Pre-painted Aluminium Sheets Market Share, Size, Trends, Industry Analysis Report

Thickness (Under 2.5 mm, 2.5 mm - 3.0 mm); By Application (Aluminum Composite Panels, Signages & Boards); By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3554

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

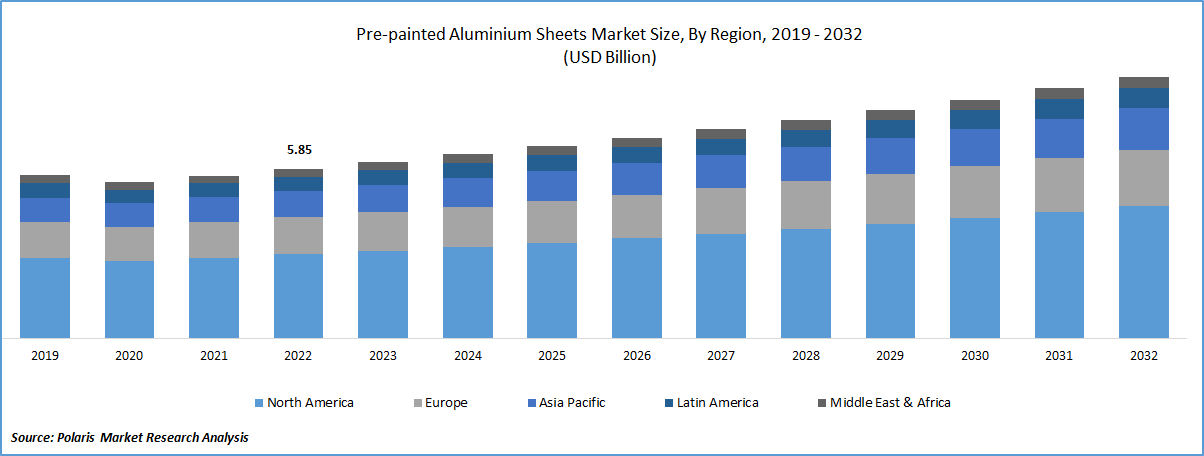

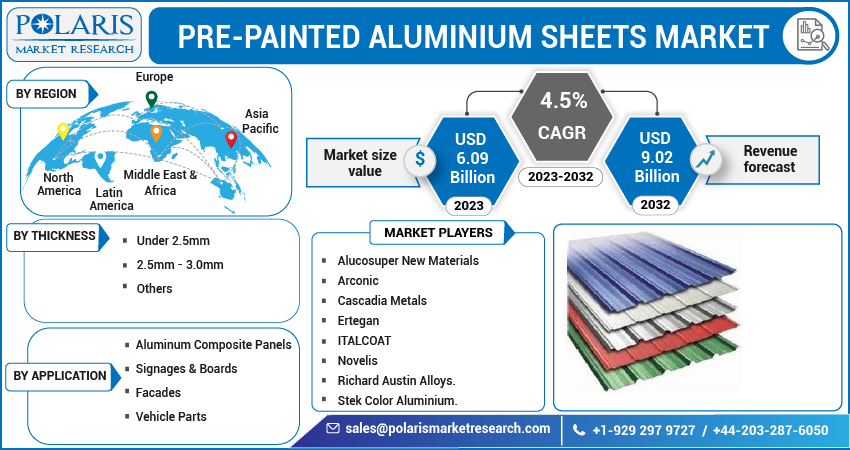

The global pre-painted aluminium sheets market was valued at USD 5.85 billion in 2022 and is expected to grow at a CAGR of 4.5% during the forecast period. Rising demand for metal products in the construction industry and the growing importance of ACPs as a preferred construction material are both significant drivers of market growth. This trend is expected to continue in the future as the construction industry continues to expand and demand for high-performance, aesthetically appealing building materials increases. One of the metal products that is seeing increased demand in the construction industry is aluminum composite panels (ACPs). ACPs are made up of two thin aluminum sheets bonded to a non-aluminum core, such as polyethylene. ACPs are lightweight, durable, and versatile, and they offer a wide range of aesthetic options for architects and builders. They are commonly used in exterior cladding, interior decoration, and signage.

To Understand More About this Research: Request a Free Sample Report

Growing importance of ACPs in the construction industry is driven by their superior performance characteristics compared to other materials like steel, concrete, & wood. ACPs are highly resistant to weathering, corrosion, and fire, and they are easy to install and maintain. Additionally, ACPs are available in a variety of colors and finishes, making them ideal for creating unique and visually striking designs. Consumption of ACPs and other façade materials has increased in the hotel and restaurant industry, and this trend is expected to continue in the future as building owners strive to differentiate themselves in a competitive market and meet the increasing demand for visually appealing and modern building designs.

Aluminum composite panels (ACPs) can be used for both exterior and interior applications in buildings, such as wall cladding, signage, and decorative elements. ACPs are popular among architects, builders, and building owners because they offer numerous benefits, including their lightweight, durability, versatility, and aesthetic appeal. The aesthetic appeal of ACPs is especially important for hotel and restaurant owners, as they aim to create an inviting and visually appealing environment for their customers. As a result, many hotel and restaurant owners have been upgrading the look of their buildings with the use of ACPs for their façades and interior design.

Moreover, in today's competitive market, customer satisfaction is crucial for the success of any business, and the visual appeal of a building can have a significant impact on customers' perception of a hotel or restaurant. Therefore, many owners are investing in improving the aesthetic appeal of their buildings to attract more customers and enhance their brand image.

Market is not immune to price fluctuations, which can have an impact on demand and supply. One of the main factors affecting the price of aluminum, and consequently ACPs, is the supply and demand dynamics of the aluminum market. Sudden surges in demand, geopolitical conflicts, and production disruptions can all lead to price fluctuations in the aluminum market, which can impact the price of ACPs. For example, a sudden increase in demand for aluminum in other industries, such as the automotive or aerospace sectors, could lead to a shortage of supply, which could cause prices to rise.

For Specific Research Requirements, Speak to Research Analyst

Industry Dynamics

Growth Drivers

The growth in the residential sector is projected to drive the demand for various building materials, including HVAC systems & decorative elements such as glass panels, cladding, partitioning walls, & roofing. As the construction of new residential buildings increases worldwide, the demand for these materials is also projected to increase over the forecast period. This trend is driven by various factors, including population growth, urbanization, and rising disposable incomes, which have led to an increased demand for new homes and apartments.

In addition, consumers are increasingly focusing on the aesthetics and comfort of their homes, which has led to an increase in spending on HVAC systems and decorative elements. For example, glass panels and cladding are popular for their aesthetic appeal and energy-efficient properties, while composite partitioning walls and roofing are known for their durability and ease of installation.

Moreover, the growing focus on sustainable construction practices and energy efficiency is also driving the demand for HVAC systems and other building materials that meet these standards. As a result, the construction industry is seeing an increasing demand for innovative, energy-efficient, and sustainable building materials and systems.

Report Segmentation

The market is primarily segmented based on thickness, application, and region.

|

By Thickness |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

2.5 - 3.0 mm segment accounted for the largest market share in 2022

One of the main reasons for the popularity of ACPs in this thickness range is their excellent bending and surface coating properties. ACPs in this thickness range can be easily bent and shaped to meet the specific design requirements of architects and builders, making them an ideal choice for various exterior and interior applications. Moreover, ACPs in this thickness range also offer high corrosion resistance and strength, which are crucial properties for construction materials used in harsh outdoor environments. The high corrosion resistance ensures that the ACPs retain their structural integrity and aesthetic appeal over time, while the strength helps to ensure that they can withstand various environmental stresses and strains.

Under 2.5 mm segment recorded the highest growth rate over the study period. Thinly coated aluminum sheets and coils are preferred in these industries due to their high strength, corrosion resistance, and ductility with lightweight. The use of lightweight materials helps to reduce the overall weight of the construction or automotive components, leading to improved fuel efficiency and lower carbon emissions.

Moreover, thinly coated aluminum sheets and coils are also preferred in applications where flexibility and versatility are important, such as in roofing, cladding, and signage. The ability to bend and shape these materials to meet the specific design requirements of the project is a significant advantage, making them a popular choice among architects and builders.

North America region dominated the global market in 2022

North America region dominated the global pre-painted aluminium sheets market with considerable market share, in 2022. The construction industry is a significant end-user of ACPs, and the demand for these panels is expected to grow in response to the increasing investments in public infrastructure and construction projects. For instance, in April 2022, the Government of Canada allocated USD 4 Bn in its 2022 budget to launch the "Housing Accelerator Fund" for building 100,000 affordable homes in next 5 years. This initiative is expected to drive the demand for construction-related materials, including pre-painted aluminum sheets, which are extensively used in various construction-related applications such as facades, doors, partitions, & windows.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR over the study period. Region’s growth is due to increasing manufacturing activities, surging foreign investments, and flourishing end-use industries such as automotive, aerospace, and building & construction. The increasing manufacturing activities and surging foreign investments in region have led to an increase in demand for pre-painted aluminum sheets. These sheets are extensively used in the manufacturing of various products such as automotive parts, electronic components, and building materials.

Competitive Insight

Some of the major players operating in the global market include Alucosuper New Materials, Arconic, Cascadia Metals, Ertegan, ITALCOAT, Novelis, Richard Austin Alloys., and Stek Color Aluminium.

Recent Developments

- In November 2022, AZZ Inc. expanded its production capacity with the introduction of its new coil coating facility at the Washington to cater the rising demand of sustainable aluminum coils. With this advancement, the company is expected to meet its customized requirements of its key customers, to be used in the hotel, residential buildings, & government buildings.

- In August 2021, Egyptian government announced behemoth construction project valued around USD 64 Mn, as a part of its “Housing for All Egyptians”. With this initiative, government is planning to construct around 500,000 residential homes, by the end of 2025.

Pre-painted Aluminium Sheets Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6.09 billion |

|

Revenue forecast in 2032 |

USD 9.02 billion |

|

CAGR |

4.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Thickness, Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Alucosuper New Materials, Arconic, Cascadia Metals, Ertegan, ITALCOAT, Novelis, Richard Austin Alloys., and Stek Color Aluminium. |

FAQ's

The global pre-painted aluminium sheets market size is expected to reach USD 9.02 billion by 2032.

Top market players in the Pre-painted Aluminium Sheets Market are Alucosuper New Materials, Arconic, Cascadia Metals, Ertegan, ITALCOAT, Novelis, Richard Austin Alloys.

North America contribute notably towards the global Pre-painted Aluminium Sheets Market.

The global pre-painted aluminium sheets market expected to grow at a CAGR of 4.5% during the forecast period.

The Pre-painted Aluminium Sheets Market report covering key are thickness, application, and region.