Modular Container Market Share, Size, Trends, Industry Analysis Report

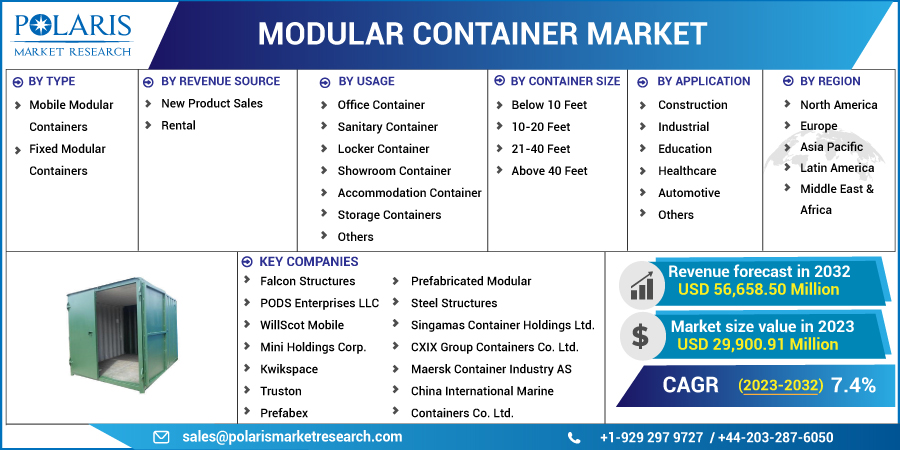

By Type (Mobile Modular Containers and Fixed Modular Containers); By Revenue Source; By Usage; By Container Size; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 115

- Format: PDF

- Report ID: PM2971

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

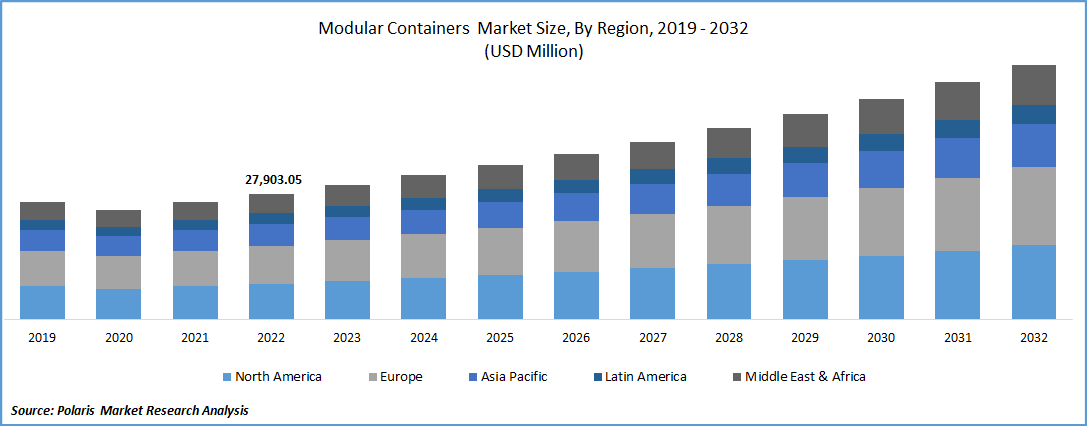

The global modular container market was valued at USD 27,903.05 million in 2022 and is expected to grow at a CAGR of 7.4% during the forecast period.

The extensive rise in industrial and commercial development coupled with the rapid urbanization in countries such as India, China, and Brazil, and the growing penetration of modular containers for storage and housing purposes, are major factors boosting the growth of the global market.

Know more about this report: Request for sample pages

In addition, the rapid surge in a shift in manufacturer’s focus to develop energy-efficient sustainable construction to minimize pollution and greenhouse gases emission and the continuously growing prevalence of efficient modular containers among various industries such as government, education, retail, construction, and agriculture, is likely to positively impact modular container market growth over the coming years.

Furthermore, increasing government efforts and push to promote energy-efficient manufacturing projects and infrastructure has been creating lucrative growth opportunities for modular containers. Governments are playing a very crucial role in the growing market opportunities by extending their support by providing loans, investments, subsidies, and an increase in FDI.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the modular container market. Due to the rapid emergence of the deadly coronavirus, several governments across the world were forced to impose stringent restrictions and regulations on various trading activities and resulting in a decline in demand for modular storage rentals. Moreover, these restrictions and several trade barriers led to more business closures and high disruptions in the supply chains.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rapid surge in the number of people shifting to metropolitan regions and the high rate of urbanization especially in developing countries like India, China, Malaysia, and South Korea has led to a significant rise in the use of modular containers for various housing and storage purposes, that is expected to drive the growth of the global market during the anticipated period.

In addition, an increase in cargo transportation through ships & growing number of trade agreements supplementing and trend of automation of modular containers for safety and higher convenience purpose are driving the market growth.

Report Segmentation

The market is primarily segmented based on type, revenue source, usage, container size, application, and region.

|

By Type |

By Revenue Source |

By Usage |

By Container Size |

By Application |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Mobile modular container segment dominated the market in 2022

The mobile modular container segment dominated the global market with a holding of significant market share in 2022 and is projected to maintain its dominance throughout the forecast period owing to its several advanced and beneficial features including high durability, easily movable, and quickly assembled on-site. Mobile modular containers offer a wide range of compelling utilities like ready-to-use offices, portable for storage purposes, building constructions, and commercial applications in offices, which drive the higher adoption of these types of containers across the globe.

The fixed modular container segment is anticipated to grow at a considerable rate of growth over the projected period owing to the rapidly growing popularity and prevalence of container homes, especially in developed nations such as the U.S., Canada, France, and Germany. These containers are customizable, durable, and cost-effective and provide innovative offsite manufacturing techniques.

Rental segment accounted for the largest market share

The rental segment accounted for the largest global market in 2022 and is likely to retain its position over the forecast period on account of the high focus of market companies to lease their units for generating revenue instead of selling new products. Key market players who are offering modular containers on rental and lease along with several other services including delivery, installation, maintenance, and others are WillScot Mobile Mini and McGrath RentCorp.

Furthermore, the new product sales segment is expected to expand fastest over the coming years, which is accelerated by the increasing purchase of modular containers from various end-use industries such as healthcare, retail, agriculture, education, and automotive for various applications of end users.

Office container segment is projected to witness the largest growth

The office container segment is projected to witness the largest growth during the forecast period. The growth of the segment market is mainly driven by its wide range of aesthetic features and comparatively strong structural design. In addition, office containers have gained high traction for being used in commercial applications, as a result of high advancements in prefabricated technology.

However, the storage container segment led the industry in 2022 and accounted for the highest share owing to rising demand for modular storage containers from manufacturers and wholesalers of different industries. These types of containers help to store a wide range of components such as materials, compressors, machinery, and tools effectively, due to which, this container is highly utilized in warehouses and manufacturing facilities.

10-20 feet segment held the significant market revenue share

The 10-20 feet segment accounted for the maximum revenue share in 2022 and is expected to continue its dominance throughout the projected period. Segment’s growth is due to its wide usage in a variety of applications like storage, locker space, and office space because of its high suitability and apt size. 20 feet modular container is a standard range used in the transportation of raw materials such as iron, rock, and ore, which are major factors influencing the growth.

The construction segment is likely to register the highest growth

The construction segment is anticipated to register the highest market growth during the projected period. Higher durability, attractive designs, and high-quality construction along with the growing prevalence of modular containers in both commercial and residential construction across the globe are key factors fueling the growth of the segment market. Modular construction is highly prevalent owing to its environmental friendliness, required little maintenance, and ability to reduce overall operational costs has paved the way for higher adoption of modular containers all over the world.

North America dominated the global market for modular container

North America dominated the market and accounted for the majority of the market share in terms of revenue. High investment in the development of infrastructure and industries and high consumer spending capacity on innovative facilities in countries like the United States and Canada are key factors driving the growth of the market in the region. Moreover, an increasing number of government initiatives and growing financial expenditure associated with construction projects are further expected to impact the market positively in the next coming years.

Furthermore, Asia Pacific is anticipated to emerge as the fastest-growing region throughout the forecast period on account of the rapid increase in the use of modular containers in construction activities and the high implementation of green building infrastructure projects. Moreover, growing preferences for intermodal transportation owing to the introduction of technological advancements like computerized vehicle routing, active traffic management, and freight exchange is boosting the market growth.

Competitive Insight

Some of the major players operating in the global market include Falcon Structures, PODS Enterprises, WillScot Mobile Mini Holdings., Kwikspace, Truston, Prefabex, Prefabricated Modular Steel Structures, Singamas Container Holdings Ltd., CXIX Group Containers Co. Ltd., Maersk Container Industry AS, and China International Marine Containers Co. Ltd.

Recent Developments

In September 2022, Container xChange announced the launch of its new product Container Control to solve issues related to non-vessel-owning common carriers and freight forwarders in real-time from pick-up to drop-off. With the launch, the customers will be capable to match all available containers to shippers and can add all release references to the platform.

Modular Container Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 29,900.91 million |

|

Revenue forecast in 2032 |

USD 56,658.50 million |

|

CAGR |

7.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Revenue Source, By Usage, By Container Size, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Falcon Structures, PODS Enterprises LLC, WillScot Mobile Mini Holdings Corp., Kwikspace, Truston, Prefabex, Prefabricated Modular Steel Structures, Singamas Container Holdings Ltd., CXIX Group Containers Co. Ltd., Maersk Container Industry AS, and China International Marine Containers Co. Ltd. |

FAQ's

key companies are Falcon Structures, PODS Enterprises, WillScot Mobile Mini Holdings., Kwikspace, Truston, Prefabex, Prefabricated Modular Steel Structures, Singamas Container Holdings Ltd.

The global modular container market expected to grow at a CAGR of 7.4% during the forecast period.

key segments are type, revenue source, usage, container size, application, and region.

key driving factors are Increase in cargo transportation through ships and Growing number of trade agreements supplementing and trend of automation.

Modular Container Market Size Worth $56,658.50 Million By 2032