North America Residential and Commercial Roofing Materials Market Share, Size, Trends, Industry Analysis Report

By Product (Asphalt Shingles, Metal Roofs, Plastics, Concrete Tiles, Clay Tiles, Others); By Application; By Construction Type; By Region; And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4583

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

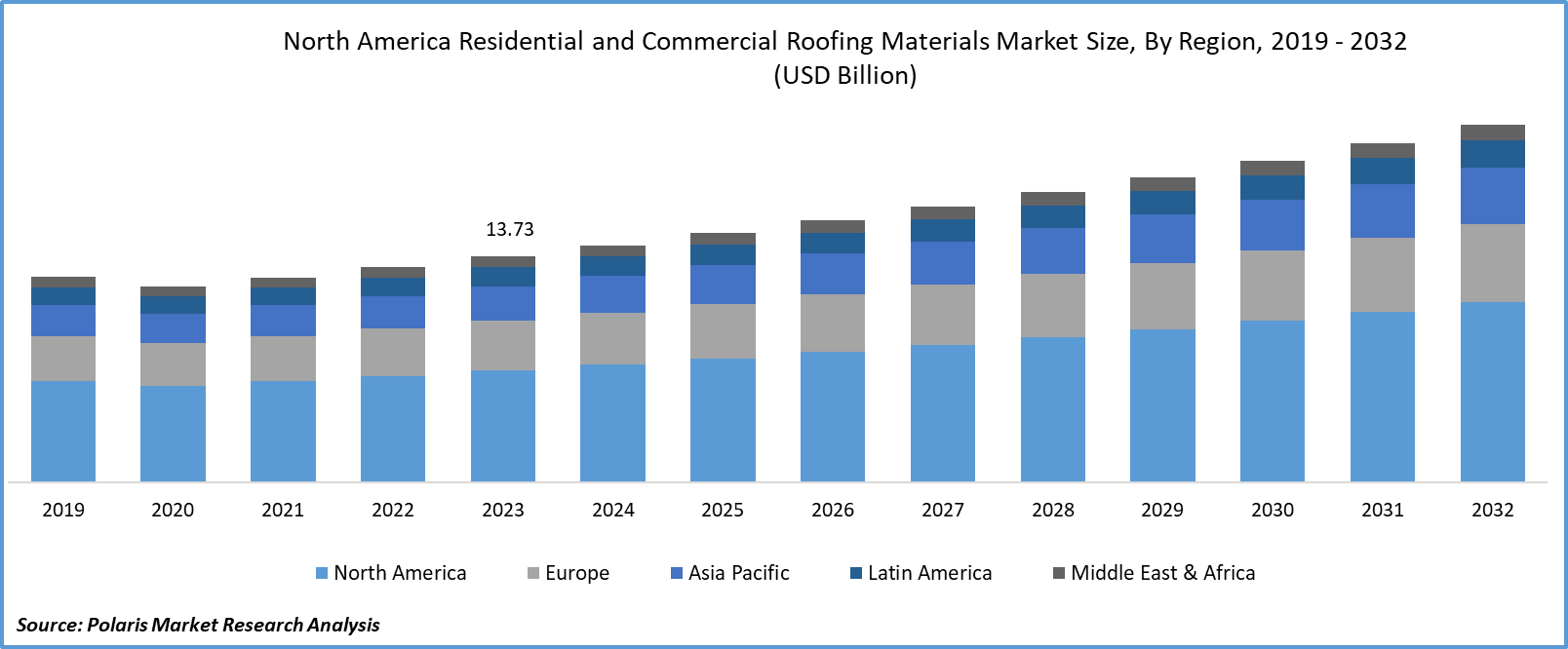

Global north america residential and commercial roofing materials market size was valued at USD 13.73 billion in 2023. The market is anticipated to grow from USD 14.42 billion in 2024 to USD 21.73 billion by 2032, exhibiting a CAGR of 5.3% during the forecast period.

Market Overview

The North America residential and commercial roofing materials market growth is primarily driven by the robust expansion of the construction industry, buoyed by increased investments in both public and private sectors for residential and commercial development across various states in the U.S. The demand for roofing materials has intensified due to the escalation in severe weather conditions, prompting a greater need for impact-resistant roofing solutions.

The surge in demand for single-family residences and commercial spaces is driving the requirement for roofing materials in the United States. The U.S. construction sector is placing a strong emphasis on energy-efficient and sustainable building practices, contributing further to the heightened demand for roofing materials. Additionally, factors such as a thriving economy, population growth, increased investments in the renovation and redevelopment of both residential and commercial structures, and robust post-COVID-19 pandemic growth in the construction industry are fueling North America residential and commercial roofing materials market demand throughout the forecast period.

To Understand More About this Research: Request a Free Sample Report

However, the market faces challenges from fluctuations in economic uncertainties, raw material prices, and the impact of installation costs on potential construction projects, due to an overall slowdown in roofing materials demand. Despite these challenges, the construction industry remains vibrant, with ongoing residential and commercial projects creating a sustained need for roofing materials across various construction applications.

This momentum is anticipated to persist at a moderate pace in the foreseeable future as property owners seek roofing materials that are not only durable and resilient but can also withstand adverse environmental conditions. Consequently, manufacturers and suppliers in the roofing industry are concentrating on the development of innovative materials that provide enhanced protection against weather-related damage, all while maintaining a focus on aesthetic appeal and sustainability.

Growth Factors

Surge in commercial and single-family homes

The surge in demand for roofing materials in the United States is fueled by the rising need for single-family residences and commercial properties. Additionally, there is a growing focus on energy-efficient and sustainable construction practices across the country, further driving the demand for roofing materials market growth & trends. Moreover, factors such as the expanding economy, population growth, increased investments in renovation and redevelopment projects for both residential and commercial buildings, and the resilient growth of the construction sector following the COVID-19 pandemic contribute to the market's demand throughout the forecast period.

Evolving building codes and favorable policy standards

The evolving building codes and regulations pertaining to energy efficiency and environmental standards are shaping the selection criteria for roofing materials across many states in the U.S. Both commercial and residential construction ventures must adhere to the mandates set forth by U.S. building authorities, which include the installation of roofing materials that comply with energy-saving guidelines and promote extended lifespan. These rigorous rules and standards contribute to the heightened demand for roofing materials in the U.S.

Restraining Factors

Stringent regulations coupled with rising installation costs

Regulations exert a substantial and varied influence on the U.S. roofing materials market size, shaping material preferences, installation methodologies, and broader industry dynamics. Their effects can be twofold, fostering advancements in safety and efficacy while also posing potential challenges by raising costs and introducing complexities.

Report Segmentation

The market is primarily segmented based on product, application, construction type, and region.

|

By Product |

By Application |

By Construction Type |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

Metal roofs segment accounted for the largest market share in 2023

In 2023, the metal roofs segment accounted for the largest market share. Renowned for their adaptability, they can be molded into diverse configurations, such as shingles or slates, effortlessly complementing various architectural designs. The projected increase in worldwide demand for metal roofs is linked to their cost-efficiency in the long run, lightweight composition, and remarkable fire resistance. These attributes position metal roofs as a preferred option, driving their expanding market prominence in the coming years.

The North American residential and commercial roofing materials market segmentation covers plastic roofs, which will grow rapidly. This is due to several advantages it offers, including ease of installation and minimal maintenance requirements. However, it is essential to note that plastic roofs typically have lower aesthetic appeal compared to other roofing materials. Additionally, one significant limitation of plastic roofs is their vulnerability to degradation caused by UV radiation. This susceptibility restricts their application in certain environments and may necessitate additional protective measures or maintenance efforts to mitigate UV-related damage over time.

By Application Insights

Commercial construction is expected to grow at the fastest CAGR During the forecast period.

Commercial construction is expected to grow at the fastest CAGR in the near future. This growth is propelled by rapid industrial expansion and increased investments from both government and private sectors. Multinational companies expanding their businesses, along with the construction of new manufacturing plants and processing units, contribute to the rising demand for commercial buildings. Consequently, this surge in commercial construction activity in North American residential and commercial roofing materials market analysis is projected to drive the demand for roofing materials.

Moreover, the residential segment dominated the North American residential and commercial roofing materials market. This dominance is due to the expanding population and the increasing inclination towards single-family residential properties among consumers. Asphalt shingles remain a popular choice for residential roofing due to their straightforward installation process and reduced maintenance requirements when compared to metal or concrete alternatives. These shingles offer homeowners a variety of colors and textures, allowing them to emulate the look of wood, cedar, or slate, thus elevating the aesthetic appeal of their roofs.

By Construction Type Insights

The re-roofing segment held the largest share of the market in 2023

In 2023, the re-roofing segment dominated the largest market share. The demand within this segment primarily stems from aging infrastructure, necessitating replacement and repair efforts. Buildings across the United States have reached the end of their initial roofing lifespan, a trend observed in many states throughout the country.

Contemporary roofing materials boast enhanced reflective properties and insulation capabilities due to greater energy savings compared to buildings lacking sufficient roofing materials. This heightened energy efficiency is anticipated to drive increased demand for roofing materials in the years ahead. Moreover, the rising frequency of extreme weather events across the United States has spurred a heightened demand for roofing materials, particularly within the re-roofing sector, observed in numerous states nationwide.

Country Insights

In 2023, the United States accounted for the largest Market share

The United States accounted for the largest Marlet share in 2023. This growth is fueled by rising per capita income, rapid urbanization, and population growth. Additionally, the construction sector in the region is benefiting from increased investments from local authorities and international investors. Numerous companies have opted to establish manufacturing facilities in Texas, contributing significantly to the growth of various construction segments.

In emerging regions of the United States, government efforts are underway to bolster infrastructure development, encompassing projects such as hospitals, educational institutions, commercial buildings, and residential communities. These endeavors, coupled with population growth, are expected to drive demand for roofing materials in the area.

Moreover, this region stands as a significant consumer of roofing materials nationwide. With increased investments in affordable housing, the establishment of smart cities, infrastructure enhancements, and tourism sector development, there is a projected uptick in the requirement for roofing materials in the foreseeable future.

California's market is propelled by its robust economic expansion, heightened construction endeavors, and growing emphasis on environmentally sustainable roofing materials. Additionally, the state ranks among the top consumers of residential and commercial roofing materials globally. Factors such as augmented investments in affordable housing, the development of smart cities, and enhancements in the tourism sector are poised to elevate the demand for residential and commercial roofing materials across the United States in the projected period.

Key Market Players & Competitive Insights

The North American residential and commercial roofing materials market reports innovation levels are elevated, with technological advancements focusing on creating products with enhanced cleaning capabilities, extended lifespan, and minimal maintenance requirements. These advancements are anticipated to significantly contribute to the market's growth throughout the forecast period.

Some of the major players operating in the North America market include:

- Atlas Roofing Corporation

- Boral Roofing. (Ltd.).

- Carlisle Companies Inc.

- CertainTeed Corporation

- Crown Building Products LLC

- CSR Ltd.

- Eagle Roofing Products

- Etex

- Fletcher Building Limited

- GAF Materials Corporation

- Johns Manville

- Metal Sales Manufacturing Corporation

- Owens Corning

- TAMKO Building Products, Inc.

- Wienerberger AG

Recent Developments in the Industry

- In November 2023, Heidelberg Materials introduced its 1st carbon net-zero cement under its innovative evoZero label, making it available to European customers. Through the utilization of carbon capture technology, evoZero achieves its zero footprint.

Report Coverage

The North America residential and commercial roofing materials market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, construction type, and their futuristic growth opportunities.

North America Residential and Commercial Roofing Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.42 billion |

|

Revenue forecast in 2032 |

USD 21.73 billion |

|

CAGR |

5.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in North America Residential and Commercial Roofing Materials Market are Atlas Roofing, Boral Roofing, Carlisle Companies, CertainTeed, Crown Building Products

North America residential and commercial roofing materials market exhibiting the CAGR of 5.3% during the forecast period.

The North America Residential and Commercial Roofing Materials Market report covering key segments are product, application, construction type, and region.

key driving factors in North America Residential and Commercial Roofing Materials Market are Surge in commercial and single-family homes

The North America residential and commercial roofing materials market size is expected to reach USD 21.73 billion by 2032