Real Estate Crowdfunding Market Share, Size, Trends, Industry Analysis Report

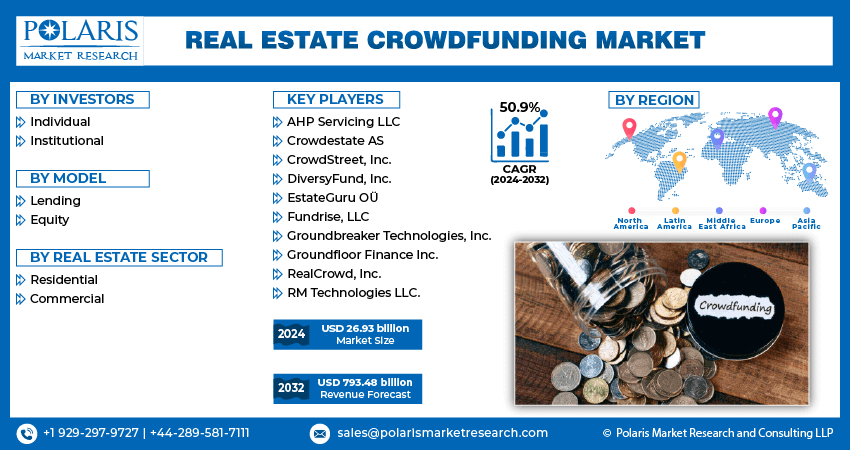

By Investor (Individual, Institutional); By Model (Lending, Equity); By Real Estate Sector; By Region; Segment Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 113

- Format: PDF

- Report ID: PM2292

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

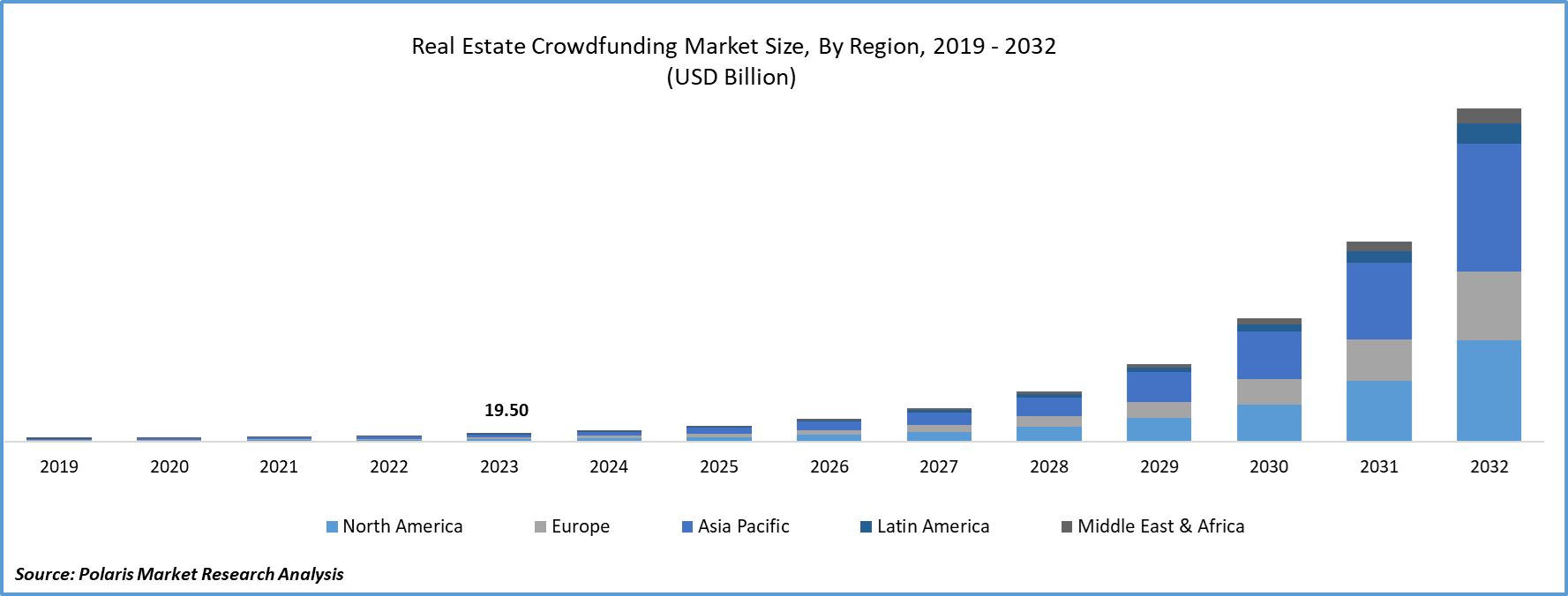

The global real estate crowdfunding market was valued at USD 10.50 billion in 2024 and is projected to register a CAGR of 12.8% from 2025 to 2034. Growing investor interest in accessible and diversified real estate investment options is driving market growth. Also, the increasing industrialization and globalization of the economy lead to more commercial activities, creating opportunities for real estate crowdfunding.

Key Insights

- The institutional investors segment held the largest revenue shares in 2024. These investors continue to increase their investments in crowdfunding platforms, particularly insurance companies and pension funds.

- The equity segment held a significant share of the market in 2024. In equity-based crowdfunding model, investors receive equity shares in the property being invested in. This model offers investors the potential for higher returns, as they are entitled to a percentage of the profits from the property.

- The residential segment is anticipated to register the highest CAGR during the forecast period. This sector offers a lower entry barrier for investors and is considered less risky than other sectors, which propels the segment growth.

- Asia Pacific dominated the real estate crowdfunding market in 2024. This is due to increasing commercial construction activities in emerging nations, supported by rapid industrialization and urbanization.

- The North American market is anticipated to exhibit the highest CAGR over the forecast period, owing to the increasing popularity and awareness of crowdfunding platforms, especially in the U.S.

Industry Dynamics

- The real estate crowdfunding industry is driven by low investment barriers that make real estate investing more accessible to a wider range of investors.

- The rapid penetration of the e-commerce industry and the rising demand for online real estate crowdfunding activities will boost the market during the forecast period.

- An increase in real estate crowdfunding sponsors is expected to boost the industry expansion during the forecast period.

- High initial costs hinder the growth of the real estate crowdfunding market.

Market Statistics

2024 Market Size: USD 10.50 billion

2034 Projected Market Size: USD 35.21 billion

CAGR (2025–2034): 12.80%

Asia Pacific: Largest market in 2024

AI Impact on Real Estate Crowdfunding Market

- Artificial intelligence algorithms analyze historical property data, emerging market trends, and macroeconomic indicators to forecast investment performance. It contributes to accurate risk profiling and better-quality listings for investors.

- AI systems customize suggestions by analyzing user preferences, behavior, and financial goals.

- The technology enables a rapid vetting process for developers and projects, thereby minimizing manual overhead.

- AI tools improve data visualization and reporting. It is fostering trust among investors.

To Understand More About this Research: Request a Free Sample Report

Real estate crowdfunding is an innovative method of investing in the commercial and residential sectors that is gaining popularity among investors worldwide. This investment option is becoming more attractive as investors seek to diversify and de-risk their portfolios. Several factors are driving the growth of this industry.

Additionally, implementing favorable government regulations across different countries is anticipated to boost the industry's growth. For instance, changes to Securities and Exchange Commission (SEC) regulations have allowed accredited and non-accredited investors to invest in real estate crowdfunding deals using online platforms, providing more flexibility to new investors. The growing trend of adopting cryptocurrency by most real estate crowdfunding platforms is another driver of the industry's growth. This trend is expected to attract more investors and make real estate more accessible.

The real estate crowdfunding market has been significantly impacted by the COVID-19 pandemic, with a slowdown in property transactions due to social distancing measures, travel restrictions, and economic uncertainty. Crowdfunding platforms have had to adjust their strategies by offering to finance distressed properties or investing in niche sectors that have seen increased demand during the pandemic. Despite the challenges, the market has continued to grow as investors are attracted to higher returns and the ability to diversify their portfolios. The market is expected to evolve as investors seek new opportunities and platforms continue to innovate to attract and retain investors, presenting opportunities for growth and innovation in the industry.

Industry Dynamics

Growth Drivers

Real estate crowdfunding is a promising investment avenue that has gained traction recently. The market is driven by various factors, including low investment barriers that make real estate investing more accessible to a wider range of investors. Crowdfunding also allows for portfolio diversification, enabling investors to invest in multiple properties across different regions and asset classes to mitigate investment risks.

Technology integration has also made real estate crowdfunding more efficient and user-friendly. Investors can easily search for and invest in properties online and receive regular updates on the performance of their investments. Additionally, regulatory oversight has been implemented to ensure crowdfunding platforms operate transparently and fairly, building investor confidence in the market.

The economic environment has also contributed to the growth of the real estate crowdfunding market. With the low-interest-rate environment and increased demand for alternative investments, real estate crowdfunding presents an attractive investment opportunity for investors looking to diversify their portfolios. As more investors become aware of the benefits of this investment model, the real estate crowdfunding market is expected to continue to grow in the coming years.

Report Segmentation

The market is primarily segmented based on investors, model, real estate sector, and region.

|

By Investors |

By Model |

By Real Estate Sector |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Institutional investors segment holds the highest revenues share in the market

Institutional investors segment holds the highest revenue shares in the market as they continue to increase their investments in crowdfunding platforms, particularly insurance companies and pension funds.

For instance, institutional investors generally invest over USD 10 million; this significantly helps the online platforms raise a large sum of money at once. There is a recent trend in the global industry of investments made by institutional investors such as insurance companies & pension funds, among others. The individual investor segment is projected to show the highest growth rate in the forecasting years.

At the same time, the individual segment is experiencing the highest CAGR rate and driving industry demand, fueled by increasing awareness among the general population about the availability of crowdfunding platforms and favorable crowdfunding regulations for investment. These factors are expected to continue to drive growth in the individual segment in the near future.

Equity segment holds the significant share of the market

Equity segment holds the significant share of the market and will continue its significant growth during the forecast period. Equity-based crowdfunding is a model in the market where investors receive equity shares in the property being invested in. This model offers investors the potential for higher returns, as they are entitled to a percentage of the profits from the property.

Equity-based crowdfunding is popular in the real estate market as it allows for access to real estate investments that may have been previously unavailable to individual investors. This model also allows for diversification in investment portfolios, reducing overall investment risk. However, equity-based crowdfunding carries a higher risk as the investment returns depend on the property's success.

Residential segment holds the highest CAGR during the forecast period

Residential segment anticipated to hold highest CAGR, and likely to continue its dominance in forecast period. Residential real estate refers to properties used primarily for residential purposes, such as single-family homes, townhouses, duplexes, and multi-family apartment buildings. This sector is the most popular in the Real Estate Crowdfunding market as it offers a lower entry barrier for investors and is considered less risky than other sectors.

Residential properties are typically used as primary residences by the owner or as rental properties for tenants. The demand for residential real estate is influenced by population growth, changing demographics, economic conditions, and government policies. Real estate crowdfunding platforms offer investors the opportunity to invest in residential properties with smaller amounts of capital and diversify their investment portfolios across multiple properties.

Asia Pacific region dominated the global market in 2024

The Asia Pacific region dominated the Real Estate Crowdfunding market in 2024 with the largest market share due to increasing commercial construction activities in emerging nations, such as South Korea, India, Japan, and China, supported by rising industrialization and rapid urbanization. The adoption of innovative technologies, such as digital payments, blockchain, and machine learning, is further fueling the growth of the market in the region.

The North American market is anticipated to exhibit the highest CAGR over the forecasted years, owing to the increasing popularity and awareness of crowdfunding platforms, especially in the US. The supportive regulatory landscape and the potential for high returns have also led to the rising focus of non-institutional investors investing in crowdfunding platforms, driving market growth in the region. Additionally, the presence of key institutional investors is expected to drive market growth in North America further.

Competitive Insight

Some of the major players operating in the global market include AHP Servicing LLC, Crowdestate AS, CrowdStreet, Inc., DiversyFund, Inc., EstateGuru OÜ, Fundrise, LLC, Groundbreaker Technologies, Inc., Groundfloor Finance Inc., RealCrowd, Inc., and RM Technologies LLC.

Recent Developments

- In January 2023, Neighborhood Ventures launched NV REIT, allowing non-accredited investors nationwide to invest in commercial real estate with as little as $1,000, targeting multifamily properties and aiming for 10-15% annual returns.

- In January 2022, Brikkapp, a real estate crowdfunding platform, has launched its new marketplace that consolidates over 200 property marketplaces worldwide in a single location. This platform allows users to access a vast range of real estate investment opportunities from around the world in one place.

- In June 2022, Arrived Homes, a real estate investment platform based in the US, is stepping up its acquisition efforts in response to the growing demand from retail investors for fractional real estate. The company has recently purchased 59 single-family rental homes in 17 markets worth $23 million. This move aims to offer its investors a broader selection of investment opportunities in the real estate market.

Real Estate Crowdfunding Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 11.8 billion |

|

Revenue forecast in 2034 |

USD 35.21 billion |

|

CAGR |

12.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 – 2034 |

|

Segments Covered |

By Investors, By Model, By Real Estate Sector, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

AHP Servicing LLC, Crowdestate AS, CrowdStreet, Inc., DiversyFund, Inc., EstateGuru OÜ, Fundrise, LLC, Groundbreaker Technologies, Inc., Groundfloor Finance Inc., RealCrowd, Inc., and RM Technologies LLC. |

FAQ's

The global real estate crowdfunding market size is expected to reach USD 35.21 billion by 2034.

Key players in the Real Estate Crowdfunding Market are AHP Servicing LLC, Crowdestate AS, CrowdStreet, Inc., DiversyFund, Inc., EstateGuru OÜ, Fundrise, LLC.

Asia Pacific contribute notably towards the global Real Estate Crowdfunding Market.

The global real estate crowdfunding market expected to grow at a CAGR of 12.80% during the forecast period.

The Real Estate Crowdfunding Market report covering key segments are investors, model, real estate sector, and region.