Operating Room Integration Market Share, Size, Trends, Industry Analysis Report

By Component (Software, Services); By Device Type (Audio Video Management System, Display System, Documentation Management System), By Application (General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Neurosurgery, Others), By End-Use, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 115

- Format: PDF

- Report ID: PM2163

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

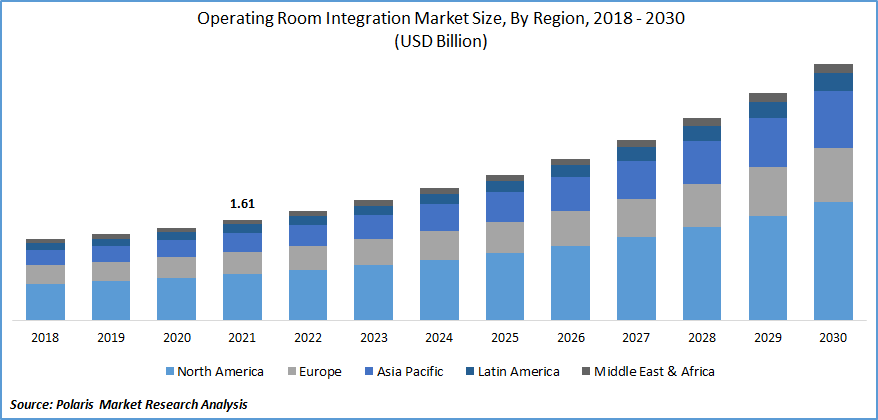

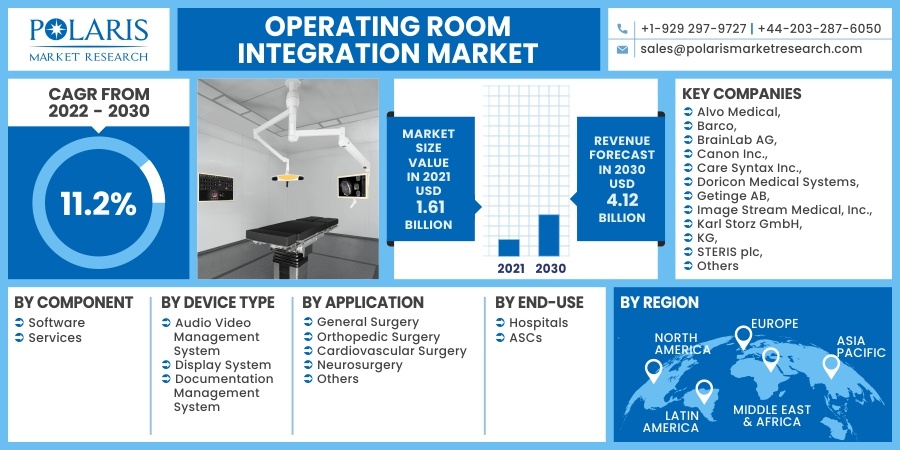

The global operating room integration market was valued at USD 1.61 billion in 2021 and is expected to grow at a CAGR of 11.2% during the forecast period. The growth in the market is being driven by the rise in the number of surgical procedures around the world. As per to the Centers for Disease Control and Prevention (CDC), every six in 10 people in the U.S. have at least one chronic disease such as heart disease and stroke, cancer, or diabetes, which increases the admission of patients in the hospitals.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Chronic diseases like these are the primary causes of death and disability in the U.S. and significantly contribute to healthcare expenses. This constant rise in chronic disease prevalence drives the growth of more and more surgical procedures to treat diseases which in turn will boost the growth of operating room integration over the forecast period.

Furthermore, the rising adoption of AI and robots in the surgical rooms is also the factor that is driving the operating area integration industry growth during the forecast period. Like AI (artificial intelligence), Robotics has emerged as a "game-changer" technology in recent years. While AI works mainly in cyberspace and robotics works primarily in physical space, they both have demonstrated exceptional capability and impact on the globe and enormous potential in the revolution of a human being's life.

However, as robotic technology has advanced, robots' function in the operating room has dramatically shifted, from individual usage of one or two surgical robots to integrated systems containing many robotic devices that support the surgery from different angles and levels. Meanwhile, robotic OR architectures are being designed and distributed for standardization to meet the growing market demand for device system management and entire OR integration.

Besides, the major players such as Zimmer Biomet are focusing on installing robotics technologies in their operation room systems. In March 2021, The ZBEdge connected intelligence package of digital and robotic technologies was launched by Zimmer Biomet.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The operating room integration market has observed extensive developments in the last few decades supported by various factors such as the growing market demand for efficient healthcare services, adequate electronic health records (EHR), and the increasing need to decrease healthcare costs has led to an increase in the use of OR integration systems around the world which is boosting the operating room integration industry.

The objective of an electronic health record (EHR) is to keep accurate information about a patient's health across time. One of the key advantages of electronic health records is that health information may be quickly produced and processed in a digital format by authorized users. These data and reports can be shared with other healthcare providers from different organizations.

Electronic health records (EHR) are driven by government initiatives to increase healthcare IT adoption, digitize healthcare delivery procedures, and increase market demand for healthcare services. In Australia, for example, My Health Record is a national digital health record portal. Every Australian citizen, unless they sign out, has a "My Health Record." By the end of 2022, all healthcare practitioners in Australia will be expected to contribute to and use the healthcare information available on the platform, according to the Australian Digital Health Agency, which the Australian government founded. Thus, the rising adoption of EHR systems across the healthcare industry has led to increased operating room integration systems.

Report Segmentation

The market of operating room integration is primarily segmented based on component, device type, application, end-use, and region.

|

By Component |

By Device Type |

By Application |

By End-use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Based on the application segment, general surgery dominated the global operating room integration market in 2021 and is expected to retain its dominance in the foreseen period due to the rise in the incidence of breast, colorectal, liver cancers, and other endocrine disorders. Besides, it is estimated that the number of new invasive breast cancer diagnosed in women will be around 281,550 in 2021 in the U.S. alone.

Geographic Overview

In terms of geography, North America had the highest market share in the operating room integration industry. The operating room integration market for the North American region is anticipated to grow significantly as a result of the rising prevalence of the chronic disease. According to the Fight Chronic Disease group, chronic diseases will impact an estimated 164 million Americans (almost half of the population) by 2025, according to Fight Chronic Disease group.

In addition, around 133 million Americans, which is 45% of the population, will be suffering from at least one chronic disease in the U.S. in 2020. Furthermore, the rising adoption of advanced surgical treatment methodologies in the region is also a driving factor in market growth.

The significant players of the operating room integration industry are the adoption of various strategies in the North American market, such as partnerships, collaborations, mergers and acquisitions, and product launches, is also a factor driving the market's growth. For instance, in October 2021, Teladoc Health's Solo platform for health systems was integrated with Proximie, focusing on modernizing operating rooms integration.

Moreover, Asia-Pacific is expected to witness a high CAGR in the global operating room integration industry in 2021. A rising pool of patients with chronic disorders requiring surgical interventions, rising demand for advanced medical devices in hospitals, an increase in MIS procedures, and rapidly expanding healthcare infrastructure are driving the market. The Indian government, for example, wants to raise healthcare spending to 3% of GDP by 2022, according to the IBEF. Investment in health infrastructure increased by 2.37 times, or 137 percent, in the Union Budget 2021; the total health sector allocation for FY22 was Rs. 223,846 crores, around USD 30.70 billion.

Competitive Insight

Some of the major players operating in the global operating room integration market include Alvo Medical, Barco, BrainLab AG, Canon Inc., Care Syntax Inc., Dorion Medical Systems, Getinge AB, Image Stream Medical, Inc., Karl Storz GmbH, KG, STERIS plc, Merivaara Corporation, Olympus Corporation, Skytron Plc, Steris Plc, Stryker Corporation, and TRILUX Medical.

Operating Room Integration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.61 billion |

|

Revenue forecast in 2030 |

USD 4.12 billion |

|

CAGR |

11.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Device Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Alvo Medical, Barco, BrainLab AG, Canon Inc., Care Syntax Inc., Doricon Medical Systems, Getinge AB, Image Stream Medical, Inc., Karl Storz GmbH, KG, STERIS plc, Merivaara Corporation, Olympus Corporation, Skytron Plc, Steris plc, Stryker Corporation, and TRILUX Medical |