Procure To Pay Solution Market Size, Share, Trends & Industry Analysis Report

By Component (Software, Services), By Deployment, By Enterprise Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM5863

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

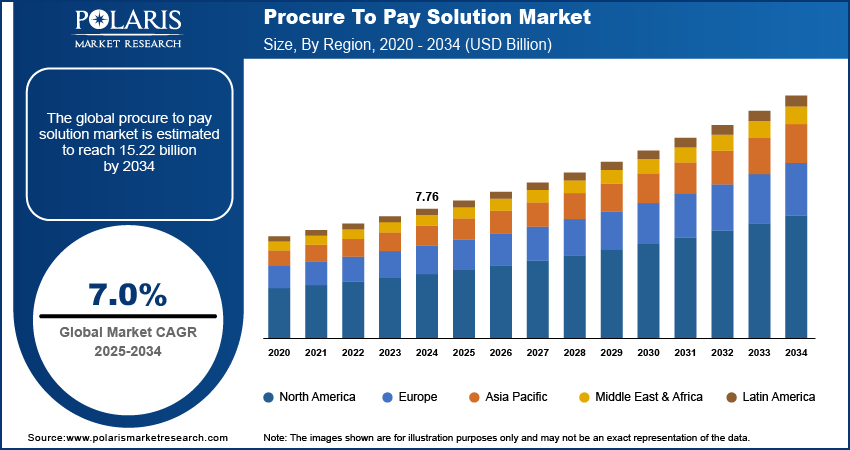

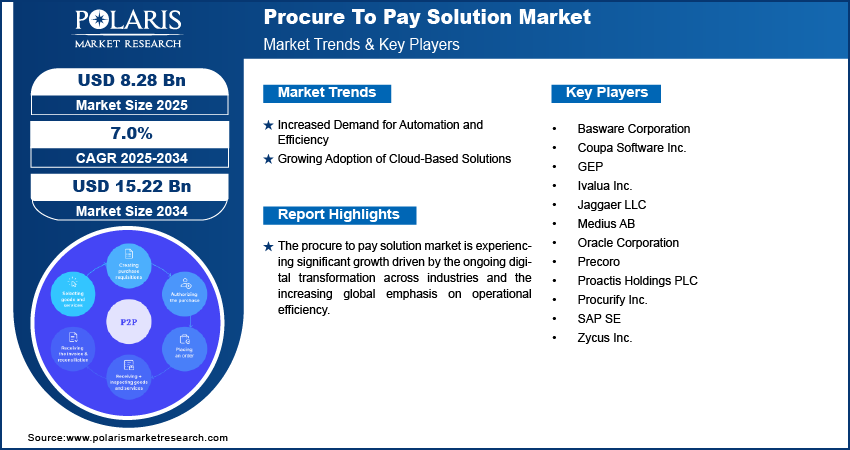

The global procure to pay solution market size was valued at USD 7.76 billion in 2024, and is anticipated to grow at a CAGR of 7.0% from 2025 to 2034. The procure to pay (P2P) solution is driven by the growing need for businesses to automate and digitalize their procurement workflows. Companies are also focused on reducing costs and gaining better control over their spending.

Key Insights

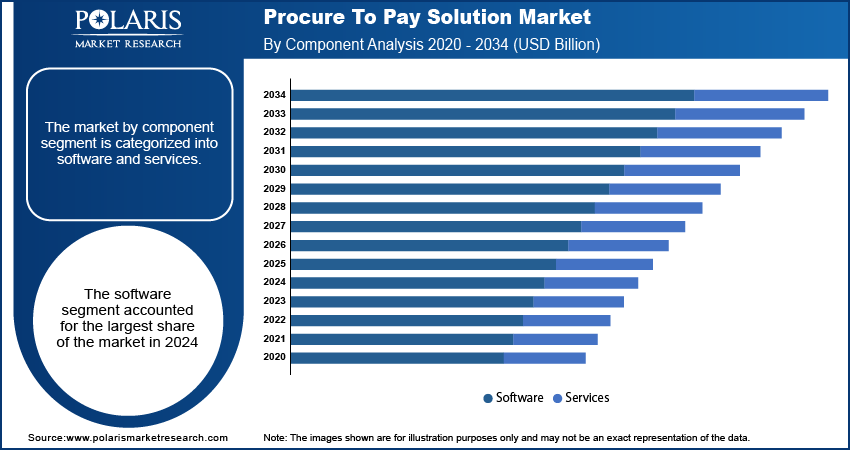

- The software segment held the largest share in 2024. It is due to the growing need for integrated platforms that can manage the entire procurement and payment process from start to finish.

- The cloud segment held the largest share in 2024. Organizations increasingly choose cloud-based platforms as they offer real-time access, seamless updates, and better integration across different global locations.

- The large enterprises segment dominated in 2024. These organizations have complex, global supply chains and high transaction volumes, making manual procurement processes inefficient and costly.

- The manufacturing segment held the largest share in 2024. This dominance is attributed to the sector's complex supply chains, high volume of raw material and component purchases.

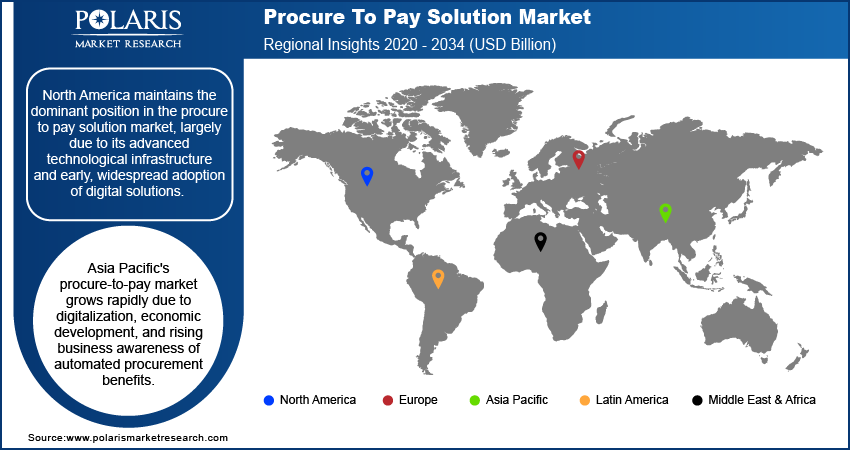

- North America held the largest share in 2024. This is largely due to the early and widespread adoption of advanced technologies and a high concentration of large enterprises.

- The Asia Pacific procure to pay solution industry is witnessing rapid growth. Increasing digitalization efforts and rising awareness among businesses about the benefits of automated procurement propel the growth.

Industry Dynamics

- Rising focus of businesses on automating procurement processes to boost efficiency and minimize manual work propels the demand for procure to pay solutions.

- Increasing adoption of cloud-based solutions contributes to the growth of the procure to pay solution market.

- Growing complexity of supply chain operations is expected to offer lucrative opportunities during the forecast period.

- Integration challenges with existing legacy systems hinder the market growth.

Market Statistics

2024 Market Size: USD 7.76 billion

2034 Projected Market Size: USD 15.22 billion

CAGR (2025–2034): 7.0%

North America: Largest market in 2024

AI Impact on Procure To Pay Solution Market

- Artificial intelligence (AI) systems and machine learning (ML) platforms automatically extracts and matches data with purchase orders and receipts. It streamlines invoice processing, reduces manual errors, and accelerates payment cycles.

- AI tools analyze historical procurement data to predict demand, plan purchases, and optimize inventory. It helps businesses avoid overordering or stockouts while improving budget accuracy.

- Robotic process automation (RPA) and AI systems reduce bottlenecks in approval chains by flagging anomalies and routing documents. It leads to faster cycle times and avoids delays.

To Understand More About this Research: Request a Free Sample Report

The procure to pay (P2P) solution market includes software and services that help organizations manage the entire process of acquiring goods and services. This starts from identifying a need and creating a requisition, all the way through placing purchase orders, receiving items, processing invoices, and finally making payments to suppliers. It aims to streamline operations and bring financial visibility.

Businesses are facing a growing number of complex regulations related to procurement, invoicing, and financial transactions. These regulations, which can vary significantly by industry and geography, necessitate robust systems to ensure adherence and avoid hefty fines or reputational damage. P2P solutions are becoming indispensable tools for managing these compliance requirements, offering features like audit trails, automated policy enforcement, and real-time visibility into spending that help organizations meet regulatory standards and mitigate risks like fraud spending.

Modern supply chains are becoming increasingly intricate, involving numerous suppliers, diverse geographic locations, and a multitude of product components and services. This complexity makes it challenging for organizations to maintain visibility, control costs, and manage supplier relationships effectively using manual or fragmented systems. Procure to pay solutions address this by providing a centralized platform for supplier onboarding, contract management, and order tracking across a global network, thereby enhancing efficiency and resilience.

Industry Dynamics

Increased Demand for Automation and Efficiency

Businesses today are increasingly focused on automating their procurement processes to boost efficiency and cut down on manual work. Traditional procurement methods often involve a lot of paperwork, repetitive data entry, and slow approval cycles, which can lead to errors and higher operational costs. P2P solutions automate these tasks, from creating purchase requests to processing invoices and making payments. This not only speeds things up but also reduces the chance of human mistakes.

For instance, a research article titled "Benchmarking Cost Efficiency Gains from Procurement Automation: Evidence from the Electronics Manufacturing Industry" showed that companies implementing automated purchase order systems experienced a reduction in procurement administrative costs by up to 40%. The study further indicated that error rates in automated procurement environments can decrease by over 70%, directly leading to cost savings. This strong push for efficiency and cost reduction is a major force driving the growth of the procure to pay solution market.

Growing Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is another significant driver for the procure to pay solution market. Cloud P2P platforms offer many advantages over older, on-premise systems, such as lower initial investment, easier setup, and the ability to access the system from anywhere with an internet connection. This makes them especially attractive to businesses of all sizes, including small and medium-sized enterprises (SMEs), as they do not require heavy investments in IT infrastructure and maintenance.

An article titled "Prioritising Organisational Factors Impacting Cloud ERP Adoption and the Critical Issues Related to Security, Usability, and Vendors: A Systematic Literature Review," highlighted that cloud-based ERP systems (which often include P2P functionalities) saw their market share increase from 23% to 51% between 2015 and 2019, indicating a rapid move from on-premises to cloud-based solutions. This widespread move to the cloud is clearly fueling the expansion of the procure to pay solution market.

Segmental Insights

By Component

The software segment held the largest share in 2024. This dominance is due to the growing need for integrated platforms that can manage the entire procurement and payment process from start to finish. Businesses are looking for digital tools that offer real-time data insights, adjustable workflows, and smooth connections with their existing financial systems.

The services segment is anticipated to grow at the highest growth rate during the forecast period. This rise is driven by companies seeking expert support for implementing, integrating, and maintaining P2P solutions. As regulatory requirements evolve and systems become more complex, businesses increasingly rely on consulting, training, and managed services to ensure they get the most out of their P2P investments.

By Deployment

The cloud segment held the largest share in 2024. Organizations increasingly choose cloud-based platforms because they offer real-time access, seamless updates, and better integration across different global locations. This approach allows companies to manage procurement tools from anywhere, a crucial advantage in today's flexible work environments.

The cloud segment is also anticipated to grow at the highest growth rate during the forecast period. Businesses are recognizing that cloud solutions offer greater flexibility and scalability, allowing them to adapt quickly to changing market demands without major IT infrastructure investments. These platforms simplify remote collaboration and ensure continuous feature upgrades. For instance, Eurostat, an intergovernmental organization, reported in December 2023 that approximately 45.2% of European businesses used cloud computing services, a noticeable increase from previous years. This growing reliance on cloud services across various sectors underscores its rapid expansion within the procure to pay solution space.

By Enterprise Size

Large enterprises held the dominant share in 2024 in the procure to pay solution market. These organizations often have complex, global supply chains and high volumes of transactions, making manual procurement processes inefficient and costly. P2P solutions offer large enterprises the ability to centralize their purchasing, gain full visibility into spending, and enforce compliance across numerous departments and locations.

The small and medium enterprises (SMEs) segment is anticipated to grow at the highest growth rate during the forecast period. Historically, SMEs have lagged in adopting advanced procurement tools due to budget constraints or a perception of complexity. However, the rise of affordable, user-friendly cloud-based P2P solutions is changing this trend, enabling SMEs to streamline their purchasing, control costs, and improve cash flow.

By End Use

The manufacturing sector held the largest share in 2024. This dominance stems from the sector's complex supply chains, high volume of raw material and component purchases, and the critical need for cost optimization and operational efficiency. P2P solutions help manufacturing companies manage a vast number of suppliers, automate procurement workflows, and ensure timely acquisition of materials to keep production lines running smoothly.

The IT & Telecom sector is anticipated to grow at the highest growth rate during the forecast period. This segment is characterized by rapid technological advancements, frequent hardware and software upgrades, and a high reliance on recurring service contracts and decentralized purchasing. P2P solutions offer IT and telecom firms enhanced spend tracking, efficient contract management for numerous vendors, and automated approval processes, all of which align with their demand for speed and digital-first operations.

Regional Analysis

North America procure to pay solution market held the largest share in 2024, largely due to the early and widespread adoption of advanced technologies and a high concentration of large enterprises. Businesses in this region are keen on streamlining complex operations, reducing costs, and ensuring compliance, all of which are key benefits of P2P solutions. The region's mature IT infrastructure and a strong drive for digital transformation contribute to its leading position.

US Procure To Pay Solution Market Insight

Within North America, the US is a primary driver of the procure to pay solution market. The country's strong economy, a large number of multinational corporations, and a robust push for digital efficiency across various industries fuel the demand for sophisticated P2P solutions. US businesses are actively investing in automation to gain better control over spending, improve supplier relationships, and enhance overall operational transparency. The Bureau of Economic Analysis (BEA) reported in November 2022, in their "New and Revised Statistics of the U.S. Digital Economy, 2005–2021" article, that the digital economy contributed significantly to the US GDP, reflecting a broad environment supportive of digital solutions like P2P across different sectors.

Europe Procure To Pay Solution Market

Europe represents a substantial portion of the procure to pay solution market, driven by a strong focus on digital transformation, increasing regulatory pressures for electronic invoicing, and a general emphasis on efficiency across various industries. European businesses are progressively moving towards automated procurement systems to comply with evolving regulations, achieve cost savings, and enhance transparency in their purchasing processes. This widespread move towards digital platforms is a key factor in the region's overall adoption of P2P solutions. Germany procure to pay solution market stands out as a major country contributing to the market in Europe. German businesses are known for their focus on efficiency and precision, making them early adopters of advanced digital tools to optimize their operations. The country's strong manufacturing base and highly organized industrial sector particularly benefit from P2P solutions that offer robust control over supply chains and financial processes. A 2019 OECD article on "Public Procurement in Germany" highlighted the country's ongoing efforts to expand the use of e-procurement, acknowledging the benefits of digitalization in increasing productivity for both procurers and businesses.

Asia Pacific Procure To Pay Solution Market Overview

The Asia Pacific region is a rapidly expanding market for procure to pay solutions, propelled by increasing digitalization efforts, growing economic development, and a rising awareness among businesses about the benefits of automated procurement. Countries across this region are investing in modernizing their infrastructure and adopting advanced business processes to remain competitive on a global scale. This is leading to a strong demand for P2P solutions, particularly cloud-based ones, which offer scalability for diverse and fast-growing enterprises. China procure to pay solution market is a major country within the Asia Pacific region driving the growth of the market. The country's strong emphasis on digital transformation and its vast manufacturing and e-commerce sectors create a significant demand for streamlined procurement processes. Chinese enterprises, both large and small, are increasingly adopting digital tools to enhance efficiency, manage complex supply chains, and reduce operational costs.

Key Players and Competitive Insights

The procure to pay solution market is highly competitive, with a mix of established technology giants and specialized providers. Companies in this space are constantly innovating, focusing on integrating advanced features like artificial intelligence and machine learning, enhancing user experience, and offering comprehensive end-to-end solutions. The competition often revolves around factors like ease of integration with existing systems, scalability for different enterprise sizes, and the ability to provide deep insights into spending patterns.

Prominent companies in the industry include SAP SE, Oracle Corporation, Coupa Software Inc., Jaggaer LLC, GEP, Basware Corporation, Zycus Inc., Ivalua Inc., Proactis Holdings PLC, Medius AB, Procurify Inc., and Precoro.

Key Players

- Basware Corporation

- Coupa Software Inc.

- GEP

- Ivalua Inc.

- Jaggaer LLC

- Medius AB

- Oracle Corporation

- Precoro

- Proactis Holdings PLC

- Procurify Inc.

- SAP SE

- Zycus Inc.

Industry Developments

March 2025: Vroozi was named a Value Leader in Spend Matters’ Spring SolutionMap for Procure-to-Pay (P2P) in the mid-market segment, earning distinctions in both E-Procurement and AP Automation.

February 2025: Stampli introduced its new procure-to-pay solution aimed at streamlining procurement by consolidating processes, documents, and communications into a unified workflow. The platform offers complete oversight from purchase requests through to payments and integrates seamlessly with existing ERP systems.

Procure To Pay Solution Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Software

- Services

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-Premises

- Cloud

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Procure To Pay Solution Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.76 billion |

|

Market Size in 2025 |

USD 8.28 billion |

|

Revenue Forecast by 2034 |

USD 15.22 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.76 billion in 2024 and is projected to grow to USD 15.22 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

North America dominated the market share in 2024.

Key players in the market include SAP SE, Oracle Corporation, Coupa Software Inc., Jaggaer LLC, GEP, Basware Corporation, Zycus Inc., Ivalua Inc., Proactis Holdings PLC, Medius AB, Procurify Inc., and Precoro.

The software segment accounted for the largest share of the market in 2024.

The cloud segment is expected to witness the fastest growth during the forecast period.