Military Simulation and Training Market Share, Size, Trends, Industry Analysis Report

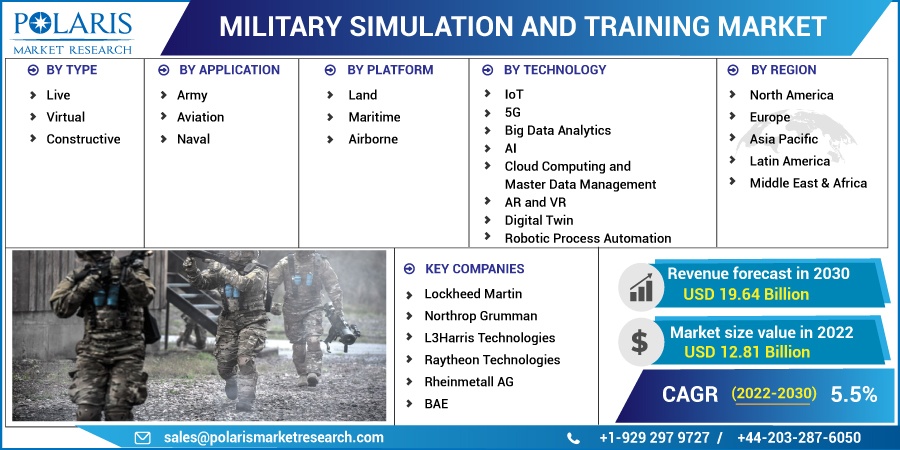

By Type (Live, Virtual, Constructive); By Application; By Platform; By Technology; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2879

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

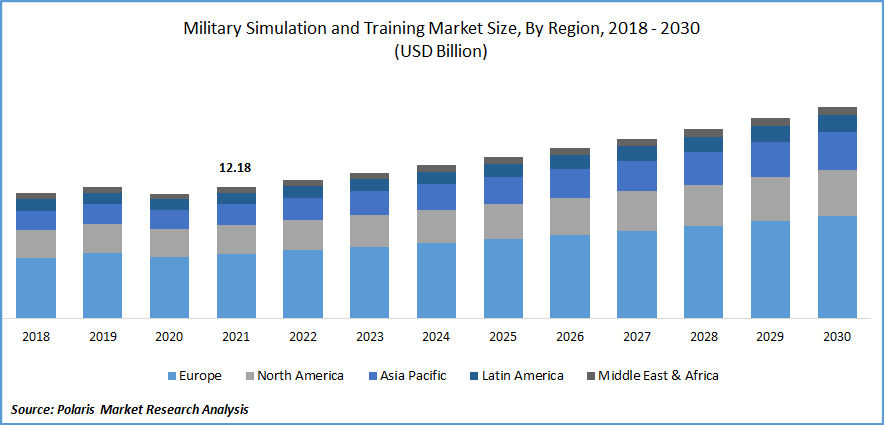

The global military simulation and training market was valued at USD 12.18 billion in 2021 and is expected to grow at a CAGR of 5.5% during the forecast period.

Increasing defense budget as well as technical developments to improve military capabilities and efficiency are predicted to stimulate demand for military simulation and training. Rising geopolitical tensions among the various nations, as well as global strengthening measures, are driving defense expenditure in these regions. Thus, more high-resolution, high-tech military simulators are being produced by manufacturers for use in training defense personnel. An increase in terrorist activities, wars, conflicts, and a rise in the military budget drives the growth of the global market.

Know more about this report: Request for sample pages

Military simulation training extensively uses modern simulation technology based on computers, virtual reality, artificial intelligence, and distributed simulation to replicate weapon system performance, combat environment, and combat itself. The department and trainees can feel the environment like an actual installation and like an actual conflict by using high-fidelity simulations of their adversary, combat mission, and combat procedure. This can maximize their training level.

Simulated training can more objectively and accurately reflect the training level of the training unit and has greater training pertinence by creating a realistic simulated training environment depending on modern science and technology. Military simulation and training are a successful strategy for military personnel training that does not involve high costs. Military simulation and training find their application in the air force, military armed forces, and naval force. Military simulation and training provide trainees with a real, immersive environment where they may learn their response and decision-making abilities. These potent platforms for simulation-based training might not provide actual "real-life" experience. The simulators give trainees the chance to practice working in a wide range of scenarios and environmental settings.

The covid-19 pandemic has put a negative effect on market growth. Due to the lockdown imposed by the government worldwide all the manufacturing units that manufacture training equipment was shut down. It has impacted the overall economy and therefore, decreased the revenue share of the major market players.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The armed services now use simulation and training as a vital training tool because it gives trainees a distinctive and thorough simulation-based training experience while saving the armed forces time and money.

For the armed forces, simulation-based training is a highly cost-effective option since it eliminates the expenses related to maintaining an environment, running vehicles, and using weapons. Additionally, simulation-based training provides trainees with a secure, controlled environment in which to practice using dangerous equipment. This prepares them for real-world situations by giving them the practice and confidence they need. Thus, military simulation and training are cost-effective and time-saving, and hence the growth of the market increases.

For instance, in August 2022 the defense ministry of India approved the transfer of budgetary powers to the armed forces for an emergency purchase of indigenous weapon systems and ammunition due to the ongoing military conflict with China in eastern Ladakh, which has lasted for more than two years.

Report Segmentation

The market is primarily segmented based on type, application, platform, technology, and region.

|

By Type |

By Application |

By Platform |

By Technology |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Based on type, the live segment is expected to grow at the fastest CAGR

In a live simulation, real humans control real systems in a simulation. Live simulations are military training exercises that use actual equipment. Because they are not performed against a real enemy, they are regarded as simulations. Example: Pilot in a real plane, performing formation training with other pilots in real planes

A simulation in which actual people use fake systems. Virtual simulations place a Human-in-the-Loop in a key position by testing their ability to communicate, make decisions, or control their movements. In a constructive simulation fictitious characters control fictitious equipment. Such simulations are stimulated (have input), but the outcomes are not decided by real humans. A computer program is a constructive simulation.

The Aviation segment drives the growth of the market at a faster pace

The aviation segment is expected to have a larger market share. This is mostly because aircraft are more complex and riskier than other end users. The simulation training to pilots gives them knowledge and development in a plane and the ability to encounter challenging situations. It is more affordable than real flights and less time-consuming. Training through simulators is the safest way to learn and experiment with flight methods and aircraft controls. It improves the navigational abilities of the pilot. They also got the idea of various weather situations they need to face in real-time. Trainees are prepared for emergencies with more efficiency and success. The military may need to train pilots to get familiar with the newest tools and systems due to the growing usage of newer-generation aircraft that integrate complicated technologies.

North America is expected to witness the highest growth in the forecast period

During the forecast period, the North American market is expected to rise at the highest rate of CAGR. The region provides advanced technologies and platforms to trainees for military simulation and training which reduces time and effort and wear and tear of weapons and equipment. It reduces the utilization of real weapons and combat vehicles which is responsible for efficient cost saving. Growth in demand for military training programs also arises from this.

The surge in orders from the US & Canada to replace the outdated fleet with the new ones as well as the rise in exports of goods is the key factors causing the need for new ship commanders and crew. This is expected to boost demand for maintenance personnel training in the region during the projected period. Also, with the increased defense budget and usage of advanced simulators for air, land, and water, the growth of the market has increased.

Competitive Insight

Some of the major players operating in the global market include Lockheed Martin, Northrop Grumman, L3Harris Technologies, Raytheon Technologies, Rheinmetall AG, and BAE.

Recent Developments

In August 2022, Northrop Grumman & Terma signed an MoU to collaborate on electronic warfare simulation & training opportunities in Northern Europe. Fourth & 5th generation aircraft will receive realistic air combat training due to the company’s simulation & training capabilities.

In July 2022, the RHEINMETALL introduced simulators for the NH 90 NFH Sea naval helicopters. Moreover, Naval Air Squadron 5 of the Bundeswehr can perform practical maintenance & repair tasks because of these simulators.

Military Simulation and Training Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 12.81 billion |

|

Revenue forecast in 2030 |

USD 19.64 billion |

|

CAGR |

5.5% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Platform, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Lockheed Martin, Northrop Grumman, L3Harris Technologies, Raytheon Technologies, Rheinmetall AG, and BAE |