SiC Wafer Polishing Market Share, Size, Trends, Industry Analysis Report

By Product Type (Abrasive Powders, Polishing Pads, Diamond Slurries, Colloidal Silica Suspensions); By Application; By Process; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 119

- Format: PDF

- Report ID: PM3992

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

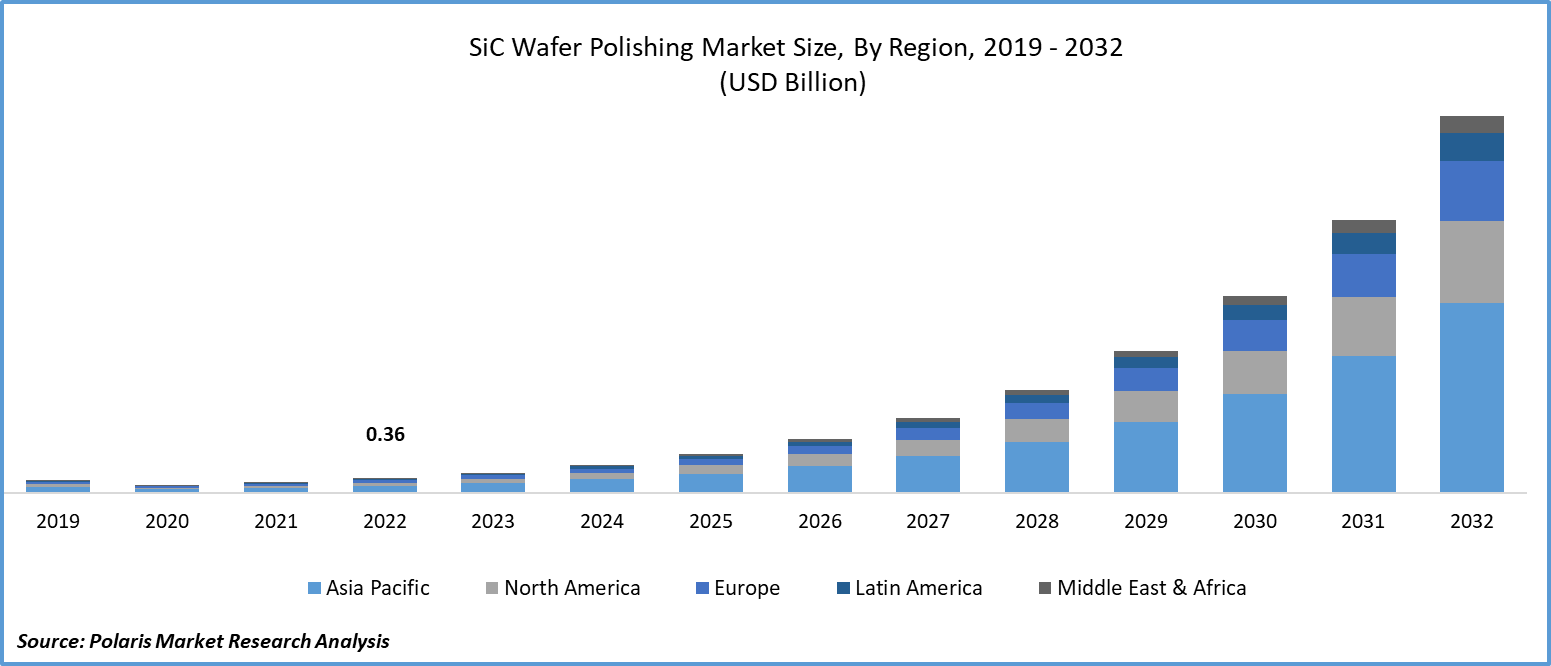

The global sic wafer polishing market was valued at USD 0.36 billion in 2022 and is expected to grow at a CAGR of 38.1% during the forecast period.

Silicon carbide, a substance renowned for its high thermal conductivity, good mechanical strength, and broad band gap, is used to make silicon carbide (SiC) wafers, specialized materials used in semiconductor technology. SiC wafers, which are exceptionally durable and light in weight, offer a stable base for the construction of high-power, high-frequency electronic devices, such as power electronics and radio frequency components. The wafer preparation procedure used in the semiconductor industry includes a crucial step called polishing. It is used to make the water's surface flat, smooth, and free of imperfections and contamination. The growing demand for SiC wafers will further create a need for polishing services in the coming years. The rise in experiments and reviews by researchers is fueling innovations in wafer polishing technology.

To Understand More About this Research: Request a Free Sample Report

- For instance, in January 2022, a study published in MDPi focused on reviewing the polishing technology of SiC wafers. It elaborated on the applications of various technologies and their environmental impacts, including chemical mechanical polishing (CMP), photocatalytic chemical mechanical polishing (PCMP), and others.

Moreover, SiC wafers are highly used in devices that operate at higher temperatures, including electric vehicles, due to the ability of silicon carbide to withstand temperatures up to 2700°. Growing demand and production of electric vehicles in the marketplace will further fuel the demand for these wafers, in turn fueling the expansion of the SiC wafer polishing market in the coming years.

However, one of the main factors impeding the expansion of SiC wafer polishing is the higher initial costs for the establishment of advanced technologies for polishing, including chemical and mechanical polishing, which discourages new market players from entering this field. Furthermore, the renovation of SiC wafers into smooth surfaces required skilled labourers, as it was done through advanced technologies. The lack of expertise in small-scale industries will further reduce the efficiency of the wafer polishing process.

For Specific Research Requirements: Request for Customized Report

Growth Drivers

- Increasing SiC semiconductor adoption

The SiC Wafer Polishing Market is experiencing significant growth, driven primarily by the increasing adoption of SiC (Silicon Carbide) semiconductors. SiC semiconductors offer several advantages over traditional silicon-based semiconductors, including higher temperature tolerance, lower power loss, and enhanced overall performance. These advantages have led to a growing demand for SiC semiconductors in various applications, such as power electronics, electric vehicles, renewable energy systems, and telecommunications.

As SiC semiconductor adoption continues to rise, the need for high-quality SiC wafers with precise surface characteristics becomes paramount. This demand fuels the SiC wafer polishing market, as the manufacturing of flawless and precisely polished SiC wafers is essential for the production of efficient and reliable SiC-based electronic components.

Moreover, the growing interest in SiC technology is encouraging advancements in wafer polishing techniques and equipment, further enhancing the market's growth. This trend is expected to continue as industries increasingly recognize the potential benefits of SiC semiconductors for enhancing the performance and efficiency of various electronic systems.

Report Segmentation

The market is primarily segmented based on product type, application, process and region.

|

By Product Type |

By Application |

By Process |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

- Diamond slurries segment is expected to witness the highest growth during the forecast period

The diamond slurry segment is projected to grow at a CAGR during the projected period, mainly driven by its wide range of applications in numerous places. In the semiconductor sector, diamond slurry is frequently used to polish silicon wafers and other electrical parts. Additionally, it is employed in the jewelry sector for polishing and cutting gemstones as well as in the production of precision optics, including lenses and mirrors. For precise and high-quality surface treatments across a variety of sectors, polishing slurries are essential, boosting their use in SiC wafer polishing in the coming years.

The polishing pads segment held the largest share, largely attributable to the demand for distinct wafers in various applications. The semiconductor becomes flat after polishing, which also thins out the silicon wafer. The pads also eliminate extra wiring and guarantee the seamless operation of the circuits in the product. Due to the effectiveness of polishing pads in modifying wafers, it is fueling the use of SiC wafers in several areas.

By Application Analysis

- Power Electronics segment accounted for the largest market share in 2022

The power electronics segment garnered the largest share. The growing use of SiC wafer polishing electronic appliances is driven by the silicon carbide’s effectiveness in functioning at higher temperatures. The presence of power conversion ability is further propelling its use in the power electronics segment, driving its demand in the coming years.

LED segment will grow at rapid pace, highly attributable to the prevalence of its usage in the manufacturing process of LED lights. One of the main factors driving SiC wafers in LED is their ability to provide a longer shelf life, which in turn fuels the demand for wafer polishing technologies. The growing technological innovations in this field are fueling the expansion of the market soon.

Regional Insights

- Asia Pacific witnessed the largest share in the global market in 2022

The Asia Pacific region registered the largest global market share in 2022 and is expected to maintain its dominance over the anticipated period. The rising awareness of renewable energy is providing new growth potential for SiC wafers in the region. According to the report developed by Ember, CREA, & IEEFA, in 5 important Asian economies—China, India, the Philippines, Japan, & Indonesia—solar power is anticipated to increase exponentially, with an average annual growth rate of 22% through 2030. This will drive demand for SiC wafers as they can handle higher temperatures and voltages compared to silicon, making them more dependable and adaptable inverter components.

Europe will grow at rapid pace, owing to the growing demand for electrical devices, which is fostering the growth of the SiC wafer polishing market as it is highly incorporated in electrical vehicles due to its lower weight and power handling capacity. To meet higher demand for electric vehicles in the region, companies are working to increase production of electric vehicles, which may increase demand for SiC wafer, which in turn fuels the demand for wafer polishing as a smooth surface is required in the manufacturing process.

Key Market Players & Competitive Insights

The SiC wafer polishing market is expected to have higher growth driven by growing innovations by key market players. Companies are working on expanding their market presence through collaborations, acquisitions, partnerships, and product innovations in order to increase their market share and their consumer base. The rising government initiatives to promote the evolution of companies are fueling the competition in the marketplace.

Some of the major players operating in the global market include:

- 3M

- DuPont Incorporated

- Engis Corporation

- Entegris

- Ferro Corporation

- Fujimi Corporation

- Iljin Diamond

- International

- JSR Corporation

- Kemet

- Saint-Gobain

- SKC

Recent Developments

- In March 2023, Amtech Systems, introduced re-flow systems used in the advanced packaging applications. This USD 1.8 Mn order came from a reputable OSAT client of BTU International.

SiC Wafer Polishing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 0.49 billion |

|

Revenue forecast in 2032 |

USD 8.93 billion |

|

CAGR |

38.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Application, By Process, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |