North America Automated Test Equipment Market Share, Size, Trends, Industry Analysis Report

By Type (Non-Memory ATE, Memory ATE, Discrete); By End-User; By Country; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4214

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

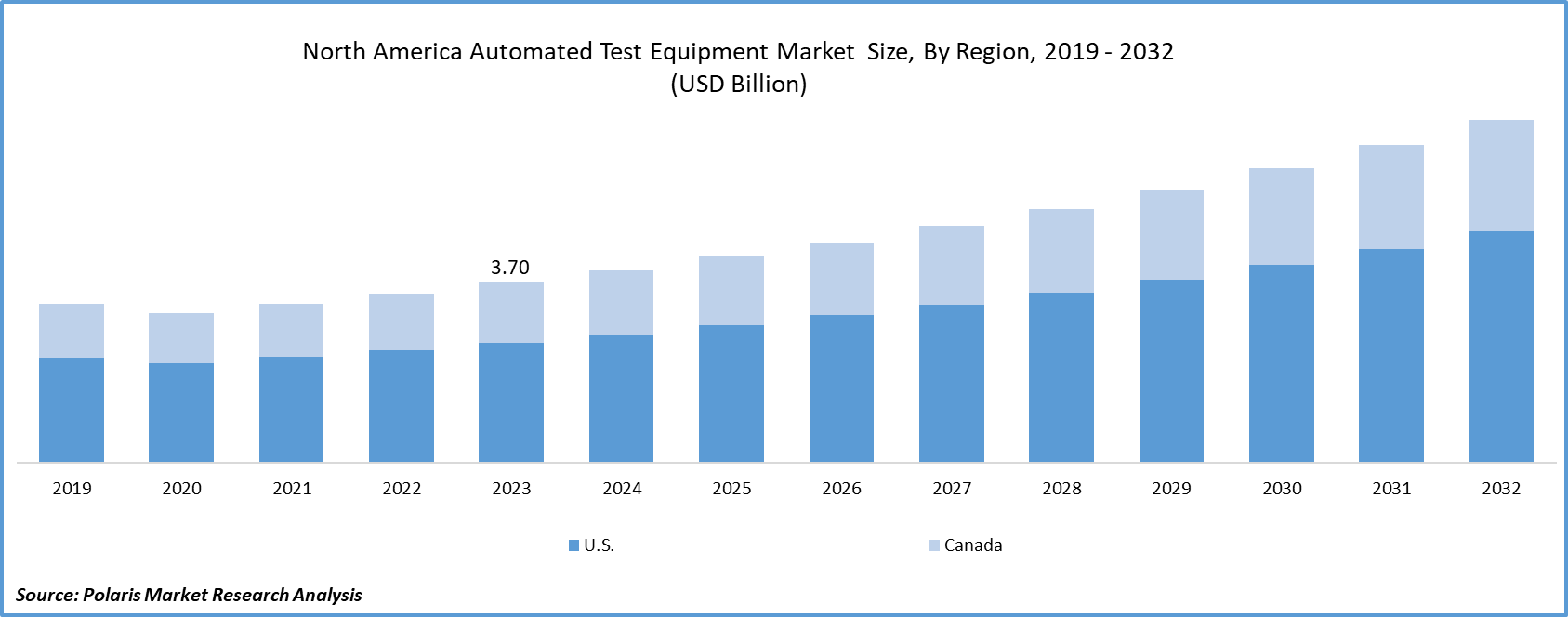

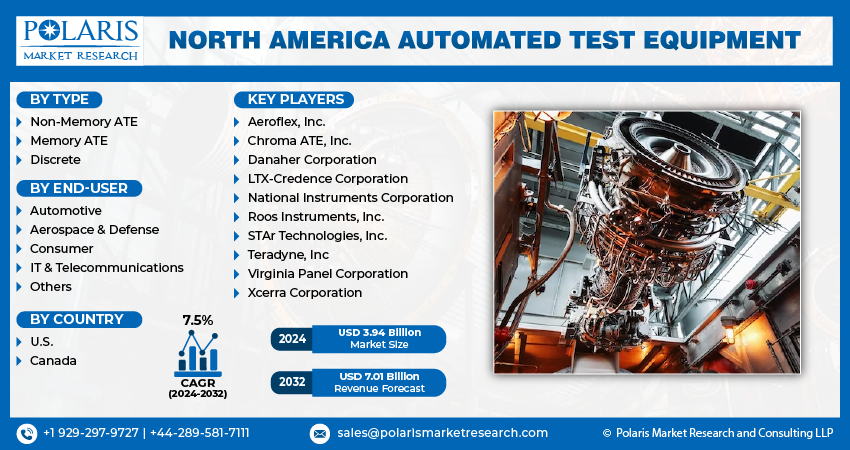

The North America automated test equipment market size was valued at USD 3.70 Billion in 2023 and is expected to grow at a CAGR of 7.5% during the forecast period.

Automatic Test Equipment (ATE) is widely used for testing circuits and devices in modern electronics. This technology is crucial for detecting faults in printed circuit boards found in electronic and electrical equipment. Primarily, ATE processes are known for their efficiency and speed, outperforming manual testing methodologies in terms of time.

The automated test equipment market in North America is witnessing substantial growth owing to various factors such as the demand for higher test accuracy and throughput, the surging complexity and miniaturization of electronic devices, and an increasing demand for quality assurance in numerous industries.

To Understand More About this Research: Request a Free Sample Report

The adoption of the Internet of Things and industry 4.0 principles has expedited to the increased automation and connectivity in the manufacturing processes. Automated test equipment systems are combined into an IoT-enabled production lines, sanctioning real-time monitoring, smart factories, intelligent testing, and data analysis.

The COVID-19 pandemic has had a significant impact on the North America automated test equipment market. The outbreak disrupted the global supply chain, causing delays in the production and deployment of ATE solutions. Economic uncertainty and virus-control measures resulted in a temporary drop in demand for ATE across a variety of industries, including electronics and semiconductor manufacturing.

Companies faced challenges with workforce availability, logistics, and project timelines. The ATE market is anticipated to rebound as the region gradually recovers from the pandemic and industries alter to the normal. The increasing focus on automation, digital transformation, and the growing demand for advanced testing technologies are likely to propel the post-pandemic recovery and growth of the North america automated test equipment market.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the north america automated test equipment market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Growth Drivers

The enhancements in the semiconductor technology will drive the growth of the market

The improvements in semiconductor technology will drive the growth of the North america automated test equipment market. The semiconductor industry is persistently growing, with manufacturing processes, advancements in chip design, and packaging technologies. Automated test equipment systems play an essential role in validating and testing semiconductor components which are utilized to assuring their performance and functionality.

The adoption of advanced technologies like machine learning, and artificial intelligence, will also bolster the market’s growth, these technologies facilitate smarter testing processes, allowing for faster and more accurate detection of defects and performance issues in semiconductor devices. Furthermore, there has been a significant shift toward the development of ATE systems that are capable of meeting the testing requirements of advanced semiconductor nodes, such as smaller process geometries and higher device densities.

Report Segmentation

The market is primarily segmented based on type, component, end-user, and country.

|

By Type |

By End-User |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The non-memory ATE segment accounted for the largest market share in 2023

The non-memory ATE segment held the largest market share in the North america automated test equipment market. The latest innovations in autonomous vehicles and IoT devices as well as substantial advancements in the aerospace and defense sectors. Key players are concentrating on enhancing customer satisfaction by providing excellent product quality and less testing cost.

The memory ATE segment has witnessed for the fastest growth in the North america automated test equipment market, owing to the surging demand for a memory device in the numerous applications like automotive electronics, data centers, and phones. Memory ATE systems are designed specifically for evaluating memory chips and verifying their operational integrity, dependability, and efficiency.

By End-Use Analysis

The automotive segment accounted for the largest market share in 2023

The automotive segment held the largest market share in the North america automated test equipment market, owing to the surging demand for driver safety and vehicle diagnosis features which raises the durability of the vehicle. The increasing integration of electronics in vehicles, combined with stringent emission standards and the need for faster diagnosis, has resulted in an increase in demand for equipment, software, and repair data.

The aerospace and defense segment witnessed the fastest growth in the North america automated test equipment market. Safety is a pivotal parameter in the aerospace industry. It is critical to ensure safety and quality, and having a reliable and cutting-edge testing system is essential. Because aircraft incorporate a wide range of systems, including communication, navigation, and military applications, it is critical to thoroughly test each electronic component to ensure optimal performance and safety standards.

Country Insights

U.S. dominated the automated test equipment market in terms of revenue share in 2023

The U.S. dominated the automated test equipment market. In the United States, mainly three states are dominating in the process of automation namely Austin, Detroil, and Boston. These locations have risen to prominence as the country's leading robotics development centers. Boston Dynamics' creation of Atlas, a humanoid robot, was a remarkable achievement in the field of robotics, particularly in Boston. This accomplishment is expected to fuel growth in the automation test equipment market.

Companies across the region are increasing the test coverage of their enterprise application suites by leveraging Automated Test Equipment (ATE) in response to escalating cybersecurity threats and increasing application complexity. The primary driver of the ATE market in the United States is the rising demand for low-cost consumer goods, as well as a consistent increase in the adoption of semiconductor industry technologies.

Key Market Players & Competitive Insights

The North america automated Test equipment market is highly competitive, with several prominent players varying for market share. Leading manufacturers such as Aeroflex, Inc., Chroma ATE Inc., Danaher Corporation, LTX-Credence Corporation, National Instruments Corporation, Roos Instruments, Inc., STAr Technologies, Inc., Teradyne, Inc., Virginia Panel Corporation, Xcerra Corporation are also present in the region.

Some of the major players operating in the North America Automated Test Equipment Market include:

- Aeroflex, Inc.

- Chroma ATE, Inc.

- Danaher Corporation

- LTX-Credence Corporation

- National Instruments Corporation

- Roos Instruments, Inc.

- STAr Technologies, Inc.

- Teradyne, Inc

- Virginia Panel Corporation

- Xcerra Corporation

Recent Developments

- In April 2023, STAr technologies launched the latest 3D/2.5D MEMS micro-cantilever probe card developed to provide reliable Wafer Acceptance Test (WAT) results. This advanced probe card offers excellent physical characteristics, especially improving testing efficiency.

- In October 2022, Chroma ATE Inc. introduced the advanced Chroma 3650-S2, an innovative testing platform designed for high-performance power ICs. Specifically tailored for evaluating batteries, power management ICs (PMICs), and power conversion components, this automated testing equipment sets a new benchmark in precision testing.

North America Automated Test Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.94 Billion |

|

Revenue Forecast in 2032 |

USD 7.01 Billion |

|

CAGR |

7.5% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By End-User, By Country |

|

Country Scope |

U.S., Canada |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

Explore the landscape of North america automated test equipment in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The North America Automated Test Equipment Market report covering key segments are type, end user and country.

North America Automated Test Equipment Market Size Worth USD 7.01 Billion By 2032

The north america automated test equipment market is expected to grow at a CAGR of 7.5% during the forecast period.

Key players in the market are Aeroflex, Inc., Chroma ATE Inc., Danaher Corporation, LTX-Credence Corporation, National Instruments Corporation

key driving factors in North America Automated Test Equipment Market are rising demand for consumer electronics will bolster the growth of the market