Mobile Video Surveillance Market Size, Share, Trends, Industry Analysis Report

By Offering (Hardware, Software, and Service), By Application, By Vertical, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2991

- Base Year: 2024

- Historical Data: 2020-2023

Overview

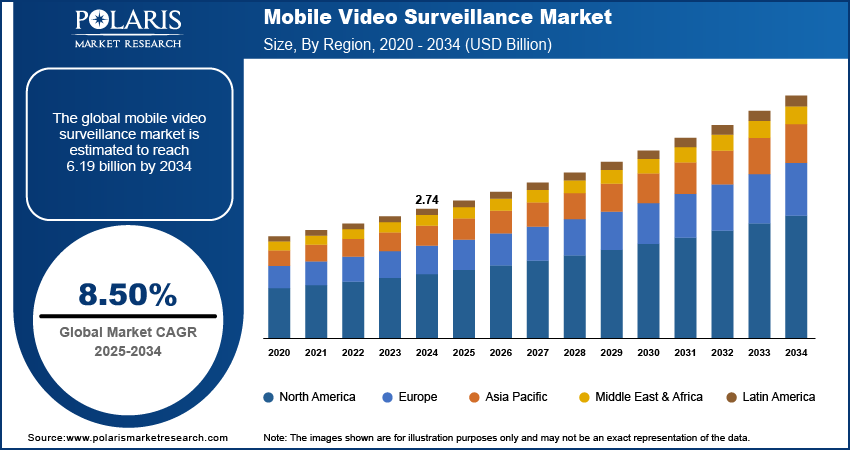

The global mobile video surveillance market size was valued at USD 2.74 billion in 2024. The market is projected to grow at a CAGR of 8.50% during 2025 to 2034. Key factors driving demand for mobile video surveillance include increased global security concerns, technological advancements like AI and IoT, and the need for real-time monitoring.

Key Insights

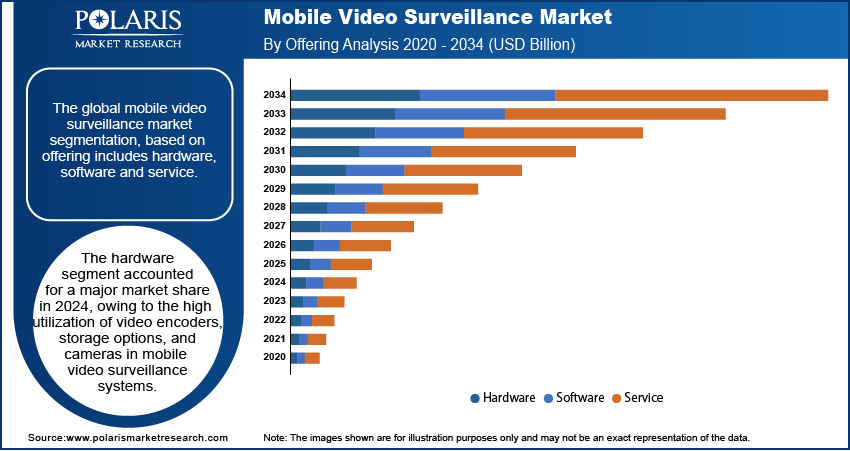

- The hardware segment accounted for a major market share in 2024, owing to the high utilization of video encoders, storage options, and cameras in mobile video surveillance systems.

- The drone segment is projected to grow at a considerable CAGR during the anticipated period, due to the easy deployment and integration of drones into a wide range of command, control, communications, intelligence, surveillance, and reconnaissance systems.

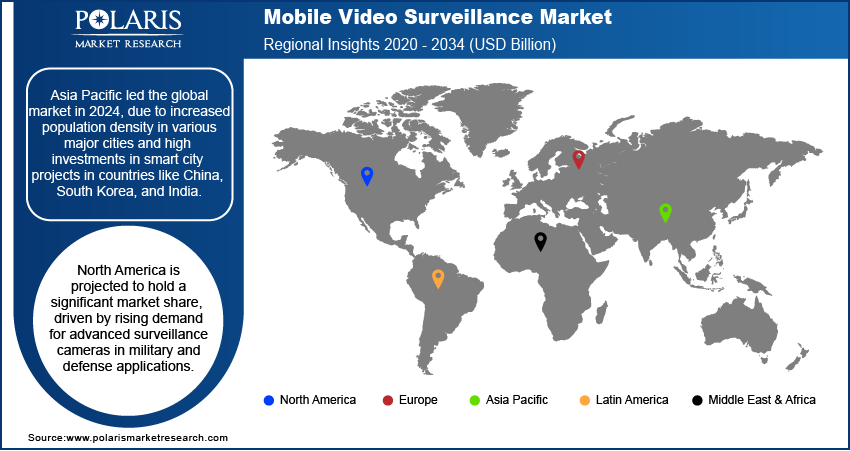

- Asia Pacific led the global market in 2024, due to increased population density in various major cities and high investments in smart city projects in countries like China, South Korea, and India.

- North American region is projected to account for a prominent market share over the forecast period, on account of increasing demand for advanced surveillance cameras mainly from military & defense applications in countries like the United States and Canada.

Industry Dynamics

- The growing number of smart city projects and digitalization of infrastructure, especially in emerging economies like India, China, Indonesia, and South Korea, is driving the market growth.

- The growing need to provide higher safety levels to people living in urban areas is also increasing the demand for mobile video surveillance.

- Innovation in intelligent cameras and sensors is creating a lucrative market opportunity.

- Privacy and security concerns regarding video data in wireless cameras may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 2.74 Billion

- 2034 Projected Market Size: USD 6.19 Billion

- CAGR (2025-2034): 8.50%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Mobile Video Surveillance Market

- AI helps in real-time video analytics for faster threat detection and response.

- AI helps in improving accuracy and reducing false alarms by enhancing object, vehicle, and facial recognition.

- AI helps in preventing incidents by analyzing behavioral patterns.

The popularity of mobile video surveillance systems is attributed to its ability to allow video to be easily wirelessly streamed through a mobile video surveillance camera to a control center. In addition, to offer and provide adequate security from fraud, theft, terrorism, and vandalism various government authorities and businesses are seeking highly adaptable and practical video surveillance technology that has led to rising innovations and new product launches by key companies and fueling the market growth. For instance, in February 2022, Hikvision announced the launch of its latest TandemVu PTZ camera range, which integrates multiple lenses and bullets in one single unit for providing the big picture and smaller details in tandem. The new range of cameras comes with 100% security coverage without any blind spots, extraordinary image performance, and PTZ and bullet capabilities for efficiency and cost savings.

The rising awareness regarding the benefits of advanced video surveillance software including system health management, video content analysis, and retrieval of video information along with the undergoing evolutionary transitions in a variety of surveillance systems likely to create high market growth opportunities over the coming years. However, increased privacy and security concerns associated with video data especially in wireless cameras, as video surveillance is often taken as a violation of privacy and people think that their personal information could be leaked or used for illegal purposes, are key factors expected to hamper the global market growth over the study period.

Industry Dynamics

Growth Drivers

The extensive rise in the use of various advanced software analytics and artificial intelligence across mobile video monitoring solutions around the world is the primary factor expected to drive the growth and demand of the global market during the anticipated period. Intelligent mobile video surveillance systems have gained high popularity and becoming very crucial and in fact essential for upholding safety and security as well as the identification of trends and patterns. In addition, the growing number of smart city projects and digitalization of infrastructure especially in emerging economies like India, China, Indonesia, and South Korea, highly leverage networks of innovative intelligent cameras and sensors to organize system responses. Thus, the rapidly growing demand for these intelligent monitoring devices across the globe is also likely to positively impact the market for video surveillance systems in the coming years.

Report Segmentation

The market is primarily segmented based on offering, application, vertical, and region.

|

By Offering |

By Application |

By Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hardware Segment Accounted for the Largest Market Share in 2024

The hardware segment accounted for a significant global market share in 2024 owing to the high utilization of video encoders, storage options, and cameras in mobile video surveillance systems. Moreover, with the increase in the shift towards IP cameras, a large number of hardware-based advancements have emerged, which further improve low-light performance, object tracking, and security. Many large market players are heavily investing in research & development activities to introduce innovative cameras and other surveillance products, which is also pushing segment market growth forward. For instance, in May 2024, Hanwha Techwin, unveiled its new PNM-C12083RVD & PNM-C7083RVD, multi-directional cameras that come with AI capabilities. The new cameras are powered by AI-deep learning algorithms that reduce the occurrence of false alarms with the help of reliable object detection.

Drones Segment is Expected to Register the Highest Growth Rate

The drone segment is projected to grow at a considerable CAGR during the anticipated period, due to the easy deployment and integration of drones into a wide range of command, control, communications, intelligence, surveillance, and reconnaissance systems. Drones have very simple maintenance and operational procedures along with high tactical capabilities and they are capable of performing a spread of missions like mountain search and rescue, army support, intelligence missions, and illegal traffic monitoring, as result, drones are gaining high traction and contributing to market growth significantly.

Furthermore, the railway segment is anticipated to grow significantly with a healthy growth rate over the coming years. The growth of the segment can be attributed to the continuously growing need to provide higher safety levels to passengers and goods and improvement in railway management systems. Additionally, increasing proliferation and demand for minimizing the risk and concerns related to uncertified access to platforms are also propelling market growth.

Transportation Segment Held the Largest Market Revenue Share in 2024

The transportation segment held the majority of the market share in terms of revenue in 2024 and is projected to retain its position throughout the projected period. Increase in the crime, harassment, vandalism, terrorism, and liability suits, and the growing necessity of providing surveillance for effective transportation around the world are key factors fueling the segment’s growth. However, the commercial segment is projected to grow at a rapid pace in the coming years, due to a surge in the number of security concerns in companies, retail, financial institutes, and banks.

Asia Pacific Region Dominated the Global Market in 2024

The Asia Pacific region held the largest mobile video surveillance market share in 2024 and is expected to maintain its dominance throughout the projected period. The increased population density in various major cities and high investments in smart city projects in countries like China, South Korea, and India coupled with the growing number of retail chains, small businesses, and favorable government initiatives are major reasons behind the market growth in the region. In addition, a rapid increase in smartphone penetration as a result of the easy availability of fast internet facilities in the region, is driving the demand and growth significantly.

North American region is projected to account for a prominent market share over the forecast period, on account of increasing demand for advanced surveillance cameras mainly from military & defense applications in countries like the United States and Canada. Moreover, the surge in the usage of surveillance cameras along both regional and international borders to get control of terrorist and criminal attacks will also propel the market in the near future.

Competitive Insight

Some of the major players operating in the global market include Dahua Technology, Axis Communications, Bosch Security and Safety Systems, Hanwha Techwin, Avigilon, Huawei Technologies, Rosco Vision, Wireless CCTV, Strops Technology, Ivideon, DTI Group, Agent Video Surveillance, Cisco Systems Inc., Advantech, Infinova and United Technologies, Pelco, Hikvision, and Eagle Eye Networks.

Recent Developments

In February 2022, Bosch Security & Safety Systems introduced its latest “MIC IP fusion 9000i 9 mm cameras” which offer the highest situational awareness for perimeter detection applications. This is developed with a 9-mm lens that provides an expanded thermal view of 360 degrees in just 30 seconds. It comes with a solid metal body with metallurgy and finishes that provide exceptional safety against corrosion.

In November 2022, Axis Communications announced its new partnership with SecuriThings, a leading IoTOps solution provider. With this partnership, both companies will focus on simplifying and improving the operational management of physical security and safety infrastructure.

Mobile Video Surveillance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.74 billion |

| Market size value in 2025 | USD 2.97 billion |

|

Revenue forecast in 2034 |

USD 6.19 billion |

|

CAGR |

8.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Dahua Technology, Axis Communications, Bosch Security and Safety Systems, Hanwha Techwin, Avigilon, Huawei Technologies, Rosco Vision, Wireless CCTV, Strops Technology, Ivideon, DTI Group, Agent Video Surveillance, Cisco Systems Inc., Advantech, Infinova and United Technologies, Pelco, Hikvision, and Eagle Eye Networks. |

FAQ's

Key segments are offering, application, vertical, and region.

Mobile Video Surveillance Market Size Worth $6.19 Billion By 2034.

The global mobile video surveillance market expected to grow at a CAGR of 8.50% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors are Increase in hardware capabilities of mobile video cameras and Rising awareness regarding the benefits of advanced video surveillance software.