Muscle Relaxant Drugs Market Size, Share, Trends, Industry Analysis Report

: By Drug Type (Skeletal Muscle Relaxant Drugs, Facial Muscle Relaxant Drugs, and Neuromuscular Blocking Agents), Route of Administration, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM3548

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

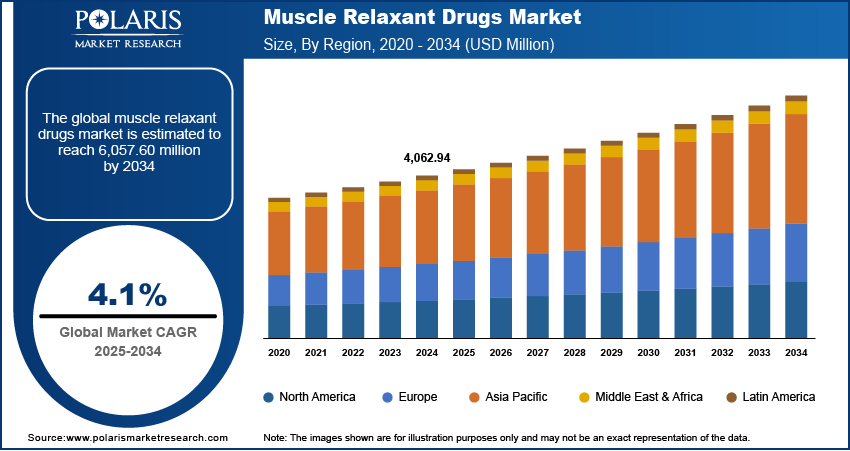

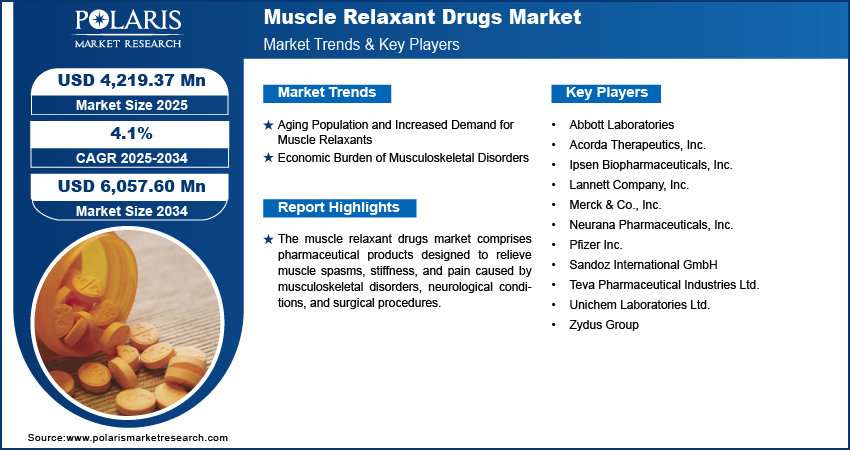

The muscle relaxant drugs market size was valued at USD 4,062.94 million in 2024, growing at a CAGR of 4.1% during 2025–2034. The rising prevalence of chronic conditions and the growing number of surgical procedures needing postoperative pain management are a few of the key factors driving market growth.

Key Insights

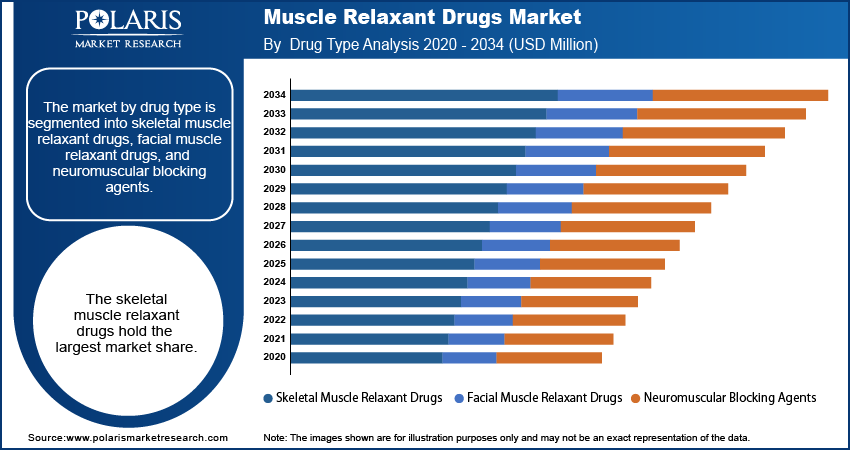

- Skeletal muscle relaxant drugs account for the largest market share. This is primarily due to the extensive use of these medications in the management of chronic pain and several musculoskeletal conditions.

- The oral segment dominates the market, owing to the ease of administration of muscle relaxant drugs and their high patient compliance.

- Hospital pharmacies lead the market. The segment’s dominance is fueled by the increasing number of clinical visits and the rising geriatric population that often needs hospitalization.

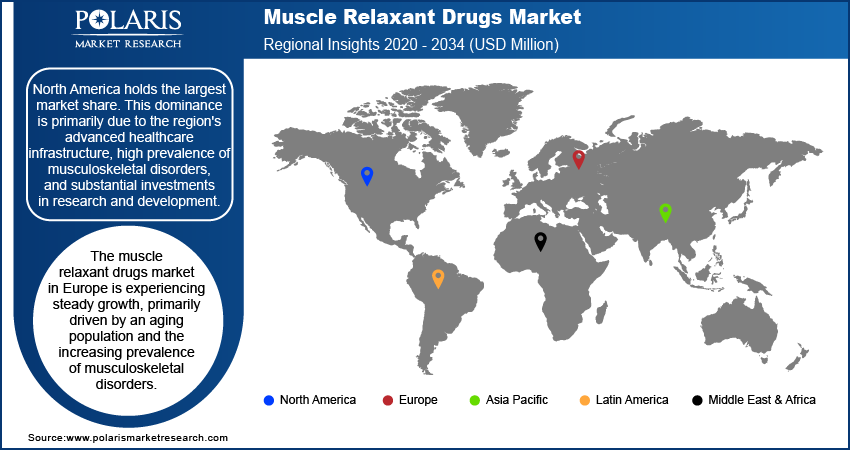

- North America dominates the market. The presence of an advanced healthcare infrastructure and significant investments in R&D drive the region’s leading market share.

- Europe is witnessing significant growth. The growing aging population and high prevalence of musculoskeletal disorders fuel market growth in the region.

Industry Dynamics

- The aging global population, which is more susceptible to conditions like lower back pain and osteoarthritis, is fueling the demand for muscle relaxant medications.

- The significant financial impact of musculoskeletal disorders has led to increased adoption of effective management strategies, including muscle relaxant drugs.

- The development of novel therapeutics with enhanced safety profiles is anticipated to create significant opportunities for market participants.

- Side effects and safety concerns associated with muscle relaxant drugs may hinder market growth.

Market Statistics

2024 Market Size: USD 4,062.94 million

2034 Projected Market Size: USD 6,057.60 million

CAGR (2025-2034): 4.1%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The muscle relaxant drugs market comprises pharmaceutical products used to relieve muscle spasms, pain, and hyperreflexia associated with conditions such as multiple sclerosis, spinal cord injuries, and musculoskeletal disorders. These drugs are classified into centrally acting muscle relaxants, which act on the central nervous system, and peripherally acting muscle relaxants, which target muscle fibers directly. The market is driven by the rising prevalence of musculoskeletal disorders, the increasing geriatric population, and growing cases of sports-related injuries. Additionally, the demand for effective pain management solutions and the expanding availability of prescription muscle relaxants contribute to muscle relaxant drugs market growth.

Key drivers influencing the market include the increasing incidence of chronic pain conditions, advancements in drug formulation, and the rising number of surgical procedures requiring postoperative pain management. The expansion of healthcare infrastructure and improved access to treatment in emerging economies further support market growth. The growing preference for non-opioid pain relief options and the development of novel therapeutics with improved safety profiles are expected to create muscle relaxant drugs market opportunities for players.

Market Dynamics

Aging Population and Increased Demand for Muscle Relaxants

The aging global population is creating new challenges for healthcare systems, particularly in managing musculoskeletal health. Older adults are more prone to conditions such as osteoarthritis and lower back pain, which can make daily activities difficult. To ease pain and improve mobility, many turn to muscle relaxant medications. The World Health Organization (WHO) reports that musculoskeletal conditions affect people of all ages but are most common among older individuals. With a growing number of people reaching this age group, the demand for muscle relaxant drugs continues to rise, driving market growth. As populations continue to age worldwide, the need for effective pain management solutions will only become more essential.

Economic Burden of Musculoskeletal Disorders

Musculoskeletal disorders not only affect individual health but also impose a significant economic burden on societies. In the United States, for instance, the annual cost for treatment and lost wages related to MSDs was estimated at USD 213 million, accounting for 1.4% of the country's gross domestic product. This figure encompasses direct medical expenses and indirect costs such as lost productivity due to disability. The substantial financial impact of MSDs highlights the importance of effective management strategies, including the use of muscle relaxant drugs, to mitigate pain and improve function, thereby potentially reducing the associated economic strain. As a result, the muscle relaxant drugs market demand is expanding.

Segment Insights

Assessment by Drug Type

The muscle relaxant drugs market segmentation, based on drug type, includes skeletal muscle relaxant drugs, facial muscle relaxant drugs, and neuromuscular blocking agents. The skeletal muscle relaxant drugs hold the largest market share. Initially approved for short-term relief of muscle spasms and back pain, these medications are now extensively utilized in managing chronic pain and various musculoskeletal conditions. Their widespread use is driven by the high prevalence of musculoskeletal disorders, which affect approximately 1.71 million people worldwide, according to the World Health Organization. The broad application of skeletal muscle relaxants in treating conditions such as low back pain and neck pain is driving the segment’s dominance in the market.

Evaluation by Route of Administration

The muscle relaxant drugs market is segmented by route of administration into oral and injectable. The oral segment holds the largest market share, primarily due to its non-invasive nature, ease of administration, and high patient compliance. Oral muscle relaxants are commonly prescribed for conditions such as back pain and muscle spasms, offering a convenient option for both patients and healthcare providers. The availability of various oral formulations further enhances their accessibility and acceptance among patients.

Outlook by Distribution Channel

The muscle relaxant drugs market is segmented by distribution channel into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacy holds the largest muscle relaxant drugs market share. This dominance is attributed to the increasing number of clinical and hospital visits and the growing geriatric population, which often requires hospitalization for various chronic conditions that require muscle relaxant medications. The centralized procurement and distribution systems in hospital pharmacies ensure the timely availability of these drugs to healthcare professionals, streamlining the supply chain and facilitating efficient inventory management.

Regional Insights

By region, the study provides muscle relaxant drugs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share. This dominance is primarily due to the region's advanced healthcare infrastructure, high prevalence of musculoskeletal disorders, and substantial investments in research and development. The aging population in North America further contributes to the demand for muscle relaxant medications, as older individuals are more susceptible to conditions such as back pain and muscle spasms. Additionally, the presence of key pharmaceutical companies in the region facilitates the availability and development of these drugs.

The muscle relaxant drugs market in Europe is experiencing steady growth, primarily driven by an aging population and the increasing prevalence of musculoskeletal disorders. Countries such as Germany, the UK, and France are at the forefront of this market expansion. This growth is attributed to the country's robust healthcare infrastructure and heightened awareness of effective pain management solutions. Similarly, the UK’s market is expected to expand due to the high prevalence of musculoskeletal issues and a well-established healthcare system. The increasing adoption of advanced therapeutic options and the presence of key pharmaceutical companies further boost the market in this region.

Key Players and Competitive Insights

The Muscle Relaxant Drugs Market is highly competitive, driven by increasing cases of musculoskeletal disorders, neurological conditions, and sports-related injuries. Market players compete based on drug efficacy, safety profiles, pricing strategies, and formulation advancements. The demand for both centrally acting and peripherally acting muscle relaxants is rising, with a growing preference for non-addictive alternatives to opioids. Generic drug penetration is intensifying competition, making affordability a key factor in market dynamics. Regulatory policies and patent expirations further shape the landscape, influencing market entry for new players. Additionally, ongoing research into novel muscle relaxants with improved therapeutic outcomes and fewer side effects continues to drive innovation, making technological advancements a crucial competitive differentiator in this evolving market.

Notable companies include Abbott Laboratories; Acorda Therapeutics, Inc.; Ipsen Biopharmaceuticals, Inc.; Lannett Company, Inc.; Merck & Co., Inc.; Neurana Pharmaceuticals, Inc.; Pfizer Inc.; Sandoz International GmbH; Teva Pharmaceutical Industries Ltd.; Unichem Laboratories Ltd.; and Zydus Group.

Pfizer Inc. is a prominent pharmaceutical company known for its extensive range of medications, including muscle relaxants. One of their notable products is Skelaxin® (metaxalone), an oral muscle relaxant used to alleviate discomfort associated with acute musculoskeletal conditions. Additionally, Pfizer manufactures vecuronium bromide, a neuromuscular blocking agent utilized as an adjunct to general anesthesia to facilitate endotracheal intubation and provide skeletal muscle relaxation during surgery or mechanical ventilation.

Teva Pharmaceutical Industries Ltd. is a global leader in generic pharmaceuticals, offering a diverse portfolio that includes muscle relaxant medications. Among their products is cyclobenzaprine hydrochloride, a skeletal muscle relaxant prescribed to relieve muscle spasms associated with acute, painful musculoskeletal conditions. Teva's commitment to providing accessible healthcare solutions is evident through its extensive range of FDA-approved generic products, covering all major therapeutic categories.

List of Key Companies

- Abbott Laboratories

- Acorda Therapeutics, Inc.

- Ipsen Biopharmaceuticals, Inc.

- Lannett Company, Inc.

- Merck & Co., Inc.

- Neurana Pharmaceuticals, Inc.

- Pfizer Inc.

- Sandoz International GmbH

- Teva Pharmaceutical Industries Ltd.

- Unichem Laboratories Ltd.

- Zydus Group

Muscle Relaxant Drugs Industry Developments

-

June 2024: The FDA granted fast-track designation to Tonmya (cyclobenzaprine HCl) for fibromyalgia, following the results of the phase 3 RESILIENT study, which showed significant pain reduction compared to placebo.

-

June 2022: Amneal's LYVISPAH (baclofen) oral granules were approved by the FDA for spasticity related to multiple sclerosis and spinal cord disorders. They offer flexible dosing and are an alternative for patients with swallowing difficulties.

Muscle Relaxant Drugs Market Segmentation

By Drug Type Outlook (Revenue-USD Million, 2020–2034)

- Skeletal Muscle Relaxant Drugs

- Facial Muscle Relaxant Drugs

- Neuromuscular Blocking Agents

By Route of Administration Outlook (Revenue-USD Million, 2020–2034)

- Oral

- Injectable

By Distribution Channel Outlook (Revenue-USD Million, 2020–2034)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,062.94 million |

|

Market Size Value in 2025 |

USD 4,219.37 million |

|

Revenue Forecast by 2034 |

USD 6,057.60 million |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The muscle relaxant drugs market size was valued at USD 4,062.94 million in 2024 and is projected to grow to USD 6,057.60 million by 2034.

The market is projected to register a CAGR of 4.1% during the forecast period, 2024-2034.

North America had the largest share of the market.

Notable companies include Abbott Laboratories; Acorda Therapeutics, Inc.; Ipsen Biopharmaceuticals, Inc.; Lannett Company, Inc.; Merck & Co., Inc.; Neurana Pharmaceuticals, Inc.; Pfizer Inc.; Sandoz International GmbH; Teva Pharmaceutical Industries Ltd.; Unichem Laboratories Ltd.; and Zydus Group.

The oral segment accounted for the larger market share in 2024.

The skeletal muscle relaxant drugs segment accounted for the larger market share in 2024.