Quinoa Seeds Market Share, Size, Trends, Industry Analysis Report

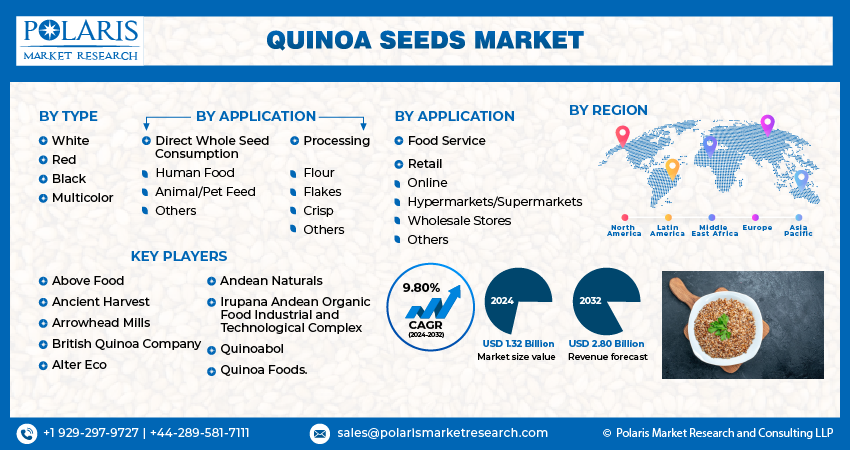

By Type (White, Red, Black), By Application (Direct Whole Seed, Processing), By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3786

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

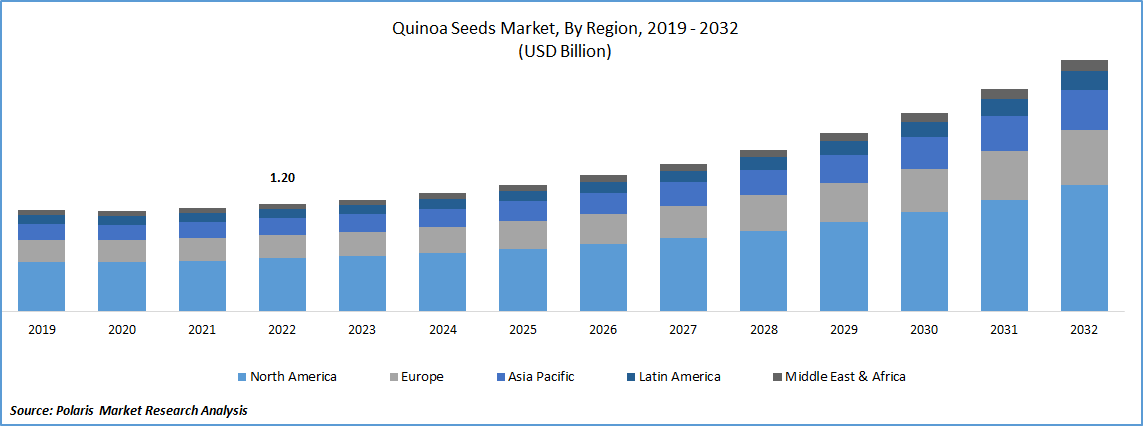

The global quinoa seeds market was valued at USD 1.25 billion in 2023 and is expected to grow at a CAGR of 9.80% during the forecast period.

Market growth is fueled by the increasing adoption of plant-based diets and the rising demand for gluten-free food products. Quinoa seeds, known for their high content of folate, calcium, fiber, zinc, anti-oxidants, & vitamins, are being utilized as a gluten-based crop substitute in various applications. Furthermore, the prevalence of cardiovascular diseases and chronic illnesses has driven the demand for quinoa seeds, owing to their health benefits. The global market has witnessed heightened demand for these seeds due to consumers' growing preference for healthier food choices and the increasing popularity of ancient grains and superfoods.

To Understand More About this Research: Request a Free Sample Report

Recently, in June 2023, a collaboration between Washington State University and Brigham Young University resulted in the development of 3 new quinoa varieties: Shisha, Cougar, & Gikungu. The introduction of these varieties holds promising potential for improving nutrition and food security for farmers in African nations. Furthermore, the market demand for quinoa is being boosted by significant advancements in farming methods, including improved breeding techniques, mechanization, and the adoption of sustainable farming practices. The incorporation of mechanized equipment has modernized various agricultural tasks such as planting, harvesting, and post-harvesting processes. These advancements have contributed to increased efficiency and productivity in quinoa production, further driving the demand for the crop in the market.

Industry Dynamics

Growth Drivers

Increasing Adoption of Quinoa Seeds is Accelerating the Market Growth

COVID-19 pandemic played a crucial role in accelerating the promotion of plant-based proteins and gluten-free foods. As consumers increasingly focused on environmental sustainability and health during the pandemic, there was a significant rise in the demand for organic grains like quinoa. For instance, in October 2020, Ingredion Incorporated took advantage of this growing trend by expanding its range of plant proteins with the introduction of the HOMECRAFT Quinoa 112 Flour product. This flour offers versatile applications in various food products, including baked goods, snacks, pasta, and even pet food. By launching quinoa flour, the company aimed to tap into the increasing demand for plant-based proteins, aligning with consumers' shifting preferences towards healthier and more sustainable food options.

Report Segmentation

The market is primarily segmented based on type, application, distribution channel, and region.

|

By Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

White Quinoa Segment Accounted for the Largest Share in 2022

White quinoa accounted for major global share. The rising popularity of white quinoa in various culinary applications, such as salads and ready-to-eat (RTE) meals, has further driven its demand. Consumers' growing preference for healthier and plant-based food options has also contributed to the segment's growth. Notably, SIMPLi, a U.S.-based food and beverages services company, offers a regenerative white quinoa product that is gluten-free and well-suited for plant-based food applications.

Multicolor segment is likely to register highest growth rate. The rising demand for multicolor quinoa can be attributed to its vibrant appearance, achieved by combining several colored grains. Consumers are increasingly drawn to the visually appealing aspect of multicolor quinoa, which adds variety and aesthetics to their meals. Moreover, food companies are actively adopting a marketing trend towards tricolor and multicolor quinoa products, further driving the demand for this segment. As these companies promote the use of multicolor quinoa in various culinary applications, its popularity is expected to continue growing in the market.

By Application Analysis

Direct Whole Seed Segment Expected to Hold Substantial Market Share

Direct whole seed segment is projected to hold significant market share. These seeds are widely used as a food source for both human and animal consumption. Their versatile application in various culinary dishes, including salads, soups, ready-to-eat (RTE) meal kits, and baked goods, has contributed to their high demand. Furthermore, the growing adoption of vegan diets has further supported the demand for whole quinoa seeds as an alternative protein source. With a complete protein profile that includes all essential amino acids, quinoa seeds have become an essential ingredient in vegan and plant-based applications. Their nutritional value and adaptability in diverse food products have made them a sought-after choice for health-conscious consumers seeking sustainable and protein-rich alternatives.

Processing segment witnessed steady growth. Processed quinoa products offer food manufacturers a unique selling proposition, enabling them to introduce innovative and appealing products to the market. The versatility of processed quinoa opens opportunities for creating a wide range of food items with enhanced nutritional profiles and unique textures. For instance, in March 2022, Undercover Snacks, a U.S.-based provider of chocolate snacks, made an announcement regarding the launch of their chocolate quinoa crisps.

By Distribution Channel Analysis

Food Service Segment Expected to Hold Substantial Market Share in 2022

Food service segment is projected to hold significant market share. The growing trend of consuming fiber-rich and plant-based foods, coupled with an increasing number of individuals adopting vegan diets, has prompted numerous restaurants and bars to incorporate plant-based protein sources like quinoa into their menus. The incorporation of quinoa and other ancient grains into various restaurant menus further reinforces the importance of plant-based protein sources in meeting consumers' dietary preferences and contributing to the segment's continued growth. For instance, Saladworks, a U.S.-based restaurant, has embraced this trend by incorporating ancient grains such as barley, quinoa, and farro into their rice and pasta dishes. This reflects the broader industry shift towards offering healthier and sustainable options to cater to the evolving preferences of health-conscious consumers.

Retail segment witnessed steady growth. The growing number of companies introducing innovative quinoa-based products, combined with consumers' heightened health consciousness, has motivated several supermarket and hypermarket chains to expand their offerings with a diverse selection of quinoa-based items. For instance, GoGo Quinoa, a Canada-based provider, has positioned itself as a prominent player in the market by offering a wide range of grains, including amaranth and quinoa, in various supermarkets.

Regional Insights

North America Region Dominated the Global Market

North America dominated the global market. The increasing influence of social media and the growing popularity of vegan diets have further contributed to the rising demand for quinoa products in the region. Additionally, advancements in farming machinery and the adoption of large-scale quinoa farming practices have bolstered the regional demand for quinoa products. Washington State University's ongoing research and testing of different quinoa varieties, focusing on factors like sprouting season and heat resistance, are enhancing the region's quinoa production capabilities.

APAC is likely to emerge as fastest growing region. This growth is driven by the increasing focus on healthy living and the rising consumption of nutritious foods in the region, contributing to the demand for quinoa products. Furthermore, several countries in the region are actively engaged in quinoa breeding research, which is bolstering the regional demand for quinoa products. The ongoing efforts to develop and promote quinoa cultivation in the region are expected to contribute to the overall growth.

Key Market Players & Competitive Insights

The Quinoa seeds market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market

- Above Food

- Ancient Harvest

- Arrowhead Mills

- British Quinoa Company

- Alter Eco

- Andean Naturals

- Irupana Andean Organic Food Industrial and Technological Complex

- Quinoabol

- Quinoa Foods.

Recent Developments

- In March 2023, ADM recently introduced a direct-to-consumer (D2C) brand called Knwble Grwn. The brand focuses on promoting quinoa produced by small farmers using regenerative farming methods.

- In March 2023, Malaysian based company specializing in ready-to-eat (RTE) meals has unveiled a new noodle meal kit that features noodles made from a combination of tricolor quinoa and high-protein wheat flour. The meal kit offers a variety of flavors, including Prawn Mee, Curry Laksa, & Soy Sauce, and Scallion.

- In March 2022, Undercover Snacks, introduced a new product called chocolate quinoa crisps.

- In May 2022, Above Food has recently finalized the acquisition of the Northern Quinoa Production Corp. With this strategic move, the company aims to expand its production capacity for specialty ingredients.

Quinoa Seeds Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.32 billion |

|

Revenue forecast in 2032 |

USD 2.80 billion |

|

CAGR |

9.80% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type. By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The quinoa seeds market report covering key segments are type, application, distribution channel, and region.

Quinoa Seeds Market Size Worth $2.80 Billion by 2032.

The global quinoa seeds market is expected to grow at a CAGR of 9.4% during the forecast period.

North America is leading the global market.

key driving factors in quinoa seeds market are increasing adoption of quinoa seeds is accelerating the market growth.