Oil Immersed Power Transformer Market Share, Size, Trends, Industry Analysis Report

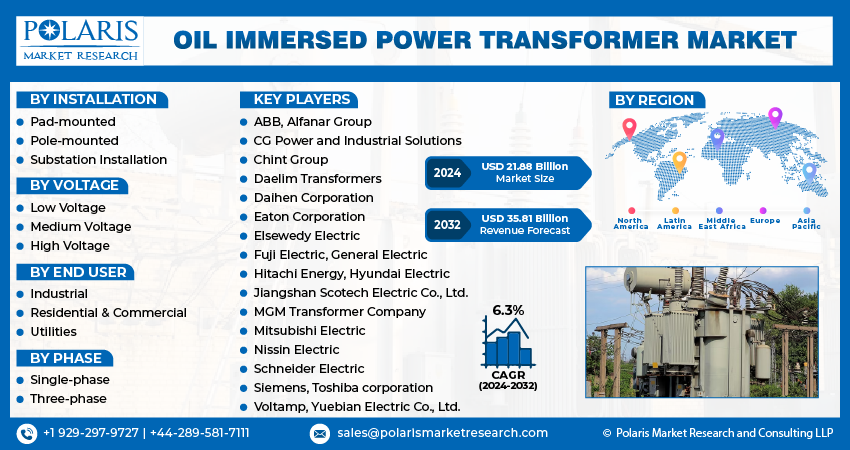

By Installation (Pad-Mounted, Pole-Mounted, Substation Installation); By Phase; By Voltage; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4433

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

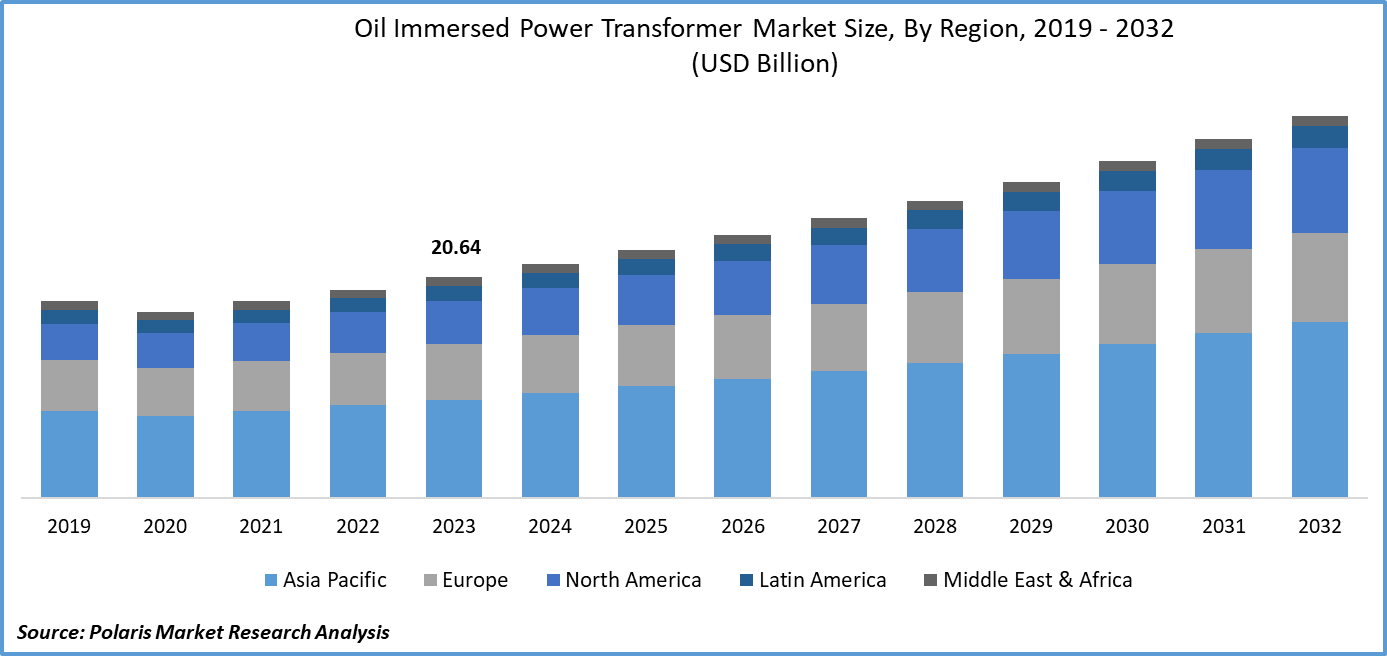

Oil Immersed Power Transformer Market size was valued at USD 20.64 billion in 2023. The market is anticipated to grow from USD 21.88 billion in 2024 to USD 35.81 billion by 2032, exhibiting the CAGR of 6.3% during the forecast period

The research report offers a quantitative and qualitative analysis of the Power Transformer Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Industry Trends

An oil immersed power transformer is a type of electrical transformer that uses oil as both an insulation and cooling medium. The transformer's primary and secondary coils are immersed in a tank filled with mineral oil or some other type of insulating oil, which provides electrical insulation between the coils and helps to dissipate heat generated by the transformation process. The oil also acts as a coolant, transferring heat away from the coils and reducing the risk of overheating. This design allows for more efficient and reliable operation compared to air-cooled transformers, especially at high voltage and current levels.

The global market is anticipated to experience significant growth during the forecast period, driven by increasing demand for efficient and reliable power transmission infrastructure. Urbanization and industrialization are leading to a rise in energy consumption, which in turn is driving the demand for oil immersed power transformers. In addition, the increasing focus on renewable energy sources such as wind and solar power, which require high-voltage direct current (HVDC) transmission systems, is also propelling the demand for oil immersed power transformers. Also, the replacement of old infrastructure in developed regions and the expansion of electrical grids in developing countries are creating opportunities for the growth of the market.

However, the market is hindered by the shift in industry trends toward dry-type transformers, which are considered more environmentally friendly and have lower maintenance costs compared to oil immersed transformers. Despite these challenges, the market is expected to continue its growth trend due to its advantages, such as low cost, high efficiency, and proven technology.

To Understand More About this Research: Request a Free Sample Report

Key Takeaways

- Asia Pacific dominated the market and contributed over 34% of the oil immersed power transformer industry share in 2023

- By installation category, the pad-mounted segment is expected to grow with a significant CAGR over the oil immersed power transformer market forecast of 2032

- By phase category, the three phase segment held the largest oil immersed power transformer industry share in 2023

- By end user category, the industrial segment dominated the global oil immersed power transformer market size

What are the market drivers driving the demand for Oil Immersed Power Transformer market?

The integration of renewable energy drives market growth.

The integration of renewable energy sources into the power grid has created a significant demand for oil immersed power transformers. Renewable energy sources such as wind and solar power generate electricity at a variable frequency and voltage, which requires transformation to match the grid's parameters. Oil immersed power transformers are well-suited for this task due to their ability to handle high voltage fluctuations and provide stable output. Also, the increasing adoption of smart grids and decentralized power generation systems necessitates the use of oil immersed power transformers to ensure efficient power transfer and distribution.

The growing industry trends toward renewable energy and decreasing reliance on fossil fuels have resulted in stricter regulations and policies promoting the use of environmentally friendly equipment, which further boosts the demand for oil immersed power transformers. Overall, the integration of renewable energy sources has driven the growth of the market.

Which factor is restraining the demand for Oil Immersed Power Transformer?

The frequent need for maintenance and its cost hampers market growth.

The market is hampered by the frequent need for maintenance and its associated costs. These transformers require regular maintenance to ensure optimal performance, which includes checking and replacing worn-out parts, cleaning, and refilling of oil. This process is usually time-consuming and expensive, as it requires trained personnel and specialized equipment. Also, unexpected failures or breakdowns can occur, leading to unplanned downtime and repair costs, further increasing the overall expenses. As a result, these factors collectively limit the widespread adoption of oil immersed power transformers, especially among small and medium-scale businesses, thereby restraining the market's growth.

Report Segmentation

The market is primarily segmented based on installation, phase, voltage, end user, and region.

|

By Installation |

By Phase |

By Voltage |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Installation Insights

Based on installation analysis, the market is segmented on the basis of pad-mounted, pole-mounted, and substation installation. The pad-mounted segment is anticipated to experience significant growth in the market during the forecast period of 2024 to 2032, owing to its several advantages over regular transformer installations. Pad-mounted transformers are compact and self-contained units that can be easily installed and maintained, making them ideal for industry applications where space is limited or accessibility is difficult. Also, they offer improved safety features, such as reduced risk of oil spills and explosions, and minimized environmental impact due to their underground installation. Further, pad-mounted transformers have lower operating costs compared to conventional transformers, as they require less maintenance and have longer lifetimes. These factors collectively contribute to the growing demand for pad-mounted transformers, driving the expansion of this segment in the market.

By Phase Insights

Based on phase analysis, the market has been segmented on the basis of single-phase, and three-phase. The three-phase segment dominated the global oil immersed power transformer industry share in 2023 due to its widespread use in various industries such as power generation, transmission and distribution, industrial processes, and railways. Three-phase transformers are capable of handling high power loads and providing efficient energy transfer, making them ideal for large-scale industry applications. Moreover, they offer better efficiency, reliability, and cost savings compared to single-phase transformers, which has led to their increased adoption in recent years. Thus, the three-phase segment is expected to continue its dominant position in the market owing to its superior performance and versatility.

By End User Insights

Based on end user analysis, the market has been segmented on the basis of industrial, residential & commercial, and utilities. The industrial segment accounted for the dominant share of the total oil immersed power transformer market size. Oil immersed power transformers are widely used in various industries, such as manufacturing, mining, and construction, which require high-power electrical systems to operate heavy machinery and equipment. These transformers provide efficient and reliable power supply, which is essential for smooth operations in these industries. In addition, many industrial processes require customized power solutions that can handle high voltage and current fluctuations, which oil immersed power transformers are well-equipped to provide. Thus, the reliability, efficiency, and versatility of oil immersed power transformers make them an attractive choice for industrial applications, resulting in their large oil immersed power transformer industry share.

Regional Insights

Asia Pacific

The Asia Pacific region emerged as the largest market for oil immersed power transformers in 2023 due to the region's rapid industrialization and urbanization, leading to an increased demand for electricity and, subsequently, higher demand for power transmission and distribution infrastructure. Also, many countries in the region, such as China, India, and Japan, have embarked on renewable energy initiatives, which require the use of oil immersed power transformers to integrate renewable energy sources into the grid. The region has seen significant investments in infrastructure development, including power generation, transmission, and distribution projects, which have created opportunities for the growth of the market.

North America

The North American region is expected to witness substantial growth in the oil immersed power transformer market forecast period of 2024 to 2032. The primary reason for this growth is the increasing demand for power and energy in the region. The need to upgrade and replace old infrastructure, including power transmission and distribution systems, is also driving the adoption of oil immersed power transformers. Also, the presence of major players in the region, such as General Electric, ABB, and Siemens, is contributing to the growth of the market.

Competitive Landscape

Financially stable oil immersed power transformer industry key players primarily dominate the market for with extensive experience in producing power transformers and related components. These companies have established themselves in the market and offer an extensive range of products, leveraging cutting-edge technologies and maintaining vast international sales and marketing networks. The market leaders have a proven track record of delivering high-quality products and services to their clients and have gained a reputation for excellence in the industry. Due to their financial stability and longstanding experience, these companies have been able to invest heavily in research and development, enabling them to maintain their competitive edge in the market.

Some of the major players operating in the global market include:

- ABB

- Alfanar Group

- CG Power and Industrial Solutions

- Chint Group

- Daelim Transformers

- Daihen Corporation

- Eaton Corporation

- Elsewedy Electric

- Fuji Electric

- General Electric

- Hitachi Energy

- Hyundai Electric

- Jiangshan Scotech Electric Co., Ltd.

- MGM Transformer Company

- Mitsubishi Electric

- Nissin Electric

- Schneider Electric

- Siemens

- Toshiba corporation

- Voltamp

- Yuebian Electric Co., Ltd.

Recent Developments

- In February 2023, Hitachi Energy launched the next-generation TXpert Hub as a part of its ecosystem for transformers' digitalization. The TXpert Hub enables monitoring by aggregating, storing, and analyzing the information received from the transformer's digital sensors.

- In September 2022, Elsewedy Electric, an Egyptian multinational company, announced the launch of its new transformers plant located within the Elsewedy Electric Industrial Complex in Kigamboni, Tanzania.

- In October 2020, JSHP Transformer launched five new products, including a 110 kV single-phase dry-type power transformer, a 330 kV auto-coupling three-phase voltage-regulating power transformer, a 330 kV three-phase air-cooled tapping power transformer, and two oil-immersed transformers for offshore wind power generation.

Report Coverage

The Oil Immersed Power Transformer market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, installation, phase, voltage, end user, and their futuristic growth opportunities.

Oil Immersed Power Transformer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.88 billion |

|

Revenue Forecast in 2032 |

USD 35.81 billion |

|

CAGR |

6.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Installation, By Phase, By Voltage, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

The Oil Immersed Power Transformer Market report covering key segments are installation, phase, voltage, end user, and region.

Oil Immersed Power Transformer Market Size Worth USD 35.81 Billion By 2032

Oil Immersed Power Transformer Market exhibiting the CAGR of 6.3% during the forecast period

North American is leading the global market

key driving factors in Oil Immersed Power Transformer Market are 1. The integration of renewable energy drives oil immersed power transformer market growth