Pulse Ingredients Market Share, Size, Trends, Industry Analysis Report

By Type (Flour, Starch, Protein, Fibers & Grits); By Source; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 114

- Format: PDF

- Report ID: PM2733

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

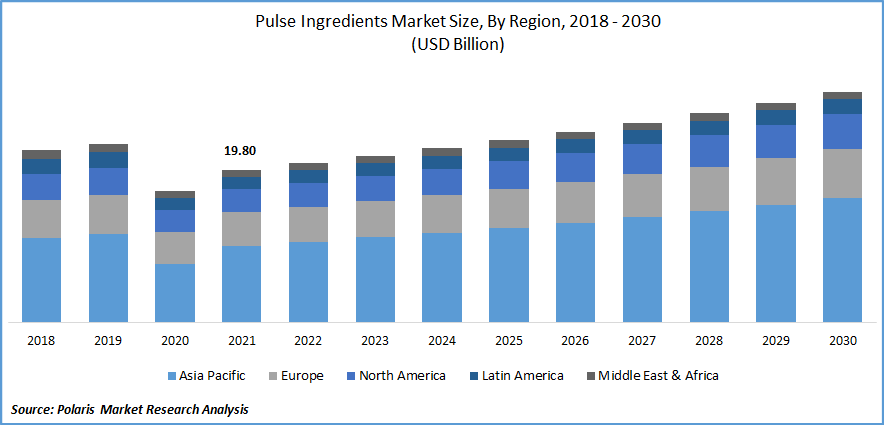

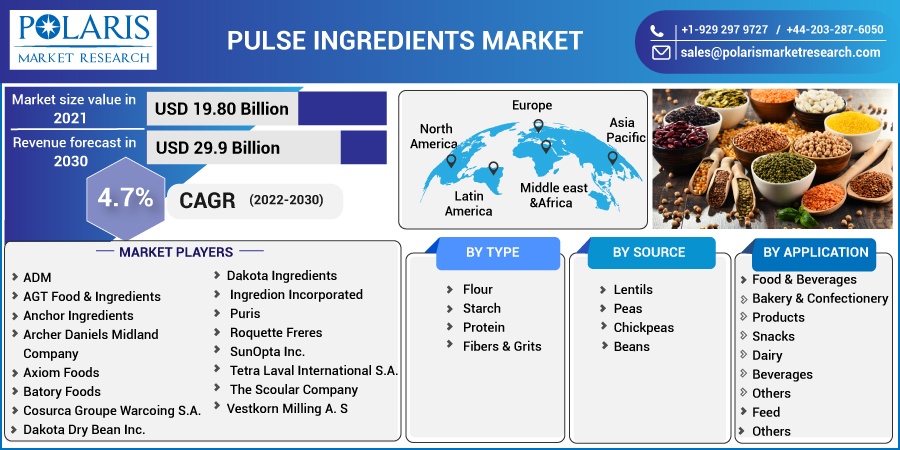

The global pulse ingredients market was valued at USD 19.80 billion in 2021 and is expected to grow at a CAGR of 4.7% during the forecast period. The growing demand for pulse ingredients is expected to be driven by the increasing worldwide urbanization population and the growing consumer demand for plant protein, natural-ingredients-based food. In addition, the rising demand for pulse ingredients in various industrial application spur market growth.

Know more about this report: Request for sample pages

Pulse proteins are replacing animal proteins as they improve the supply of macromolecules, dietary fat, and fiber consumption. Since pulses offer alternatives for animal protein, the rising vegan population is expected to drive market growth. Furthermore, these ingredients are used in a wide application in bakery & snack production, dairy & meat alternatives, pudding, and ready-to-eat meals that satisfy customer needs of high fiber, protein, and low-fat content.

The COVID-19 pandemic had a negative impact on the growth of the pulse ingredients market. The economic slowdown and negligible operations led to disruption in the supply chain and logistics in the food and beverage industry. Moreover, prices rose during the lockdown period due to the lack of workers, which increased transportation costs for raw materials.

Furthermore, technological advancement in the food and beverage industry and increasing R&D investments by implementing IoT have influenced the industry to produce goods more effectively; innovative packaging, designs, and maintenance operations will likely complement industry growth over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global pulse ingredients market is likely to be driven by the Asia Pacific owing to the production of pulses which are a high source of protein, iron, and vitamins and has a high inclination of health-conscious consumers leading to rising per capita consumption across regions like India and China. Furthermore, the ingredients are incorporated with various food products, such as energy bars, chips, and biscuits which propels the industry growth for the product.

Vegan and vegetarian consumers are opting for formulations that contain pulses ingredients due to their favorable functional and nutritional qualities, which is fueling the industry’s growth. Moreover, urbanization, lifestyle changes, technological advancement for processing pulse ingredients food, and rising demand for clean-label and gluten-free product is expected to drive the market growth.

Report Segmentation

The market is primarily segmented based on type, source, application, and region.

|

By Type |

By Source |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Pulse flour accounted for the largest share in 2021

The pulse flour segment accounted for the highest revenue share in 2021 owing to a good source of fiber, protein, and micronutrients. The rising demand for pulse flour is due to its natural gluten-free property, longer shelf life, and better flavor carrier than wheat flour. In addition, the ability to offer better hydration, control expansion, and improve softness for end-use applications propel market growth.

Moreover, this flour has a wide application in preparing bread, cake, snacks, cereals, and meat products expected to drive demand over the forecast period.

The chickpeas segment is expected to dominate over the forecast period

The demand for chickpeas is driven by the growing consumption of plant-based meals across Europe and the Asia Pacific. Rising obesity, blood sugar level, various health concerns, and consumer shift towards a healthy diet is expected to fuel the product demand. Furthermore, chickpea provides many health benefits, such as improving digestion, managing weight, and maintaining muscle strength which supports the industry’s growth.

Moreover, Kabuli-type chickpeas are projected to lead owing to their consumption in various dips, sauces, soups, spreads, and even curries. The rise in canned and dried chickpeas due to good carbs is expected to drive market growth.

Food and beverages are expected to witness faster growth

The food and beverage industry is expected to see a significant surge over the forecast period owing to the rising awareness among consumers regarding the health benefits of this type of ingredients in their daily meals. The growing demand for food that is tasty and imparts nutritional value has created a lucrative opportunity for the food and beverage industry to transform raw food into a consumer-centric food product that meets their requirements. Furthermore, pulse-based beverages are gaining growth due to gluten-free, cholesterol-free, and low-fat properties. They are rich in protein and fiber content which is anticipated to fuel market growth.

Asia Pacific is expected to dominate and witness the fastest growth over the forecast period

The Asia Pacific is the largest region for the pulse ingredients market, and it is expected to witness faster growth over the forecast period owing to rising health-conscious consumers, and increasing demand for these ingredients in the food and beverages industry is driving demand across India, China, and Japan. India being the highest producer and China being the second largest importer of pulses supports the market’s growth. The availability of raw materials and the major production ratio collectively boost the market demand in these countries.

Furthermore, manufacturers are focusing on developing bread with pulse ingredients owing to the heavy consumption of bread across developing countries which complements the market growth. Moreover, the rising urbanization and consumer shift towards meat and dairy alternatives is expected to drive the market growth.

Competitive Insight

Some of the major players operating in the global market include ADM, AGT Food & Ingredients, Anchor Ingredients, Archer Daniels Midland Company, Axiom Foods, Batory Foods, Cosurca Groupe Warcoing S.A., Dakota Dry Bean Inc., Ingredion Incorporated, Puris, Roquette Freres, SunOpta Inc., Tetra Laval International S.A., The Scoular Company, and Vestkorn Milling A.S

Recent Developments

In February 2022, Ingredion invested in InnovoPro to provide clean-label, sustainable unique chickpea protein to increase the consumer base by investing in chickpea solutions.

In June 2020, Roquette launched a new product range named NUTRALYS derived from pea and fava beans that offer tasty and plant-based alternatives from local cuisines to curry dishes.

Pulse Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 20.66 billion |

|

Revenue forecast in 2030 |

USD 29.9 billion |

|

CAGR |

4.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ADM, AGT Food & Ingredients, Anchor Ingredients, Archer Daniels Midland Company, Axiom Foods, Batory Foods, Cosurca Groupe Warcoing S.A., Dakota Dry Bean Inc., Dakota Ingredients, Ingredion Incorporated, Puris, Roquette Freres, SunOpta Inc., Tetra Laval International S.A., The Scoular Company, and Vestkorn Milling A. S |