Military Embedded Systems Market Share, Size, Trends, Industry Analysis Report

By Platform Type (Land, Airborne, Naval, Unmanned, and Space); By Component; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 118

- Format: PDF

- Report ID: PM3145

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

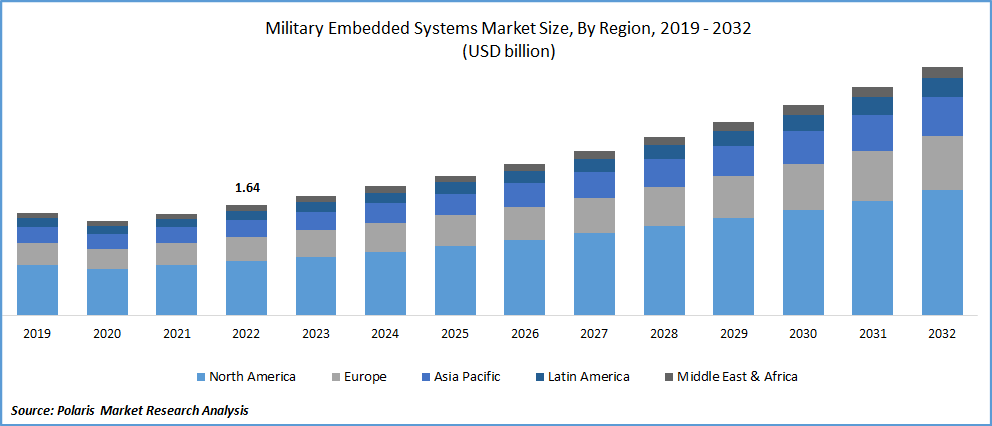

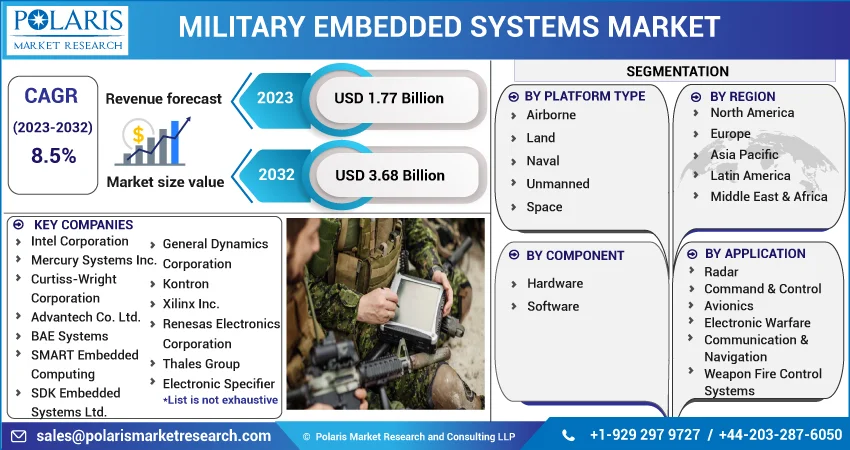

The global military embedded systems market was valued at USD 1.64 billion in 2022 and is expected to grow at a CAGR of 8.5% during the forecast period. The high deployment of advanced and innovated military embedded systems across both developed and developing regions, as these systems are a perfect combination of software and hardware based on a microprocessor or microcontroller are the key factors influencing the market growth. There has been a significant growth in the advancements of military applications with high effectiveness, durability, and simplicity of structure along with the growing focus by major companies on the development of existing systems and introduction to more advanced ones are likely to create huge growth opportunities to the market in the coming years.

Know more about this report: Request for sample pages

For instance, in October 2022, Concurrent Technologies, announced the launch of its latest system-oriented solutions named Vulcan, that further expand the company’s product portfolio. It had been designed in alignment with SOSAtm Technical Standard, and providing support for both 100G Ethernet and PCIe Gen 4.

Furthermore, the rapidly growing proliferation of military unmanned technologies and continuous rise in the investment from several armed forces across the globe for the procurement of advanced unmanned systems for numerous different missions including reconnaissance, communications, jamming, tactical warfare operations, and surveillance are further expected to contribute positively to the demand and growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the military embedded systems market. The rapid spread of deadly coronavirus created several uncertainties, resulting in high economic losses, as various businesses and organizations were temporarily closed around the world. Moreover, the disruption of global supply chain, slowdown of economies, shortage of required workforce, and several restrictions imposed by governments on migrants and workers, have affected the production and demand of these systems.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The extensively surging government financing hikes in the military budget and high prevalence for modernization and military and equipment development especially in developing countries or countries with high geopolitical issues like India and China, are major factors expected t fuel the growth and military embedded systems market expansion.

Additionally, the significant rise in the adoption of multi-core processors, wireless technologies, and advanced revolutionary warfare systems is further anticipated to support the growth of military embedded systems. For instance, according to a report published by Stockholm International Peach Research Institute, the total military spending in India was around USD 76.6 billion, followed by US and China. India’s military spending in 2021 was 0.9 percent up from 2020 and 33 percent from 2012.

In the last few decades, the world is shifting towards the more complete integration of digital technology into the modern life, for empowering people digitally and influencing the transfer of technology, due to which electronics and communication industries have seen tremendous growth. As a result, there has been a remarkable growth in the numbers of convergence of cyber and optical technologies. Thus, the demand and growth of the global market for military embedded systems is growing conventionally.

Report Segmentation

The market is primarily segmented based on platform type, component, application, and region.

|

By Platform Type |

By Component |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Naval segment accounted for the largest market share in 2022

The segment growth is mainly attributed to the wide utilization of these systems across several naval applications including submarines, combat ships, among others. Moreover, initiatives regarding the development of advanced autonomous warships and growing digitalization in the marine industry coupled with the change in sensor system technology, is also driving the growth of the segment.

The airborne segment is projected to register fastest growth rate during the anticipated period, on account of the increasing development of advanced airborne systems capabilities that makes them a crucial tool in the renewed global air intelligence superiority race. The rapid emergence of airborne surveillance equipment including forward-looking infrared, high-resolution imaging, and micro-airborne surveillance vehicles is further contributing to the segment growth.

Software segment is expected to witness fastest growth during the forecast period

The software segment is expected to grow rapidly throughout the anticipated period, owing to its easy potability and high appropriate for mass production, and they are far smaller than conventional computer systems. Embedded software systems refer to the specialized programming tools present in the embedded devices that efficiently facilitate the machines operation.

The hardware segment held a dominant market share in 2022, and is expected to grow substantially in the coming years, which is mainly driven by its widespread use in military to function several applications that are complicated and far more difficult than seen in the regular applications. The rising focus by large manufacturers of embedded systems on the improvement of their products/devices by integrating new innovative features and making them more advanced, is pushing market growth forward.

Communication & navigation segment is expected to hold significant market share

The communication & navigation segment is likely to register significant market share over the study period. The growth of the segment market can be mainly attributed to the growing integration of tactical communication systems across numerous different armed forces and high deployment of advanced sensors and other embedded systems in military communication technologies.

Moreover, the electronic warfare segment is also expected to grow at substantial growth rate and likely to account for a healthy market share over the coming years. The growth of the segment is mainly attributed to the ongoing technological developments across various applications of anti-stealth radars, air defense, munitions, next-generation aircraft, and cruise missiles.

The North America region dominated the global market in 2022

North America region accounted for majority market share in 2022 and is expected to continue its dominance throughout the estimated period. The tremendous rise in the military expenditure by United States government to highly facilitate the adoption of innovated military embedded systems in the country’s defense sector and robust presence of key market companies in North America region are key factors fueling the growth of the market in the region.

The widespread use of the multicore technologies and high emergence of modern warfare systems like electronic warfare and network centric warfare with the use of cloud computing is also anticipated to augment market growth.

However, Asia Pacific is expected to emerge as fastest growing region in the global market at a significant growth rate. The key factors responsible for the growth of the regional market is continuous upgradation of military by upgrading warfare platform technologies and introduction to several new communication devices in countries like China, Indonesia, India, and Malaysia. Additionally, China is highly implementing on the developments of space-related operations and high penetration for geo-political issues with neighboring countries, is further creating lucrative opportunities for the adoption of military embedded systems in the market.

Competitive Insight

Some of the major players operating in the global market include Intel Corporation, Mercury Systems, Curtiss-Wright Corporation, Advantech., BAE Systems, SMART Embedded Computing, SDK Embedded Systems, General Dynamics Corporation, Kontron, Xilinx, Renesas Electronics Corporation, Thales Group, Electronic Specifier, NXP Semiconductors, & General Micro Systems.

Recent Developments

- In April 2022, Elbit Systems has entered a partnership with Physical Sciences Inc., and Stanford University, with an aim to develop the night vision equipment for the US military, that offers high capability in a smaller & lighter package. With the partnership, Elbit Systems, America will focus on providing night vision services with a wider bandwidth, situational awareness, & expanded night view.

- In November 2022, Curtiss-Wright Corporation announced the completion of its acquisition of Keronite Group for a cash consideration of USD 35 million. Keronite is a leading provider of PEO surface treatment applications that offers corrosion resistance, wear protection, and thermal protection for defense and commercial aerospace.

Military Embedded Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.77 billion |

|

Revenue forecast in 2032 |

USD 3.68 billion |

|

CAGR |

8.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Platform Type, By Component, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Intel Corporation, Mercury Systems Inc., Curtiss-Wright Corporation, Advantech Co. Ltd., BAE Systems, SMART Embedded Computing, SDK Embedded Systems Ltd., General Dynamics Corporation, Kontron, Xilinx Inc., Renesas Electronics Corporation, Thales Group, Electronic Specifier, NXP Semiconductors, and General Micro Systems Inc. |

FAQ's

Key companies in military embedded systems market are Intel Corporation, Mercury Systems, Curtiss-Wright Corporation, Advantech., BAE Systems, SMART Embedded Computing, SDK Embedded Systems, General Dynamics Corporation, Kontron.

The global military embedded systems market expected to grow at a CAGR of 8.5% during the forecast period.

The military embedded systems market report covering key segments are platform type, component, application, and region.

Key driving factors in the military embedded systems market are surging government financing hikes in the military budget.

The global military embedded systems market size is expected to reach USD 3.68 billion by 2032.