Pectinase Market Share, Size, Trends, Industry Analysis Report

By Type (Protopectinases, Polygalacturonases, Pectin Iyases, and Pectinesterase); By End-User; By Region; Segment Forecast, 2023 – 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM3898

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

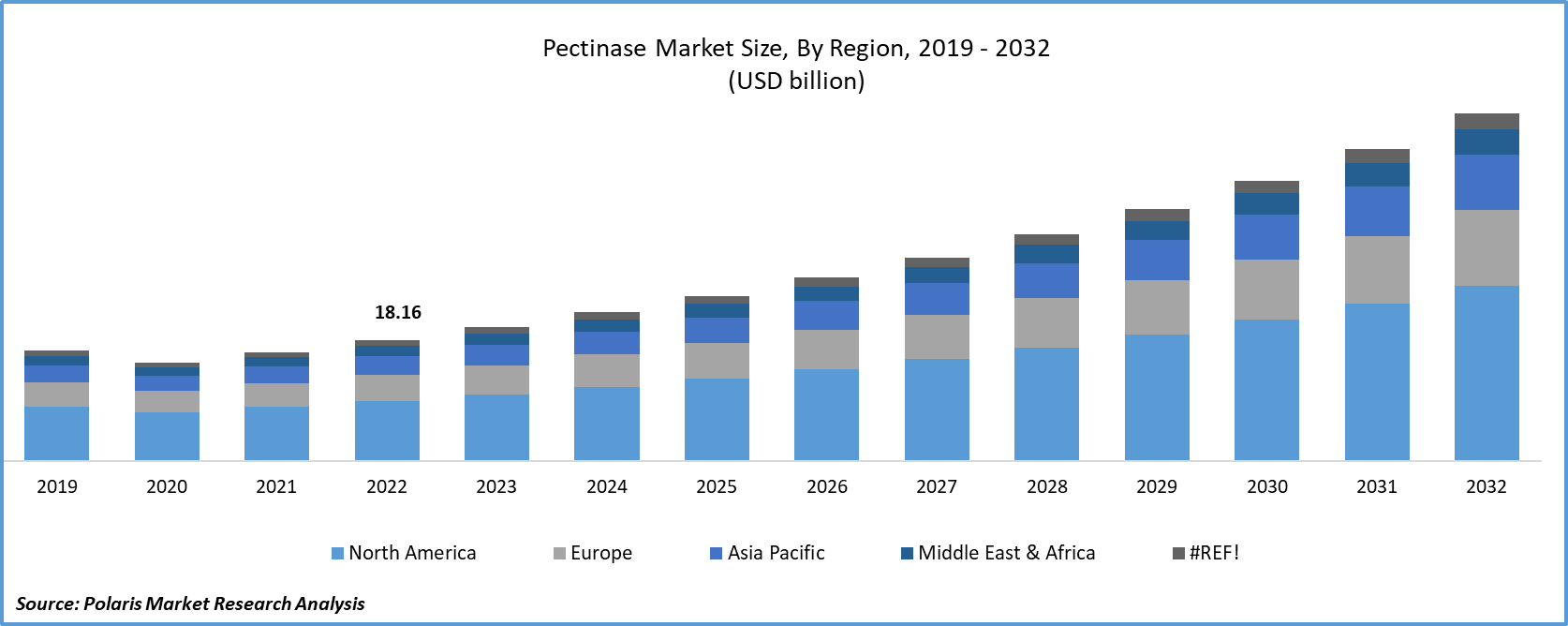

The global pectinase market was valued at USD 18.16 billion in 2022 and is expected to grow at a CAGR of 11.2% during the forecast period.

The significantly growing product use in the food & beverage industry for various types of applications such as juice clarification, wine production, and fruit processing, among others, and the continuously growing proliferation of product utilization in the textile industry, especially for designing cotton fabrics and sourcing, are among the leading factors propelling the global market growth. In addition, pectinase enzymes are now being widely employed in various applications within the pharmaceutical and biotechnology sectors, such as cell culture and drug production. Therefore, the need for new enzymes with more advanced characteristics and features is likely to spur market growth.

To Understand More About this Research: Request a Free Sample Report

- For instance, in February 2022, Kerry Group announced the acquisition of c-LEcta, which has expertise in precise fermentation, biotransformation for high-valued targeted enzymes, and optimized bioprocessing, for €137 million. The acquisition will expand the company’s innovation capabilities in enzyme engineering and bioprocess development.

Moreover, a wide range of companies operating in the market have increased their focus and investments on developing tailored enzyme solutions to meet specific customer needs, which basically involves customizing enzyme formulations to optimize processes in different industries such as food and beverage, textiles, and agriculture among others, which have also been propelling the market growth at a rapid pace over the years.

However, the prices of enzymes, including pectinase, often fluctuate due to several factors, such as availability of raw materials, production costs, and market demand, and these enzymes are also subject to regulatory scrutiny. They must meet labeling and safety requirements imposed by government agencies, which are acting as major restraints for market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the pectinase market. The rapid spread of the deadly coronavirus pandemic across the globe disrupted global supply chains and also halted the manufacturing and processing facilities across several industries, including the enzyme industry. The disruption in the production and distribution network could have largely affected the availability of pectinase enzymes, potentially leading to supply shortages or delays during the pandemic.

Industry Dynamics

Growth Drivers

Increasing demand for beverages and refreshments are likely to boost market growth

The rapidly growing demand for products like beverages and refreshments mainly in high-income and developed countries like United States, Canada, and France and constant increase in demand for nutraceuticals and higher proliferation for purchasing organic and natural products without any kind of synthetic or harmful substances, are among the primary factors influencing the demand and growth of the market.

As consumers seek healthier and natural options, the demand for pectinase is further fueled, as it supports clean-label and organic product trends. However, market growth may still face challenges such as cost fluctuations and regulatory issues. Nonetheless, the rising preference for refreshing and health-conscious beverages positions the Pectinase market for positive expansion in response to these consumer demands.

Globalization of food trade and favorable regulatory policies driving the global market growth

The exponential rise in the globalization of food trade in the last few years, which has fueled the demand for enzymes like pectinase that are crucial for preserving and processing food products in the international markets and growing number of regulatory agencies promoting the use of pectinase as a safe and natural food additive, are further anticipated to create huge demand and growth for the global market.

Report Segmentation

The market is primarily segmented based on type, end-user, and region.

|

By Type |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Proto-pectinase segment accounted for the largest market share in 2022

The proto-pectinase segment accounted for largest market share in terms of revenue. The growth of the segment market can be largely attributed to its widespread utilization in the food processing industry due to their ability to easily break down pectin in fruits and vegetables along with the increasing consumer preferences for products that are free from chemical additives and more natural.

Additionally, the ongoing research and development efforts in enzyme technology leading to the discovery of new enzyme variants including proto-pectinase, which offer improved properties and efficiency and could boost revenue opportunities and streams for companies developing innovative enzyme solutions.

By End-User Analysis

Food & beverage segment held the significant market share in 2022

The food & beverage segment held the substantial market share in 2022, which is majorly driven by continuous expansion of juice and beverage industry with a greater number of consumers looking for healthier beverage options, is major factor driving the global market growth. Beside this, with the increasing wine production and consumption worldwide, the demand and need for pectinase is growing rapidly, as it is being widely used for the maceration of grapes and clarification of grapes.

- For instance, according to international organization of vine & wine, Italy was the leading wine producer in the world in 2022 with almost 49.8 million hectolitres, and also had the highest wine export volume with around 21.9 million hectolitres, followed by Spain and France with 21.2 million and 14 million hectolitres respectively.

The textile segment is anticipated to register highest growth rate over the next coming years, on account of its growing adoption in the textile industry because of its capabilities to offer an eco-friendly alternative to traditional chemical processes in textiles and also helps in reducing the use of water and harsh chemical, which in turn, positively contributing to the global market growth at exponential rate.

Regional Insights

North America region dominated the global market in 2022

The North America region dominated the global market with considerable share in 2022, and is expected to maintain its dominance throughout the forecast period. The regional market growth can be largely attributed to surge in the number of health-conscious consumers leading to higher adoption for fruit-based or plant-based food products and growing R&D activities to find product applications in pharmaceutical industry for the extraction of active compounds from plant materials. Apart from this, the robust presence of some of the world’s leading producer or suppliers in the region with increased focus on developing new product applications with higher investments, are also likely to bode well for the growth of the market.

The Asia Pacific region is expected to emerge as fastest growing region with a healthy CAGR over the next coming years, owing to rising prevalence for the product use in various industries including food processing, pharmaceutical, and textile and growing adoption of pectinase as an environmentally-friendly alternative to various harmful or conventional enzymes.

In addition, the rapid increase in wine consumption particularly by Gen Z population and changing consumer dietary preferences towards healthier and plant-based products in countries like India, China, and Indonesia among others, are also anticipated to create lucrative growth opportunities for the regional market over the years.

- For instance, as per a report published in 2023, the Indian wine consumption is approx. 30 million litres every year and the consumption is growing steadily in the recent years, and most of the wine consumption in the country takes place in urban areas including Mumbai, Delhi, Bangalore, Pune, and Hyderabad with 32%, 25%, 20%, 5%, and 3% respectively.

Key Market Players & Competitive Insights

The pectinase market is highly competitive with the presence of several regional and global market players all over the world, who are extensively focusing on several business development strategies including collaboration, partnerships, acquisition, new product launches, and production capacity expansion, in order to expand their market reach and cater to surging product demand globally.

Some of the major players operating in the global market include:

- AB Enzymes

- Amano Enzyme

- BASF

- Challenge Group

- Creative Enzymes

- Genecor

- International Flavors & Fragrances

- Jinyuan Biochemical Co. Ltd.

- Koninklijke DSM N.V.

- Novozymes

- Royal DSM N.V.

- Shandong Longa

- Sukahan Bio-Technology

- Sunson

- YSSH

Recent Developments

- In May 2021, India’s Cosmo Specialty Chemicals, introduced new chemical named “Microenz”, which is sourced through enzymatic process that makes the chemical environment-friendly alkaline pectate-lyase. The development and advancement of newly launched chemical ensures less fabric and garment.

- In May 2022, WeissBioTech, announced the expansion of its product portfolio with the launch of NATUZYM MAX Extra. The product contains several pectinase activities like pectin methyl-esterase and poly-galacturonase in an optimized ratio.

Pectinase Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 20.15 billion |

|

Revenue forecast in 2032 |

USD 52.35 billion |

|

CAGR |

11.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |