Polyurethane Sealants Market Share, Size, Trends, Industry Analysis Report, By Type (One Component Polyurethane Sealant, Two Component Polyurethane Sealant); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 118

- Format: PDF

- Report ID: PM3173

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

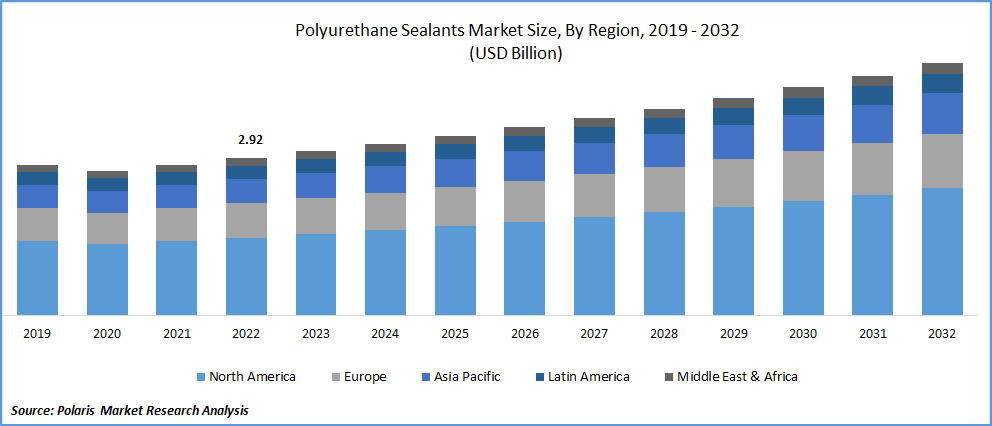

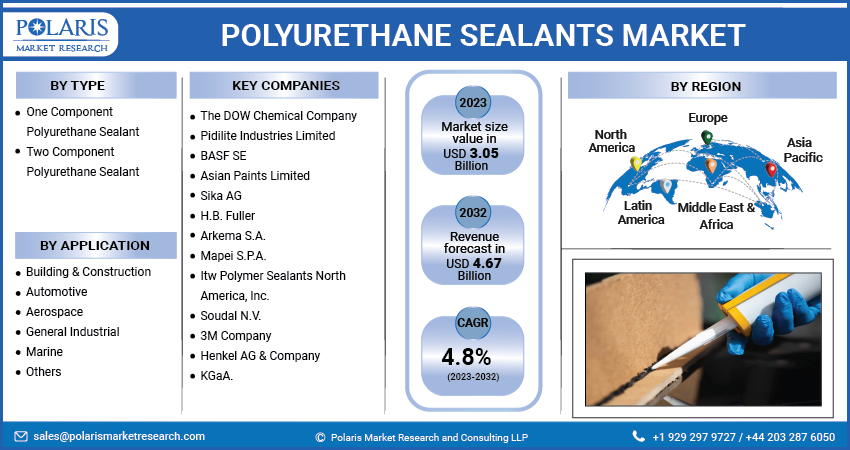

The global polyurethane sealants market was valued at USD 2.92 billion in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period. The global polyurethane sealant market is growing due to increasing demand for high-performance materials that offer superior resistance to extreme conditions, particularly in the construction industry. These sealants are commonly used for waterproofing, sealing joints in walls and floors, plumbing, electrical cables, and more.

Know more about this report: Request for sample pages

The polyurethane sealants market comprises two sealants includes one-component and two-component polyurethane sealant. The one-component sealant is widely used in construction activities due to its elasticity, durability, and excellent waterproofing properties. However, the market growth is restrained by fluctuating prices of raw materials, such as toluene diisocyanate. Despite this, major players' growing interest in polyurethane sealants is expected to drive market growth in the forecast period.

The market for polyurethane sealants is experiencing rapid growth and involves manufacturing and selling sealant products made from polyurethane. These sealants are utilized for bonding and sealing various materials such as wood, metal, concrete, plastic, and more. Polyurethane sealants provide superior strength for bonding, flexibility, durability, and protection against chemicals, water, and UV radiation.

Furthermore, the market is expected to see growth opportunities in the forecast period due to the rising demand for green, sustainable sealants with low VOC. Additionally, the market will likely benefit from the high growth rate and increased government expenditure on infrastructure development. These factors will provide growth opportunities for the polyurethane sealants market.

The COVID-19 pandemic caused a decline in the polyurethane sealant market due to the temporary shutdown of manufacturing and construction activities and disruption in the supply chain. However, as restrictions eased, the market started to recover, with increased demand in the healthcare sector to construct hospitals and in the automotive and transportation industries to produce electric vehicles. Furthermore, the pandemic highlighted the importance of eco-friendly and sustainable materials, increasing demand for bio-based polyurethane sealants.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

Firstly, the increasing demand for high-performance materials with superior resistance to extreme conditions, particularly in the construction industry, has surged the demand for polyurethane sealants. This, along with the growth of the automotive and transportation sectors, where polyurethane sealants are used for sealing and bonding in vehicle interiors and door and window sealing, is driving the polyurethane sealants market growth.

Furthermore, the rising demand for eco-friendly and sustainable products has led to the development of bio-based polyurethane sealants, which are gaining popularity due to their lower environmental impact and better performance characteristics.

The Government initiatives to boost infrastructure development, particularly in emerging economies, are expected to increase the demand for polyurethane sealants in construction projects. Technological advancements in the production process of polyurethane sealants are also driving market growth further, with improved quality and reduced manufacturing costs. These factors, combined with the increasing awareness and demand for eco-friendly products, are expected to continue driving the future growth of the polyurethane sealant market.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

One component segment expected to dominate the market over the projection period

One component segment is anticipated to dominate the market because it is widely used in construction due to its high elasticity, durability, and superior waterproofing abilities. The one-component polyurethane sealant does not require mixing and is ready to use directly from the container. It is highly resistant to weathering, UV radiation, and chemicals, making it suitable for various applications, including sealing joints in floors and walls, waterproofing, and sealing roofs.

However, two component segment is expected to hold the highest shares in the market. two-component polyurethane sealants are used for sealing and bonding applications in vehicle interiors, windows, and doors and for other industrial applications such as sealing and bonding electrical cables.

The increasing demand for high-performance materials in the automotive and transportation industries, driven by the production of electric vehicles and the need for sealing and bonding in their manufacturing, is expected to drive the growth of the polyurethane sealant market further.

Building and construction segment held the largest market share in 2022

Building and construction segment holds the largest market shares in 2022 and likely to continues the growth over the forecast period. As these sealants are widely used for sealing and bonding construction materials such as concrete, metal, wood, and plastic. Polyurethane sealants offer excellent adhesion, flexibility, and durability, making them a popular choice for various applications in the building and construction industry.

The building and construction industry is a growing demand for energy-efficient buildings. Polyurethane sealants are used to seal gaps and joints in buildings, which helps to prevent air and moisture from entering or escaping the building. This helps to improve energy efficiency by reducing heating and cooling costs and maintaining a comfortable indoor environment.

North America is expected to dominate the market

North America is expected to experience steady growth in future and will dominate the market. The region is a significant market for polyurethane sealants due to a large construction industry and the demand for high-quality sealants for various applications.

The increasing demand for energy-efficient buildings is driving the growth of the market in North America. Polyurethane sealants are widely used in the construction industry for sealing joints, gaps, and cracks to prevent air and water infiltration, which helps improve buildings' energy efficiency. In addition, the automotive industry in North America is also a significant end-user of polyurethane sealants. These sealants are used in the production of vehicles for sealing and bonding various parts, such as windshields, windows, and roofs.

Competitive Insight

Some of the major players operating in the global polyurethane sealants market include The DOW Chemical Company, Pidilite Industries Limited, BASF SE, Asian Paints Limited, Sika AG, H.B. Fuller, Arkema S.A., Mapei S.P.A., ITW Polymer Sealants North America, Inc., Soudal N.V., 3M Company, Henkel AG & Company, and KGaA.

Recent Developments

- In March 2022, Arkema acquired Ashland's Performance Adhesives business in the US. This acquisition is a significant milestone in Arkema's efforts to strengthen its Adhesive Solutions segment.

- In April 2021, Sika Acquired Hamatite, the adhesives arm of The Yokohama Rubber Co., Ltd. Hamatite providing adhesives and sealants to the automotive and construction sectors. This acquisition is expected to greatly enhance Sika's position in Japan, providing wider access to all major Japanese original equipment manufacturers (OEMs) and expanding its range of products for sealing and bonding applications in the construction industry.

Polyurethane Sealants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.05 billion |

|

Revenue forecast in 2032 |

USD 4.67 billion |

|

CAGR |

4.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

The DOW Chemical Company, Pidilite Industries Limited, BASF SE, Asian Paints Limited, Sika AG, H.B. Fuller, Arkema S.A., Mapei S.P.A., Itw Polymer Sealants North America, Inc., Soudal N.V., 3M Company, Henkel AG & Company, and KGaA. |

FAQ's

The global polyurethane sealants market size is expected to reach USD 4.67 million by 2032.

Key players in the polyurethane sealants market are The DOW Chemical Company, Pidilite Industries Limited, BASF SE, Asian Paints Limited, Sika AG, H.B. Fuller, Arkema S.A., Mapei S.P.A., ITW Polymer Sealants North America, Inc.

North America contribute notably towards the global polyurethane sealants market.

The global polyurethane sealants market expected to grow at a CAGR of 4.8% during the forecast period.

The polyurethane sealants market report covering key segments are type, application, and region.