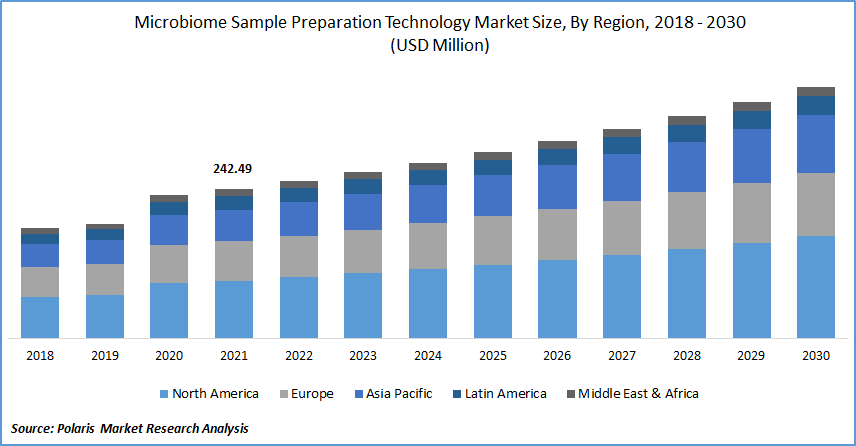

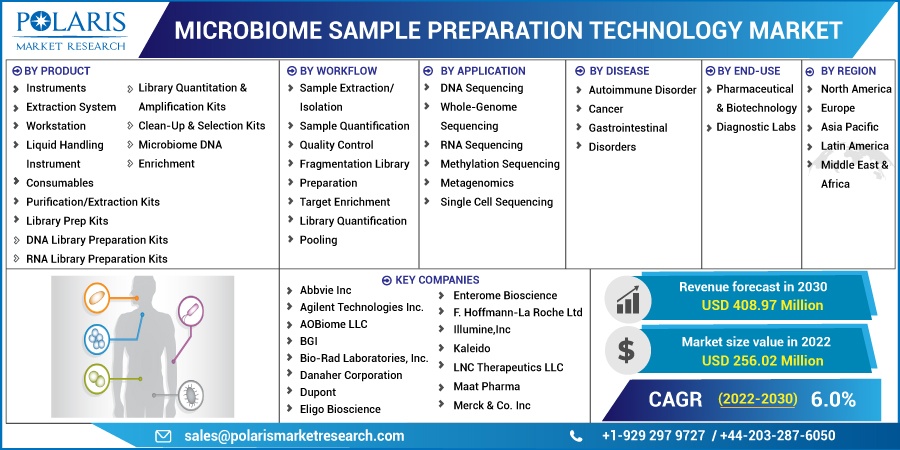

The global microbiome sample preparation technology was valued at USD 242.49 million in 2021 and is expected to grow at a CAGR of 6.0% during the forecast period. The growing demand for microbiome sample preparation technology is expected to be driven by the prevalence of various gut-related disorders, rising investment in research, and the development of novel microbiome therapies to cure such illnesses.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The increasing number of clinical trials and demand in diagnostic labs to examine the characteristics of microorganisms and the inclination of healthcare professionals on microbiome technology to identify traces at an early stage is expected to drive industry growth.

Furthermore, the growing demand for the next generation sequencing in laboratories is rising as it allows the cultivation of large sample preparation that has led to the understanding of the relationship between microbiome and disease, which is expected to influence the microbiome sample preparation technology market growth.

The COVID-19 pandemic had a positive impact on the growth of the microbiome sample preparation technology market as it detected the mutation and complex traits of the SARS-CoV-2 virus when incorporated with the microbiome sample. In addition, the technology also analyzed that pathophysiology of the virus is marked by increased inflammatory cytokine synthesis, which leads to lung and organ failure and, ultimately, death which created a demand for microbiome kits in the industry.

However, a lack of awareness related to gastrointestinal diseases and low investment in healthcare across various developing nations is expected to restrain the industry growth. Moreover, the low penetration of this technology and expensive instruments required for sample preparation are some of the factors having an adverse impact on the microbiome sample preparation technology market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rapid development in drug discovery with the help of microbiome sample preparation technology as it determines the composition of various diseases and illnesses related to them, as well as the rising incidence of rare diseases has created a lucrative opportunity to develop personalized medicines fueling the industry growth.

Furthermore, the reduction in the cost of DNA sequencing increases the demand for research therapeutics owing to the collection of various microbes, which is likely to treat a range of chronic diseases such as cancer, autoimmune, and mental health disorders, fueling the microbiome sample preparation technology market growth.

Report Segmentation

The market is primarily segmented based on product, workflow, application, disease, end-use, and region.

|

By Product |

By Workflow |

By Application |

By Disease |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Consumable segment to account for the highest growth rate

The consumable segment is expected to grow over the forecast period owing to the rising demand for kits in laboratories for the preparation of the sample. Furthermore, library quantification & amplification kits are expected to see a significant surge in analyzing samples and obtaining quick results.

For instance, integrated DNA technologies launched the xGen Prism DNA library prep kit to convert low quality DNA samples into high-quality data, which is helpful in detecting cancer mutation and other applications.

Sample extraction is expected to hold highest market share

The demand for sample extraction/isolation is growing in clinics and laboratories as the technology is widely used to handle samples and provide all necessary information when isolation is done from a complex sample.

In addition, during sample preparation, extraction plays a major role in making reliable and economic analyses. Environmental factors and dietary choices have an impact on the functioning of human gut microbiota, where extraction helps to detect and eliminate non-compatible components from the sample; such factors are driving segment growth.

DNA sequencing is expected to witness faster growth

The demand for DNA sequencing is expected to witness the fastest growth over the forecast period owing to its wide application in end-use industries such as research and diagnostic labs. The growing incidence of genetic disorders, complex traits, and mutations could be easily detected. In addition, this application is quick, reliable, scalable, and cost-effective, which increases its demand from basic to human biology.

For instance, seqWell, along with plexWell, collaborated with element biosciences inc. to improve data quality and workflow, and this technology enables to multiply 2,304 samples reducing sample handling and the need for individual sample preparation in laboratories with next-generation sequencing.

Gastrointestinal disorder is expected to account for the largest share in 2030

Gastrointestinal disorder is expected to dominate the market over the forecast period owing to the increasing poor eating habits among consumers. Disease-causing germs can enter the body through the infected animal, contaminated water, or infected people leading to diarrhea, Crohn’s disease, ulcerative colitis, and many more resulting in damaging the intestine internally. Advancements in DNA sequencing and novel therapies allow microbiomes to target and make dysbiosis corrections to develop new treatments, which is fueling market growth.

Diagnostic lab is expected to lead the market over the forecast period

Diagnostic labs are anticipated to lead the market over the forecast period owing to the rise in chronic diseases such as inflammatory bowel disease, type 2 diabetes, cancer, and many more. Microbiome samples are finding their way into clinical trials to diagnose gastrointestinal infections and many other medical conditions. Moreover, consumer shift toward microbiome tests that are performed under supervision and provide in-depth analysis are also some factors propelling the market growth.

North America dominated the market and led the market in 2021

North America is the largest region for microbiome sample preparation technology and is expected to dominate the market owing to the rising concerns of autoimmune & cardiovascular diseases, gastrointestinal illness, and cancer among the geriatric population.

In addition, the increasing health concerns have led to the demand for consumables in clinical rooms and laboratories, which is anticipated to drive microbiome sample preparation technology market growth over the forecast period.

Competitive Insight

Some of the major players operating in the global market include Abbvie Inc, Agilent Technologies Inc., AOBiome LLC, BGI, Bio-Rad Laboratories, Inc., Danaher Corporation, Dupont, Eligo Bioscience, Enterome Bioscience, F. Hoffmann-La Roche Ltd, Illumine,Inc, Kaleido, LNC Therapeutics LLC, Maat Pharma, Merck & Co. Inc, Perkin Elmer, Inc. QIAGEN, Rebiotix Inc, Second Genome, Seres Therapeutics, Synthetic Biologics Inc., Vedanta Biosciences Inc, Vithera Pharmaceuticals Inc., Yakult Honsha Co., Ltd

Recent Developments

In September 2022, Agilent technologies collaborated with Mettler Toledo to address error- prone sample preparation with mettle software that allow automatic and seamless transfer of sample.

In June 2021, Danaher corporation acquired Aldevron to expand in the field of genomic medicines and bring novel therapies & vaccines faster in the market.

Microbiome Sample Preparation Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 256.02 million |

|

Revenue forecast in 2030 |

USD 408.97 million |

|

CAGR |

6.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Workflow, By Application, By Disease, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Abbvie Inc, Agilent Technologies Inc., AOBiome LLC, BGI, Bio-Rad Laboratories, Inc., Danaher Corporation, Dupont, Eligo Bioscience, Enterome Bioscience, F. Hoffmann-La Roche Ltd, Illumine,Inc, Kaleido, LNC Therapeutics LLC, Maat Pharma, Merck & Co. Inc, Perkin Elmer, Inc. QIAGEN, Rebiotix Inc, Second Genome, Seres Therapeutics, Synthetic Biologics Inc., Vedanta Biosciences Inc, Vithera Pharmaceuticals Inc., Yakult Honsha Co., Ltd

|