Racing Drone Market Share, Size, Trends, Industry Analysis Report

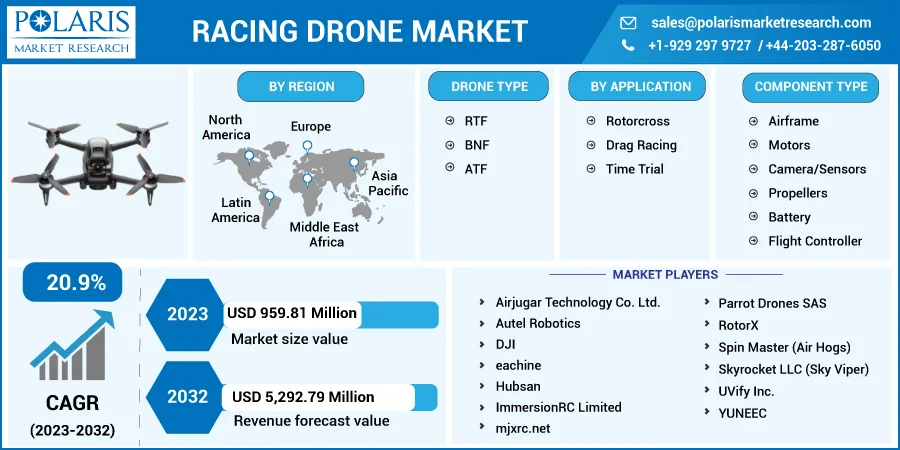

By Drone Type (RTF, BNF, ATF); By Component Type; By Application (Rotor Cross, Drag Racing, Time Trial); By Region; Segment Forecast, 2023 - 2032

- Published Date:Mar-2023

- Pages: 114

- Format: PDF

- Report ID: PM1660

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

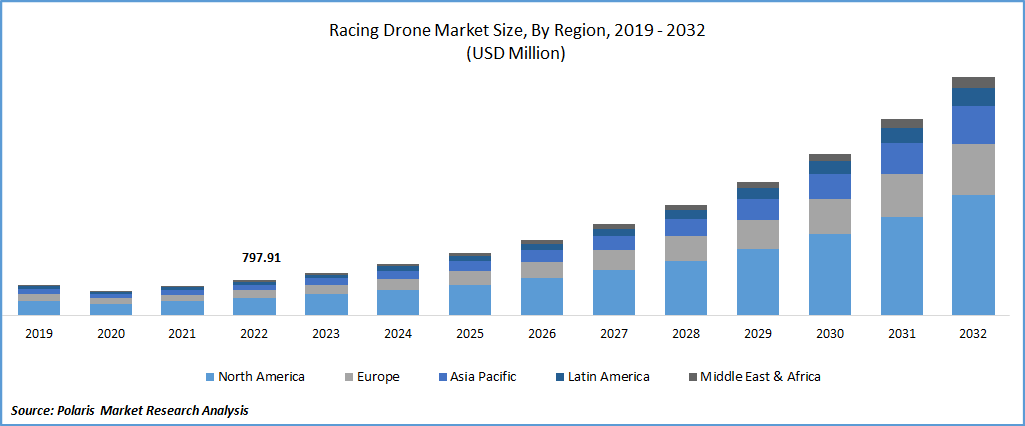

The global racing drone market was valued at USD 797.91 million in 2022 and is expected to grow at a CAGR of 20.9% during the forecast period. The racing drone market has experienced significant growth in recent years due to the rising popularity of drone racing. Drone racing involves piloting small, agile drones through obstacle courses at high speeds, often using first-person view (FPV) goggles to see from the drone's perspective. Racing drones (often called high-speed or FPV drones) are used by pilots of drone racing events wherein several participants compete in a racing sports match. It is rapidly becoming a popular sport throughout the world. This is a sport wherein human pilots fly and control their drones at high speed in an arena filled with obstacles in a complex environment. The government of many countries allowing them to fly for sports events is one of the factors generating the demand & awareness for such racing events across different regions.

Know more about this report: Request for sample pages

Growing adoption across the world, increasing production, the introduction of high-speed drones, growing expenditure in research and development of flying technologies, the introduction of racing sports leagues across different regions, raising awareness of reducing harmful environmental emissions from sports vehicles, and the growing number of racing events are some of the key factors driving the growth of market globally.

In addition, some factors are restraining the market, such as the requirement of highly skilled pilots to operate them in the racing tournaments and the complexity in the assembly of ARF parts for beginners.

Furthermore, the drone racing industry is highly regulated, and many countries have established government drone racing associations. For instance, the International Drone Racing Association (IDRA) governs and sanctions racing events on a global scale.

Additionally, countries like the United States and Japan have their own respective drone racing associations, such as the US Drone Racing Association (USDRA) and the Japan Drone Racing Association (JDRA). These associations play a crucial role in maintaining safety standards, organizing events, and promoting the growth of the drone racing industry.

The COVID-19 pandemic has notably impacted the aerospace industry, including the racing drone market. In response to the pandemic, many governments worldwide implemented containment measures such as trade restrictions, factory shutdowns, and social distancing regulations that limited the number of personnel at workplaces. These measures significantly impacted the supply chain of drones and subsequently affected the production volume of racing drones during the pandemic.

The pandemic-related disruptions to the drone supply chain included component shortages, logistics difficulties, and delays in production and shipment. These challenges reduced the availability of key drone components, such as motors and controllers, and led to production delays and higher manufacturing costs.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market has witnessed significant growth due to various factors. The primary drivers have been the advancements in drone technology, which has enabled the production of high-performance racing drones that can achieve faster speeds and more precise maneuvers. Improvements in battery life, speed, and agility have all contributed to the development of these high-performance racing drones.

Another significant driver of the market is the rising popularity of drone racing as a competitive sport. The growing interest in drone racing has helped to drive demand for racing drones and related accessories, such as FPV goggles and controllers. This has resulted in the developing of more advanced and innovative racing drone products, further fueling the demand for these drones.

The increasing adoption of drones for commercial purposes, such as aerial photography, inspection, and search and rescue operations, has also contributed to the growth of the market. High-performance racing drones with advanced capabilities have become essential for such applications, leading to increased demand for these drones.

Additionally, the availability of a wide range of racing drone accessories, such as spare parts, replacement batteries, and upgraded components, has made it easier for drone enthusiasts to customize and upgrade their drones, further driving demand. Finally, the growing investment in drone technology by governments, private companies, and venture capitalists has led to the development of new and innovative racing drone products and technologies, driving growth in the market.

Report Segmentation

The market is primarily segmented based on drone type, component type, application, and region.

|

By Drone Type |

By Component Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

RTF segment is accounted for the largest revenue in the market

The RTF segment is accounted for the largest revenue in the market. The market is a rapidly growing segment of the drone industry. Within this market, the "RTF" or "Ready-To-Fly" drone type is popular among enthusiasts and beginners. RTF drones are pre-built and have all the necessary components to fly right out of the box. They are often equipped with high-performance motors and controllers, making them a great choice for racing and acrobatic maneuvers.

Various RTF racing drones come with different features, capabilities, and price points. Some factors to consider when choosing an RTF racing drone include the size and weight of the drone, the quality of the camera and video transmission, and the durability of the components.

Furthermore, During the forecast period, the ARF segment of the market is anticipated to exhibit the highest growth rate. This growth can be attributed to the rising number of racing events such as the Drone Racing League, Drone Champions League, Drone World Championship, and MultiGP, which bring together pilots from multiple countries to compete, thus stimulating the global expansion of ARF drones.

Airframe segment is estimated for the dominant in the market

The airframe segment is accounted for the dominant segment in the market and likely to continue its dominance during the forecast period. The airframe segment refers to the physical structure or frame of the drone that holds all the components together. The airframe segment is a crucial aspect of racing drones, as it can significantly impact the drone's performance, stability, and maneuverability.

In recent years, there has been a growing demand for lightweight, high-performance frames that can withstand the rigors of racing. The airframe segment has responded to this demand by developing new and improved frame designs offering better performance, durability, and customization options.

Rotor cross segment dominated the market in 2022

The rotor cross segment has dominated the market in 2022 and will continue its dominance over the projected period. Time trial and drag racing are popular applications but are less dominant than rotor cross. Most racers prefer to use Almost-Ready-to-Fly (ARF) drones that can be customized for weight, motor capacity, size, and speed to meet the specific requirements of rotor cross-racing events.

To stay competitive in the rotor cross segment, manufacturers continually innovate and improve their products. The focus is on creating lightweight, agile, and powerful drones that can handle the high speeds and tight turns required in rotor cross racing. Additionally, there has been an increasing demand for customized and modular drones that can be easily repaired or upgraded.

North America dominated the global market in 2022

North America is a most dominant region in 2022 and expected to be largest region over forecast period. North America is home to several innovative startups constantly pushing the boundaries of drone technology and performance. Competitors are focused on creating faster, more agile, and more customizable drones that can meet the specific needs of racing enthusiasts.

The United States, in particular, is a significant player in the market, with many drone enthusiasts and a well-developed racing scene. The country has hosted several high-profile drones racing events, including the Drone Racing League (DRL), which attracts millions of viewers worldwide. Furthermore, racing events are becoming an attraction in the media and entertainment industry as most television sports channels collaborate with organizers to provide online video streaming platforms to fulfill the demand generated by increasing the fan base in the region.

Competitive Insight

Some of the major players operating in the global market include Airjugar Technology Co. Ltd., Autel Robotics, DJI, eachine, Guangzhou Walkera Technology CO. LTD, Hubsan, ImmersionRC Limited, mjxrc.net, Parrot Drones SAS, RotorX, Spin Master (Air Hogs), Skyrocket LLC (Sky Viper), UVify Inc., 3D Robotics, SkyTech, Lumenier, GoPro, Storm, Gemo Copter, TBS and YUNEEC.

Recent Developments

- In July 2022, Microsoft launched a new simulator to train artificial intelligence (AI) drone systems. The simulator, Microsoft AirSim, aims to provide a realistic virtual environment for AI developers to test and refine their algorithms in a safe and controlled setting before deploying them in real-world applications.

- In June 2022, EXO Drones partnered with Hubsan, an industry titan in the drone industry. This partnership is expected to bring together the expertise and resources of both companies to develop and market innovative drone products.

- In June 2021, Kitty Hawk, a company specializing in developing electric-powered flying vehicles, has acquired 3D Robotics, which produces drone technology for industrial and commercial applications.

Racing Drone Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 959.81 million |

|

Revenue forecast in 2032 |

USD 5,292.79 million |

|

CAGR |

20.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Drone Type, By Component Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Airjugar Technology Co. Ltd., Autel Robotics, DJI, eachine, Guangzhou Walkera Technology CO. LTD, Hubsan, ImmersionRC Limited, mjxrc.net, Parrot Drones SAS, RotorX, Spin Master (Air Hogs), Skyrocket LLC (Sky Viper), UVify Inc., 3D Robotics, SkyTech, Lumenier, GoPro, Storm, Gemo Copter, TBS and YUNEEC. |

FAQ's

Key companies in the racing drone market are Airjugar Technology Co. Ltd., Autel Robotics, DJI, eachine, Guangzhou Walkera Technology CO. LTD, Hubsan, ImmersionRC Limited, mjxrc.net, Parrot Drones SAS.

The global racing drone market expected to grow at a CAGR of 20.9% during the forecast period.

The racing drone market report covering key segments are drone type, component type, application, and region.

Key driving factors in racing drone market are ancreasing adoption of drones for commercial purposes.

The global racing drone market size is expected to reach USD 5,292.79 million by 2032.