Organic Liquid Soap Market Share, Size, Trends, Industry Analysis Report

By Application (Household, Commercial), By Distribution Channel (Supermarkets & Hypermarket, Convenience Stores, Online, Others), By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 114

- Format: PDF

- Report ID: PM2031

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

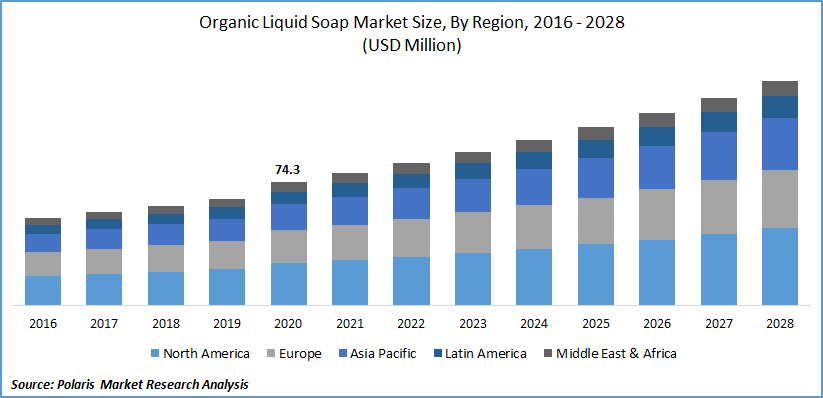

The global organic liquid soap market was valued at USD 74.3 million in 2020 and is expected to grow at a CAGR of 7.8% during the forecast period. The organic liquid soap market growth is determined by the constant need for organic liquid personal care products, tied with the intensifying inclination towards environmentally friendly goods. Moreover, leading market players are engaged in devising innovative, customized marketing strategies for product promotion such as advertisement, free samples, discounts, etc., also favoring the adoption of the organic liquid product.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The outbreak of the COVID 19 shows a positive influence on the industry as rising need and spending on personal care products for preventing the communal spread of the disease. For instance, Dettol swapped the corporation's eminent logo with the picture of covid soldiers on the set of its liquid hand wash. This emotional marketing tactic favors the organic liquid soaps uptake among the price-sensitive population strata in the South Asian countries.

Industry Dynamics

Growth Drivers

In the current scenario, the higher demand for natural and organic liquid products has been observed due to the factors such as the constant surge in consumer awareness regarding the destructive effects of certain compounds like aluminum and parabens compounds. The increased number of health-conscious consumers mostly prefers organic liquid brands over chemically formulated products. This has paved the demand for natural, safe, and organic liquid soap products in recent times. The purchases are usually based on their efficacy, durable protection, and clinical properties.

The demand for such organic liquid products has been further quite apparent in the industry, and this has significantly led to a majority of companies introducing new products with nature-inspired resources, like the finest botanical ingredients, united with multi-functional properties. For instance, in April 2020, UK-based Stephenson has launched a new liquid soap in the U.S. and Canadian industry intending to improve personal care and hygiene among people.

Know more about this report: request for sample pages

The proliferation of organic liquid soap has been expanding gradually, owing to the growing distribution network of organic liquid products through the online channel and increased awareness among people about hand hygiene, specifically in the wake of the COVID-19 pandemic.

According to estimates of UNCTAD, the drastic rise in e-commerce has been witnessed during the movement restrictions caused by COVID-19, which eventually increased online retail sales' share in overall retail sales from 16 to 19% in 2020. Thus, the rise in e-commerce infrastructure and growing awareness among people regarding health is expected to contribute to the higher organic liquid soap market growth during the foreseen period.

Report Segmentation

The market is primarily segmented based on application, distribution channel, and region.

|

By Application |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Application

Based on the application, the household segment is leading the industry with the largest revenue share and is projected to hold its dominance in the near future. Rising disposable income in an emerging economy offering better spending capacity to middle-class people leads the segment growth. As well as a large population is mainly living in semi-urban and urban areas that are more tends toward high product consumption.

Besides, the introduction of various government policies for household sectors like the Swachh Bharat Mission and the Total Sanitation Campaign also catalyzes organic oil cleanser industry growth. Thus, these initiatives and rising government programs may positively influence segment growth around the globe.

The commercial segment is witnessing a moderate, robust CAGR, which is growing significantly over the forecast period of 2021-2028. The demand for organic liquid soap is expected to nurture in the commercial sector mainly due to the growing health awareness among working professionals and the increasing prevalence of communicable infectious diseases. Moreover, there are many agendas introduced by the government and in the company’s norms for employee’s health safety which further fuels the significant growth in the commercial segment in the near future.

Insights by Distribution Channel

The supermarkets and hypermarkets segment clutch the dominating position in terms of revenue creation across the worldwide market among the distribution channel segment. Large groups of end-users generally prefer to purchase personal care products from supermarkets or hypermarkets since they offer a broad product line with a physical display. Also, in urban areas, supermarkets and hypermarkets are rising, which presents more ledges to the organic liquid soaps, which will further lead the segment growth worldwide.

The online sector segment is anticipated to accelerate at a lucrative rate in the forthcoming years. It is owing to the substantial reduction in the price of the products offered in e-trading, coupled with many retailers offering free delivery of products on a fixed amount of purchasing. In addition, it is a simplistic approach to shopping as well as various retailers also provide after-sales services like product exchange, and others are attributing to the segment growth in the forthcoming future.

Geographic Overview

Geographically, North America dominated the global industry in 2020, owing to the significant presence of a health-conscious consumer base and rising government programs for promoting the health and well-being of individuals in the region. Moreover, companies operating within these countries benefit from the increase in demand for personal care products made using sustainably from plant-sourced ingredients/raw materials. It also holds a sizable share in terms of privately-held industry participants, which is further expanding the organic liquid soap market growth at a rapid pace considering the global scenario.

Moreover, Asia-Pacific accounted for the fastest CAGR growth in the global organic liquid cleanser industry in 2020. The demand for an organic liquid cleansers in this region is attributed to an increase over the forecast period. The manufacturers operating within this region capitalize on the ample supply of raw materials and labor available at an economical rate. For instance, according to the India-Briefing in 2021, India has the most competitive and economical labor force in Asia, coupled with the minimum wage estimated at almost USD 2.8 (INR 176) each day, which turns out to be USD 62 (INR 4,576) per month.

Furthermore, India and China remain to be the most prominent and productive markets within the region. These countries have a long-term association with organic liquid hygiene and personal care products. Large-scale market players, particularly in India, are extensively expanding their organic liquid soaps product portfolios (including liquid formats), and so, the organic liquid cleanser industry is booming at a significant rate worldwide.

Competitive Insight

Some of the major global market players include Botanie Natural Soap, Inc., Country Rose Soap Company Ltd, Lunaroma Inc., Mountain Rose Herbs, Oregon Soap Company, Penns Hill Organic Soap Company, SFIC, Soap Solutions Tropical Products, and Vanguard SoapLLC.

Organic Liquid Soap Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 74.3 million |

|

Revenue forecast in 2028 |

USD 135.1 million |

|

CAGR |

7.8% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Application, By Distribution Channel By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Botanie Natural Soap, Inc., Country Rose Soap Company Ltd, Lunaroma Inc., Mountain Rose Herbs, Oregon Soap Company, Penns Hill Organic Soap Company, SFIC., Soap Solutions Tropical Products, and Vanguard SoapLLC. |