Postal Automation System Market Share, Size, Trends, Industry Analysis Report

By Component (Hardware, Software, Services); By Application; By Product; By Technology; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2748

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

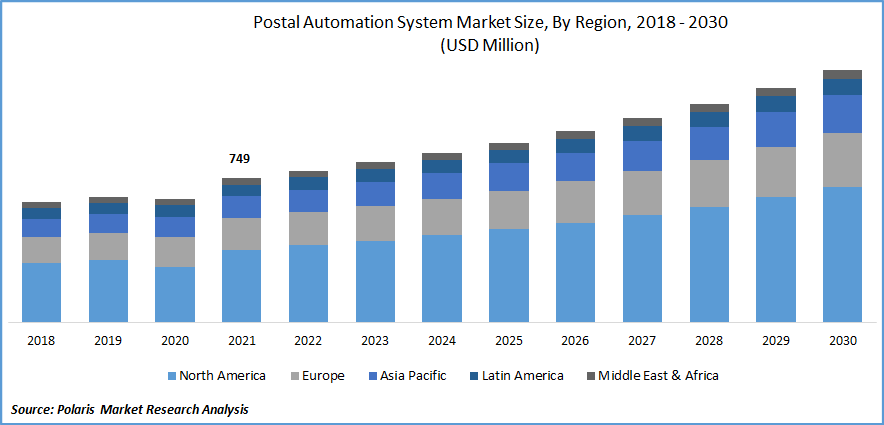

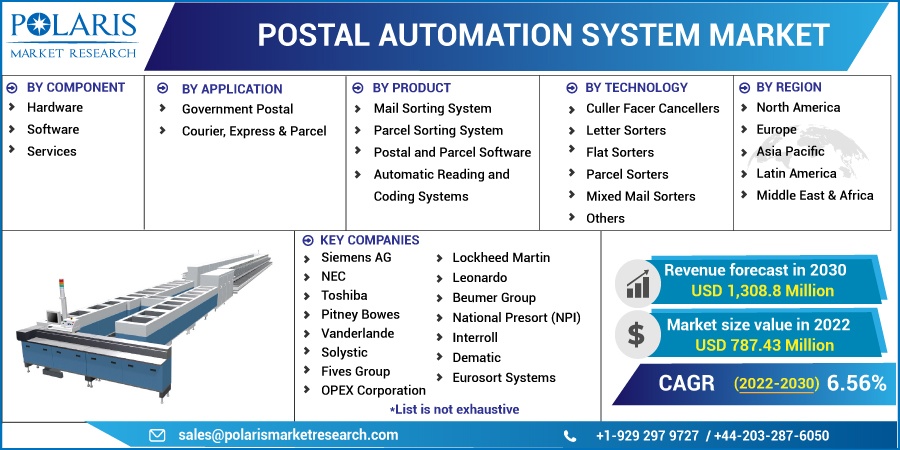

The global postal automation system market was valued at USD 749 million in 2021 and is expected to grow at a CAGR of 6.56% during the forecast period.

Expanding e-commerce sector has increased the need for parcel delivery which accelerated the market's expansion. In the upcoming years, the market is anticipated to be driven by factors such as the growing need for industrial automation systems, rising labor costs, and end-user demands for speedy delivery. The growing adoption of Industry 4.0 practices to enhance single-day delivery and reduce end-to-end turnaround time in the postal delivery market is another key factor driving the growth of the market.

Know more about this report: Request for sample pages

Moreover, the increased demand for smart, connected, and efficient automated postal operations worldwide have increased the adoption of advanced technologies such as RFID, Barcode Readers, Scanners, etc., which are estimated to fuel the market growth during the forecast period.

A postal automation system is a letter-handling device with a high processing speed and address reading rate. This system automates the procedure, which offers consumers a dependable, rapid, and affordable alternative. In addition to being a cost-effective alternative, postal automation systems aid in lowering the likelihood of human error during sorting and handling operations. It provides more affordable options with better customer support. The system consists of bar code readers, culler facer cancellers, OCR letter sorting devices, and other components. It is frequently used to improve courier and package services.

The COVID-19 pandemic positively affected the market since, starting in 2020, there was a noticeable increase in the number of parcel deliveries worldwide. The COVID-19 pandemic-related lockdowns and limitations enforced by numerous governments in most nations are responsible for the rise in parcel delivery, as they forced customers to turn to online shopping to satisfy their necessities. Postal offices saw greater package volumes in major economies worldwide, with most parcel distribution in the domestic market. This immediately influenced the market owing to the automatic usage and extensive outcome.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One of the major drivers of the market's growth is the rising demand for automation in the postal and parcel sector. For instance, India Post will be able to provide high-quality service, increase production, and drastically cut processing time due to the automation technology installed by Siemens. The system has the ability to handle a variety of mail types, including letters, periodicals, plastic-wrapped products, and parcels. Up to 55,000 items per hour, including 35,000 letters and 20,000 mixed mail bundles, can be processed through the system in a given time frame. Therefore, more than 22,100 of these systems have been installed by Siemens for letter, package, and courier express parcel services in more than 40 nations worldwide.

Other significant factors anticipated to drive the market growth include the growing need for efficient delivery services, the growing desire to reduce operational costs with cutting-edge technology, new product introductions from major players, government initiatives supporting letter carriers, businesses offering automated solutions, etc.

The market will continue to expand over the coming years due to manufacturers putting more emphasis on boosting the effectiveness of sensors, scanners, processors, and recognition systems.

The sortation process can be streamlined and accelerated thanks to these technologies. The increased capacity that automated distribution centers provide is just one of the numerous advantages that come with them. These technologies shorten the handling period as well, resulting in less physically demanding workplaces. Another benefit is that when smartly constructed, automatic sortation systems don't take up a lot of space.

Moreover, in the CEP sector, logistics robots are the upcoming big thing, and many eagerly anticipate their introduction.

Report Segmentation

The market is primarily segmented based on component, application, product, technology, and region.

|

By Component |

By Application |

By Product |

By Technology |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Hardware segment is expected to witness the highest growth in 2021

Hardware component generated the largest revenue share in 2021 due to improvements in sensors, processors, scanner systems, recognition, and the need for new solutions to increase the capacity of the ones already in place. Over the projection period, the market is expected to continue to rise significantly. The major suppliers of postal automation systems are concentrating on increasing their market share by enhancing their current capabilities and setting up production facilities internationally.

Services category is expected to increase with the fastest CAGR during the predicted period. The increased demand for services, including domestic and international mail registration and monitoring of mail items. The expansion of the software category is being driven by elements like improved operational flexibility and efficiency brought on by simple sorting logic design, as well as network-wide uniform parcel processing based on centralized sorting configuration.

Couriers, Express, and Parcels (CEP) accounted for the largest market share in 2021

The government postal services category is expected to grow with a significant CAGR throughout the forecast period. This is due to the government services’ focus on strengthening the network, adopting new technology, and enhancing operations. It assists enterprises in standardizing their operations connected to parcel tracking and package sortation at various mailroom or carrier route levels, among others.

Applications for courier, express, and parcels (CEP) are anticipated to expand faster during the projection period. This is ascribed to the global expansion of electronic communications fuels online shopping, and last-mile delivery services are a growing segment for many logistics organizations worldwide. The two main reasons propelling the growth of this market are the expanding use of parcel automation systems and the rise in business-to-consumer (B2C) courier services.

Parcel sorting system sector is expected to hold the significant revenue share

The segment with parcel sorter systems had a major share in 2021. The parcel sorter systems work using various software-controlled devices. Sortation detects products on conveyer systems and rerouting them to the desired location. The solutions improve traceability to increase accuracy and lower the number of requests for missing packages. It also enhances operations by enabling real-time access and reducing processes.

The market segment for automatic reading and coding systems is anticipated to experience significant growth during the forecast period. The need for flexibility, high speed, and reading performance; the demand for simple-to-use systems for labels, stamps, and symbols; and the demand for one solution to extract all process-relevant information are factors influencing the category growth in the coming years.

The postal and parcel software category is anticipated to experience the highest CAGR growth during the projection period. The high growth rate of postal and parcel software category is primarily driven by the rising need for operational flexibility and efficiency for simple sorting logic configuration and network-wide uniform parcel processing.

Culler facer cancellers sector is expected to witness the fastest growth

Culler facer canceller (CFC) is anticipated to witness the fastest growth during the forecast period. This is owing to its capacity to recognize and remove postage stamps coupled with distinguishing different types of mail (including postal cards, letter envelopes, and others), based on their width, stiffness, thickness, and length. Additionally, it removes the complicated objects the machine can't handle. The culler facer canceller process mail according to thickness, weight, and size while automatically determining its destination.

In 2021, the category for parcel sorters was anticipated to have a major share and is estimated to witness the fastest growth throughout the forecast period. This industry is expanding due to the rising need for sorting case goods and packages, sorting single items for order fulfillment and packages, and shipping bags for receiving, cross-docking, and shipping.

The mixed mail sorters category is anticipated to experience significant CAGR growth throughout the forecast period. The main reasons propelling the market growth of this category are the rising desire to handle a wide variety of mail and the growing requirement to combine large-scale automated sorting in a smaller space.

The demand in North America is expected to witness significant growth

In 2021, North America accounted for a key share of the global market and was presumed to witness significant growth in the coming years. The growing implementation of the most recent technologies in postal services and the presence of major market players in the region are credited with the expansion of the global market in the region. Additionally, the market is expanding as a result of enterprises adopting automation due to increased labor prices and labor shortages. Government, BFSI, and other industry segments are seeing an increase in demand for postal automation services, which is driving regional market expansion.

Major postal and CEP enterprises are concentrated in the North American region, contributing to the growth of the market by expanding their product categories and launching advanced products.

The Asia Pacific is expected to be the fastest-growing global market over the forecast period. A highly advanced e-commerce logistics sector is now necessary due to the rapid expansion of the e-commerce sector in nations like China, Japan, and India. Additionally, the growing demand for postal automation systems from the BFSI industry to further enhance the market growth in the region over the coming years.

Competitive Insight

Some of the major players operating in the global market include Siemens AG, Toshiba, Pitney Bowes, Lockheed Martin, GBI Intralogistics, Fluence Automation, National Presort, Interroll, Dematic, Eurosort Systems, Honeywell International, Bastian Solution, OPEX Corporation, Leonardo, Beumer Group, and Planet Artificial Intelligence.

Recent Developments

- In July 2022, Siemens Logistics GmbH, was acquired by Korber AG. By utilizing the automation and software solutions of Siemens Logistics GmbH, Korber AG in expanding its market offerings and mail and package operations, which will help the company to grow in the market.

Postal Automation System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 787.43 million |

|

Revenue forecast in 2030 |

USD 1,308.8 million |

|

CAGR |

6.56% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Application, By Product, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Siemens AG, NEC, Toshiba, Pitney Bowes, Vanderlande, Solystic, Fives Group, Lockheed Martin, Leonardo, Beumer Group, National Presort (NPI), Interroll, Dematic, Eurosort Systems, Intelligrated, Honeywell International Inc, Bastian Solutions, Inc., Falcon Autotech Private Limited, GBI Intralogistics, Inc, Fluence Automation, LLC, OPEX Corporation, Planet Artificial Intelligence Gmb |