Payment Gateway Market Share, Size, Trends, Industry Analysis Report

By Type (Hosted, Non-Hosted); By End-Use (BFSI, Media & Entertainment, Retail & E-commerce, Travel & Hospitality, Others); By Enterprise; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 116

- Format: PDF

- Report ID: PM2360

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

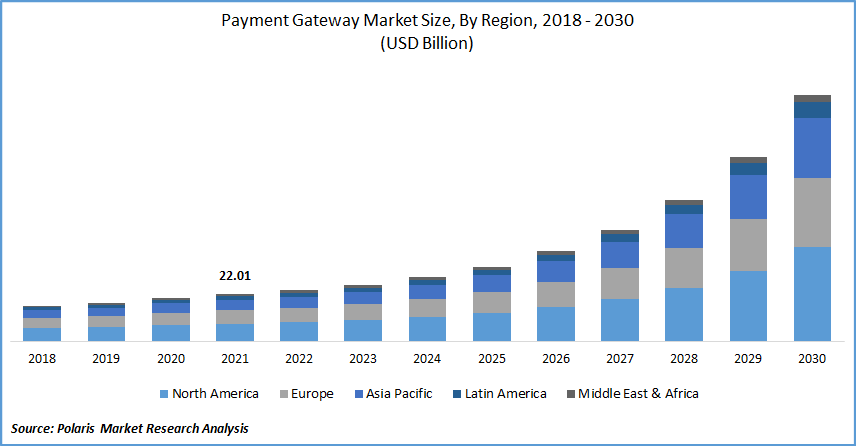

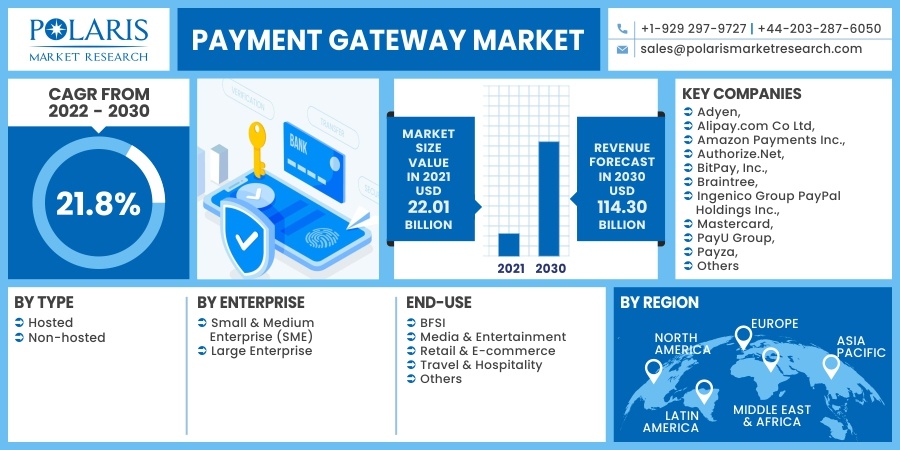

The global payment gateway market was valued at USD 22.01 billion in 2021 and is expected to grow at a CAGR of 21.8% during the forecast period. The payment gateway is an important part of the electronic processing system since it is the front-end technology that sends customer information to the merchant acquiring bank, where the transaction is subsequently processed. These gateway solutions are constantly developing to match new consumer preferences and technological capabilities.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Previously, terminals accepted credit cards with magnetic strips and required paper signatures from customers. The signature phase could be replaced by a Personal Identification Number (PIN) entered directly into the payment gateway hardware as chip technologies advance. Contactless purchases are already available, with many customers using mobile phones as payment devices rather than conventional credit cards.

Industry Dynamics

Growth Drivers

The rise of the internet and the advent of e-commerce accelerated the digitization of electronic processes by introducing a variety of electronic remittance choices such as cards (credit and debit), digital and mobile wallets, electronic currency, contactless systems, etc. With their growing popularity, mobile services are currently in a transition period, pointing to a promising future of uncertain possibilities and technological advancement.

A cashless economy, mobile banking, digital commerce, and the expanding influence of regulatory bodies are a few of the changes affecting the retail industry. Online gateway simplifies the electronic process and makes it more comfortable for consumers, who benefit from shorter lines, the elimination of cash-on-hand issues, and faster moving queues. The COVID-19 pandemic had a favorable effect on payment gateway market growth. This can be due to increased internet usage, which has boosted the use of these gateways.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of type, enterprise, end-use, and region.

|

By Type |

By Enterprise |

End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The hosted segment accounts for the largest market share in the payment gateway market. This market segment benefits the merchant since the service provider manages the entire transaction process and provides greater security and data protection for a fee. Hosted gateways are easy to set up; they frequently employ templates that require you to just input information and require no maintenance from merchants because the service provider (SP) manages the process.

Even for first-time online shoppers, a hosted disbursement solution simplifies the electronic procedure. Customers can pay using any method they like. They can, for example, use net banking, cards, wallets, UPI, Pay Later, or EMI. Furthermore, for subscription-based business models, organizations can allow recurring billing. It improves client satisfaction even further because they are not required to authorize every single transaction. These factors are contributing to the segment market growth.

Insight by Enterprise

Due to the enormous volume of transactions generated by large organizations, such gateways are increasingly used. Furthermore, with developing electronic methods, greater e-commerce use, improved broadband access, and the advent of new technologies, the cashless system is expanding at an exponential rate.

The substantial expansion of the sub-segment can be linked to people's growing propensity for online purchases, as well as large-scale firms' increasing adoption of payment processing and digital transaction strategies for collecting money from their clients.

Geographic Overview

Asia Pacific is expected to emerge as the fastest-growing market during the forecasted period. Asia is undergoing a financial change that is being driven by digitalization, shifting consumer and retail trends and more inclusive alternatives. Several initiatives undertaken by the government to improve gateway are fueling the payment gateway market.

For instance, the Indian government has announced initiatives such as Digidhan Abhiyan and PayGov India to improve digital payment infrastructure in the country. Furthermore, cheap internet data and high smartphone penetration has fueled the rapid scale-up of online payment system in the country.

Competitive Landscape

Prominent players operating in the global market are Adyen, Alipay.com Co Ltd, Amazon Payments Inc., Authorize.Net, BitPay, Inc., Braintree, Ingenico Group PayPal Holdings Inc., Mastercard, PayU Group, Payza, Stripe, Skrill Limited, Verifone Holdings Inc., Wepay, Inc., Visa.

Market players are focusing on mergers & acquisitions to expand their product folio in the payment gateway market. For instance, Bitpay partners with Simplex to Offer Zero Fees for U.S. Based Crypto Purchases for a Limited Time. In collaborating with Simplex, a Nuvei company and the leading fiat infrastructure for digital assets globally, BitPay Wallet app users can quickly and easily buy crypto fee-free using the BitPay Debit Card, Apple Pay®, or Google Pay™ for a limited time.

Recent Development

- February 2024: Euronet, a global leader in the digital payments realm, announced acquisition of Infinitium. The acquisition is set to empower Infinitium to offer innovative solutions and superior services in the markets it serves.

- August 2024: PayU announced partnership with Fynd to enhance payment solutions for Indian merchants. By combining PayU’s Payment Gateway on its platform, Fynd will enable its sizeable network of 2300+ merchants to seamlessly and safely receive payments through 150+ online alternatives involving affordability and EMI alternatives such as credit or debit card UPIs, wallets and net banking.

Payment Gateway Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 22.01 billion |

|

Revenue forecast in 2030 |

USD 114.30 billion |

|

CAGR |

21.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Enterprise, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Adyen, Alipay.com Co Ltd, Amazon Payments Inc., Authorize.Net, BitPay, Inc., Braintree, Ingenico Group PayPal Holdings Inc., Mastercard, PayU Group, Payza, Stripe, Skrill Limited, Verifone Holdings Inc., Wepay, Inc., Visa. |