Microencapsulation Market Share, Size, Trends, Industry Analysis Report

By Core Material (Agricultural inputs, Food additives, Others); By Shell Material; By Technology; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4889

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

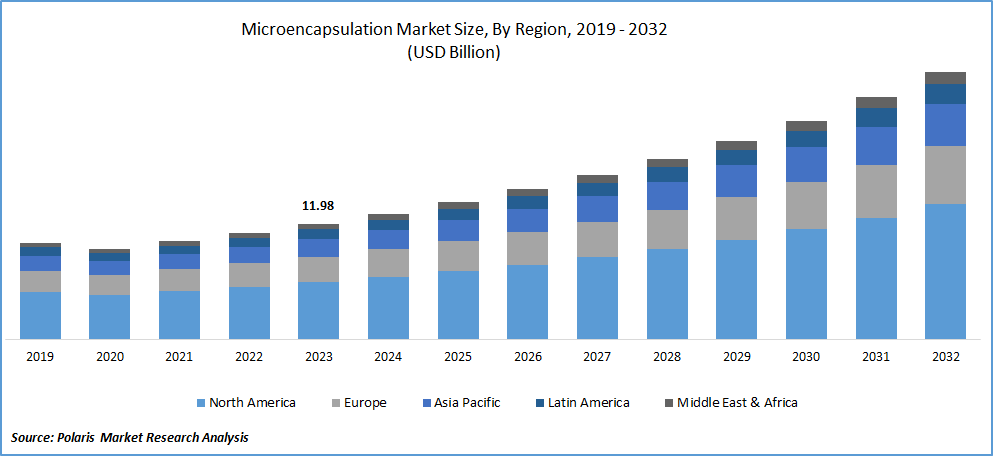

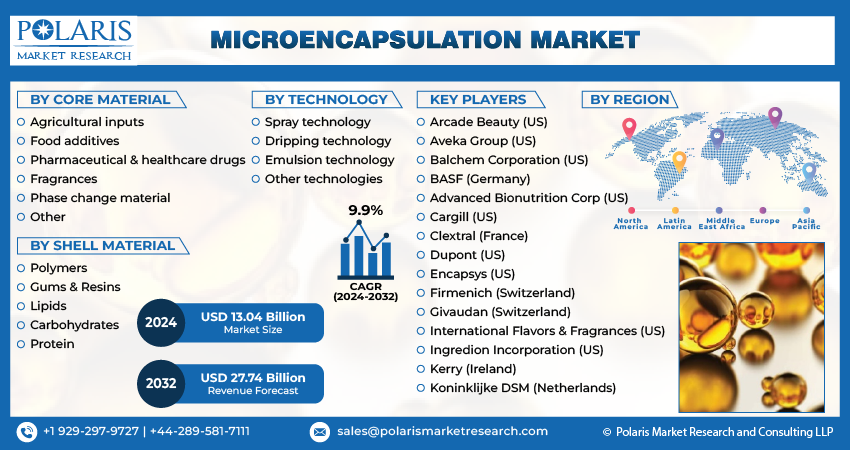

Microencapsulation market size was valued at USD 11.98 billion in 2023. The market is anticipated to grow from USD 13.04 billion in 2024 to USD 27.74 billion by 2032, exhibiting the CAGR of 9.9% during the forecast period.

Market Overview

The worldwide demand for convenience foods and healthcare supplements to enhance their nutritional levels among people is facilitating the need for prominent microencapsulation technology in the marketplace. As people show preferences for convenience foods, there will be a significant demand for the food additives, flavor, and fragrance enhancers on the market, contributing to the adoption of stable encapsulation methods. This trend, in a way, is driving the new technological developments in microencapsulation.

To Understand More About this Research:Request a Free Sample Report

For instance, in May 2023, TopGum, Ltd., announced the launch of its new caffeine gummy product line, Gummiccino, with the first use of its proprietary microencapsulation technology. This technology promotes flavor and increases food absorption.

Moreover, food additives, mainly colors, are widely employed in several dishes, starting from Laddoo’s to other prominent dishes and sweets in the food industry. This is certainly fueling the production of food additives, which require microencapsulation technology to improve the flavor and texture of fortified foods by masking certain flavors.

However, the higher cost of microencapsulation technology and the limited awareness about the functioning and benefits of microencapsulation are anticipated to lower demand in the next few years.

Growth Drivers

Rising Pharmaceutical Studies Exploring Microencapsulation Benefits

The pharmaceutical sector is registering increasing product innovations and new formulations tablets, with the increasing prevalence of numerous health problems in the world. These medicines require control over release and stability, as that can help in teaching to the targeted area in the treatment procedures, driving the use of microencapsulation. For instance, a 2023 study published in Nature Biomedical Engineering focused on developing exosome-loaded microcapsules for the treatment of vitreoretinal health diseases. Additionally, in February 2022, Galderma launched Microencapsulated Benzoyl Peroxide Rx Cream for the treatment of rosacea, which affects 16 million individuals in the United States.

Increasing Use in the Food and Beverages Industry

The growing number of people opting for healthy beverages is encouraging food and beverage manufacturers to formulate food and drinks with healthy ingredients. This is in a way stimulating the need for microencapsulation, as it can extend the product's shelf life. For instance, in March 2023, AnaBio Technologies unveiled the new micro-encapsulation technology with the capability to improve the stability of probiotic beverages with moisture stabilizing and heat resistant characteristics.

Restraining Factors

Lower Level of Microencapsulation Stability is Likely to Impede the Market Growth

The same microencapsulation technology is not suitable for the diverse product range, leading to the higher resistance to adopt new technologies based on their functioning. The lesser amount of stability provided by the microencapsulation, specifically for the sensitive pharmaceutical products is anticipated to limit the market growth during the forecast timeframe.

Report Segmentation

The market is primarily segmented based on core material, shell material, technology, application, and region.

|

By Core Material |

By Shell Material |

By Technology |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Core Material Analysis

Pharmaceutical and Healthcare Drugs Segment is Expected to Witness the Highest Growth During the Forecast Period

The pharmaceutical segment will grow with substantial pace, owing to growing awareness about the physical fitness and nutritional benefits. Based on the article published in the Indian Express Group in May 2023, around 80% of the people in India are suffering from micronutrients deficiency. This is fueling the manufacturing of healthcare supplements in the world, significantly supporting the need for the microencapsulation technology.

The food additives segment led the industry market with a substantial revenue share in 2023, largely attributable to the changing consumer lifestyle after the COVID-19 pandemic. Most of the people altered their eating habits and consumption behavior towards healthy products. Food producers are increasingly focusing on incorporating healthy ingredients along with the food additives, to gain consumer attention, due to its effectiveness in enhancing taste, texture and nutritional value of the products. Microencapsulation works well in masking some flavors, which causes dissatisfaction among the users, leading to the higher rate of adoption in the food industry.

By Technology Analysis

Spray Technology Segment Held the Significant Market Revenue Share in 2023

The spray technology segment held a significant market share in revenue in 2023. This is mainly attributable to the ability to protect products and chemical compounds from extreme weather conditions, such as heat, moisture, radiation and others, leading the shelf extension. In textiles, spray technology is anticipated to drive the durability, which is a major factor considered by the individuals before consumption.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America region held the dominant share in 2023. This is due to the presence of nations with the higher purchasing power, leading to the increased consumption of snacking and fortified foods. Younger people in the region are significantly showing interest to consume healthcare supplements along with the physical activities to be physically fit. According to the Centers for Diseases Control and Prevention, about 57.6% of the people in 20’s are taken dietary supplements in the 30 days from the survey in 2017-18. This is anticipated to create demand for the microencapsulation, as mostly the used to control the spread and flavor.

The Asia Pacific region will grow at the rapid pace, owing to the growing consumption of fragrance and flavor products in the region, primarily India and China. According to the Fragrances and Flavours Association of India (FAFAI) in 2023, fragrance and flavor industry is projected to grow at a annual growth rate of 12%, and reach USD 5.2 billion in the next three to four years, driven by the changing consumer preferences along with the disposable income. This is anticipated to facilitate growth opportunities for the microencapsulation, due to its extensive use in the fragrance and flavor management.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The microencapsulation market is competitive. The increasing investments in the research and development activities among the companies is driving the new technological innovations in the world. Additionally, growing interest in expansion activities, such as partnerships and acquisitions are anticipated to propel the competition in the long run. For instance, in August 2023, Spray-Tek completed the acquisition of TRuCapSol, an encapsulation services provider to expand its product portfolio into microencapsulation.

Some of the major players operating in the global market include:

- Advanced Bionutrition Corp (US)

- Arcade Beauty (US)

- Aveka Group (US)

- Balchem Corporation (US)

- BASF (Germany)

- Cargill (US)

- Clextral (France)

- Dupont (US)

- Encapsys (US)

- Firmenich (Switzerland)

- Givaudan (Switzerland)

- International Flavors & Fragrances (US)

- Ingredion Incorporation (US)

- Kerry (Ireland)

- Koninklijke DSM (Netherlands)

Recent Developments in the Industry

- In October 2023, Vitaquest International announced the acquisition of Paterson, a powder processing facility to improve its product development capability. It is expected to manufacture solutions with the application of bed technology for microencapsulation, drying, granulation and more.

- In March 2023, Surtex completed the acquisition of Omnitechnik Mikroverkapselung, to promote its market position and enhance product offering in the global marketplace.

Report Coverage

The microencapsulation market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, core material, shell material, technology, application, and their futuristic growth opportunities.

Microencapsulation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.04 billion |

|

Revenue forecast in 2032 |

USD 27.74 billion |

|

CAGR |

9.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Microencapsulation Market report covering key segments are core material, shell material, technology, application, and region.

Microencapsulation Market Size Worth $ 27.74 Billion By 2032

Microencapsulation market exhibiting the CAGR of 9.9% during the forecast period.

North America is leading the global market

The key driving factors in Surgical Equipment Market are Rising pharmaceutical studies exploring microencapsulation benefits.