Pyrophyllite Market Share, Size, Trends, Industry Analysis Report

By Type, By Application (Ceramics, Refractories & Foundries, Fillers), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3750

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

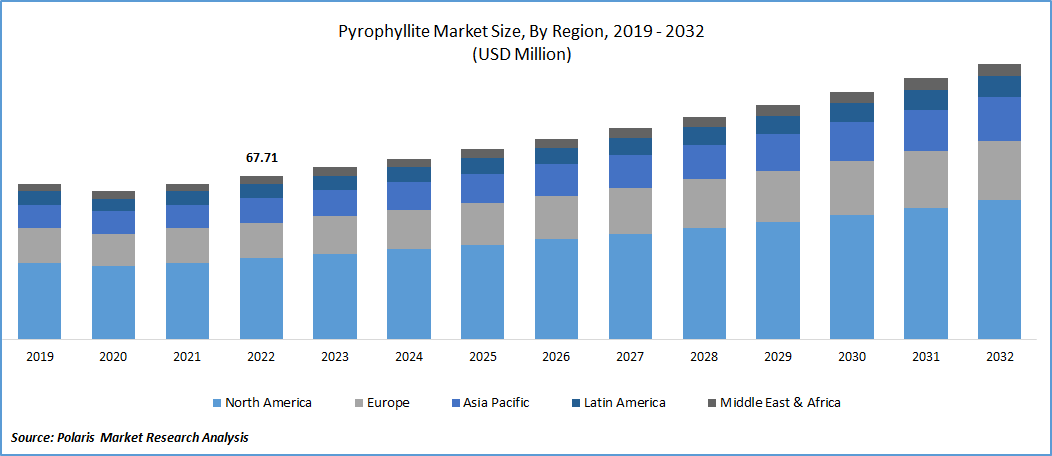

The global pyrophyllite market was valued at USD 71.21 million in 2023 and is expected to grow at a CAGR of 5.40% during the forecast period.

Increasing utilization of ceramic products across diverse industries like construction, aerospace, and automotive is projected to fuel market expansion in the upcoming years. Notably, pyrophyllite holds a significant position within the ceramics sector. This mineral is pivotal in multiple applications, including the composition of ceramic bodies and glazes, managing thermal expansion, and contributing to producing porcelain, insulators, kiln furniture, and glaze suspensions. The distinctive characteristics of pyrophyllite confer its versatility and substantial value, rendering it an indispensable material across various ceramic applications.

To Understand More About this Research : Request a Free Sample Report

The increasing demand from the refractories and foundries sectors propels the market's expansion. The foundries industry is witnessing substantial worldwide growth, attributed to the thriving automotive, aerospace, and manufacturing sectors. These sectors drive the need for the metal components produced by the foundries. An essential factor stimulating market growth is using pyrophyllite-enabled refractories, particularly as furnace linings in iron and steel production.

The market is hindered by the detrimental impact of mining activities on the environment. Inadequate management of mining processes can lead to negative socio-economic consequences, posing risks to ecosystems, animal life, and human health. To address these concerns, numerous regional governments have enforced regulations to mitigate the environmental and social repercussions of mining and processing activities. However, these regulations often result in a gradual establishment process for new quarries and pyrophyllite processing plants, restraining the market's growth.

Furthermore, due to its enhanced properties, the growing demand for pyrophyllite in its pure form has led to the depletion of high-grade pyrophyllite reserves. While lower-grade pyrophyllite is available, it comes with impurities that limit its utility in various industries. This scarcity of high-quality pyrophyllite has prompted a shift towards alternatives. This scarcity of high-quality pyrophyllite market has prompted a shift towards alternatives.

Industry Dynamics

Growth Drivers

Expanding industrial sectors drives the market

The market is experiencing growth due to the expanding industrial sectors, ongoing infrastructure projects, and technological progress within the United States. Substantial developments in the construction industry further support this growth. According to data from the U.S. Census Bureau, the total spending on construction reached USD 1,844.1 billion in February 2023, marking a noteworthy increase of nearly 5.2 percent. The increased investments in the construction sector have a cascading effect on related industries. For instance, the heightened activity in construction is expected to drive demand for various materials such as paints and coatings, castings, and iron and steel. This, in turn, positively impacts the consumption of pyrophyllite over the projected period.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Repor : Speak to Analyst

By Application Analysis

Refractories & foundries segment accounted for the largest share in 2022

The refractories and foundries segment held the largest share. Pyrophyllite can be transformed into mullite, a substance that can withstand exceedingly high temperatures up to 1810 °C. This exceptional property renders pyrophyllite suitable for crafting cost-effective refractory materials and adept at withstanding extreme heat conditions. The escalating influx of private investments aimed at establishing new steel manufacturing plants is anticipated to significantly enhance the growth of this specific segment during the projected period.

Pyrophyllite is a valuable filler across various end-use sectors, including paper, pesticides, plastics, and paints. Additionally, it finds utility as a soil conditioner. Its application in the paints industry is notable, where it functions as both a suspending agent and a pigment, thereby enhancing paint volume. The distinctive attributes of pyrophyllite make it an effective alternative to the costlier Chinese clay. Moreover, it contributes to elevating film cracking resistance by refining paints' drying and dispersion characteristics.

The anticipated growth in the production of paints, attributed to the global surge in construction activities, is poised to contribute to the expansion. A notable illustration of this trend is seen in the example of Asian Paints, which declared its intent to invest around USD 242 Mn in Madhya Pradesh, aiming to establish a production capacity of around 4 lac Kl/annum. The initiation of this facility is projected to occur within three years following the acquisition of the necessary land.

The ceramics segment will grow at a rapid pace. Pyrophyllite demonstrates its versatility in numerous critical roles within the ceramics industry. Notably, it is a highly cost-effective alternative to minerals like kaolin and talc. Ceramics are employed extensively across various sectors, including sanitary ware, pottery, automotive, brick manufacturing, and aerospace. This widespread usage is expected to drive substantial production growth within these industries, directly contributing to the heightened demand for pyrophyllite over the forecast period.

By Regional Analysis

APAC region dominated the global market in 2022

APAC held the largest share in 2022. The driving forces behind this impressive growth are the escalating manufacturing endeavors and the remarkable influx of foreign investments. Moreover, thriving end-use sectors, particularly iron and steel mills, foundries, paints, coatings, and building and construction, play a pivotal role in this dynamic. These sectors are experiencing robust growth; therefore, the demand for pyrophyllite is witnessing a notable increase in the region. This interplay of industrial activities and burgeoning end-use industries has solidified the region's leading position in the pyrophyllite market.

The government of India's Smart City project stands as a notable example. This project strategically harnesses the opportunities emerging from ongoing urbanization trends in the country. This burgeoning urbanization has triggered substantial construction and infrastructure development activities. This augmented demand across these sectors contributes significantly to the market's growth.

Pyrophyllite is a mineral essential for the paper and paint industries, serving as a valuable filler. Notably, the Indian Paper Manufacturers Association (IPMA) reports a notable surge in paper and paperboard exports from India, registering a remarkable growth rate of approximately 80% during the fiscal year 2021–22. This remarkable upswing propelled the total value of these exports to a record high of INR 139.63 billion (equivalent to USD 1.68 billion).

In agriculture, pyrophyllite is a fertilizer carrier, enhancing soil's nutrient-holding capacity while curbing leaching. Notably, China stands as the global leader in fertilizer manufacturing. As indicated by data from the National Bureau of Statistics of China, the aggregate production volume of nitrogen, phosphate, and potash fertilizers within China reached 55.44 million tons in 2021, demonstrating a marginal growth of 0.87% compared to the 54.96 million tons recorded in 2020.

Middle East region is anticipated to be the fastest-growing region. The Middle East has recently experienced a surge in investments dedicated to developing resorts, hotels, artificial islands, and upscale residential projects. These endeavors are strategically orchestrated to bolster the advancement of the construction industry within the region.

A tangible instance of such strategic initiatives is evident in Nakheel PJSC's announcement in August 2022. The announcement outlines a comprehensive plan to establish five expansive islands spanning an impressive 17 square kilometers, with completion targeted by 2040. These progressive steps in construction and infrastructure are poised to play a significant role in fostering market growth across the region throughout the forecast period.

Competitive Insight

The pyrophyllite market is fragmented and is anticipated to witness competition due to several players' presence. Major key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ANAND TALC

- Chirag Minerals

- D.K Industries

- Eastern Minerals

- Guilin Laxmi Ceramics Co Ltd

- Ishwar Mining Industrial Corporation

- Jindutta Mineral

- Kamlesh Minerals

- Khajuraho Minerals

- R.T. Vanderbilt Holding

- Resco Products

- Rio Tinto Group

- SKKU Minerals

- Standard Mineral Co.,

- Trinity Resources

- Tsuchihashi Mining

- Wonderstone

Recent Developments

In June 2022, Mohawk Industries completed the acquisition of the Vitromex ceramic tile at an estimated valuation of USD 293 million. This strategic move was orchestrated to bolster the company's presence in Mexico across key dimensions, including enhanced manufacturing efficiency, an expanded customer base, and fortified logistical capabilities.

Pyrophyllite Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 74.92 million |

|

Revenue forecast in 2032 |

USD 114.03 million |

|

CAGR |

5.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key segments in the Pyrophyllite Market type, application, and region.

Pyrophyllite Market Size Worth $ 114.03 Million By 2032

The global pyrophyllite market is expected to grow at a CAGR of 5.4% during the forecast period.

Asia Pacific regions is leading the global market.

Expanding industrial sector drives the market key driving factors in Pyrophyllite Market.