Post-Consumer Recycled Plastics Market Share, Size, Trends, Industry Analysis Report

By Source (Non-bottle Rigid, Bottles, Others); By Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4074

- Base Year: 2023

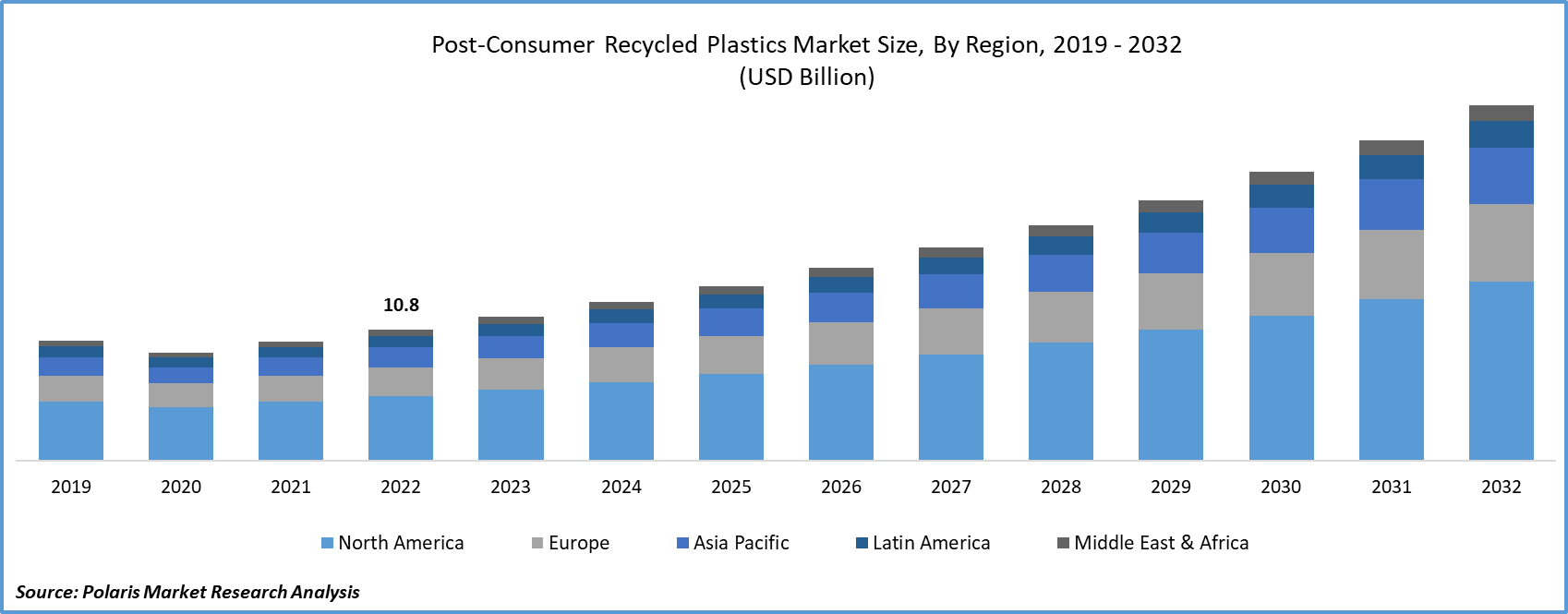

- Historical Data: 2019-2022

Report Outlook

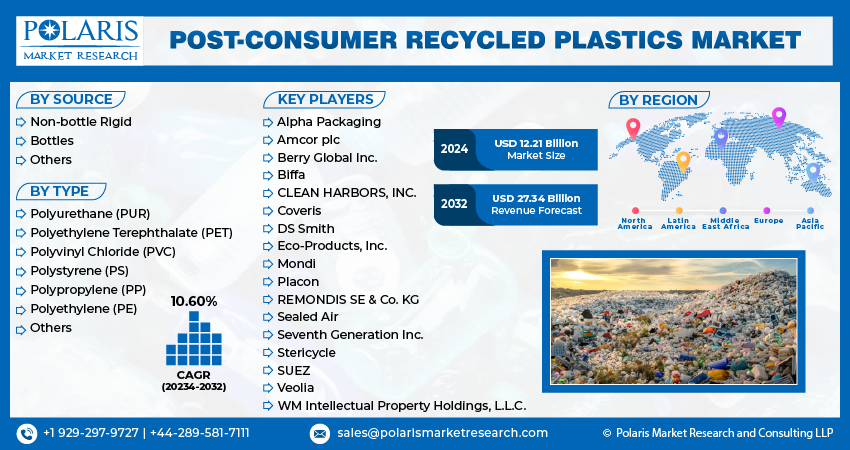

The global post-consumer recycled plastics market was valued at USD 11.09 billion in 2023 and is expected to grow at a CAGR of 10.60% during the forecast period.

The market is expected to experience growth in the forecast period due to the rising use of plastic in manufacturing lightweight components across industries like construction, automotive, and food processing. Furthermore, the increased demand for packaging products, particularly driven by the surge in online sales of electronics, cosmetics, personal care items, and personal protective equipment during the global COVID-19 pandemic, is spurring the need for post-consumer recycled plastics in packaging applications.

To Understand More About this Research: Request a Free Sample Report

China's strict regulations concerning post-consumer plastic recycling, which has a substantial influence on the plastic recycling sector, are compelling plastic recyclers to relocate to Southeast Asian nations like Malaysia and Indonesia. The increasing economic capacity and disposable income in these Southeast Asian countries are expected to boost demand in the forecast period, especially in the automotive, construction, and packaging sectors, where plastic can replace traditional metal and wooden components in vehicles. In contrast, ongoing infrastructure development in residential, industrial, commercial, and public sectors further contributes to market expansion.

The expansion of the construction sector in emerging markets like Brazil, China, India, and Mexico is projected to create a surge in demand for post-consumer recycled plastics. These recycled plastics will be utilized in the production of various components, including insulation, fixtures, and safety products like vests, belts, and gloves, during the forecast period. This growth in recycled plastics for personal protective equipment can be linked to the increased foreign investment in the construction industries of the mentioned nations, driven by relaxed FDI regulations and the need for redeveloping public and industrial infrastructure.

Industry Dynamics

Growth Drivers

- Increasing Interest Driven by Positive Environmental Impact

The market for post-consumer recycled plastic packaging materials is thriving due to its positive environmental impact. As the awareness of environmental sustainability and reducing plastic waste grows, both consumers and businesses are increasingly seeking eco-friendly alternatives to traditional packaging.

Recycled packaging materials derived from post-consumer plastics play a significant role in reducing the demand for new plastic production, conserving precious natural resources, and diverting plastic waste from landfills and oceans. By opting for recycled packaging, industries contribute to the reduction of greenhouse gas emissions, lower energy consumption, and reduced reliance on fossil fuels.

Furthermore, recycled packaging promotes a circular economy, where materials are reused, recycled, and repurposed, aligning with global efforts to combat climate change and minimize environmental harm. This positive environmental impact resonates with consumers, propelling post-consumer recycled plastics market growth as companies strive to achieve sustainability objectives and address the urgent need for responsible packaging solutions.

Report Segmentation

The market is primarily segmented based on type, source, and region.

|

By Source |

By Type |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

- The Bottles Segment Held the Largest Revenue Share in 2022

Plastic bottles represent the primary sources of post-consumer recycled materials, finding application in various industries for packaging water, oils, pharmaceuticals, and carbonated beverages. Key manufacturers of post-consumer recycled plastic bottles include SKS Bottle & Packaging, Inc., CABKA Group, Maynard & Harris Plastics, and Placon.

The non-bottle rigid category encompasses post-consumer plastic foam and sheets extensively employed in packaging. Among these, expanded polystyrene stands out as the most prevalent form of post-consumer recycled plastic foam. Leading manufacturers in the automotive, electrical, and electronics sectors, including Panasonic Corporation, SONY Electronics Inc., Ltd., Hitachi, Ltd., and Honda Motor Company Ltd., are increasingly shifting towards the use of post-consumer recycled plastic foam in favor of virgin plastics.

By Type Analysis

- The Polyethylene Segment Accounted for the Highest Market Share During the Forecast Period

This can be attributed to its outstanding chemical resistance properties, including resistance to solvents, alcohols, alkalis, and diluted acids. Polyethylene is predominantly employed in the manufacture of films, tubes, laminates, and plastic components, which find applications across various industries, including packaging, electrical and electronics, and automotive.

Polypropylene is widely applied in the production of automotive parts, packaging, medical devices, and a range of laboratory equipment due to its exceptional chemical and mechanical attributes. This material demonstrates resistance to various chemical solvents, acids, and bases, along with impressive mechanical strength. It plays a role in crafting floor mats, piping systems, plastic hinges, consumer products, carpets, and rugs, among various other applications. The increasing demand for such products is expected to fuel the need for post-consumer recycled polypropylene in the coming forecast period.

Regional Insights

- Asia Pacific Dominated the Largest Market in 2022

The region significantly contributing to the global revenue share. The construction industry in the Asia Pacific region is on the brink of substantial growth in the upcoming years, fueled by the increasing demand for non-residential construction projects, which encompass hospitals and educational institutions such as schools and colleges. This upswing in construction activities is expected to drive the demand for personal protective equipment products, including helmets, safety vests, safety belts, and various other items, consequently propelling industry growth.

Europe is expected to witness significant growth in the forecast period. This expansion is propelled by the region's adoption of circular economy principles aimed at minimizing the carbon footprint linked to plastic production through increased post-consumer plastic recycling. The implementation of landfill bans has led to sluggish production growth in European nations due to the flourishing post-consumer plastic recycling sector. As some European countries impose exorbitant landfill taxes, the cost of disposal often surpasses that of plastic recycling, incentivizing the active participation of the European population in the collection and recycling of post-consumer plastics.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Alpha Packaging

- Amcor plc

- Berry Global Inc.

- Biffa

- CLEAN HARBORS, INC.

- Coveris

- DS Smith

- Eco-Products, Inc.

- Mondi

- Placon

- REMONDIS SE & Co. KG

- Sealed Air

- Seventh Generation Inc.

- Stericycle

- SUEZ

- Veolia

- WM Intellectual Property Holdings, L.L.C.

Recent Developments

- In October 2022, Veolia introduced its latest PlastiLoop offering at the K 2022 trade fair, the premier event for plastics and rubber held in Düsseldorf, Germany.

- In March 2022, Thales and Veolia collaborated to develop the inaugural environmentally designed SIM card crafted from recycled plastic.

Post-Consumer Recycled Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.21 billion |

|

Revenue forecast in 2032 |

USD 27.34 billion |

|

CAGR |

10.60% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Source, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |