Motor Monitoring Market Share, Size, Trends, Industry Analysis Report

By Offering (Hardware, Software, Services); By Deployment (On-premises, Cloud); By Monitoring Process; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 112

- Format: PDF

- Report ID: PM2407

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

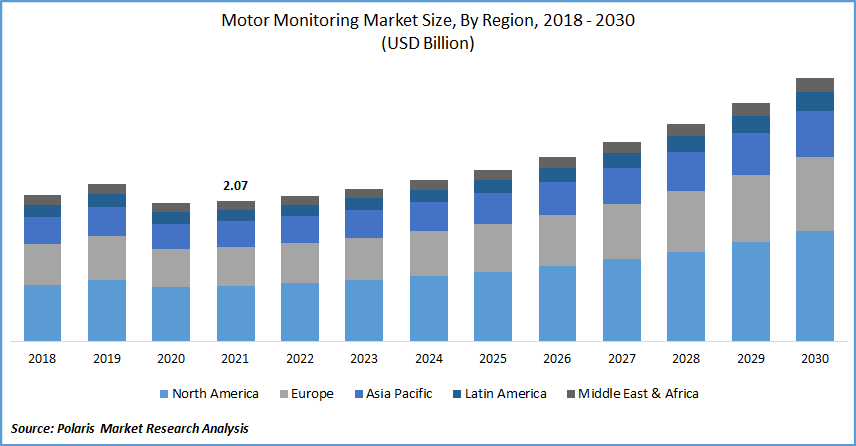

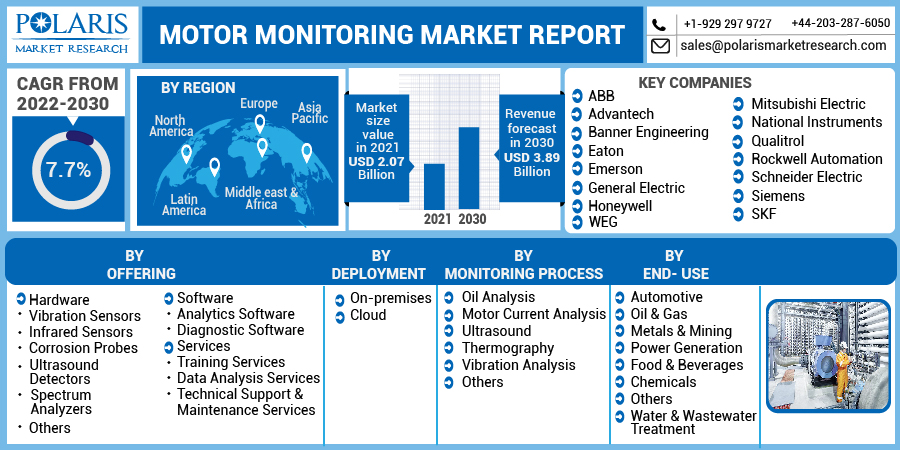

The global motor monitoring market was valued at USD 2.07 billion in 2021 and is expected to grow at a CAGR of 7.7% during the forecast period. The main factors driving the market's growth include the rising demand for warm imaging applications and the growing popularity of small advances in the modern world. Remote advancements are gaining traction in the advanced business landscape, including oil and gas, auto, synthetic substances, and various enterprises.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Various firms have started sending remote innovations because it is easy to build devices with a remote correspondence feature. Such progress has been observed in astute meters. Information is extracted naturally from it rather than dispatching someone to inspect the meters physically. Predictive support has been recognized in businesses all over the world. A proactive maintenance program's primary goal is to identify, locate, and follow up on potential problems before they become disasters.

Additionally, motor control and monitoring systems, also known as intelligent control devices, allowing motors to be started, controlled, stopped, and monitored remotely via a motor control module. This technology enables real-time online monitoring of motor parameters such as voltage, current, temperature, and speed.

This information can be gathered over time and stored in the database for long-term analysis. The system is primarily a software application and the hardware units that go with it. System providers attempt to enhance the product by increasing the quality of the software application while simultaneously lowering the number of hardware units. However, the high price of the industry restricts the market growth.

Industry Dynamics

Growth Drivers

Rising adoption of the market in automotive and transportation, increasing demand for thermal imaging applications, and rising demand for Intelligent Transportation Systems (ITS). In recent years, the automotive world has experienced a protest movement against the quick adoption of electric vehicles in developed and developing economies. This system can be used in a variety of ways with EVs. Furthermore, the automotive industry's shift toward automated systems has increased the demand for systems.

Besides that, the demand for efficient working systems for improved performance and fuel efficiency has increased the demand for motor monitoring market systems. Moreover, according to the US Department of Energy, there are 40 million motors in use in the United States alone. Those motors consume 70% of the industry's electricity, demonstrating their significance. Thermal imagers are extremely useful for troubleshooting motor problems and condition monitoring, used for long-term preventive maintenance.

The temperature-reflecting photograph of the industry gives the consumer a more accurate predictor of failure. The number of suppliers for providing components and raw materials to manufacture these systems increases competition. It lowers overall costs, but the cost of installing and maintaining remains high. The need for skilled labor to develop the hardware components and software algorithms and integrate them into a device makes it a high-end product.

In addition, the Aerospace industry finds a wide range of applications for motors in airplanes, buses, cranes, and trucks. The critical application of the motor in the aviation vertical necessitates the market for passenger service and avoids any inconvenience. The greater integration of autonomous electric systems in aerospace and aviation is profitable for the market.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on offering, deployment, monitoring process, end-use, and region.

|

By Offering |

By Deployment |

By Monitoring Process |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Offering

Based on the offering market segment, the hardware segment is expected to be the most significant revenue contributor in the global motor monitoring market. The hardware segment is estimated to hold a larger market share, attributed to government initiatives to integrate energy audits to increased mandatory regulations, rising demand for EVs, and a growing business for the Internet of Things (IoT).

For instance, as per the International Energy Agency, in 2019, 2.2 million electric vehicles were sold, accounting for only 2.5 % of global vehicle sales. Electric car sales more than doubled to 6.6 million in 2021, accounting for nearly 9% of the global automotive market. The essential part of a machine condition monitoring system is the hardware. Vibration sensors, infrared cameras, ultrasound detection systems, spectrum analyzers, and corrosion probes are the main components of the hardware segment.

Geographic Overview

North America had the largest revenue share. This is due to the influence of major players in the region, rising demand for EVs, enhanced security measures for cloud users, improvements in cloud computing, and the rapid development of advanced infrastructure networks. According to the International Energy Agency's World Energy Investment 2021 report, North American utilities invested roughly USD 85 billion in power generation facilities and USD 246 billion in oil and gas production in 2020.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. The Make in India initiative initiates plans to make India equally strong for domestic and foreign players and give the Indian economy global recognition.

The Indian government intends to reach 175 GW of installed renewable capacity by 2022, including solar and wind power. The country intends to obtain 40 % of its energy from renewable sources by 2030, up from 15 % currently in 2020. As a result, the demand for industrial motors is expected to rise further, as will the demand for the motor monitoring market.

Further, the Chinese government announced USD 78 billion in investments to develop 110 nuclear power plants, which are expected to begin operations by 2030. Such initiative developments are expected to broaden the scope of modern technology adoption, such as vibration monitoring systems, to assist in condition-based monitoring for motors. These activities are expected to generate strong demand for monitoring solutions, monitoring and enabling the maintenance of oil and gas equipment and infrastructure.

Competitive Insight

Some of the major players operating in the global market include ABB, Advantech, Banner Engineering, Eaton, Emerson, General Electric, Honeywell, Mitsubishi Electric, National Instruments, Qualitrol, Rockwell Automation, Schneider Electric, Siemens, SKF, and WEG.

Motor Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.07 Billion |

|

Revenue forecast in 2030 |

USD 3.89 Billion |

|

CAGR |

7.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Offering, By Deployment, By Monitoring Process, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ABB, Advantech, Banner Engineering, Eaton, Emerson, General Electric, Honeywell, Mitsubishi Electric, National Instruments, Qualitrol, Rockwell Automation, Schneider Electric, Siemens, SKF, and WEG |