Biotechnology and Pharmaceutical Services Outsourcing Market Share, Size, Trends, Industry Analysis Report

By Service (Product Design & Development, Consulting, Regulatory Affairs, Product Maintenance, Auditing & Assessment, Product Testing & Validation, Others); By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4545

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

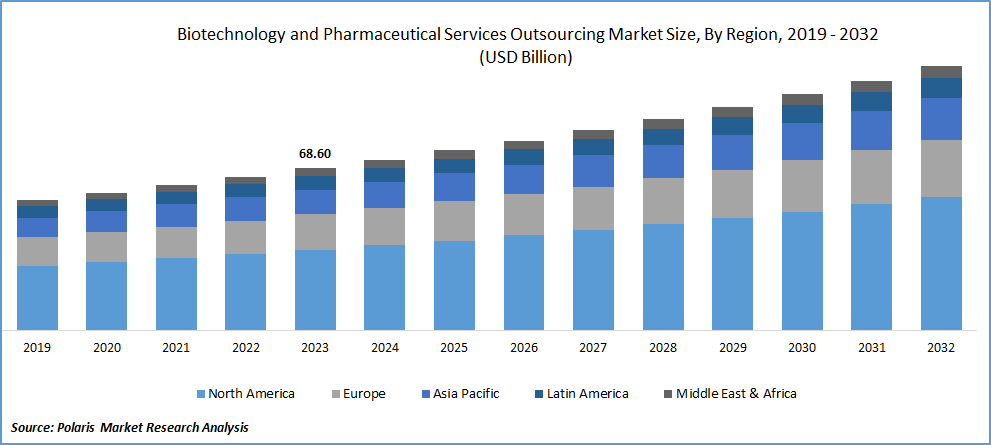

- The global biotechnology and pharmaceutical services outsourcing market size was valued at USD 68.60 billion in 2023.

- The biotechnology and pharmaceutical services outsourcing industry is anticipated to grow from USD 72.28 billion in 2024 to USD 111.86 billion by 2032, exhibiting a CAGR of 5.6% during the forecast period.

Market Introduction

The popularity of biotechnology and pharmaceutical services outsourcing, particularly for Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs), has surged in the last decade and is poised for further market demand. Emerging sectors within the outsourcing industry, such as the expanding screening services, have flourished into lucrative businesses. Operations that were once deemed essential, including in-house spontaneous animal toxicology testing, are now rare among market manufacturers engaged in biotechnology and pharmaceutical services outsourcing.

In recent years, the thriving cell banking business has enabled outsourcing companies in the biotechnology and pharmaceutical services sector to achieve substantial profits. Advanced infrastructure facilities are anticipated to play a pivotal role in clinical research across diverse applications, ranging from diabetes and cancer treatment to cardiovascular disorders management, driven by technological advancements. Consequently, numerous new service outsourcing firms have emerged across various industries.

To Understand More About this Research: Request a Free Sample Report

- For instance, in November 2023, Aragen Life Sciences, an Indian Contract Research, Development, and Manufacturing Organization (CRDMO), allocated USD 30 million towards the construction of a state-of-the-art biologics manufacturing facility spanning 160,000 square meters in Bangalore.

The rising demand driven by the ongoing patent cliff for biotechnology drugs is expected to boost market growth. The growth of end-to-end service providers to cater to the increasing need for cost-effective drug development and manufacturing is also projected to drive market expansion. Additionally, the outsourcing demand is anticipated to be propelled by innovative drug delivery mechanisms and the introduction of new products. In response to heightened competition in the healthcare industry, numerous companies are choosing outsourcing as a strategic approach to generate market revenue.

The biotechnology and pharmaceutical services outsourcing market report details key industry dynamics to help market players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Market New.png)

Industry Growth Drivers

Economic advantages linked to the process of drug discovery are spurring the product demand.

Owing to substantial cost savings and various advantages over internal manufacturing processes, biotechnology and pharmaceutical companies consistently exhibit a strong interest in outsourcing drug discovery. The drug discovery outsourcing market is expected to maintain a higher presence of small and medium-sized firms compared to larger entities, primarily due to a limited number of market players and fewer organizational hurdles in decision-making. Additionally, factors such as low production capacity and technical expertise lead smaller businesses to increasingly depend on drug discovery outsourcing for product development and manufacturing. These dynamics, coupled with the upward trajectory of research and development expenses, contribute to the significant growth of the global biotechnology and pharmaceutical services outsourcing market.

Increased demand and competition are driving biotechnology and pharmaceutical services outsourcing market growth.

The industry's growing demand for drug development services, coupled with heightened competition, encourages companies to outsource various aspects of their operations. Accordingly, outsourcing enables companies to focus on core competencies, accelerate development timelines, and introduce products to market more efficiently, addressing the challenges posed by a competitive landscape.

Industry Challenges

Regulatory challenges are likely to impede the market biotechnology and pharmaceutical services outsourcing growth.

Strict government laws and regulations limit the expansion of the outsourcing sector for pharmaceutical and biotechnology services. Laboratory-developed tests are covered under the regulatory framework that oversees the licensing and commercialization of medical devices, albeit no enforcement proceedings have required laboratories to follow regulations. Therefore, based on the market outlook it is anticipated that the existence of strict regulatory frameworks will impede the expansion of the outsourcing market for biotechnology and pharmaceutical services during the forecast period.

Report Segmentation

The market is primarily segmented based on service, end-user, and region.

|

By Service |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Service Analysis

The product Design & Development segment is expected to witness the highest growth during the forecast period

The product design and development segment is projected to grow at the highest CAGR during the projected period in the biotechnology and pharmaceutical services outsourcing market. According to industry analysis, there are key factors that will propel the growth of the biotechnology and pharmaceutical services outsourcing market. As the industry seeks innovation and efficiency, outsourcing these processes becomes increasingly attractive. External partners specializing in product design and development offer valuable expertise, advanced technologies, and streamlined processes, allowing pharmaceutical companies to focus on core competencies. Therefore, above mentioned approaches accelerate the development of novel drugs, biologics, and medical devices, addressing the industry's evolving needs.

According to market analysis, the trend towards personalized medicine and complex therapeutic modalities further emphasizes the importance of outsourcing product design to meet diverse requirements. Collaborating with specialized service providers aids in navigating intricate regulatory landscapes, reducing time-to-market, and managing costs. Additionally, with a focus on flexibility and innovation, the outsourcing of product design and development is poised for continued growth in the biotechnology and pharmaceutical services sector.

By End-User Analysis

The pharma segment is expected to dominate the biotechnology and pharmaceutical services outsourcing market during the forecast period

In 2023, the biotechnology and pharmaceutical services outsourcing market share was predominantly influenced by pharma, commanding a significant market revenue. Anticipated market growth in the region is driven by increased R&D expenditure from pharmaceutical companies dedicated to developing innovative products and increased investments by Contract Research Organizations (CROs) to bolster core capabilities. Contract service providers are acknowledged as a strategic solution to address challenges, including drug shortages and elevated production costs, while also effectively meeting the escalating market demand. This strategic approach proves instrumental in navigating the complex landscape of pharmaceutical development and reinforces the industry's ability to fulfill market needs efficiently.

Regional Insights

North America region dominated the global biotechnology and pharmaceutical services outsourcing market in the year 2023

North America dominated the global biotechnology and pharmaceutical services outsourcing market in the year 2023 and is expected to continue to do so. Increased R&D spending from pharmaceutical companies focusing on launching innovative products is driving this upsurge. The market is gaining momentum due to the active expansion of capabilities by Contract Research Organizations (CROs). The area views outsourcing as a calculated approach to reduce medication shortages and effectively control production costs. A dynamic and innovative landscape characterizes the biotechnology and pharmaceutical services outsourcing market in North America. It provides a vital means for industry participants to augment their efficiency and satisfy the ever-increasing demands.

Furthermore, based on market analysis, Asia-Pacific is expected to be the most lucrative region during the forecast period. This is due to the upswing in investments by developed nations and regulatory reforms in the assessment of clinical trials, aligning with diverse country standards in the invested region. Moreover, cost-effective drug development, manufacturing, and the availability of a proficient workforce will foster the growth of contract development and manufacturing. Additionally, economic policy reforms in nations such as China are poised to establish an open and balanced economy, creating significant growth prospects for market manufacturers to explore and invest in this promising region.

Market Reg.png)

Key Market Players & Competitive Insights

The biotechnology and pharmaceutical services outsourcing market is fragmented and is projected to witness competition among major competitors. Key players in the market are on a constant approach to developing and upgrading their existing technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Charles River Laboratories International, Inc.

- ICON plc

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- Lonza Group

- Parexel International Corporation

- Pharmaceutical Product Development, LLC (PPD)

- Sartorius Stedim Biotech

- Syneos Health

- Thermo Fisher Scientific Inc.

- WuXi AppTec

- Vetter Pharma International GmbH

Recent Developments

- In November 2023, Charles River Laboratories International, Inc. announced a collaboration agreement involving multiple programs to implement Logica across various targets within the RS portfolio that were previously untapped for drug development. Logica, an Artificial Intelligence (AI)- driven drug solution, transforms biological insights into refined assets.

- In May 2023, Aurigene Pharmaceutical Services, a Contract Research, Development, and Manufacturing Organization (CDMO), announced plans for the establishment of an advanced facility dedicated to the development and manufacturing of therapeutic proteins, antibodies, and viral vectors.

Report Coverage

The biotechnology and pharmaceutical services outsourcing market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, service, end-user, and their futuristic growth opportunities.

Biotechnology and Pharmaceutical Services Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 72.28 billion |

|

Revenue Forecast in 2032 |

USD 111.86 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Gain profound insights into the 2024 biotechnology and pharmaceutical services outsourcing market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

SiC Wafer Polishing Market Size, Share 2024 Research Report

Data Visualization Tools Market Size, Share 2024 Research Report

Diesel Particulate Filter Market Size, Share 2024 Research Report

Automotive Oil Recycling Market Size, Share 2024 Research Report

Autopilot System Market Size, Share 2024 Research Report

FAQ's

Charles River Laboratories International, Inc., ICON plc, IQVIA Holdings Inc. are the key companies in Biotechnology and Pharmaceutical Services Outsourcing Market.

Biotechnology and Pharmaceutical Services Outsourcing Market is exhibiting the CAGR of 5.6% during the forecast period

The Biotechnology and Pharmaceutical Services Outsourcing Market report covering key segments are service, end-user, and region.

Economic advantages linked to the process of drug discovery are spurring the product demand.

The global biotechnology and pharmaceutical services outsourcing market size is expected to reach USD 111.86 billion by 2032