Oil Well Cementing Market Size, Share, Trends, Industry Analysis Report

By Type (Primary, Remedial, Others); By Well Type; By Deployment; By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM1598

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

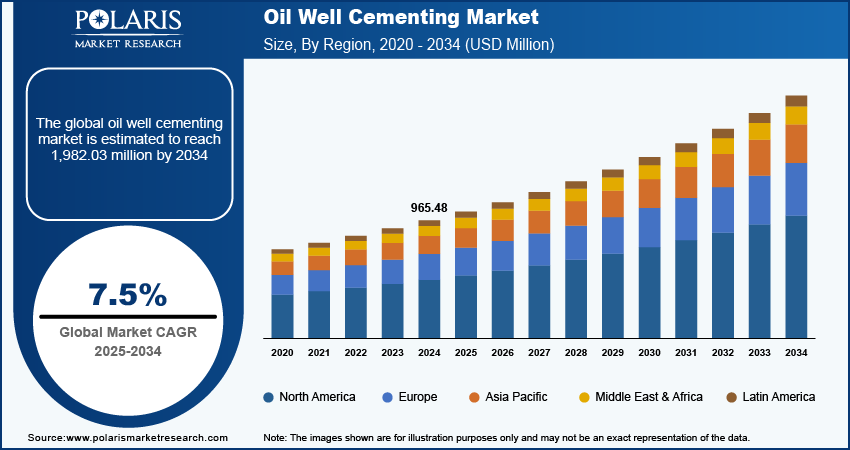

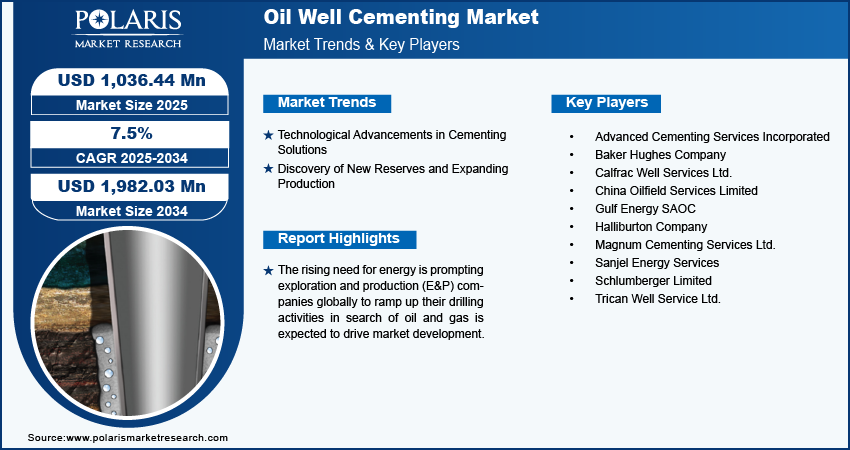

The global oil well cementing market size was valued at USD 965.48 million in 2024. The market is projected to exhibit a CAGR of 7.5% from 2025 to 2034. Oil well cementing refers to the process of injecting cement into oil wellbores to prevent fluid exchange between different zones by filling voids. Technological advancements in cementing solutions support oil well cementing business growth.

Market Insights

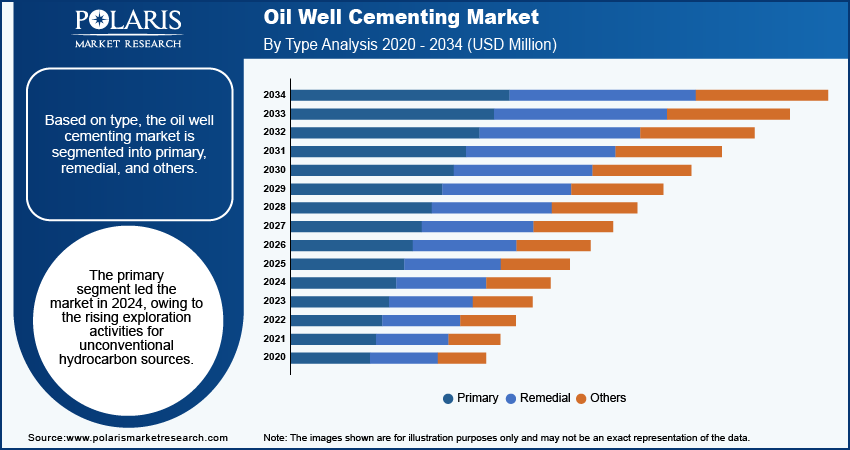

- Based on type, the primary segment led the market in 2024. A surge in exploration activities for unconventional hydrocarbon sources, including tight and shale gas, drives the demand for primary well cementing services as they are essential in the initial phase of well construction for structural integrity and zonal isolation.

- In terms of deployment, the onshore segment accounted for a larger share of oil well cementing revenue in 2024. Onshore drilling operations are more cost-effective and accessible than offshore operations, making them attractive for a large number of projects, which results in a greater demand for service offerings for these operations.

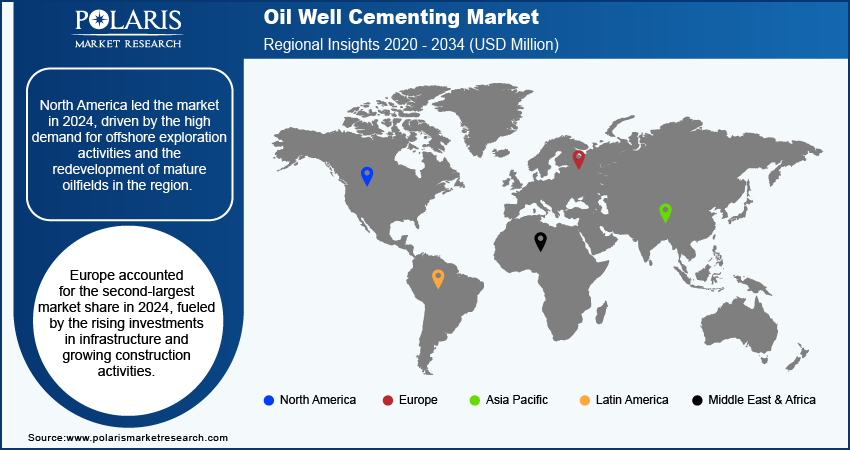

- North America led the global oil well cementing industry in 2024, driven by the high demand for offshore exploration activities across the region.

- Europe held the second-largest revenue share in 2024, owing to rising investments in infrastructure, along with the revival of the real estate sector.

Industry Dynamics

- The introduction of new additives and cement types designed for different and adverse well conditions, including foam cements, lightweight cements, and ultralow-density cements, propels the popularity of oil well cementing services.

- The increased effectiveness and accuracy of well cementing due to smart cementing solutions, such as real-time monitoring systems, bolster oil well cementing business revenue.

- Ongoing efforts for the exploration of untapped oil and gas reserves are expected to create an additional need for oil well cementing products and services in the future.

- The burgeoning preference for more complex projects, such as enhanced oil recovery (EOR), mainly due to the aging of oil fields, will likely result in a significant need for advanced oil well cementing techniques in the coming years.

- Stringent regulations on cement production and use due to its negative impact on ecosystems hamper oil well cementing operations.

Market Statistics

Market Size in 2024: USD 965.48 million

Projected Market Size in 2034: USD 1,982.03 million

CAGR (2025–2034): 7.5%

Largest Market in 2024: North America

AI Impact on Oil Well Cementing Market

- With its ability to optimize material formulation through innovative approaches, artificial intelligence (AI) is perceived as a valuable tool in cement and concrete research and development.

- It can enhance real-time monitoring tasks and streamline quality control processes in the manufacturing of cement additives for oil and gas drilling operations.

- AI and smart technologies in drilling can help predict leakages, detect the rate of penetration (ROP), provide intelligent drilling risk warnings, evaluate smart cement quality, optimize the fracturing process, and facilitate intelligent decision-making, among others, further bolstering the need for oil well cementing operations.

To Understand More About this Research: Request a Free Sample Report

Oil well cementing refers to the process of injecting cement into the wellbore of oil wells to fill voids. It is used to prevent fluid communication between different zones of the well. Also, it provides support to the casings and protects them from corrosive fluids. Oil well cementing plays a vital role in maintaining well integrity and protecting the environment.

The rising oil prices have prompted several players in the oil & gas industry to renew investments in projects that were previously put on hold. These renewed investments are driving the oil well cementing market demand, as well cementing services are essential for the completion of oil & gas wells.

Increasing offshore drilling operations in the Gulf of Mexico and the discovery of new reserves in the North Sea are driving the demand for deep-sea drilling operations. In addition, the rising need for energy is prompting exploration and production (E&P) companies globally to ramp up their drilling activities in search of oil and gas, which is expected to fuel the oil well cementing market development in the coming years. Regulatory trends are also closely linked to the rising demand for oil well cementing services, as governments worldwide implement more stringent rules and regulations to protect the environment and minimize damage during well operations.

Market Dynamics

Technological Advancements in Cementing Solutions

Advancements in cementing technologies have led to the development of enhanced additives and cements, including foam cements, lightweight cements, and ultra-low density cements. These cements are designed for different well conditions and offer enhanced performance in challenging drilling environments. In addition, smart cementing solutions, such as real-time monitoring systems for cementing operations, have resulted in increased effectiveness and accuracy of well cementing. Thus, technological advancements in cementing solutions are driving the oil well cementing market revenue.

Discovery of New Reserves and Expanding Production

The discovery of new oil and gas reserves, especially in deepwater fields, has led to increased demand for oil well cementing services. New reserves in the Gulf of Mexico, West Africa, and the North Sea need specialized cementing techniques to handle extreme conditions. Further, with aging oil fields, well operators are shifting to more complex projects such as enhanced oil recovery (EOR), which need advanced cementing techniques to ensure the integrity of the wellbore over the long run. Thus, the exploration of untapped oil and gas reserves and growing production are fueling the oil well cementing market development.

Segment Insights

Market Outlook Based on Type

The oil well cementing market, based on type, is segmented into primary, remedial, and others. The primary segment led the market with a revenue share of 80.1% in 2024. The rising crude oil prices have primarily driven exploration activities for unconventional hydrocarbon sources, including tight and shale gas. This surge is a major driver of the primary well cementing services as they play a vital role in the initial phase of well construction for providing structural integrity and ensuring zonal isolation. Additionally, advancements in drilling operations are playing a crucial role in boosting the success of primary well cementing operations.

Market Evaluation Based on Deployment

The oil well cementing market, based on deployment, is segmented into offshore and onshore. The onshore segment led the market with a revenue share of 86.1% in 2024. Onshore drilling operations typically require less sophisticated logistics as compared to offshore drilling operations. Also, they are more cost-effective and accessible as compared to offshore drilling operations, making them attractive for a large number of projects. In addition, the rising focus on research initiatives that aim at developing abandoned oil wells contributes to the robust growth of the segment.

Regional Analysis

By region, the oil well cementing market research report offers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America led the market with a 44.2% revenue share in 2024. The high demand for offshore exploration activities in North America has led to an increased need for oil well cementing in the region. Further, the redevelopment of mature oilfields contributes to the regional market demand.

The Europe oil well cementing market market accounted for the second-largest market share in 2024, owing to rising investments in infrastructure and growing construction activities. The revival of the real estate sector has also played a key role in propelling the market growth in the region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations.

To expand and survive in a more competitive and rising market environment, market participants must offer efficient and cost-effective oil well cementing solutions. In recent years, the market has witnessed several technological advancements. A few of the key players in the oil well cementing market are Calfrac Well Services Ltd., China Oilfield Services Limited, Advanced Cementing Services Incorporated, Halliburton Company, Magnum Cementing Services Ltd., Baker Hughes Company, Gulf Energy SAOC, Trican Well Service Ltd., Sanjel Energy Services, and Schlumberger Limited.

List of Key Players

- Advanced Cementing Services Incorporated

- Baker Hughes Company

- Calfrac Well Services Ltd.

- China Oilfield Services Limited

- Gulf Energy SAOC

- Halliburton Company

- Magnum Cementing Services Ltd.

- Sanjel Energy Services

- Schlumberger Limited

- Trican Well Service Ltd.

Oil Well Cementing Industry Developments

July 2023: RPC, Inc. announced the signing of an agreement to acquire Spinnaker Oilwell Services, LLC, a leading provider of oilfield cementing operations within the Permian Basin and the Mid-Continent region. According to RPC, the acquisition will significantly expand its cementing business in the Permian Basin.

November 2022: Halliburton Company introduced the EnviraCem and NeoCem E cement barrier systems. The company stated the introduction of these barriers is part of its plans to expand its portfolio of high-performance Portland cement systems.

Oil Well Cementing Market Segmentation

By Type Outlook

- Primary

- Remedial

- Others

By Well Type Outlook

- Gas

- Shale Gas

- Oil

By Deployment Outlook

- Offshore

- Onshore

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oil Well Cementing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 965.48 million |

|

Market Size Value in 2025 |

USD 1,036.44 million |

|

Revenue Forecast by 2034 |

USD 1,982.03 million |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 965.48 million in 2024 and is projected to grow to USD 1,982.03 million by 2034

The market is projected to register a CAGR of 7.5% from 2025 to 2034.

North America accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Calfrac Well Services Ltd., China Oilfield Services Limited, Advanced Cementing Services Incorporated, Halliburton Company, Magnum Cementing Services Ltd., Baker Hughes Company, Gulf Energy SAOC, Trican Well Service Ltd., Sanjel Energy Services, and Schlumberger Limited

The primary segment accounted for the largest market share in 2024.

The onshore segment led the market in 2024.