Mobile Payment Technology Market Share, Size, Trends, Industry Analysis Report

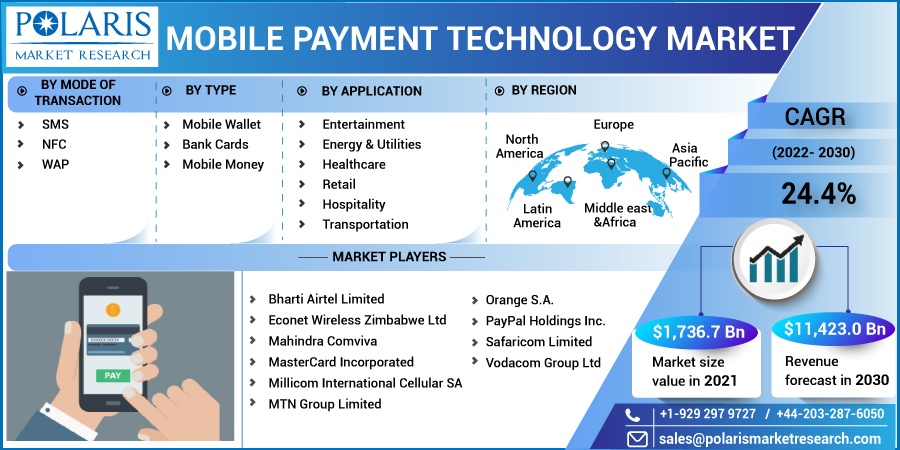

By Mode of Transaction (SMS, NFC, WAP); By Type (Mobile Wallet, Bank Cards, and Mobile Money); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 113

- Format: PDF

- Report ID: PM2290

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

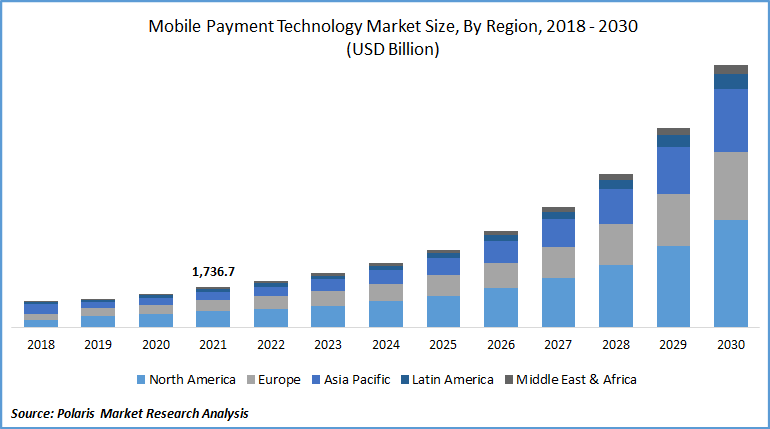

The global mobile payment technology market was valued at USD 1,736.7 billion in 2021 and is expected to grow at a CAGR of 24.4% during the forecast period. The major factors driving the growth of the industry include rising customer convenience and merchant efficiency coupled with the reduction in infrastructural & operation costs for the banks.

Know more about this report: request for sample pages

The rising adoption of innovative technology such as NFC (Near-field Communication) and others are fueling the global industry growth. The adoption of NFC is estimated to open various revenue channels for banks & mobile operators. The use of NFC enables banks to tap micro-transactions made by cash, which represents over 20% of total transactions in the US. The adoption of NFC will reduce the use of paper-based transactions. Moreover, the rising production of smartphones having NFC in them is anticipated to drive the growth of the industry.

Fund transfer and transactions through online options have increased cell phone payment volume, which has encouraged various start-ups to introduce their gateway model in the global industry. However, some merchants of E-wallets have increased their fees in this pandemic, thus giving room for the newcomers in the industry to acquire customers and offer new models at a considerable rate.

Further, the shift of consumer preference on shopping has encouraged the retailers and other business sectors operating on a small and medium scale to adopt the E-commerce platform with e-wallets and other paying options for maintaining social distancing. Closures of shopping malls and stores across the region have compelled a huge group of consumers to change their shopping habits from offline to online. This is estimated to boost the use of online platforms globally, offering huge growth opportunities. However, the reduced consumer spending globally on account of the COVID- 19 outbreak is anticipated to hinder the growth of the industry.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The primary factor driving the growth of the industry is the rising online transactions along with the growing government initiatives for the development of blockchain payment gateway, among others. For instance, in July 2019, The UAE Ministry of Community Development launched a blockchain payment gateway technology in partnership with Dubai Blockchain Centre. The online technology payment gateway accepts all cryptocurrencies.

Furthermore, the rising young internet-savvy population, increasing social media usage, and increasing per capita income are driving online transactions globally, presenting huge growth opportunities. The rising government initiatives for the promotion of cashless transactions are further creating familiarity with the process of paying online using cell phones. Moreover, the growing popularity of e-wallets globally is anticipated to drive the growth of the mobile payment technology market.

For instance, in 2017, the UAE launched the Emirates Digital Wallet in partnership with 16 national banks to offer various technology services such as mobile Point of Sale (POS) payments and mobile Peer-to-Peer (P2P) bank technology payments. Additionally, the rising internet and smartphone penetration rates across nations globally are anticipated to offer lucrative mobile payment technology market growth opportunities.

Report Segmentation

The market is primarily segmented on the basis of mode of transaction, type, application, and region.

|

By Mode of Transaction |

By Type |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The bank cards segment is recorded to hold the larger share in 2021 and is expected to lead the mobile payment technology market over the forecast period. The huge share of the segment can be attributed to the acceptance of payments through credit/debit cards across all e-commerce platforms. Further, advancements in technology such as the use of blockchain for better security are anticipated to boost the segment's growth.

The array of exclusive rewards and perks gained using credit cards is estimated to boost the cell phone technology payments made by this method. The mobile wallets segment is projected to show the fastest growth rate in the forecasting years. The fast growth of the segment can be attributed to the rising number of mobile wallets globally.

Further, the launch of cross-border technology payment platforms is anticipated to drive the growth of the segment. For instance, in May 2021, HSBC launched its first global wallet, which is a multi-currency digital wallet for international technology payments. Moreover, the increasing penetration of smartphones globally is anticipated to boost the growth of the segment.

Geographic Overview

North America is accounted for the largest revenue share in the global market in 2021. This huge market share can be attributed to the region's high adoption of advanced innovative technology. Further, the escalating awareness for an e-wallet in US & Canada is anticipated to drive the growth of the market. The increasing usage of wearable devices along with the increasing adoption of NFC in smartphones & wearable devices is anticipated to offer huge market growth opportunities.

For instance, Starbucks initially launched their order & pay program in the US, through which consumers can order & pay through the store's mobile application. Thus, the increasing demand for fast & hassle-free technology payment modes is anticipated to drive the growth of the market.

Moreover, the Asia Pacific market is anticipated to exhibit the highest CAGR over the forecasting years. The fast growth of the market in the Asia Pacific can be attributed to the increasing trend of digitization coupled with the high adoption of various technology payment modes such as mobile wallets, credit/ debit cards, and others. Further, the growth of the market is fuelled by the rapid urbanization, improving living standards, and rising disposable income of the population in the emerging nation. The emerging nations such as South Korea, India, Japan, and China primarily attribute to market growth. The increasing number of mobile wallets and the growing population are amplifying the growth of the manufacturing industries.

Competitive Insight

Some of the major players operating in the global market include Bharti Airtel Limited, Econet Wireless Zimbabwe Limited, Mahindra Comviva, MasterCard Incorporated, Millicom International Cellular SA, MTN Group Limited, Orange S.A., PayPal Holdings Inc., Safaricom Limited, and Vodacom Group Limited.

Mobile Payment Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1,736.7 billion |

|

Revenue forecast in 2030 |

USD 11,423.0 billion |

|

CAGR |

24.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Mode of Transaction, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Bharti Airtel Limited, Econet Wireless Zimbabwe Limited, Mahindra Comviva, MasterCard Incorporated, Millicom International Cellular SA, MTN Group Limited, Orange S.A., PayPal Holdings Inc., Safaricom Limited, and Vodacom Group Limited. |