Power Device Analyzer Market Share, Size, Trends, Industry Analysis Report

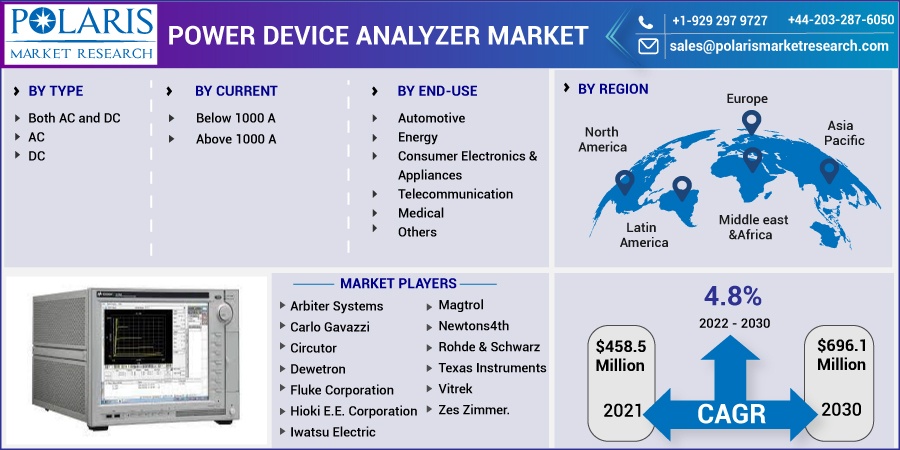

By End-Use (Automotive, Energy, Telecommunication, Consumer Electronics & Appliances, Medical, Others); By Type; By Current; By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 113

- Format: PDF

- Report ID: PM2263

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

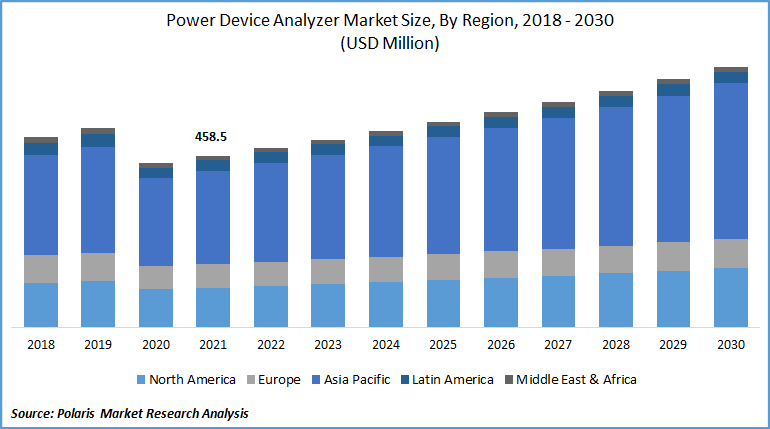

The global power device analyzer market was valued at USD 458.5 million in 2021 and is expected to grow at a CAGR of 4.8% during the forecast period. Consumption and investment in highly engineered and energy-saving electronic products, particularly in the consumer electronics and healthcare industries, are driving the industry's growth.

Know more about this report: request for sample pages

Other aspects boosting demand include the rising adoption of electric vehicles and the inclination toward these automobiles to reduce dependency on fossil fuels and provide cleaner power. Besides these, there is a use of IoT across various industries that are also supporting the industry demand.

The COVID-19 pandemic has had a negative impact on the power device analyzer market. This is due to the imposition of lockdowns due to the COVID-19 outbreak. Since the governments were obliged to impose lockdowns throughout 2020, COVID-19 has delayed the expansion of the power device analyzer market, thus declining their demand.

Governments and municipalities executed stringent restrictions that led to the lack of attention on the growth of the end user's sector. Furthermore, production and supply chain disruptions were also observed during the year, posing a threat to the power device analyzer.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The rising inclination towards renewable energy is propelling the demand for power device analyzers, which is driving the industry's growth globally. The various government is creating policies & schemes to promote the adoption of renewable energy resources to reduce carbon emissions and lead to market development. Thereby, several solar and wind (offshore and onshore) energy projects are initiated for the potential development of the country. Also, growing investments from the government as well as private players are projecting the productive demand for the power device analyzers as the solar industry majorly adopts them for testing solar cells and further purposes.

Furthermore, various power device analyzers require high bias voltage capacitance evaluation proficiencies for precise estimation of the energy device switching characteristics. Additionally, it facilitates material researchers to doping profile characterizations. Moreover, power device analyzers are also used for testing purposes across the wind power sector. Wind turbines also need to fulfill several regulations, like power regulations and others. Hence, numerous organizations present inclusive energy testing solutions with the help of power device analyzers, which, in turn, accelerates industry growth in the near future.

Report Segmentation

The market is primarily segmented based on type, current, end-use, and region.

|

By Type |

By Current |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

By type, the AC and DC type analyzer segments constituted the majority of the power device analyzer market. The various regional governments are encouraging consumers to adopt routine inspections owing to the rise in obligatory laws and increasing demand for electric vehicles (EVs), which are majorly contributing to the industry growth. In addition, emerging demand for the Internet of Things (IoT) is also boosting the demand for both AC and DC type analyzers, which, in turn, is driving the segment growth across the globe.

The AC segment is exhibiting a significant growth rate in the forecasting years. An alternator is an instrument that produces alternating current. This device analyzer is an alternating current generator, which is a sort of electrical generator. A wire loop is twirled inside a magnetic field, causing a current to flow along with it. AC current is widely utilized to run homes and businesses and transmit audio and radio signals across electrical cables. DC current is commonly found in flashlights and other domestic appliances and in some commercial applications.

Insight by End-Use

The automotive segment is recorded to hold the largest revenue share in 2021 and is expected to lead the market in the forecasting years. Power device analyzers are used in the auto industry to evaluate different systems such as drivetrains, navigation systems, batteries, and electrical systems. Moreover, the adoption of electric vehicles is bolstering, along with numerous government policies and initiatives encouraging the utilization and inclusion of electric vehicles. Thereby, these factors are propelling the growth of the segment.

The consumer electronics & appliances segment is projected to show the fastest growth in the forecasting years due to the increased demand for electronics including smartphones, laptops, refrigerators, smart TVs, and smartwatches. The power device analyzer has a wide range of voltage and current properties and functions, which allows it to measure a wide range of devices and, therefore, attract demand.

Geographic Overview

Geographically, Asia Pacific is accounted for the largest revenue share in the global market. The Asia Pacific is a prime hub for industrial production due to emerging countries such as China, India, Australia, and rising disposable income. The surge in demand for electric cars (EVs) and more rigorous government rules are supporting the regional market growth.

Asia's continued prominence as a manufacturing hub has aided industrialization, with South-East Asia playing an increasingly significant role. Furthermore, the tremendous economic development and the growth in energy consumption are fueling the market demand. Additionally, the rising inclination toward renewable energy sources is also supporting the market demand across the APAC.

Moreover, the North American market is anticipated to have progressive growth during the forecast period. The progressive growth of the regional market can be attributed to the developing test and measurement equipment deployment and application in wireless communications and networks. Moreover, big automakers such as BMW, Tesla, and Volkswagen are manufacturing plants, creating various lucrative prospects across the region.

Competitive Insight

Some of the major players operating in the global market include Arbiter Systems, Carlo Gavazzi, Circutor, Dewetron, Fluke Corporation, Hioki E.E. Corporation, Iwatsu Electric, Keysight Technologies, Magtrol, Newtons4th, Rohde & Schwarz, Texas Instruments, Vitrek, Yokogawa Electric Corporation, and Zes Zimmer.

Power Device Analyzer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 458.5 million |

|

Revenue forecast in 2030 |

USD 696.1 million |

|

CAGR |

4.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Current, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Arbiter Systems, Carlo Gavazzi, Circutor, Dewetron, Fluke Corporation, Hioki E.E. Corporation, Iwatsu Electric, Keysight Technologies, Magtrol, Newtons4th, Rohde & Schwarz, Texas Instruments, Vitrek, Yokogawa Electric Corporation, and Zes Zimmer. |