Process Oil Market Share, Size, Trends, Industry Analysis Report

By Type (Aromatic, Naphthenic, Non-carcinogenic, Paraffinic); By Function; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 115

- Format: PDF

- Report ID: PM2665

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

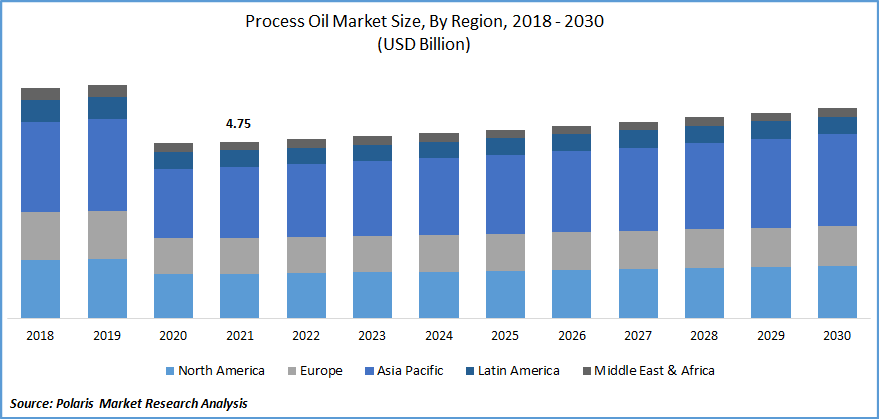

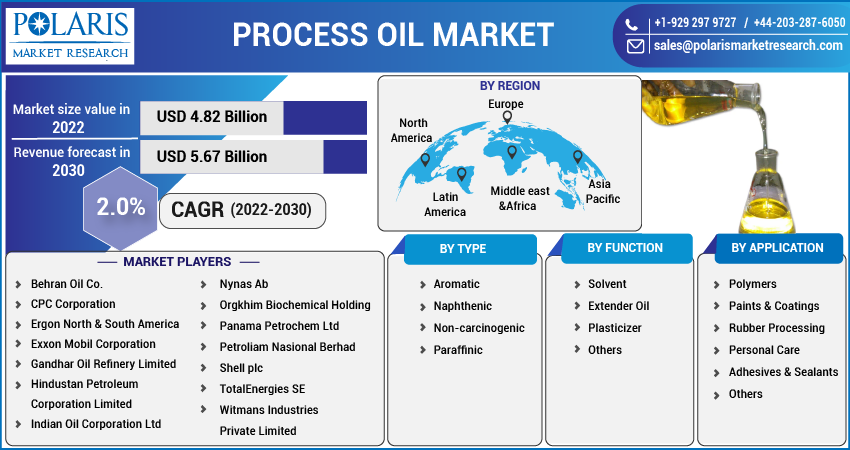

The global process oil market was valued at USD 4.75 billion in 2021 and is expected to grow at a CAGR of 2.0% during the forecast period. The increasing uses of process oil in end-use industries such as manufacturing, automobile, cosmetics, textiles, and others drive the market over the forecast period. In addition, the rising disposable income of consumers, implementation of stringent emission regulation, and greater inclination toward use of electric vehicles further accelerate the demand for process oil.

Know more about this report: Request for sample pages

Process oils is a mineral oil derived from petroleum. It is used as a raw material in manufacturing or as a processing aid to enhance the properties of rubbers and polymers. Some other applications of this oil include inks, paints, personal care, metalworking, adhesives & sealants, and others. It offers higher ductility, strength, mechanical flexibility, and low-temperature resistance. It is widely used as a plasticizer in automotive, construction, and wire & cable sectors.

Several agricultural products, such as pesticides, fertilizers, and crop protection oils use process oil. Some other applications of process oil include textile, personal care, and leather goods, among others.

Process oil is used in personal care products such as cosmetics and toiletry. Rising demand for skin care and hair care products, expanding cosmetics industry, and greater demand from emerging economies accelerate the demand for process oil in this sector.

Growth in awareness regarding personal care and hygiene, the introduction of new innovative products in the market, and increasing adoption of western trends are some other factors supporting the growth of this sector.

The global market was hampered by the outbreak of COVID-19. The global market suffered from logistical issues, disrupted supply chains, and closed global markets. Operational challenges, transportation delays, and lockdown restrictions caused limitations in acquiring raw materials. The market was also affected by restrictions on manufacturing activities and workforce impairment. Reduced demand from transportation and industrial sectors was also experienced during the pandemic.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Economic growth worldwide, rising industrialization, and rapid urbanization support market growth. Greater demand for passenger vehicles and strengthening automotive, personal care, and textile industries boost the market growth. Increasing disposable income and improving consumers’ lifestyles have resulted in greater demand for personal care, boosting the demand for process oils in tire manufacturing.

Rising demand for process oils for emerging economies, increasing application of low-viscosity oils for use in vehicles, and technological advancements have increased the demand for process oils.

Increasing application of process oil in adhesives & sealants and paints & coatings, investments in research and development, and rising advancements in the construction industry are expected to offer growth opportunities. Moreover, rise in environmental awareness coupled with the implementation of stringent environmental regulations by governments across the globe has boosted the demand for green process oils.

Report Segmentation

The market is primarily segmented based on type, function, application, and region.

|

By Type |

By Function |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Naphthenic segment accounted for the largest market share

Based on type, the global process oil market has been segmented into aromatic, naphthenic, non-carcinogenic, and paraffinic. The naphthenic segment accounted for a significant share of the market in 2021. The high demand for naphthenic process oil is due to its superior solvency, stability, reduced flash points, and significant high-temperature properties. It also offers high colour and thermal stability, with wide application in moulded & extruded products, foo wear, and LPG tubes.

Paraffinic process oil is used in producing butyl tubes, hose pipes, and several automotive components because of its light color, greater viscosity range, and superior flash point.

Extender oil segment contributed a significant share to the market revenue

Based on function, the global market has been segmented into a solvent, extender oil, plasticizer, and others. Extender oil is used in manufacturing tires, rubber bushes, battery cases, and belts. It enables softening of rubber compounds and decreases compounding time while assisting in mixing operations and enhancing processing ability. It also acts as a cost-efficient secondary plasticizer for improved plasticizing and processing, thereby providing decreased energy loss, wear, and frictional heat.

Extender oil is widely used in insulation, rubber compounding, and metalworking fluids or greases. It offers high viscosity and shear stability. Some other advantages of extender oil include reduced temperature dependency, a small number of polycyclic aromatics, and oxidation stability and solubility.

Rubber processing segment contributed a significant share of the market revenue

On the basis of application, the global market has been segmented into polymers, paints & coatings, rubber processing, personal care, adhesives & sealants, and others. In 2021, the rubber processing segment accounted for a significant market share. Greater demand for tires and rubber products from the automotive sector, rising penetration of passenger vehicles, and an increasing trend toward modernized and low-weight vehicles boost the growth of this segment.

Asia-Pacific is expected to hold the largest revenue share

The Asia-Pacific process oil market generated significant revenue in 2021. Industrial growth in the developing countries in the region has resulted in greater demand for process oil. High demand from the automotive, construction and industrial sectors further contribute to the market growth. Economic growth in the region, strong manufacturing sector, and availability of raw materials offer growth opportunities in the region.

Several market players are establishing production units to cater to the growing demand for process oil in the region. Increasing urbanization, demand for passenger vehicles, and growth in infrastructure development are other factors boosting the demand for process oil. An increase in use of process oil in rubber processing, adhesives and sealants, and paints and coatings has been observed in the region.

Greater awareness among market players and consumers regarding bio-based products has increased the demand for green process oils in the region. Increasing investment in research and development of advanced materials and government support for adopting sustainable products in the region is expected to offer growth opportunities during the forecast period.

Competitive Insight

Some of the key market players in the market are Behran Oil Co., CPC Corporation, Ergon North & South America, Exxon Mobil Corporation, Gandhar Oil Refinery Limited, Hindustan Petroleum Corporation Limited, HollyFrontier Refining & Marketing LLC, Indian Oil Corporation Ltd, Nynas Ab, Orgkhim Biochemical Holding, Panama Petrochem Ltd, Petroliam Nasional Berhad, Shell plc, Total Energies SE, and Witmans Industries Private Limited.

The prominent companies operating in the global process oil market are launching new products that offer greater efficiency and sustainability to cater to the growing industry demand. These market players are also adopting acquisitions and partnerships to strengthen their distribution network and market presence.

Recent Developments

In August 2022, US Ergon Company Process Oils, Inc. signed an agreement with Cross Oil to market and sell its naphthenic base oils. Through this partnership, the company would distribute Cross Oil’s CrossTrans, L-Series, Corsol, B-Series, and Ebonite oils.

In May 2020, Nynas introduced NYTEX 8022. The new product is developed for diverse applications for high performance. It offers high solvency, which stabilizes formulations in varied applications such as ceramic inks, printing inks, and leather and textile treatments.

Process Oil Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.82 billion |

|

Revenue forecast in 2030 |

USD 5.67 billion |

|

CAGR |

2.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Function, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Behran Oil Co., CPC Corporation, Ergon North & South America, Exxon Mobil Corporation, Gandhar Oil Refinery Limited, Hindustan Petroleum Corporation Limited, Hollyfrontier Refining & Marketing LLC, Indian Oil Corporation Ltd, Nynas Ab, Orgkhim Biochemical Holding, Panama Petrochem Ltd, Petroliam Nasional Berhad, Shell plc, TotalEnergies SE, and Witmans Industries Private Limited |