Microprinting Market Share, Size, Trends, Industry Analysis Report

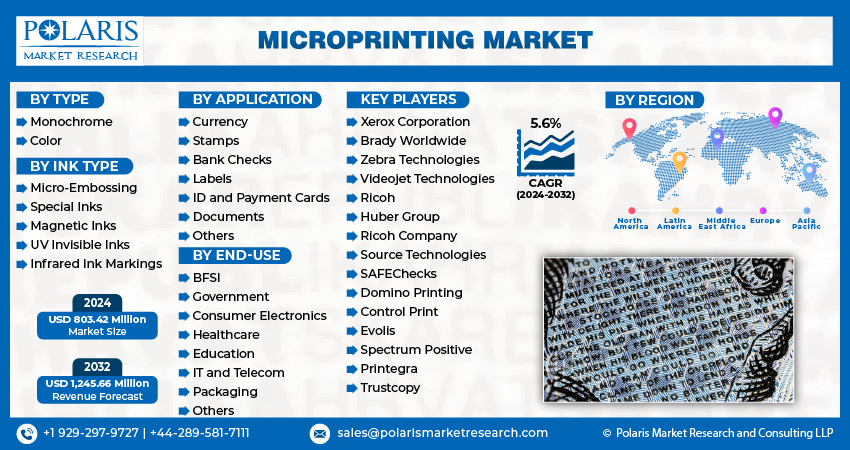

By Type (Monochrome, Color); By Ink Type; By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: pdf

- Report ID: PM3039

- Base Year: 2022

- Historical Data: 2019-2022

Report Outlook

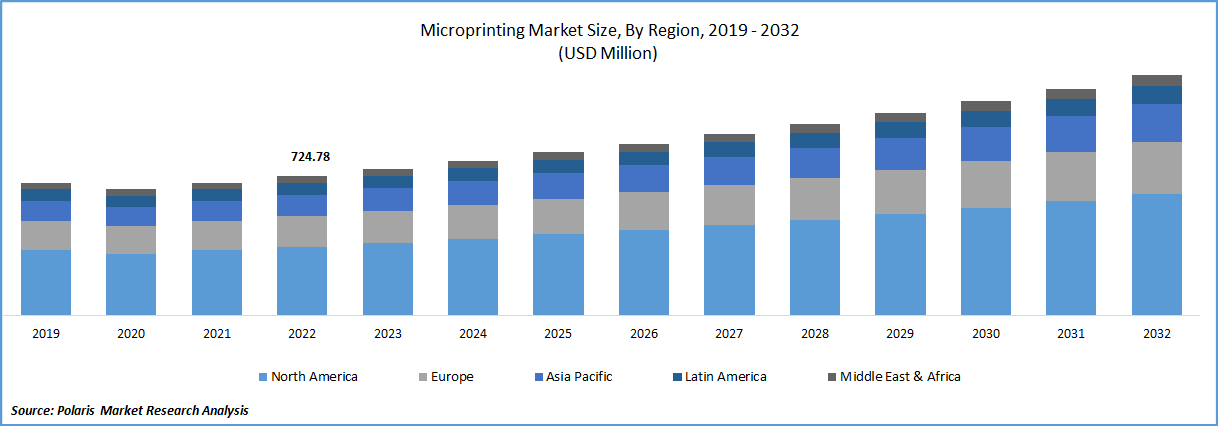

The global microprinting market was valued at USD 762.83 million in 2023 and is expected to grow at a CAGR of 5.6% during the forecast period. Digital technology advances are increasingly being integrated into fundamental value generation processes in enterprises. Various organizations are widely implementing microprinting. Important aspects such as financial industry laws and regulations, new product launches, e-commerce expansion, and increased demand for anti-counterfeiting products are expected to grow significantly during the forecast period. In addition, the development of microprinting technology and the rising need for low-cost printing technology are important drivers of the market's expansion.

Know more about this report: Request for sample pages

For instance, a research group from the Queensland University of Technology (QUT), Heidelberg University, and the Karlsruhe Institute of Technology (KIT) has made significant progress toward achieving this goal. It created a laser printing technique that creates pieces as small as micrometers in a matter of seconds. The work was published in Nature Photonics by the worldwide team.

Most governmental organizations are using microprinting to improve security features on identity documents, certificates, and other security devices, which is projected to support the growth of the microprinting industry as a whole. Due to the escalating check and currency fraud in numerous countries, the market is generally growing. The microprinting procedure has lately been embraced by governments and business organizations to combat fraud and lessen the usage of licenses and identity cards improperly. This has considerably aided the market for microprinting in expanding.

The numerous inks used in microprinting include magnetic inks, invisible UV inks, infrared ink marking, special inks, and micro-embossing inks. The development of the microprinting sector is being aided by technological developments including the availability of magnetic ink and other specialized inks. Consumer electronics, money, bank checks, the military, and ID cards are just a few of the industries that have seen an increase in the use of microprinting. Microprinting is most commonly used on ID cards and packages, and it is expected that both subcategories in the application segment would lead the market by the forecast period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Microprinting is a somewhat mature industry globally, making it challenging for new competitors to succeed. A variety of things are in the existing player’s favor. The development and release of cutting-edge products is one of the major factors influencing the microprinting industry. For instance, small firms can revolutionize their production processes with the aid of FDM 3D printers, which are well known for their considerable performance at lower costs. Companies can save up to 50% on their tooling process overall by employing FDM technology.

Future potential for companies in this market have also been spurred by the spike in research efforts being conducted by institutions all over the world to expand the capabilities of microprinting. The market is anticipated to be driven over the projected period by the expanding use of microprinting on currency and stamps.

Report Segmentation

The market is primarily segmented based on type, ink type, application, end-use, and region.

|

By Type |

By Ink Type |

By Application |

By End-use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Monochrome segment will account for a higher share of the market.

The monochrome segment dominated the overall market in 2022. This is driven by recent product launches, for instance, SHARP Business introduced new monochrome multi-purpose printers in January 2022. It includes 4 new BP-20M31T, BP-20M28T, BP-20M24T, & BP-20M22T, provide a range of enhanced productivity features, security updates, complex workflow capabilities, and user interface. These features all contribute to increased productivity and lower operating costs.

The magnetic inks segment has the highest revenue.

Magnetic inks led the whole market in 2022. Due to the security services required by technical and digital advancements to decrease fraud in banking operations, transaction processes, etc., the magnetic ink segment is predicted to rise at a substantial CAGR over the forecast period.

Furthermore, the magnetic ink market is also rising as a result of the expanding use of Magnetic Ink Character Recognition, which helps with document authenticity analyses. For example, in October 2021, TROY Group, Inc., a provider of on-demand printing solutions, will cooperate with Loffler Companies, Inc., a managed service provider, to provide MICR check printing solutions.

The currency segment is expected to increase at the exponential rates.

The key reason driving the segment’s growing concerns about counterfeit cash has prompted legal tender issuers around the world to upgrade the security components of their money. Another element influencing the rise is how frequently the government prints new notes using microprinting. The use of microprinting makes money notes more difficult to counterfeit because photocopiers cannot accurately replicate the print. Governments everywhere are using the microprinting technique as a result to halt the production of counterfeit money, which is causing the sector to grow.

The packaging sector is anticipated to experience the largest growth.

The packaging segment is anticipated to grow at the highest CAGR in 2022. The packaging industry's growing adoption of microprinting is the main driver of the expansion. The bulk of industry players employ this technique to prevent product duplication.

Additionally, packaging serves the primary purposes of transferring information, safeguarding the product, enhancing convenience, and enhancing security. A significant portion of the materials used to package items come from paper and paper products. Due to the numerous environmental issues raised using plastic, paper is used in packaging. The protection of trademarks and the safety of products are necessities for all firms because counterfeiting can reduce annual revenue. Boxes, packages, tags attached to packaging, labels, and tags all make use of microprinting.

The demand in Asia Pacific is expected to witness significant growth

Asia Pacific is anticipated to grow the fastest during the projection period, registering the greatest CAGR. The expansion is linked to the prevalence of numerous banking and financial institutions, governmental agencies, and corporate firms in APAC as well as the rising use of printers with microprinting technology.

For instance, In April 2020, Ricoh Manufacturing Ltd., a new manufacturing company, will begin operations. By utilizing cutting-edge analyses of sales and production data through the Internet of Things and adding state-of-the-art robots and factory automation to improve our manufacturing process, this central production site for Ricoh's office printing machines will also help us improve the accuracy of our production planning.

Competitive Insight

Some of the major players operating in the global microprinting market include Xerox Corporation, Brady Worldwide, Zebra Technologies, Videojet Technologies, Ricoh, Huber Group, Ricoh Company, Source Technologies, SAFEChecks, Domino Printing, Control Print, Evolis, Spectrum Positive, Printegra , and Trustcopy.

Recent Developments

- On March 2022, Boston Micro Fabrication announced a new cooperation to deliver micro 3D printing to the India. Another cutting-edge printing technique is now available to the Indian clients.

Microprinting Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 803.42 million |

|

Revenue forecast in 2032 |

USD 1,245.66 million |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Ink Type, By Application, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Xerox Corporation, Brady Worldwide, H.P. Development, Zebra Technologies, Videojet Technologies, Ricoh, Huber Group, Matica Technologies Group S.A., Ricoh Company, Canon Finetech Nisca , Source Technologies , SAFEChecks , Xeikon , Domino Printing Sciences PLC , Control Print , Data Carte Concepts, Evolis, Micro Format , Spectrum Positive, Printegra , and Trustcopy |

FAQ's

The global microprinting market size is expected to reach USD 1,245.66 billion by 2032.

Top key players in the microprinting market are Xerox Corporation, Brady Worldwide, Zebra Technologies, Videojet Technologies, Ricoh, Huber Group, Ricoh Company, Source Technologies, SAFEChecks, Domino Printing, Control Print, Evolis, Spectrum Positive.

Asia Pacific contribute notably towards the global microprinting market.

The global microprinting market expected to grow at a CAGR of 5.6% during the forecast period.

The microprinting market report covering key segments are type, ink type, application, end-use, and region.