Plastic Compounding Market Share, Size, Trends, Industry Analysis Report

By Source (Fossil-based, Bio-based, Recycled); By Product; By End-use; By Region; And Segment Forecasts, 2024 - 2032

- Published Date:Jun-2024

- Pages: 120

- Format: PDF

- Report ID: PM1197

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

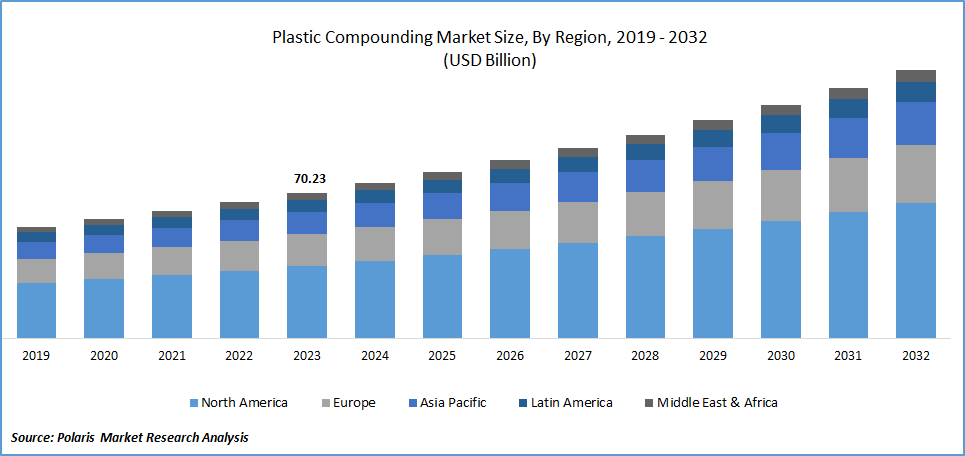

Plastic compounding market size was valued at USD 70.23 billion in 2023. The market is anticipated to grow from USD 75.09 billion in 2024 to USD 129.55 billion by 2032, exhibiting the CAGR of 7.1% during the forecast period.

Plastic Compounding Market Overview

Rise in demand of consumer goods due to rising population has escalated the demand for plastic compounds to have desired characteristics in the end product. Due to advancements in technology and increased research and development in the electrical and electronic industry, there has been a significant increase in demand for electrical and electronic equipment in the past few years. The demand for cars has been spurred by rising industrialization and increased disposable income in emerging economies. Moreover, rise in light-weight electric vehicles, miniaturized consumer electronics and strong demand from consumer durables have influenced market’s growth.

To Understand More About this Research:Request a Free Sample Report

- For instance, in December 2023, Simrax Group announced launch of its new facility in Tamil Nadu, India which will be functional in 2026, to attract foreign subsidiaries to meet the increasing demands of compounding plastics from the Southeast Asia.

However, growing worries about pollution in the environment and the need for long-term fixes have led to tight restrictions on single-use plastics, difficulties with recycling, and a move toward biodegradable substitutes might slow the development of conventional plastic compounds. The emergence of substitute materials such as bio-based polymers and the increasing need for recycled plastics.

Growth Factors

Rise in Adoption of Plastic Compounding Materials

There is a rise in adoption of plastic compounding materials over the traditional materials due to their higher physical attributes including conductivity, broad spectrum of flame retardancy, wear resistance. The quality of light- weight raises their demand in a variety of construction, automotive, and building applications as well as in packaging, electrical & electronics. There is a rise in demand from downstream industries because of plastics versatile and easy to mold ability and as a result, they propel the expansion of the worldwide plastic compounding market by encouraging utilization in the infrastructural sectors.

Rise in Industrialization

The rapid industrialization of nations in emerging regions has led to an increasing need for plastic compounded materials across many sectors. Because of their versatility, low cost, and wide range of applications, plastic compounds are indispensable to industrial processes; thus, the plastic compounding market is driving this industrial revolution.

The need for plastic compounded materials is rising faster than ever before due to emerging markets, which are primarily focused on consumer products, packaging, automotive end-use production, infrastructure construction, and other related areas. For instance, study findings conducted by McKinsey, considered Asia as a prominent player in domains such as, world order, energy systems, demographic forces, technology platforms, capitalization and resources.

Restraining Factors

Rising Environmental Concerns

The rising environmental concerns and depleting crude oil supplies by the extensive use by petrochemical polymers has led to the development bio-based goods which are becoming more accessible to meet the demand for the usage of renewable sources. Producers of plastic additives are increasing their capacity to meet the growing demands of the world's plastic compounding markets.

Report Segmentation

The Plastic Compounding Market is primarily segmented based on source, product, end-use, and region.

|

By Source |

By Product |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Source Insights

Fossil-Based Segment Accounted for the Largest Market share in 2023

The fossil- based segment accounted for the largest market share. This dominance is due to its widespread usage based on petrochemicals, which are derived from fossil fuels. Furthermore, derivation of polymers from fossil fuels, is far more convenient and cost-effective for the manufacturers. Dependency on polymers derived from petroleum has grown significantly over time. These derived polymers from fossil fuels are a very adaptable class of substances; and they are so adaptable that they can be discovered in a wide variety of industries due to its extremely desired qualities, which include chemical inertness, strength, flexibility, and resistivity.

Bio- based segment is expected to expected to grow at the fastest pace. This growth is due to its ability to include Nano clays, waste materials and natural fibers to improve their mechanical properties, such as strength, durability, and stiffness. Further, the increasing prices of crude oil and a growing need for sustainable materials made of renewable resources. Because of their decreased density, bio-based materials are advantageous for lightweight applications.

By End-Use Insights

Automotive Segment Accounted to Hold Largest Revenue share of the Market in 2023

Automotive segment garnered the largest revenue share. This dominance is due to the rising demand for automobiles production manufactured with lightweight materials which makes the automobile more affordable for consumer. Moreover, there is increasing demand for electrical, fuel-efficient vehicles which contribute into environmental sustainability reducing carbon emissions.

- According to ACEA, World motor vehicle production, in May 2023, the number of motor vehicles manufactured worldwide increased to 85.4 million, up 5.7% from 2021. With over 27 million motor cars manufactured in 2022, China is the largest vehicle manufacturer in the world.

Packaging segment will grow at the fastest pace, owing to its ability to undergo various physical processes combining with additives to help achieve the required color, performance requirements and properties contributing to cost-efficient packaging solution that helps improve durability, transparency, flexibility and process efficiency.

Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market share in 2023

The Asia Pacific region dominated the global market. Region’s share is primarily due to rapidly rising urbanization and industrialization in emerging countries and also increasing manufacturing production, thriving e-commerce business, and advantageous demographics. The need for plastic compounding in applications such as washing machines, automobiles and refrigerators is expected to rise to meet the increasing demands for consumer electronics in regions such as China, India, Japan, and South Korea.

Also, the rising demand for electronic devices in various markets. For instance, In October 2023, BenQ India is a provider of consumer electronics that has gained milestones by surpassing Japan and becomes the largest market in the Asia Pacific. This growth is primarily due to increasing demand for consumer electronics and display products in India in recent years.

The Europe region will grow rapidly the plastic compounds are consumed in large quantities by the German vehicle sector, which accounts for 10% of all plastic consumption. Given that they make up much to 15% of the weight of a car, plastics are essential for lightweight, fuel-efficient automobiles. There will likely be more plastic used in the automobile industry due to the requirement to satisfy CO2 emission reduction standards as well as the growing demand for safer, greater comfort, and more sustainable automobiles. It will also need more stringent fuel economy regulations. According to Zipdo, German automotive industry produced 4.66 million passenger vehicles, in 2021.

Key Market Players & Competitive Insights

Technological Advancements to Drive the Competition

The plastic compounding market is a highly competitive environment with a continually changing landscape due to the ongoing innovation of major companies in response to changing industry needs. Technology innovations, differentiation of products, and strategic alliances are some of the tactics used by businesses to fight for market dominance. Furthermore, the market is being driven by worries about sustainability more and more, which is forcing competitors to invest in recycled materials and eco-friendly solutions to stay competitive.

Some of the major players operating in the global market include:

- AKRO-Plastic GmbH

- Arkema Group

- Asahi Kasei Plastics

- BASF SE

- Celanese Corporation

- Covestro AG LLC

- DowDuPont

- Dyneon GmbH & Co KG

- Kingfa Sci &Tech Co Ltd

- Kraton Polymers, Inc.

- Kuraray Plastics Co Ltd.

- Lyondell Basell Industries N.V.

- SABIC

- Solvay SA

- Teijin Limited

Recent Developments in the Industry

- In December 2023, Lyondell Basell announced the utilisation of marine gear’s plastic to produce high quality plastic recycle to be used in injection moulding to enhance environmental sustainability in automotive industry.

- In November 2023, Covestro inaugurated its new production lines for poly-carbonate compounding in India to expand the capacity to 5,000 tonnes annually to meet the rising consumer demands.

Report Coverage

The plastic compounding market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, source, product, end use, and their futuristic growth opportunities.

Plastic Compounding Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 75.09 billion |

|

Revenue forecast in 2032 |

USD 129.55 billion |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Plastic Compounding Market report covering key segments are source, product, end-use, and region.

Plastic Compounding Market Size Worth $ 129.55 Billion By 2032

Plastic compounding market exhibiting the CAGR of 7.1% during the forecast period.

Asia Pacific is leading the global market

The key driving factors in Plastic Compounding Market are Rise in adoption of plastic compounding materials