North America AI in Medical Imaging Market Share, Size, Trends, Industry Analysis Report

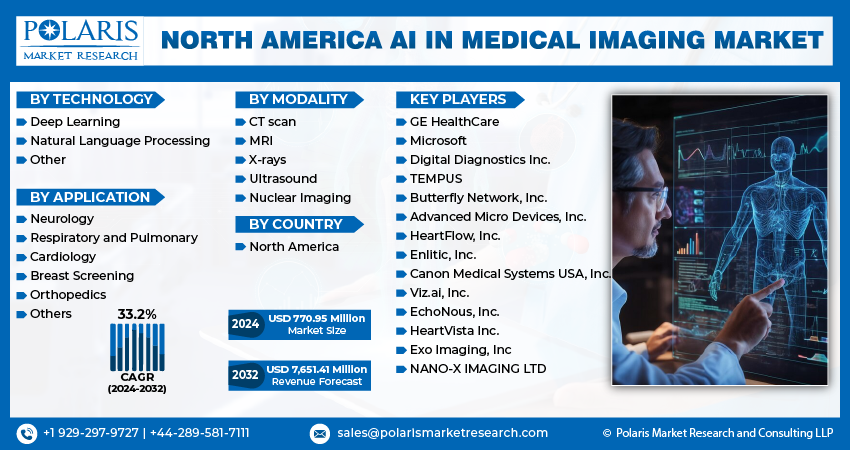

By Technology (Deep Learning), By Application (Neurology), By Modality (MRI), By End-use (Hospitals), And Segment Forecasts, 2024 - 2032

- Published Date:Apr-2024

- Pages: 115

- Format: PDF

- Report ID: PM4796

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

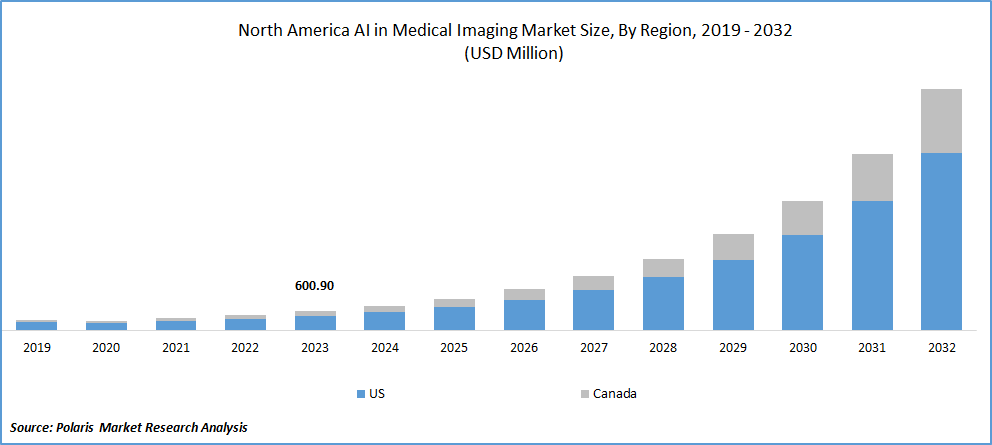

North America AI in medical imaging market size was valued at USD 600.90 million in 2023. The market is anticipated to grow from USD 770.95 million in 2024 to USD 7,651.41 million by 2032, exhibiting the CAGR of 33.2% during the forecast period.

Market Overview

Rising demand for managing extensive and intricate medical datasets has resulted in a higher uptake of artificial intelligence within medical imaging. This upward trend is propelled by AI's capacity to refine diagnostic accuracy, hasten image interpretation, and enhance overall healthcare efficacy through sophisticated data handling and analysis capabilities. For instance, Rayscape CXR distinguishes between regular X-rays and those presenting abnormalities, streamlining patient treatment, and facilitating prompt physician assessment. With the ability to identify more than 147 pathologies, it provides a rapid and effective means for doctors to prioritize and manage patient requirements.

To Understand More About this Research:Request a Free Sample Report

Government efforts in the U.S. to promote the integration of artificial intelligence into healthcare, especially within medical imaging, have driven notable progress in the field. These initiatives encompass financial support and regulatory backing, fostering partnerships between public and private entities. The consequent increase in AI utilization in medical imaging has boosted diagnostic precision, optimized processes, and elevated patient care standards, thereby advancing the market.

In September 2022, the National Institutes of Health (NIH) unveiled plans to allocate USD 130 million over a four-year period, contingent upon fund availability, to accelerate the extensive integration of artificial intelligence into biomedical and behavioral research. The initiative, known as Bridge2AI under the NIH Common Fund, aims to unite interdisciplinary teams in developing specialized AI tools, resources, and comprehensive datasets. The objective is to facilitate broader adoption of AI technology within research communities. Additionally, the FDA is actively developing a regulatory framework for the software modifications driven by the AI/ML to establish guidelines ensuring safety and efficacy.

Growth Drivers

- Increasing complex healthcare datasets

The increasing need to handle vast and intricate datasets, combined with government initiatives promoting the integration of artificial intelligence-based technologies in healthcare, drives the adoption of AI tools in the industry. A rising emphasis on reducing the workload of radiologists has stimulated the use of artificial intelligence (AI) solutions to automate mundane tasks and improve diagnostic procedures.

- Financial assistance to innovative AI start-ups

The U.S. market for artificial intelligence (AI) in medical imaging is expected to experience growth driven by increased financial support for AI-based startups. For instance, in June 2023, Carta Healthcare, Inc., focused on improving patient care through clinical data, revealed its Series B funding round with an additional USD 25 million, backed by investments from leading health systems UnityPoint Health & Memorial Hermann Health System. This additional funding supplements the initial USD 20 million Series B financing announced in November 2022, which received backing from investors including Asset Management Ventures & Frist Cressey Ventures.

Restraining Factors

- Regulations penetrating to fluorinated greenhouse gases

The market is facing increasing regulatory scrutiny, driven by concerns surrounding patient safety, data privacy, and the reliability of diagnostic tools powered by artificial intelligence. For instance, initiatives such as the AI Risk Management Framework, Executive Order 14091 issued in February 2023, & Blueprint for an AI Bill of Rights aim to ensure AI compliance with Federal laws, promote vigilant oversight, rigorous technical evaluations, stringent regulation, and engagement with affected communities.

Report Segmentation

The market is primarily segmented based on technology, application, modality, and region.

|

By Technology |

By Application |

By Modality |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Application Analysis

- Neurology segment held the largest share in 2023

Neurology segment held the largest revenue share in 2023. This is propelled by the increased adoption of AI in neurology, which enhances patient care while ensuring higher accuracy and efficiency. Additionally, AI technology finds applications in neuro-oncology, brain injury detection, & neurosurgery. For instance, in May 2023, TeraRecon introduced Neuro Suite, tailored for the disease triage, and providing insights for the differential diagnosis.

Breast screening segment will grow with the rapid pace. Factors such as the rising occurrence of breast cancer cases and patients' inclination towards early-stage detection for timely and accurate treatment initiation are key drivers stimulating the demand for breast screening services. Moreover, government initiatives aimed at facilitating clinical interpretation and the increased availability of breast cancer screening technologies are expected to play pivotal roles in fostering market expansion.

By Modality Analysis

- CT Scans segment accounted for the largest market share in 2023

CT scans segment accounted for the largest market. CT scans provide more comprehensive data compared to alternative methods, and there is no conclusive evidence demonstrating that the low levels of radiation utilized in CT scans pose long-term harm. The market is segmented based on modality into MRI, CT scan, ultrasound, X-ray, and nuclear imaging. For instance, in November 2023, Brainomix, a company specializing in AI-powered software solutions for precision medicine in stroke, lung fibrosis, and cancer, announced its ongoing expansion efforts in the U.S.

X-ray segment expected to witness robust growth rate. This is primarily due to increasing use of interventional X-ray equipment for imaging-guided surgeries, such as C-arms and similar devices. The advancements in C-arm technology, particularly the development of compact C-arms featuring flat panel detectors and digital radiography, have significantly boosted the global demand for X-rays. For example, in October 2023, Philips launched the Philips Image Guided Therapy Mobile C-arm System 3000, also known as Zenition 30.

Regional Insights

- United States held the largest share of the global market in 2023

U.S. region dominated the market. Region’s growth is due to technological partnerships serve to expand market presence, provide access to complementary expertise, and consolidate resources strategically to enhance research and development capabilities. For instance, in January 2024, GE HealthCare revealed an acquisition agreement with MIM Software. The acquisition is designed to incorporate company's imaging analytics & digital workflow capabilities across different therapeutic areas, fostering innovation and differentiating GE HealthCare's solutions to positively impact patients & healthcare systems worldwide.

Key Market Players & Competitive Insights

The market is experiencing a high growth stage, with the pace of expansion accelerating. The market's significant innovation is propelled by advancements in machine learning algorithms, enhanced collaboration, abundant medical datasets, and supportive government initiatives. For instance, in September 2023, COTA, unveiled Vista, a comprehensive automated EHR dataset, aimed at accelerating cancer research and deploying reliable generative artificial intelligence in cancer care.

Some of the major players operating in the global market include:

- GE HealthCare

- Microsoft

- Digital Diagnostics Inc.

- TEMPUS

- Butterfly Network, Inc.

- Advanced Micro Devices, Inc.

- HeartFlow, Inc.

- Enlitic, Inc.

- Canon Medical Systems USA, Inc.

- Viz.ai, Inc.

- EchoNous, Inc.

- HeartVista Inc.

- Exo Imaging, Inc

- NANO-X IMAGING LTD

Recent Developments in the Industry

- In November 2023, at the RSNA 2023 conference, GE HealthCare unveiled its AI suite, MyBreastAI. This cutting-edge product is designed to enhance the efficiency of radiologists' workflows by providing advanced tools for the early detection and diagnosis of breast cancer.

- In November 2023, at RSNA 2023, Philips extended its enterprise imaging portfolio and unveiled its HealthSuite Imaging AI solutions on Amazon Web Services. This move aims to expedite the integration of new functionalities, enhance operational efficiency, and elevate patient care by leveraging secure cloud-based PACS. These systems enable swift remote access and employ AI-driven workflow management to streamline processes.

Report Coverage

The North America AI in Medical Imaging market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, application, modality, end use, and their futuristic growth opportunities.

North America AI in Medical Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 770.95 million |

|

Revenue forecast in 2032 |

USD 7,651.41 million |

|

CAGR |

33.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in North America AI in Medical Imaging Market GE HealthCare, Microsoft, Digital Diagnostics, TEMPUS, Butterfly Network, Advanced Micro Devices

North America AI in medical imaging Market exhibiting the CAGR of 33.2% during the forecast period

North America AI in Medical Imaging Market report covering key segments are technology, application, modality, and region

The key driving factors in North America AI in Medical Imaging Market Increasing complex healthcare datasets

North America AI in Medical Imaging Market Size Worth $ 7,651.41 Million By 2032