Plasma Protease C1-inhibitor Market Size, Share, Trends, and Industry Analysis Report

: By Drug Class (C1-inhibitors, Kallikrein Inhibitor, and Selective Bradykinin B2 Receptor), Dosage Form, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 117

- Format: PDF

- Report ID: PM5058

- Base Year: 2023

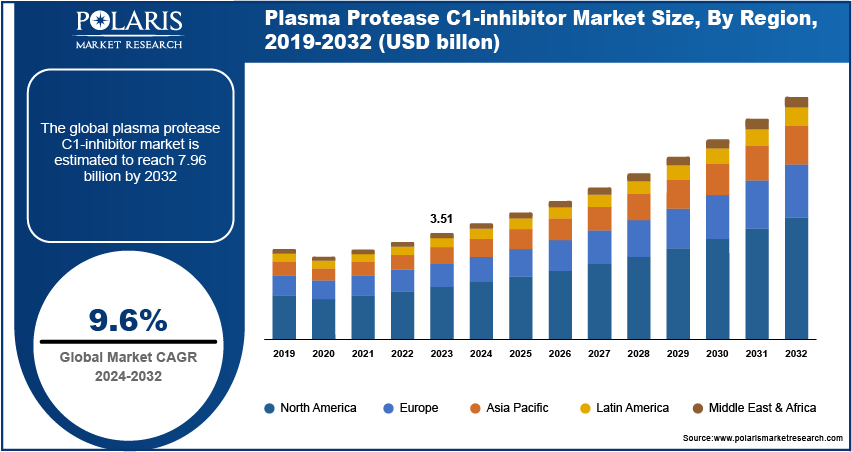

- Historical Data: 2019-2022

Plasma Protease C1-inhibitor Market Overview

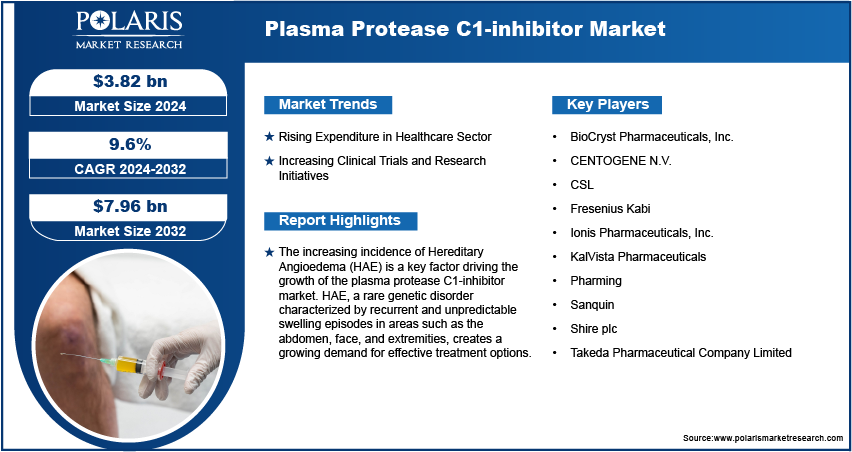

Global plasma protease C1-inhibitor market size was valued at USD 3.51 billion in 2023. The market is projected to grow from USD 3.82 billion in 2024 to USD 7.96 billion by 2032, exhibiting a CAGR of 9.6% during the forecast period.

Plasma protease C1-inhibitor is a protein that regulates the complement and contact coagulation systems. It inhibits proteases, preventing excessive inflammation and c, crucial for maintaining hemostatic balance. The increasing incidence of Hereditary Angioedema (HAE) is a key factor driving the growth of the plasma protease C1-inhibitor market. HAE, a rare genetic disorder characterized by recurrent and unpredictable swelling episodes in areas such as the abdomen, face, and extremities, creates a growing demand for effective treatment options. Plasma protease C1-inhibitors are crucial in managing these symptoms, thereby propelling market expansion as healthcare providers seek advanced therapeutic solutions for this challenging condition.

For instance, the research article published in the Journal of Cutaneous Immunology and Allergy (JCIA) in March 2024 stated that approximately 1 in 50,000 people are affected by Hereditary Angioedema (HAE). Variations in reported cases across different regions, such as China and Japan, suggest potential differences in awareness and diagnosis rates. As awareness about this condition increases globally among healthcare providers and patients, there has been a significant rise in the diagnosis of HAE cases. This heightened awareness leads to earlier detection and treatment initiation, thereby driving demand for therapeutic options like C1-INH.

To Understand More About this Research:Request a Free Sample Report

Advancements in diagnostic techniques and genetic testing have further facilitated the identification of individuals with HAE, contributing to the expanding patient pool. Additionally, the availability of effective treatments, such as C1-INH therapies, which help to manage and prevent acute swelling attacks, underscores the importance of timely diagnosis and treatment in improving patient outcomes. As healthcare systems continue to improve their capacity to diagnose rare diseases as HAE, the market for C1-INH is poised to grow, driven by the increasing number of diagnosed patients seeking effective therapeutic solutions.

Plasma Protease C1-inhibitor Market Drivers

Increasing Clinical Trials and Research Initiatives

The market for plasma protease C1-inhibitors is experiencing significant growth, driven by a robust CAGR. This growth can be attributed to the ongoing clinical trials and research efforts aimed at broadening treatment options and exploring new indications beyond hereditary angioedema (HAE). These trials are assessing the efficacy and safety of plasma protease C1-inhibitors in a variety of clinical scenarios, potentially expanding their use to conditions characterized by dysregulation of the complement system or similar inflammatory and swelling mechanisms. Positive results from these trials not only affirm the therapeutic potential of plasma protease C1-inhibitors in new applications but also facilitate regulatory approvals, which are essential for further market expansion.

Regulatory agencies often grant expedited reviews or special designations for orphan drugs like C1-INH, further incentivizing pharmaceutical companies to invest in research and development in the plasma protease C1-inhibitor market. For instance, in September 2022, CSL Behring K.K. received approval for Berinert S.C. Injection 2000, a subcutaneous C1-esterase inhibitor concentrate, for preventing acute attacks of Hereditary Angioedema (HAE) in Japan.

Rising Expenditure in Healthcare Sector

The increasing healthcare expenditure globally is a significant driver of market expansion for the plasma protease C1-inhibitor (C1-INH) market. As countries allocate more resources toward healthcare infrastructure and services, there is greater affordability and accessibility of specialized therapies such as C1-INH. This increased financial investment supports the development, production, and distribution of C1-INH products, making them more widely available to patients who require treatment for conditions such as hereditary angioedema (HAE).

Higher healthcare spending also often correlates with improved healthcare access and quality, leading to earlier diagnosis and treatment initiation for patients with rare diseases as HAE. This trend not only benefits patients by improving their quality of life but also boosts market demand for C1-INH therapies as healthcare providers and institutions prioritize effective treatments for such conditions. In addition, the rise in healthcare expenditure globally creates a favorable environment for the growth of the C1-INH market, fostering innovation, accessibility, and improved outcomes for patients in need of these specialized therapies driving the plasma protease C1-inhibitor market revenue.

Plasma Protease C1-inhibitor Market Segment Insights

Plasma Protease C1-inhibitor Market – Drug Class Insights

The global plasma protease C1-inhibitor market segmentation, based on drug class, includes C1-inhibitors, kallikrein inhibitors, and selective bradykinin B2 receptor antagonists. The C1-inhibitors segment emerged to hold the largest market revenue share in 2023, owing to advances in medical technology that have significantly increased the demand for treatments targeting the complement system, where C1 inhibitors play a pivotal role. These inhibitors are crucial in regulating the complement cascade, which is involved in immune response and inflammation. As chronic inflammatory diseases and cases of hereditary angioedema (HAE) have risen, there has been a growing need for more effective therapies, driving up the demand for C1 inhibitors. Their ability to mitigate the excessive activation of the complement system makes them essential in managing these conditions.

The development of recombinant human C1 inhibitors has further expanded market growth by providing safer and more reliable treatment options compared to earlier alternatives. Additionally, pharmaceutical companies have intensified their investment in research and development focused on refining the efficacy and accessibility of C1-inhibitor-based therapies. This led to innovations in product formulations, delivery methods, and expanded indications, thereby expanding the market reach and ensuring continued growth in the C1-inhibitor segment of the pharmaceutical industry.

Plasma Protease C1-inhibitor Market – Distribution Channel Insights

The global plasma protease C1-inhibitor market segmentation, based on distribution channels, includes hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies dominated the market in 2023, primarily due to their integral role in acute care settings and specialist treatment of conditions such as hereditary angioedema (HAE). Hospital pharmacies are strategically positioned to handle and dispense specialized medications like C1-inhibitors promptly, which is crucial during emergencies when rapid intervention is needed to manage HAE attacks effectively.

Hospital pharmacies also provide a controlled environment that ensures direct oversight by healthcare professionals. This oversight is essential for the safe and appropriate administration of C1-inhibitors, monitoring patient responses, and managing any potential adverse effects. The presence of trained medical staff within hospital settings enhances patient care and compliance with treatment protocols, thereby reinforcing the preference for hospital pharmacies as the primary distribution channel for C1-inhibitors.

Plasma Protease C1-inhibitor Regional Insights

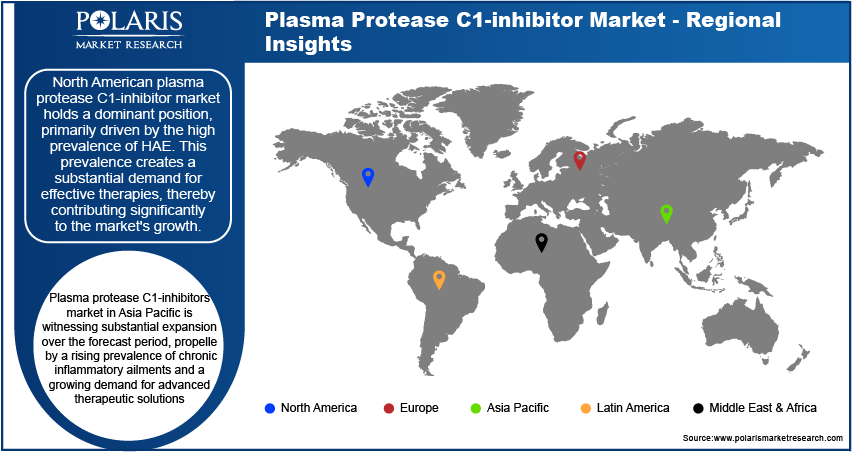

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North American plasma protease C1-inhibitor market holds a dominant position, primarily driven by the high prevalence of HAE. This prevalence creates a substantial demand for effective therapies, thereby contributing significantly to the market's growth. Moreover, North America benefits from advanced healthcare infrastructure and a robust regulatory environment that facilitates rapid approvals and widespread adoption of new treatments. This supportive regulatory framework not only expedites the introduction of C1-inhibitors but also encourages continuous innovation in the field of HAE treatment. For instance, In June 2022, ORLADEYO (berotralstat) emerged as the first oral, once-daily prophylactic therapy designed to prevent swelling attacks in patients with Hereditary Angioedema (HAE) aged 12 years and older. Developed by BioCryst Pharmaceuticals and distributed through Optime Care, ORLADEYO represents a significant advancement in HAE treatment by offering a convenient and effective option for long-term management of this challenging condition.

North American pharmaceutical firms lead research and development efforts focused on HAE therapies. Their investments in R&D foster innovation, driving the development of new treatments and reinforcing the region's industry leadership. This leadership position is further strengthened by strong awareness among healthcare providers and patients about HAE and its management, ensuring early diagnosis and treatment initiation.

Plasma protease C1-inhibitors market in Asia Pacific is witnessing substantial expansion over the forecast period, propelled by a rising prevalence of chronic inflammatory ailments and a growing demand for advanced therapeutic solutions. The key drivers of this growth also include the emergence of novel recombinant human inhibitors, which provide enhanced safety and effectiveness compared to conventional treatments. Furthermore, the region's aging population is contributing to increased occurrences of age-related conditions that benefit from C1-inhibitor therapy. Also, the industry's growth is facilitated by new entrants introducing innovative formulations and delivery techniques, addressing the evolving healthcare requirements of the region.

Plasma Protease C1-inhibitor Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the plasma protease C1-inhibitor market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the plasma protease C1-inhibitor industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global plasma protease C1-inhibitor industry to benefit clients and increase the market sector. In recent years, the plasma protease C1-inhibitor industry has offered some technological advancements. Major players in the plasma protease C1-inhibitor market includes BioCryst Pharmaceuticals, Inc.; CENTOGENE N.V.; CSL; Fresenius Kabi; Ionis Pharmaceuticals, Inc.; KalVista Pharmaceuticals; Pharming, Sanquin; Shire plc; and Takeda Pharmaceutical Company Limited.

Takeda, a global biopharmaceutical company headquartered in Japan, is discovering and providing life-changing treatments through research and development. It concentrates its research efforts on four main therapeutic areas: Oncology, Rare Genetics and Hematology, Neuroscience, and Gastroenterology (GI), with a particular focus on immune and inflammatory disorders. In February 2023, Takeda presented multiple new data analyses, including findings from the SPRING Study of TAKHZYRO in pediatric patients with hereditary angioedema, at the 2023 AAAAI Annual Meeting.

KalVista Pharmaceuticals, Inc. is focused to discovering, developing, and bringing to market oral, small-molecule protease inhibitors to address diseases with significant unmet medical needs. The company's pipeline features sebetralstat, an oral factor XIIa inhibitor, and KVD001 among its candidates, targeting conditions such as hereditary angioedema (both treatment and prophylaxis), thrombosis, inflammation, and diabetic macular edema. In June 2024, KalVista Pharmaceuticals, Inc. submitted an NDA to the FDA for sebetralstat, an investigational oral plasma kallikrein inhibitor, as the first oral on-demand treatment for hereditary angioedema (HAE) in adults and pediatric patients aged 12 years and older.

List of Key Companies in Plasma Protease C1-inhibitor Market

- BioCryst Pharmaceuticals, Inc.

- CENTOGENE N.V.

- CSL

- Fresenius Kabi

- Ionis Pharmaceuticals, Inc.

- KalVista Pharmaceuticals

- Pharming

- Sanquin

- Shire plc

- Takeda Pharmaceutical Company Limited

Plasma Protease C1-inhibitor Industry Developments

- May 2024: BioCryst Pharmaceuticals, Inc. presented new real-world evidence at ISPOR 2024 showing significant reductions in healthcare resource utilization among US patients with hereditary angioedema (HAE) following initiation of ORLADEYO (berotralstat).

- May 2023: KalVista Pharmaceuticals presented data at the 13th C1-inhibitor Deficiency & Angioedema Workshop, highlighting insights on sebetralstat's short-term prophylaxis regimen and patient preferences for oral on-demand treatments in hereditary angioedema (HAE).

- December 2022: Takeda launched CINRYZE in India as the first C1 esterase inhibitor for prophylaxis in hereditary angioedema patients, offering both acute attack treatment and prevention options.

Plasma Protease C1-inhibitor Market Segmentation

By Drug Class Outlook

- C1-inhibitors

- C1-esterase Inhibitor

- Recombinant Inhibitor

- Kallikrein Inhibitor

- Selective Bradykinin B2 Receptor Antagonist

By Dosage Form Outlook

- Lyphophlised

- Injectables

By Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Plasma Protease C1-inhibitor Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3.51 billion |

|

Market Size Value in 2024 |

USD 3.82 billion |

|

Revenue Forecast in 2032 |

USD 7.96 billion |

|

CAGR |

9.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global plasma protease C1-inhibitor market size was valued at USD 3.51 billion in 2023.

The global market is projected to grow at a CAGR of 9.6% during the forecast period, 2024-2032.

North America had the largest share of the global market.

The key players in the market are BioCryst Pharmaceuticals, Inc.; CENTOGENE N.V., CSL; Fresenius Kabi; Ionis Pharmaceuticals, Inc.; KalVista Pharmaceuticals; Pharming; Sanquin; Shire plc; and Takeda Pharmaceutical Company Limited.

The C1-inhibitors category dominated the market in 2023.

The hospital pharmacies had the largest share in the global market.