Off-road Vehicle Braking System Market Size, Share, Trends, Industry Analysis Report

By Brake Type (Disc Brakes, Drum Brakes, Hydraulic Brakes), By Vehicle Type, By Component Material, By Brake System Operations, Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6229

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

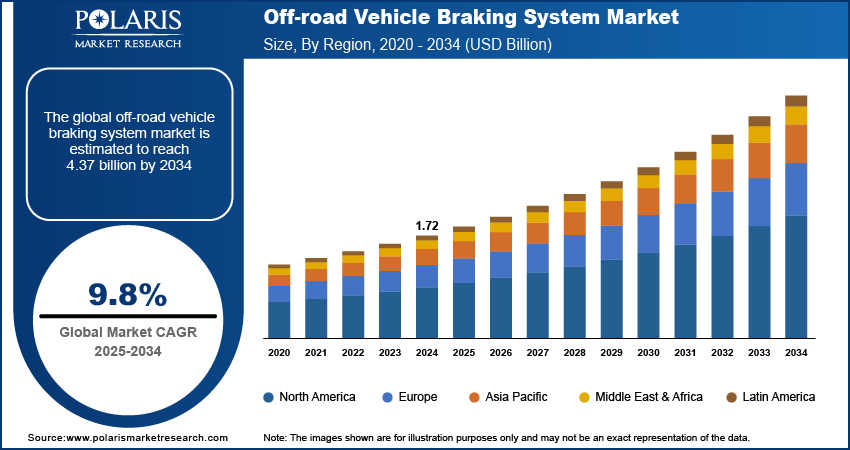

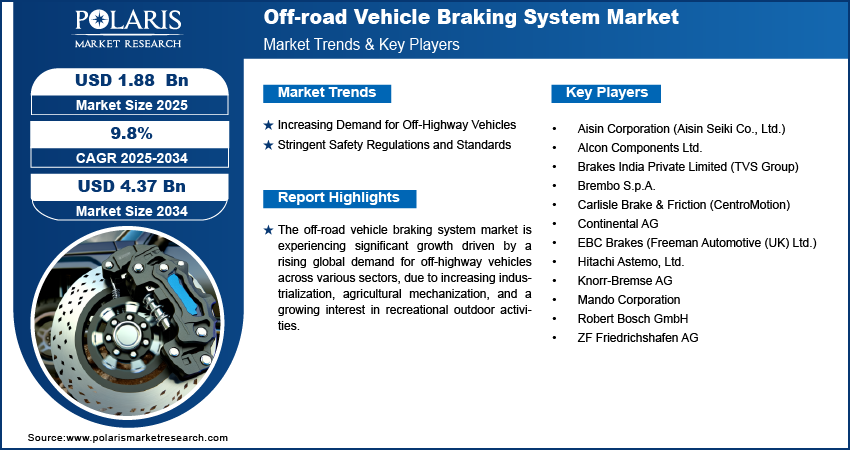

The global off-road vehicle braking system market size was valued at USD 1.72 billion in 2024 and is anticipated to register a CAGR of 9.8% from 2025 to 2034. The market growth is primarily driven by the increasing demand for off-highway vehicles in various sectors, including recreational, agricultural, and construction uses. Stricter safety regulations and standards worldwide also play a significant role in pushing the demand for more advanced and reliable braking systems.

Key Insights

- By brake type, the hydraulic brakes segment held the largest share in 2024 due to their widespread application across various off-highway vehicles and their proven reliability and consistent performance in demanding off-road conditions.

- By vehicle type, the SUV segment held the largest share in 2024 because of its extensive popularity and versatility, serving both urban and off-road driving needs, especially in key regions such as North America.

- By component material, the steel components segment held the largest share in 2024 due to their inherent strength, durability, and cost-effectiveness, making them ideal for the harsh conditions faced by off-road vehicles.

- By brake system operations, the manual brake systems segment held the largest share in 2024 due to their widespread use and mechanical simplicity, particularly in cost-sensitive and rural markets.

- By application, the agricultural off-roading segment held the largest share in 2024 because of the extensive global use of heavy machinery such as tractors and harvesters that operate in demanding and varied terrains.

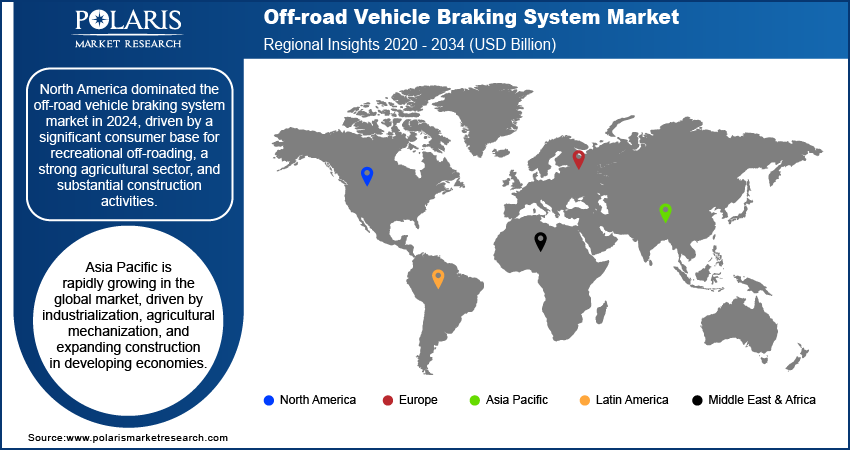

- By region, North America dominated the off-road vehicle braking system market in 2024, driven by a significant consumer base for recreational off-roading, a strong agricultural sector, and substantial construction activities.

Industry Dynamics

- The increasing use of vehicles in construction, agriculture, mining, and recreational activities is a significant factor. These demanding environments require robust and efficient braking systems to ensure operator safety and operational effectiveness, directly boosting the demand for advanced solutions.

- Governments and regulatory bodies are continuously implementing more stringent safety requirements for off-road vehicles. This push for enhanced safety compels manufacturers to adopt and integrate sophisticated braking technologies, such as ABS and electronic stability control, into their designs.

- Continuous innovation in brake technology, including the development of advanced materials, electronic braking systems (EBS), and regenerative braking, improves performance, durability, and safety. These advancements offer better control and reduced stopping distances, making them increasingly appealing to vehicle manufacturers and end users.

Market Statistics

- 2024 Market Size: USD 1.72 billion

- 2034 Projected Market Size: USD 4.37 billion

- CAGR (2025–2034): 9.8%

- North America: Largest market in 2024

AI Impact on Off-Road Vehicle Braking System Market

- AI improves braking system responsiveness by analyzing terrain, load conditions, and driving behavior in real time, allowing for adaptive brake force distribution and enhanced safety on rugged off-road surfaces.

- Integration of AI enables predictive maintenance by monitoring brake wear, temperature, and usage patterns, reducing downtime and preventing critical failures during off-road operations.

- AI-powered control systems enhance stability by dynamically adjusting braking pressure based on slope, wheel traction, and vehicle orientation, improving handling and preventing skidding in extreme environments.

- AI facilitates driver-assist features such as automated hill descent control and intelligent braking support, making off-road navigation safer and more intuitive for both amateur and professional drivers.

The off-road vehicle braking system market involves the design, manufacturing, and supply of braking components and entire systems for vehicles that operate in rugged, unpaved environments. These systems are crucial for ensuring the safety, control, and performance of various off-highway vehicles, including those used in construction, agriculture, mining, and recreation, where demanding conditions necessitate reliable stopping power.

The increasing adoption of electric and hybrid off-road vehicles and the rising adventure tourism and recreational off-roading boost the market expansion. As environmental concerns grow and technology advances, more electric and hybrid models of off-road vehicles are being introduced, which require specialized braking systems often incorporating regenerative braking capabilities. This trend pushes innovation in brake design to accommodate new power sources and vehicle characteristics.

The growing interest in adventure tourism and off-roading activities is another notable driver. More people are seeking outdoor recreational experiences that involve ATVs and UTVs and other off-road vehicles. This surge in leisure use directly translates to higher sales of these vehicles, thereby increasing the demand for robust and dependable braking systems. For instance, the National Institutes of Health (NIH) recognizes the popularity of outdoor recreation and the need for safety, which indirectly supports the development of safer off-road vehicles, including their braking components. The increasing participation in off-road events and the expansion of trails and parks also contribute to this demand.

Drivers and Trends

Increasing Demand for Off-Highway Vehicles: The global increase in demand for off-highway vehicles, including those used in agriculture, construction, and recreational activities, is a major factor fueling the growth. As infrastructure development projects continue worldwide and mechanization in farming and mining sectors rises, the production and sales of these specialized vehicles are seeing significant growth. This widespread adoption necessitates robust and efficient braking systems that can withstand the demanding conditions of rugged terrains and heavy-duty operations.

The increasing mechanization in agriculture is driving the demand for all-terrain vehicles (ATVs), offering farmers effective ways to traverse difficult landscapes and transport materials. This strong growth in off-highway vehicle sales directly translates into a higher demand for advanced and durable braking systems.

Stringent Safety Regulations and Standards: The continuous implementation of more stringent safety regulations and standards by governments and regulatory bodies globally is a critical driver. These regulations aim to enhance vehicle safety, reduce accidents, and protect operators and pedestrians in challenging off-road environments. Compliance with these evolving mandates compels off-road vehicle manufacturers to integrate advanced braking technologies, thereby boosting growth.

Segmental Insights

Brake Type Analysis

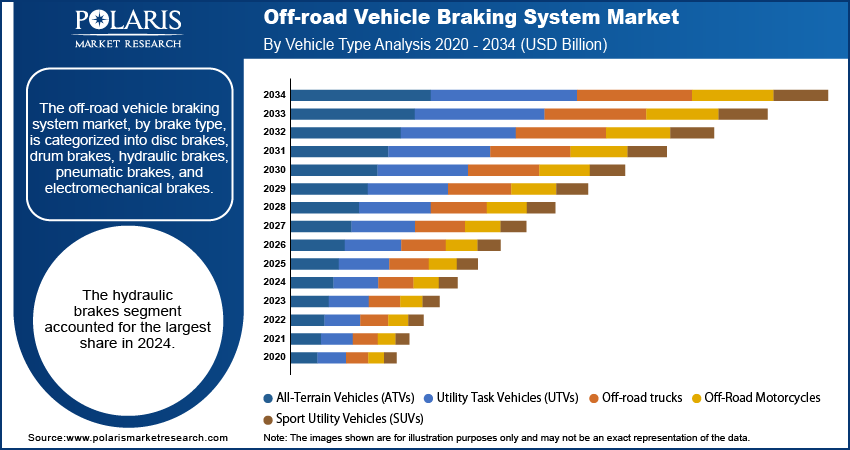

Based on brake type, the segmentation includes disc brakes, drum brakes, hydraulic brakes, pneumatic brakes, and electromechanical brakes. The hydraulic brakes segment held the largest share in 2024, owing to their widespread use across a broad range of off-highway vehicles, including Utility Task Vehicles (UTVs), All-Terrain Vehicles (ATVs), off-road trucks, and agricultural machinery such as tractors. Hydraulic systems are favored for their reliability, efficient force transmission, and consistent performance, which are critical attributes for vehicles operating in challenging and unpredictable off-road environments. Their ability to deliver strong and responsive braking power makes them a preferred choice for heavy-duty applications where safety and control are paramount. The long-standing presence and proven effectiveness of hydraulic braking technology have solidified its position as the leading segment in terms of penetration.

The electromechanical brakes segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is largely driven by the increasing adoption of electric and hybrid off-road vehicles. Electromechanical brakes offer key advantages such as precise control, integration with advanced vehicle control systems, and the potential for regenerative braking, which helps to recover energy and improve efficiency in electric powertrains. As the automotive industry, including the off-road segment, shifts toward electrification to meet environmental regulations and consumer demand for cleaner and more efficient vehicles, the demand for sophisticated electromechanical braking solutions is rapidly expanding. This segment's growth is also supported by continuous technological advancements aimed at improving performance, reducing weight, and enhancing the overall safety features of off-road vehicles.

Vehicle Type Analysis

Based on vehicle type, the segmentation includes all-terrain vehicles (ATVs), utility task vehicles (UTVs), off-road trucks, off-road motorcycles, and sport utility vehicles (SUVs). The sport utility vehicles (SUVs) segment held the largest share in 2024. This dominance stems from the widespread popularity of SUVs, particularly in North America and Europe, where consumers increasingly seek versatile vehicles that can handle both urban commutes and challenging off-road terrains. Modern SUVs, especially in mid-size and premium categories, are designed with capabilities that necessitate advanced braking systems to ensure safety and superior control across diverse driving conditions, including mud, snow, sand, and rocky slopes. The continuous integration of sophisticated braking technologies such as anti-lock braking systems (ABS), electronic stability control (ESC), and traction control systems (TCS) into these vehicles further solidifies their leading position in terms of share for braking components.

The utility task vehicles (UTVs) segment is anticipated to register the highest growth rate during the forecast period. UTVs are gaining significant traction due to their versatility and expanding applications in both commercial and recreational sectors. These vehicles are highly valued for their compact design, robust load-carrying capacities, and exceptional ability to navigate difficult terrains, making them ideal for tasks in agriculture, forestry, construction, and property management. Simultaneously, their increasing popularity in adventure tourism and recreational off-roading further contributes to their accelerated growth. The demand for reliable and high-performance braking systems in UTVs is paramount, given the varied and often demanding environments in which they operate, driving significant advancements and adoption of specialized braking technologies within this segment.

Component Material Analysis

Based on component material, the segmentation includes steel, aluminum, carbon composite, cast-iron, and metal-ceramic composites. The steel segment held the largest share in 2024, primarily due to its proven strength, durability, and cost-effectiveness, which make it a highly practical choice for the demanding conditions encountered by off-road vehicles. Steel brake components, such as discs and calipers, offer reliable performance and can withstand significant stress and heat generated during braking in rugged environments. Their widespread availability and relatively low manufacturing cost also contribute to their dominance, especially in mass-produced off-road vehicles such as ATVs, UTVs, and many off-road trucks. The material's consistent performance and ability to be easily integrated into various braking system designs have cemented its position as the leading material segment.

The metal-ceramic composites segment is anticipated to register the highest growth rate during the forecast period. This accelerating growth is driven by the increasing demand for high-performance and lightweight braking solutions, particularly in premium off-road vehicles and emerging electric and hybrid models. Metal-ceramic composites offer superior thermal resistance, reduced weight, and enhanced resistance to brake fade compared to traditional materials. These properties are crucial for vehicles that experience extreme braking conditions or benefit significantly from weight reduction for improved efficiency and handling. The ongoing development of advanced composite materials that can offer a balance of performance, durability, and cost-effectiveness is further propelling the adoption of metal-ceramic composites, positioning them as a key material for future off-road braking innovations.

Brake System Operations Analysis

Based on brake system operations, the segmentation includes manual brake systems, automatic brake systems, anti-lock braking systems (ABS), electronic stability control (ESC), and traction control systems (TCS). The manual brake systems segment held the largest share in 2024. This dominance is primarily attributed to their long-standing use and prevalence in a significant portion of off-road vehicles, particularly in cost-sensitive and rural areas. Manual brake systems offer mechanical simplicity, which translates to easier repair and lower maintenance costs, making them a practical choice for owners and operators in areas where access to advanced diagnostic tools or specialized technicians might be limited. They are widely favored in various agricultural machinery and certain recreational off-road vehicles where robust, straightforward, and reliable braking is prioritized over complex electronic functionalities. Their widespread existing installed base and continued adoption in specific segments contribute to their leading position.

The anti-lock braking systems (ABS) segment is anticipated to register the highest growth rate during the forecast period. The rapid expansion of this segment is driven by a global push for enhanced vehicle safety and increasingly stringent regulatory mandates. ABS technology significantly improves braking performance by preventing wheel lock-up, thereby maintaining steering control during sudden braking on slippery or uneven off-road surfaces. As manufacturers strive to comply with evolving safety standards and consumers demand safer off-road vehicles, the integration of ABS is becoming more common, even in vehicle types that traditionally relied on simpler systems. This trend is further accelerated by advancements in sensor technology and electronic controls, making ABS more efficient and adaptable to the diverse and challenging conditions encountered in off-road environments.

Regional Analysis

The North America off-road vehicle braking system market accounted for the largest share in 2024. North America is a prominent region, driven by a strong consumer base for recreational off-roading, a robust agricultural sector, and significant construction activities. The demand for ATVs, UTVs, and heavy-duty off-road trucks is consistently high, necessitating advanced and durable braking solutions. The region also benefits from a high rate of technological adoption and stringent safety regulations, which push manufacturers to integrate sophisticated braking systems such as ABS and electronic stability control into a wider range of off-road vehicles. This emphasis on safety and performance, coupled with a strong aftermarket for vehicle modifications and upgrades, sustains the region's position.

U.S. Off-road Vehicle Braking System Market Insights

In North America, the U.S. stands out as a key country contributing significantly to the demand for off-road vehicle braking systems. The U.S. has a vast landscape suitable for diverse off-roading activities, from desert riding to trail exploration, leading to a substantial demand for recreational vehicles. Moreover, the country's large agricultural industry relies heavily on machinery that requires reliable braking systems. The presence of major off-road vehicle manufacturers and a strong aftermarket industry further strengthens the U.S. position, with continuous investments in research and development to enhance braking technology.

Europe Off-road Vehicle Braking System Market Trends

Europe represents a significant and evolving region for the off-road vehicle braking system market. The demand here is driven by a diverse range of applications, including agricultural machinery, light commercial off-road vehicles, and a growing recreational off-roading segment. Strict environmental regulations and a focus on vehicle safety across the European Union encourage the adoption of more advanced and environmentally friendly braking solutions, such as electromechanical brakes and systems designed for electric and hybrid off-road vehicles. European manufacturers are also at the forefront of innovation in braking technology, contributing to the development and integration of high-performance and intelligent braking systems.

The Germany off-road vehicle braking system market, in particular, plays a crucial role in Europe. As a hub for automotive engineering and manufacturing, Germany contributes significantly to the research, development, and production of sophisticated braking components and systems. The country's strong industrial base, coupled with a high demand for quality and safety in vehicles, fosters an environment conducive to the adoption of advanced braking technologies in both commercial and agricultural off-road applications. German innovation often sets trends for the broader European region in terms of technical advancements and safety standards for off-road vehicle braking.

Asia Pacific Off-road Vehicle Braking System Market Assessment

Asia Pacific is rapidly emerging as a dynamic and high-growth region for the global market landscape. This growth is primarily fueled by rapid industrialization, increasing agricultural mechanization, and burgeoning construction activities in developing economies across the region. The expanding middle class and rising disposable incomes are also contributing to a growing interest in recreational off-roading, driving the demand for ATVs, UTVs, and SUVs equipped with modern braking systems. Furthermore, the region is a major manufacturing hub for various vehicle types, leading to high production volumes that necessitate a large supply of braking components.

China Off-road Vehicle Braking System Market Overview

China is a dominant country in the Asia Pacific market. Its vast manufacturing capabilities and substantial domestic demand across agricultural, construction, and recreational sectors make it a leading consumer and producer of off-road vehicles and their components. The country's strong economic growth and increasing investments in infrastructure development projects further propel the demand for heavy-duty off-road equipment, all requiring advanced braking systems. The rising adoption of electric off-road vehicles in China also influences the shift toward more sophisticated and energy-efficient braking technologies.

Key Players and Competitive Insights

The off-road vehicle braking system features a dynamic competitive landscape, with a mix of established global automotive suppliers and specialized brake system manufacturers. Key players focus on innovation in materials, electronic integration, and system performance to meet the rigorous demands of off-road environments and evolving safety standards. The competitive rivalry is strong, with companies continuously investing in research and development to offer lightweight, durable, and highly efficient braking solutions. Strategic collaborations with off-road vehicle original equipment manufacturers (OEMs) and expansions into emerging markets are common strategies to gain a competitive edge.

A few prominent companies in the industry include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Brembo S.p.A., Aisin Corporation (Aisin Seiki Co., Ltd.), Knorr-Bremse AG, Hitachi Astemo, Ltd. (Hitachi, Ltd. and Honda Motor Co., Ltd.), Mando Corporation, Alcon Components Ltd., Carlisle Brake & Friction (CentroMotion), EBC Brakes (Freeman Automotive (UK) Ltd.), and Brakes India Private Limited (TVS Group).

Key Players

- Aisin Corporation (Aisin Seiki Co., Ltd.)

- Alcon Components Ltd.

- Brakes India Private Limited (TVS Group)

- Brembo S.p.A.

- Carlisle Brake & Friction (CentroMotion)

- Continental AG

- EBC Brakes (Freeman Automotive (UK) Ltd.)

- Hitachi Astemo, Ltd. (Hitachi, Ltd. and Honda Motor Co., Ltd.)

- Knorr-Bremse AG

- Mando Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Off-road Vehicle Braking System Industry Developments

September 2023: Carlisle Brake & Friction introduced the EL121 Disc Brake Pads, part of their new Extended Life (EL) Series, specifically designed for mine haul truck applications.

Off-road Vehicle Braking System Market Segmentation

By Brake Type Outlook (Revenue – USD Billion, 2020–2034)

- Disc Brakes

- Drum Brakes

- Hydraulic Brakes

- Pneumatic Brakes

- Electromechanical Brakes

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- All-Terrain Vehicles (ATVs)

- Utility Task Vehicles (UTVs)

- Off-road trucks

- Off-Road Motorcycles

- Sport Utility Vehicles (SUVs)

By Component Material Outlook (Revenue – USD Billion, 2020–2034)

- Steel

- Aluminum

- Carbon Composite

- Cast-Iron

- Metal-ceramic Composites

By Brake System Operations Outlook (Revenue – USD Billion, 2020–2034)

- Manual Brake Systems

- Automatic Brake Systems

- Anti-lock Braking Systems (ABS)

- Electronic Stability Control (ESC)

- Traction Control Systems (TCS)

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Recreational Off-Roading

- Commercial Off-Roading

- Agricultural Off-Roading

- Military and Defense

- Mining and Extraction

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Off-road Vehicle Braking System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.72 billion |

|

Market Size in 2025 |

USD 1.88 billion |

|

Revenue Forecast by 2034 |

USD 4.37 billion |

|

CAGR |

9.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.72 billion in 2024 and is projected to grow to USD 4.37 billion by 2034.

The global market is projected to register a CAGR of 9.8% during the forecast period.

North America dominated the share in 2024.

A few key players include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Brembo S.p.A., Aisin Corporation (Aisin Seiki Co., Ltd.), Knorr-Bremse AG, Hitachi Astemo, Ltd. (Hitachi, Ltd. and Honda Motor Co., Ltd.), Mando Corporation, Alcon Components Ltd., Carlisle Brake & Friction (CentroMotion), EBC Brakes (Freeman Automotive (UK) Ltd.), and Brakes India Private Limited (TVS Group).

The hydraulic brakes segment accounted for the largest share in 2024.

The utility task vehicles (UTVs) segment is expected to witness the fastest growth during the forecast period.