Process Mining Software Market Size, Share, Trends, & Industry Analysis Report

By Component (Services, Software), By Deployment, By Application, By Industry Vertical, and By Region -Market Forecast, 2025 – 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2250

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

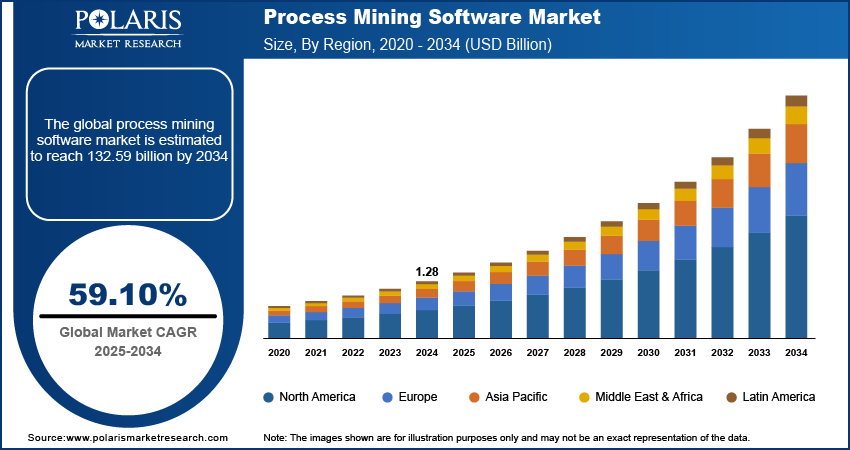

The global process mining software market size was valued at USD 1.28 billion in 2024. The market is projected to grow at a CAGR of 59.10% during 2025 to 2034. Key factors driving demand for process mining software include widespread digital transformation initiatives, growing need for process optimization and efficiency, and enhanced regulatory compliance.

Key Insights

- The BFSI segment held the largest revenue share in 2024 and is expected to retain its dominance in the foreseen period. This is due to fierce competition among global banking and financial service companies.

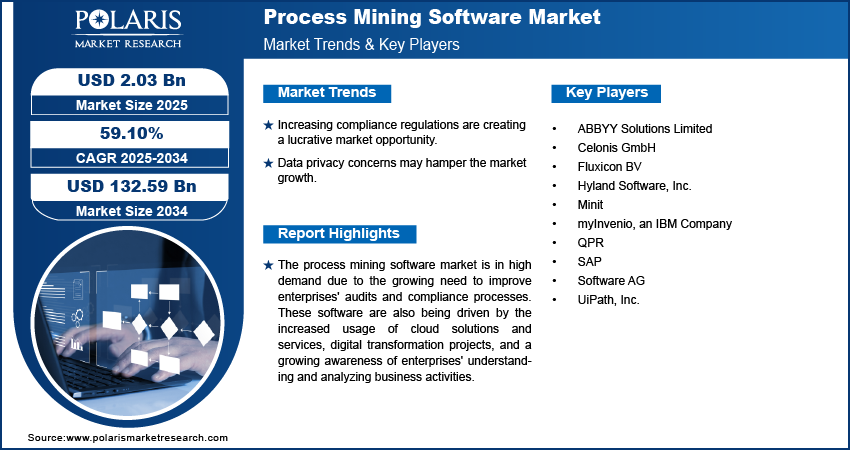

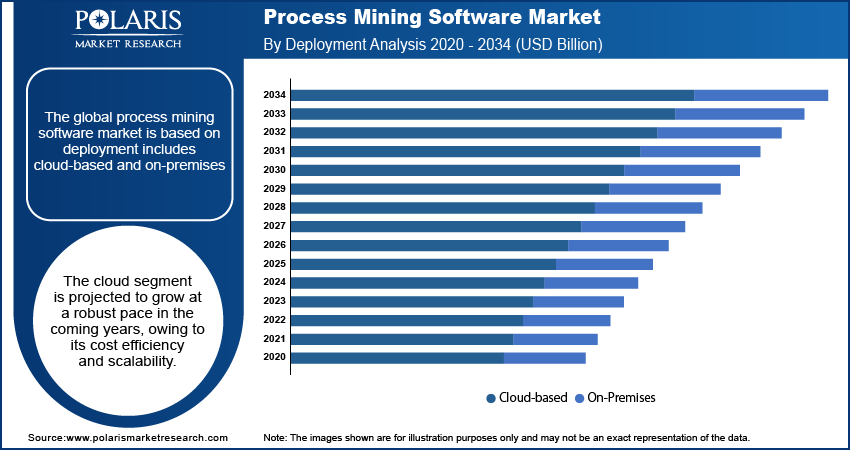

- The cloud segment is projected to grow at a robust pace in the coming years, owing to its cost efficiency and scalability.

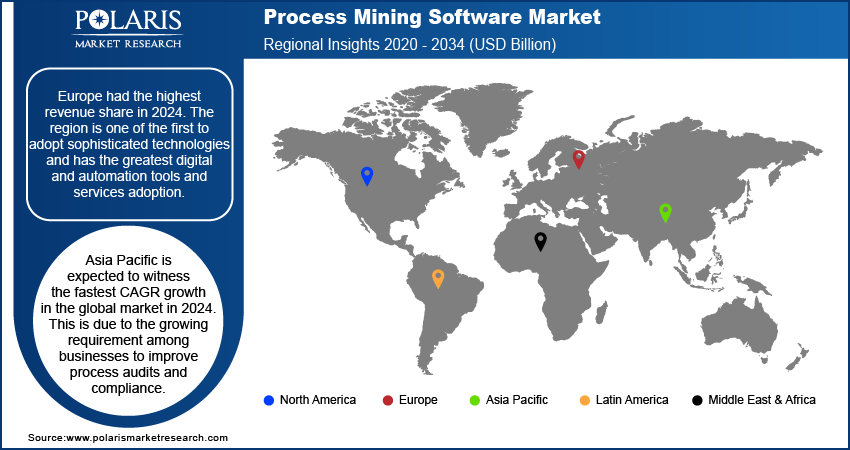

- Europe held the largest revenue share in 2024, owing to high adoption of digital and automation tools.

- Asia Pacific is expected to witness the fastest CAGR in the global market during the forecast period. This is due to the growing requirement among businesses to improve process audits and compliance.

Industry Dynamics

- The rising demand for specialized mining applications to automate the process is leading to market growth.

- The need for process optimization in enterprises is encouraging them to invest in process mining software.

- Increasing compliance regulations are creating a lucrative market opportunity.

- Data privacy concerns may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 1.28 Billion

- 2034 Projected Market Size: USD 132.59 Billion

- CAGR (2025-2034): 59.10%

- Europe: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Process Mining Software Market

- AI enhances process mining by identifying hidden inefficiencies.

- AI aligns with RPA and workflow automation to streamline complex business operations.

- AI provide continuous monitoring and instant process adjustments.

The process mining software market is in high demand due to the growing need to improve enterprises' audits and compliance processes. These software are also being driven by the increased usage of cloud solutions and services, digital transformation projects, and a growing awareness of enterprises' understanding and analyzing business activities. For instance, digital transformation usually has three effects on businesses: a change in the business model, a change in the product and service offering, and a shift in the value chain. Enterprises are being forced to assess existing practices in order to make necessary adjustments to improve productivity and customer experience as a result of digital transformation.

As a result, an organization's focus switches to process mining to optimize existing data-focused studies to provide real-time updates on their progress. Furthermore, the major player's initiatives in the process mining software market are also boosting the growth during the forecast period. For instance, in March 2021, SAP SE has announced the completion of its acquisition of Signavio. Signavio and SAP SE collaborated to provide end-users with a 360-degree picture of every business through standardized process mining, behavioral mining, KPIs, benchmarking data, and customer experience analysis

Also, in September 2021, People Tech Group (PTG), a Cloud, Data, and AI Transformation and Engineering Services company, and UiPath, a leading enterprise automation application company, have announced the launch of a Robotic Process Automation (RPA) services capability for organizations looking to increase efficiency through enterprise automation application.

PTG can now provide its customers across the world with the UiPath market-leading automation platform and proactive, ongoing service and support to help them with their digital transformation efforts. Thus, the key players' collaborations, mergers and acquisitions, partnerships, and advanced technology product launches have propelled the market growth. However, companies in emerging markets still use sticky notes and interviews as part of their typical process mining application. This traditional approach is sometimes criticized for being unduly subjective, and it is received with justified mistrust.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The process mining software market has witnessed extensive developments in the last few decades, supported by factors such as the combination of RPA and processing mining applications and the rising installation of technology-based applications. With the help of automation, businesses from all industries are moving toward digital transformation. They're looking for technology that can help them increase productivity while lowering investment costs.

The demand for RPA to improve performance and productivity is growing rapidly due to this rapid expansion. Companies are dependent on digital systems to automate both back-end and front-end activities. RPA is a developing technology across numerous industries because it can run organizations efficiently amid the epidemic. As a result, there is a rising demand for specialized mining applications to automate the process. RPA technology is one of the best applications to enhance work from home and remote location productivity. It is predicted to boost process mining software market growth over the forecast period since it offers quick automation of processes in less time.

Furthermore, businesses are also merging RPA with such services to optimize the automation impact. Throughout the RPA mining application, the software can provide crucial insights such as strategy planning, essential upgrades, new ideas, and others. Human-driven and information technology-based data-driven business processes can benefit from the integrated solution. It performs RPA analysis and monitoring to make improvements in the future. As a result, businesses turn to process mining automation to acquire real-time data and analysis.

For instance, in February 2021, Software AG has partnered with Automation Anywhere to make scalable automation more accessible to an extensive range of enterprises. Automation Anywhere RPA will be bookended by Software AG's ARIS platform. This will make it easier to find automation potential and maintain automated operations. Automation Anywhere is a pioneer in RPA technology, which has seen a major surge in demand in the last year as businesses want to improve efficiency and cut costs. Thus, the adoption of advanced technology in mining applications and major players' contribution in developing that mining software boosts market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on component, deployment, application, industry vertical, and region.

|

By Deployment |

By Component |

By Application |

By Industry Verticals |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Industry Vertical

Based on the industry verticals market segment, the BFSI segment held the largest revenue share in the global market in 2024 and is expected to retain its dominance in the foreseen period. This segment's prominence can be attributed to fierce competition among global banking and financial service companies and their efforts to improve client experience and provide better services. Furthermore, due to budget constraints, BFSI firms are changing their focus to both strong and cost-effective solutions, resulting in increased demand across the mining software market. Also, banks and financial services firms attempt to improve customer experience and provide better services promoted them to use process mining software.

Geographic Overview

In terms of geography, Europe had the highest revenue share in 2024. The region is one of the first to adopt sophisticated technologies and has the greatest digital and automation tools and services adoption. With the help of automation, numerous sectors are undergoing a digital transition. These industries are always on the lookout for innovative ideas that can help them increase efficiency while lowering investment costs.

Moreover, Asia Pacific is expected to witness the fastest CAGR growth in the global market in 2024. This is due to the growing requirement among businesses to improve process audits and compliance. Growing cloud infrastructure spending by large, small, and medium businesses and creating many startups are also driving the regional market forward. Organizations in underdeveloped nations continue to use the traditional process technique based on sticky notes and interviews. Furthermore, a lack of finances to implement emerging technologies to improve the process or workflow would hamper the demand for the mining software industry in developing countries.

Competitive Insight

Competition in the process mining software market is growing. This is due to both global leaders and niche providers trying to compete. Vendors are choosing AI features, automation, and cloud deployment to meet the changing needs of enterprises. Many are also choosing partnerships or acquiring smaller firms to strengthen their offerings. Companies such as Celonis, Software AG, UiPath, and ABBYY continue to lead the space, each focusing on scalability and tailored solutions for different industries. Some of the major players operating in the global market include ABBYY Solutions Limited, Celonis GmbH, Fluxicon BV, Hyland Software, Inc., Minit, myInvenio, an IBM Company, QPR, SAP, Software AG, and UiPath, Inc.

Process Mining Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.28 billion |

| Market size value in 2025 | USD 2.03 billion |

|

Revenue forecast in 2034 |

USD 132.59 billion |

|

CAGR |

59.10% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

ABBYY Solutions Limited, Celonis GmbH, Fluxicon BV, Hyland Software, Inc., Minit, myInvenio, an IBM Company, QPR, SAP, Software AG, and UiPath, Inc. |

FAQ's

• The global market size was valued at USD 1.28 billion in 2024 and is projected to grow to USD 132.59 billion by 2034.

• The global market is projected to register a CAGR of 59.10% during the forecast period.

• Europe dominated the market in 2024

• A few of the key players in the market are ABBYY Solutions Limited, Celonis GmbH, Fluxicon BV, Hyland Software, Inc., Minit, myInvenio, an IBM Company, QPR, SAP, Software AG, and UiPath, Inc.

• The BFSI segment dominated the market revenue share in 2024.